===================================================================

Bitcoin perpetual futures have become an essential trading instrument in the cryptocurrency market. These derivatives allow traders to speculate on Bitcoin’s price movement without the need for physical ownership of the cryptocurrency. One of the key elements influencing the success and profitability of Bitcoin perpetual futures is liquidity. In this article, we will provide an in-depth analysis of Bitcoin perpetual futures liquidity, exploring its importance, factors that impact it, and strategies to navigate it effectively.

Table of Contents

Introduction to Bitcoin Perpetual Futures

What is Liquidity in Bitcoin Perpetual Futures?

Key Factors Affecting Bitcoin Perpetual Futures Liquidity

- Market Depth

- Funding Rates

- Bid-Ask Spread

- Market Depth

Methods for Analyzing Bitcoin Perpetual Futures Liquidity

- On-Chain Data Analysis

- Market Sentiment Analysis

- On-Chain Data Analysis

Strategies for Trading in Bitcoin Perpetual Futures with Low Liquidity

- Scalping

- Liquidity Pool Management

- Scalping

Risks of Low Liquidity in Bitcoin Perpetual Futures

- Price Slippage

- Market Manipulation

- Increased Volatility

- Price Slippage

How to Manage Bitcoin Perpetual Futures Liquidity Risk

FAQ

Conclusion

Introduction to Bitcoin Perpetual Futures

Bitcoin perpetual futures are contracts that allow traders to buy or sell Bitcoin at a predetermined price without the need for actual ownership of the asset. Unlike traditional futures, Bitcoin perpetual futures do not have an expiration date, making them ideal for long-term trading. These contracts closely track the price of Bitcoin, offering both speculation and hedging opportunities for traders.

However, to successfully trade Bitcoin perpetual futures, liquidity plays a pivotal role. Liquidity refers to how easily an asset or contract can be bought or sold without affecting its price significantly. High liquidity ensures that orders are filled quickly and at favorable prices, whereas low liquidity can result in increased slippage, wider bid-ask spreads, and challenges in executing trades.

What is Liquidity in Bitcoin Perpetual Futures?

Liquidity in Bitcoin perpetual futures refers to the ease with which traders can enter or exit positions in the futures market. High liquidity means that there is a sufficient volume of orders, both for buying and selling, which allows for efficient trading with minimal price disruption. On the other hand, low liquidity can make it difficult to execute large trades without causing significant changes in price, leading to slippage.

Importance of Liquidity

Liquidity is crucial for the efficiency of the market, as it ensures:

- Faster Execution: Traders can enter or exit positions without delays.

- Tighter Spreads: The difference between the buy and sell prices (the bid-ask spread) is narrower, allowing for better pricing.

- Reduced Slippage: With high liquidity, slippage (the difference between the expected price and the executed price) is minimized.

Key Factors Affecting Bitcoin Perpetual Futures Liquidity

Several factors directly influence the liquidity of Bitcoin perpetual futures. Understanding these factors helps traders make informed decisions and optimize their trading strategies.

Market Depth

Market depth refers to the volume of buy and sell orders at various price levels. A deep market with many orders at various prices increases liquidity, as it provides multiple opportunities for traders to buy or sell without causing significant price fluctuations. Conversely, a shallow market with limited orders can result in slippage and less favorable execution.

How to Assess Market Depth

Market depth can be assessed by reviewing the order book on trading platforms. This shows the available buy and sell orders at various price levels, helping traders understand the current liquidity situation.

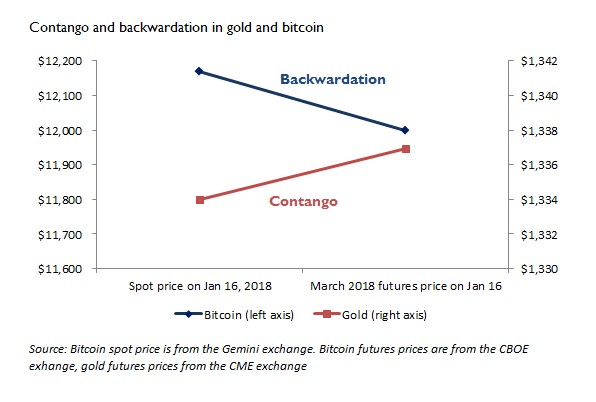

Funding Rates

Funding rates are the periodic payments made between long and short positions in Bitcoin perpetual futures. These rates are typically calculated every 8 hours and are used to maintain the price of the futures contract in line with the underlying asset’s price. A positive funding rate means long positions pay short positions, and a negative rate means short positions pay long positions.

