=====================================================

Introduction: Understanding Bitcoin Perpetual Futures in Institutional Context

Bitcoin perpetual futures have rapidly emerged as a cornerstone of digital asset trading, offering a sophisticated and flexible instrument for institutional investors. Unlike traditional futures contracts, these products do not have an expiry date, enabling continuous exposure to Bitcoin’s price with dynamic funding mechanisms. As institutional capital increasingly flows into the cryptocurrency market, understanding how to leverage bitcoin perpetual futures for institutional investors becomes essential for portfolio diversification, risk management, and alpha generation.

This article explores the structure, benefits, and risks of Bitcoin perpetual futures, highlights two advanced strategies used by institutional players, and provides actionable insights on implementation, backed by real-world experience and industry trends. We will also integrate related concepts like how do bitcoin perpetual futures work and bitcoin perpetual futures risk management guide to give you a comprehensive knowledge base.

What Are Bitcoin Perpetual Futures?

Key Characteristics

Bitcoin perpetual futures are derivative contracts that track the price of Bitcoin but never expire. Traders can hold positions indefinitely as long as they maintain margin requirements. The core mechanism ensuring price convergence with spot Bitcoin is the funding rate—a periodic fee exchanged between long and short positions.

Core features include:

- No expiry date: Continuous exposure without rollover costs.

- Leverage: Typically ranges from 2x to 20x for institutional accounts.

- Funding rate mechanism: Keeps futures price aligned with spot price.

- 24⁄7 liquidity: Around-the-clock access to global crypto markets.

How They Differ from Traditional Futures

Unlike quarterly or monthly Bitcoin futures that expire, perpetual futures offer seamless exposure. Institutions prefer them to avoid operational complexity and to optimize capital usage. The lack of expiry reduces the need for position rolling, which is both cost-efficient and operationally simpler.

Market Landscape and Institutional Growth

Institutional Adoption Trends

Institutional investors—including hedge funds, proprietary trading firms, and asset managers—have embraced Bitcoin perpetual futures to:

- Hedge spot holdings

- Generate yield from basis trading

- Gain directional exposure with leverage

- Access deep liquidity pools on major crypto exchanges

According to industry reports, open interest in Bitcoin perpetual futures regularly exceeds tens of billions of USD, indicating robust institutional involvement.

Regulatory Evolution

The maturation of crypto derivatives markets is driven by enhanced regulatory clarity. Licensed exchanges offering perpetual futures have introduced robust custody, AML/KYC frameworks, and risk controls, making them more appealing to institutional participants.

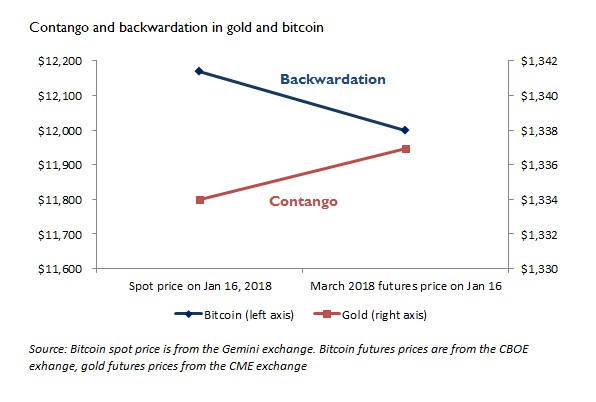

How Do Bitcoin Perpetual Futures Work

Bitcoin perpetual futures operate through a funding rate that incentivizes market balance. When the contract price is above the spot price, long positions pay shorts, and vice versa. This keeps the perpetual price tethered closely to Bitcoin’s underlying price.

Example:

- Spot BTC: $60,000

- Perpetual price: $60,300

- Positive funding rate: Longs pay shorts until the prices converge.

Institutions monitor these rates closely to optimize entry timing, as extreme positive or negative rates can create arbitrage opportunities.

Core Strategies for Institutional Investors

Institutional investors typically employ advanced strategies with Bitcoin perpetual futures. Below are two widely used approaches, along with their pros, cons, and implementation insights.

1. Basis Trading (Cash-and-Carry Arbitrage)

Description:

Basis trading exploits the price difference between spot Bitcoin and perpetual futures. Investors buy spot Bitcoin while shorting an equivalent amount of perpetual futures, capturing the funding payments or the price convergence spread.

Advantages:

- Market-neutral strategy

- Low directional risk

- Generates stable yield (especially during bullish sentiment)

Disadvantages:

- Requires capital-intensive spot purchases

- Exposure to funding rate volatility

- Counterparty and operational risks

Use Case:

Large hedge funds often deploy basis trades with automated systems that continuously monitor spreads and rebalance positions.

