=========================================

Perpetual futures have quickly become one of the most attractive trading instruments for crypto and derivatives traders around the globe. Unlike traditional futures contracts, these instruments never expire, offering both flexibility and unique opportunities for speculation and hedging. For newcomers entering the trading space, understanding perpetual futures contracts for beginners is crucial for building a strong foundation before risking real capital.

This comprehensive guide breaks down how perpetual futures work, explores strategies tailored for beginners, compares their pros and cons, and delivers actionable insights to help traders minimize risks and maximize opportunities.

What Are Perpetual Futures Contracts?

Perpetual futures contracts are derivatives that allow traders to speculate on the price of an asset—such as Bitcoin, Ethereum, or other cryptocurrencies—without owning the underlying asset. Unlike standard futures contracts, perpetuals have no expiry date. Traders can keep positions open indefinitely, provided they maintain sufficient margin.

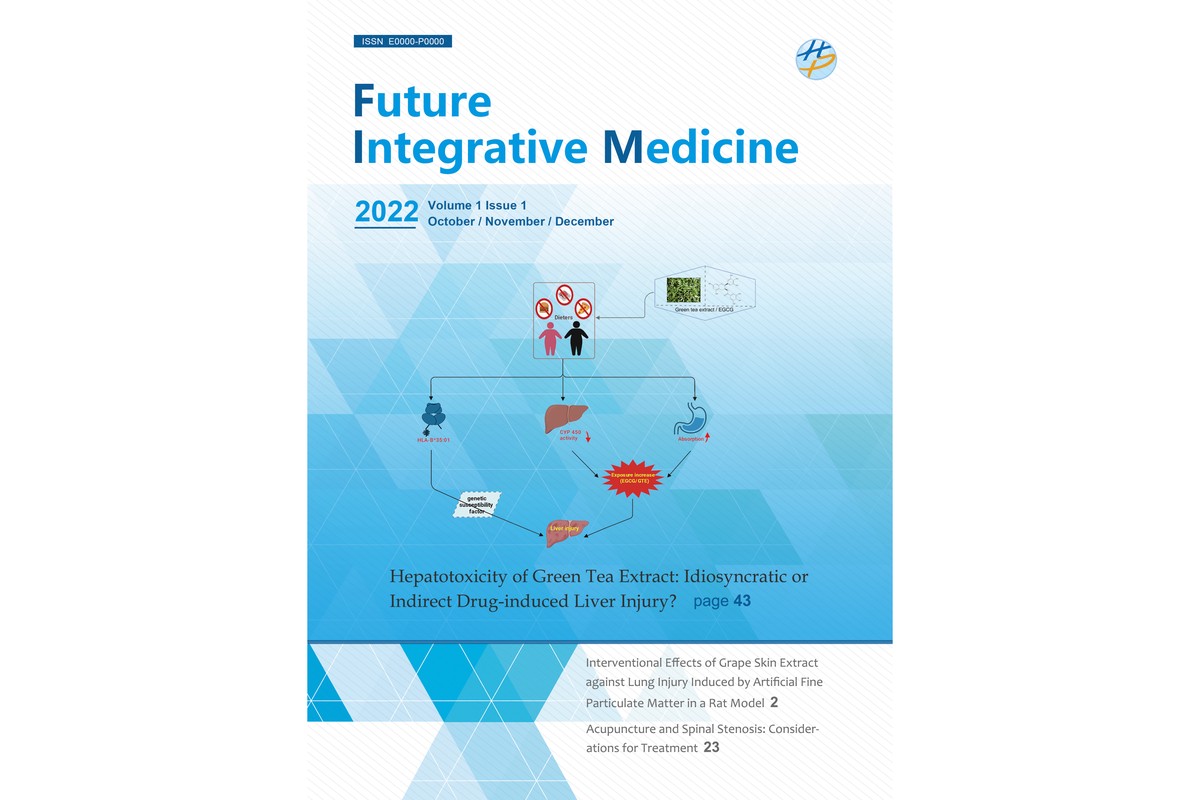

The perpetual design is maintained through funding rates, a mechanism that balances long and short positions by adjusting payments between traders at regular intervals.

How perpetual futures align with spot markets through funding rate adjustments

How Does a Perpetual Futures Contract Work?

Understanding mechanics is essential for beginners. Perpetuals mirror the spot price of the underlying asset via the funding rate system:

- If the perpetual trades above spot price, longs pay shorts.

- If it trades below, shorts pay longs.

- This incentivizes traders to balance the price toward the spot market.

New traders often start by studying how does a perpetual futures contract work before testing small positions with demo accounts or low leverage.

Why Are Perpetual Futures Contracts Popular?