Funding rates affect liquidity because:

- High Funding Rates: Can attract more traders to the market, increasing liquidity.

- Low or Negative Funding Rates: Can reduce interest in trading, leading to lower liquidity.

Bid-Ask Spread

The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A narrow bid-ask spread is indicative of a liquid market, as it shows that buyers and sellers are in close agreement on price. A wide bid-ask spread, on the other hand, signals low liquidity and may make it more expensive for traders to execute their orders.

Methods for Analyzing Bitcoin Perpetual Futures Liquidity

To trade effectively in Bitcoin perpetual futures, traders need to analyze market liquidity. Below are two primary methods for assessing liquidity in these markets.

On-Chain Data Analysis

On-chain data refers to the analysis of Bitcoin’s blockchain to assess market activity and liquidity. By examining metrics such as transaction volume, active addresses, and the flow of Bitcoin to and from exchanges, traders can gauge the level of market participation and potential liquidity.

Key On-Chain Metrics for Liquidity Analysis

- Transaction Volume: High transaction volume often indicates greater liquidity, as it suggests that there is significant market activity.

- Exchange Inflow/Outflow: The movement of Bitcoin into and out of exchanges can provide insights into market sentiment and liquidity.

Market Sentiment Analysis

Market sentiment analysis involves assessing the collective mood of market participants, which can have a significant impact on liquidity. Sentiment can be gauged by monitoring social media platforms, news sources, and on-chain metrics. Positive sentiment often leads to increased trading volume and liquidity, while negative sentiment can result in reduced liquidity as traders become more cautious.

Sentiment Tools for Liquidity Analysis

- Social Media Sentiment: Platforms like Twitter and Reddit can provide real-time insights into market sentiment.

- Fear and Greed Index: This tool measures market sentiment by combining various factors, including volatility, momentum, and social media activity.

Strategies for Trading in Bitcoin Perpetual Futures with Low Liquidity

In markets with low liquidity, traders must adapt their strategies to minimize risk and optimize execution. Below are two strategies that can help navigate low liquidity markets.

Scalping

Scalping is a short-term trading strategy that focuses on taking advantage of small price movements. In low liquidity markets, scalpers aim to make multiple small trades, capitalizing on the bid-ask spread. This strategy requires quick execution and tight risk management.

Scalping in Low Liquidity

- Benefits: Scalpers can exploit small price discrepancies in markets with low liquidity.

- Drawbacks: Increased transaction costs due to higher spreads and slippage.

Liquidity Pool Management

Liquidity pool management involves adjusting the size of your position based on the available liquidity. In markets with low liquidity, traders can reduce the size of their positions to minimize slippage and avoid impacting the market price significantly. This strategy is commonly used by institutional traders who manage large positions.

Managing Liquidity Risk

- Benefits: Reduces the impact of low liquidity on trade execution.

- Drawbacks: Limiting position size can reduce potential profits.

Risks of Low Liquidity in Bitcoin Perpetual Futures

Low liquidity in Bitcoin perpetual futures can expose traders to several risks:

Price Slippage

Slippage occurs when there is a discrepancy between the expected price of a trade and the actual execution price. In low liquidity environments, slippage becomes more pronounced, making it difficult for traders to execute orders at favorable prices.

Market Manipulation

Low liquidity markets are more susceptible to manipulation by large traders or “whales” who can influence the price of Bitcoin with relatively small trades. This can lead to price manipulation, causing significant risks for retail traders.

Increased Volatility

Low liquidity can exacerbate price fluctuations, leading to increased volatility. This can create unpredictable market conditions and pose challenges for traders seeking to manage their positions effectively.

How to Manage Bitcoin Perpetual Futures Liquidity Risk

To mitigate liquidity risk, traders can employ several strategies:

- Diversify Positions: Spread trades across different Bitcoin perpetual futures markets or exchanges to reduce exposure to a single low-liquidity market.

- Use Limit Orders: Limit orders can help manage slippage by ensuring that trades are executed only at desired price levels.

- Monitor Funding Rates: Stay updated on funding rate trends to anticipate liquidity changes.

FAQ

1. How can I assess the liquidity of Bitcoin perpetual futures before trading?

To assess liquidity, examine the market depth, bid-ask spread, and trading volume. Tools like order book analysis and on-chain data can provide insights into market liquidity.

2. What are the main risks of trading Bitcoin perpetual futures in a low liquidity market?

The main