Basis Trading Arbitrage Flow

2. Directional Momentum Strategy

Description:

This approach takes leveraged long or short positions in Bitcoin perpetual futures based on technical and macroeconomic signals. It is more speculative but can deliver higher returns.

Advantages:

- High potential return on capital

- Capital-efficient due to leverage

- Suitable for macro-driven allocation shifts

Disadvantages:

- Significant downside risk

- Requires sophisticated risk controls

- Highly sensitive to market volatility

Use Case:

Institutional proprietary desks often use momentum models based on trend-following indicators, on-chain data, and macro sentiment signals.

Momentum Strategy Based on Moving Averages

Bitcoin Perpetual Futures Risk Management Guide

Position Sizing and Leverage Control

Institutions typically cap leverage at conservative levels (e.g., 2x–5x) and implement dynamic position sizing based on portfolio volatility targets. This reduces the probability of liquidation during sharp market moves.

Collateral and Margin Management

Prudent margin allocation is critical. Firms often use multi-custody arrangements and real-time margin tracking systems to prevent under-collateralization, especially during volatile conditions.

Liquidity and Counterparty Risk Mitigation

Institutions diversify across multiple exchanges to reduce counterparty exposure and ensure access to deep order books. They also prefer platforms with robust regulatory oversight and segregated client funds.

Comparing the Two Strategies

| Aspect | Basis Trading | Directional Momentum |

|---|---|---|

| Risk Profile | Low (market-neutral) | High (directional exposure) |

| Capital Requirement | High | Moderate |

| Return Potential | Stable yield | High but volatile |

| Operational Complexity | Moderate | High |

| Ideal For | Hedge funds, arbitrage desks | Prop desks, macro funds |

Recommendation:

For most institutional investors, starting with basis trading offers a safer entry point into Bitcoin perpetual futures. Once operational workflows and risk controls are established, a hybrid approach combining basis and selective momentum trades can enhance portfolio returns.

Regulatory and Operational Considerations

Institutions must align with internal compliance frameworks and external regulations (AML/KYC, tax, reporting). They should also conduct thorough due diligence on perpetual futures platforms, reviewing:

- Custody and security controls

- Licensing status

- Market depth and execution quality

- Historical uptime and risk events

Many institutions integrate third-party risk engines and trade surveillance systems to meet regulatory and internal governance standards.

Where to Trade Bitcoin Perpetual Futures

Leading institutional-grade platforms offer:

- Deep liquidity

- Low latency execution

- Advanced APIs for algorithmic trading

- Segregated custody arrangements

These features are essential for institutional scale execution and operational risk management. Institutions should maintain relationships with multiple venues to ensure competitive pricing and redundancy.

Industry Outlook: The Future of Bitcoin Perpetual Futures

Growth Drivers

- Expanding institutional participation

- Development of crypto prime brokerage services

- Integration with traditional financial infrastructure

- Regulatory clarity in major markets

Potential Challenges

- Regulatory divergence across jurisdictions

- High market volatility

- Technology and operational risks

Long-term perspective:

Bitcoin perpetual futures are likely to remain a core instrument in institutional crypto portfolios, driving market maturity and deeper capital markets integration.

FAQ: Bitcoin Perpetual Futures for Institutional Investors

1. How do institutions hedge Bitcoin exposure with perpetual futures?

Institutions typically short an equivalent notional amount of Bitcoin perpetual futures against their spot holdings. This offsets price fluctuations, creating a delta-neutral position. They adjust positions dynamically based on funding rates and volatility.

2. What are the main risks for institutions trading perpetual futures?

Key risks include funding rate volatility, sudden price swings causing liquidations, counterparty default, and operational errors. These are mitigated by strict risk limits, exchange diversification, and real-time risk monitoring systems.

3. Are Bitcoin perpetual futures suitable for conservative institutional portfolios?

Yes, if deployed via market-neutral strategies like basis trading with low leverage. Such implementations can deliver stable yield without significant directional risk, aligning with conservative mandates.

Conclusion: Building an Institutional Edge in Bitcoin Perpetual Futures

Bitcoin perpetual futures offer institutional investors a versatile instrument to hedge, speculate, and generate yield. By understanding their mechanics, deploying proven strategies like basis trading and momentum models, and applying rigorous risk management, institutions can confidently integrate these derivatives into their portfolios.

As the digital asset ecosystem matures, the role of Bitcoin perpetual futures is expected to expand, offering new opportunities for sophisticated capital allocators.

Join the discussion below: Share your thoughts, strategies, or questions on institutional Bitcoin futures trading. Don’t forget to share this article with colleagues or on social media to help others navigate this evolving market.