Perpetuals are favored in crypto markets and beyond for several reasons:

- No Expiry: Traders don’t need to roll over contracts.

- Leverage Options: Many exchanges offer leverage from 2x to over 100x.

- Liquidity: Top perpetual contracts like BTC/USDT have deep liquidity pools.

- Accessibility: Available on major exchanges 24⁄7.

This accessibility makes perpetual futures particularly suitable for beginners, but also increases the risks of over-leverage.

Beginner Strategies for Perpetual Futures

Strategy 1: Low-Leverage Trend Following

This method involves identifying market trends and entering positions with minimal leverage (1x–3x). Beginners rely on simple indicators such as moving averages or RSI to follow momentum.

Pros

- Easy to implement.

- Minimizes liquidation risk.

- Suitable for learning market behavior.

Cons

- Gains are smaller compared to high leverage.

- Requires patience and discipline.

Strategy 2: Hedging Spot Holdings with Perpetuals

This approach helps traders who already hold assets (e.g., Bitcoin) protect against downside risk. By opening a short perpetual futures position, they offset potential losses in spot holdings.

Pros

- Effective for portfolio protection.

- Reduces emotional stress during downturns.

- Teaches the risk management principle of “insurance.”

Cons

- Requires understanding of margin and funding rates.

- May reduce upside potential in strong rallies.

For beginners learning how to minimize risk with perpetual futures contracts, hedging provides a controlled entry into perpetual trading.

Comparative Insight

- Trend Following is more suitable for speculative beginners with smaller capital.

- Hedging Strategies suit investors who already hold assets and want protection.

- A hybrid approach—combining both—offers balanced learning while managing risks.

Where Can I Trade Perpetual Futures Contracts?

Beginners often ask which platforms are reliable. Popular choices include Binance, Bybit, and OKX for crypto perpetuals, while CME Group provides institutional-grade contracts for Bitcoin and Ethereum.

When exploring where can I trade perpetual futures contracts, always prioritize:

- Regulatory compliance.

- Security features (2FA, withdrawal protection).

- User-friendly interface and educational resources.

Risk Management Essentials for Beginners

Trading perpetual futures without risk management is gambling. Here are key rules:

- Start Small: Trade with less than 5% of your portfolio.

- Set Stop-Losses: Always define exit levels.

- Control Leverage: Beginners should avoid leverage higher than 3x.

- Understand Funding Rates: Over time, funding payments can erode profits.

- Stay Informed: Follow market news and perpetual futures market analysis.

Risk increases exponentially with leverage while rewards plateau without strong discipline.

Common Mistakes Beginners Make

- Using Maximum Leverage: Leads to quick liquidation.

- Ignoring Funding Rates: Surprise costs eat into profits.

- No Exit Plan: Emotional trading results in large losses.

- Over-Trading: Frequent trades rack up fees and reduce efficiency.

- Neglecting Education: Skipping foundational knowledge on how to understand perpetual futures contracts results in poor decision-making.

Advanced Yet Beginner-Friendly Tips

- Paper Trade First: Use demo accounts to build confidence.

- Diversify Perpetuals: Don’t stick to only BTC/USDT—test ETH, SOL, or other liquid contracts.

- Follow Funding Calendars: Predict costs associated with long-term holds.

- Learn From Experts: Platforms with integrated tutorials help shorten the learning curve.

FAQ: Perpetual Futures Contracts for Beginners

1. Are perpetual futures contracts good for absolute beginners?

Yes, but only with small amounts of capital and low leverage. Beginners should use demo accounts or micro contracts to learn mechanics before committing real funds.

2. How much leverage should I use as a beginner?

The recommended leverage for beginners is 1x to 3x maximum. This range minimizes liquidation risk while still offering exposure to amplified gains.

3. What is the benefit of perpetual futures contracts compared to spot trading?

The main benefit is flexibility. With perpetuals, traders can profit in both bullish and bearish markets without owning the underlying asset. This makes them ideal for shorting or hedging, offering strategies unavailable in simple spot trading.

Conclusion: Building Confidence with Perpetual Futures

For newcomers, perpetual futures contracts for beginners provide both opportunity and challenge. The key is to treat them as learning tools rather than “get rich quick” instruments. By focusing on low leverage, trend-following or hedging strategies, and strict risk management, beginners can gain valuable experience without unnecessary exposure.

As markets evolve and perpetual futures expand beyond crypto, mastering these basics now can position traders for long-term success in derivatives trading.

A structured learning path helps beginners progress from theory to practical success.

If you found this guide useful, share it with fellow traders, leave your comments below, and help grow the community of informed perpetual futures learners.

Would you like me to create a step-by-step beginner checklist PDF for perpetual futures trading that includes risk controls, platform setup, and strategy tracking?