============================================

Introduction

The rise of bitcoin perpetual futures trading strategies has transformed how traders engage with digital assets. Unlike traditional futures contracts, perpetual futures have no expiry date, enabling participants to take long or short positions indefinitely. This unique design, coupled with funding rate mechanisms, makes perpetual futures a preferred instrument for professional traders, hedge funds, and institutions seeking both speculation and hedging opportunities.

This article explores the mechanics of bitcoin perpetual futures, highlights effective strategies for trading them, compares the advantages and risks of different approaches, and provides practical insights on how to integrate them into broader crypto portfolios.

Understanding Bitcoin Perpetual Futures

What Are Bitcoin Perpetual Futures?

Bitcoin perpetual futures are derivative contracts that track the spot price of bitcoin without an expiration date. Traders can hold positions indefinitely, with funding rates ensuring alignment between the perpetual price and the underlying spot market. To better grasp the structure, it helps to understand how do bitcoin perpetual futures work, including the role of leverage, funding intervals, and settlement dynamics.

Why Use Bitcoin Perpetual Futures?

Traders and investors use perpetual contracts for multiple reasons:

- Leverage: Amplify exposure to bitcoin without holding the underlying asset.

- Hedging: Protect against downside risk in volatile markets.

- Speculation: Profit from both rising and falling bitcoin prices.

Understanding why use bitcoin perpetual futures is crucial for building effective trading and risk management frameworks.

Bitcoin perpetual futures allow traders to profit from both rising and falling markets without contract expiry.

Core Bitcoin Perpetual Futures Trading Strategies

1. Trend-Following Strategy

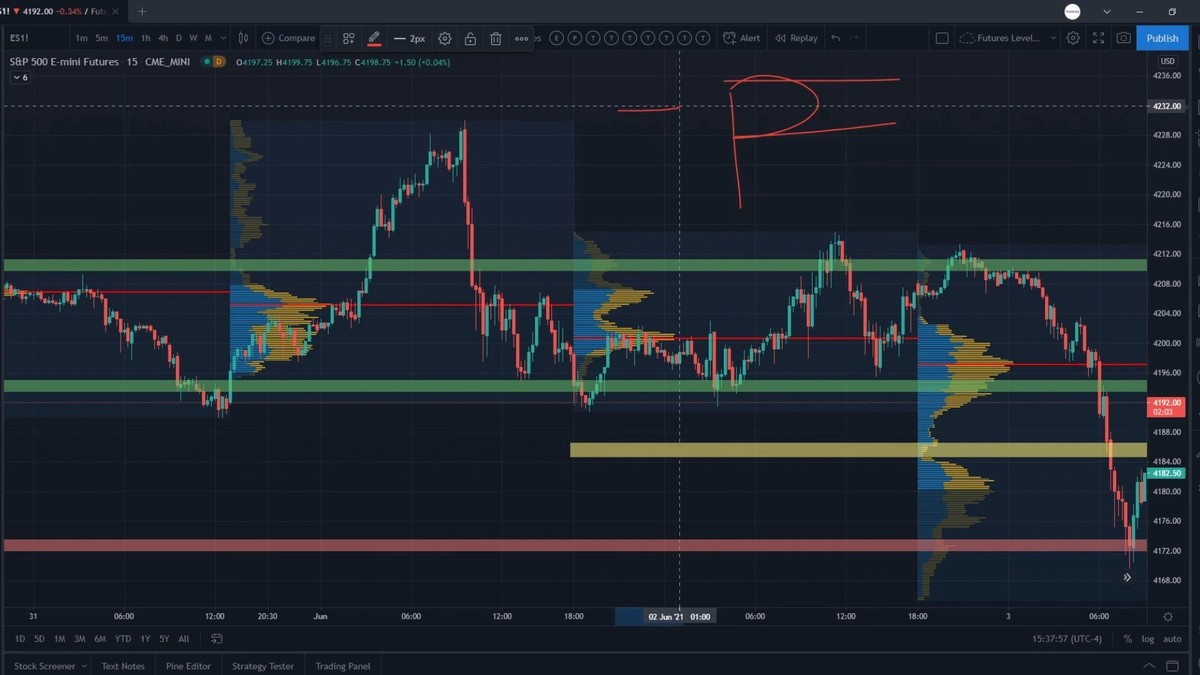

A trend-following approach relies on technical indicators such as moving averages (MA), relative strength index (RSI), and breakout signals. Traders open positions aligned with market momentum, holding them until reversal indicators appear.

Advantages:

- Simple and effective in strong directional markets.

- Reduces noise by focusing on sustained movements.

- Simple and effective in strong directional markets.

Drawbacks:

- Poor performance in sideways or choppy markets.

- Requires strong discipline to avoid false breakouts.

- Poor performance in sideways or choppy markets.

2. Mean-Reversion Strategy

Mean-reversion traders assume prices will revert to their average after deviations. Bollinger Bands, z-scores, or funding rate divergences often serve as signals. For example, if the perpetual futures price trades significantly above spot, traders may short expecting convergence.

Advantages:

- Effective in range-bound markets.

- Exploits inefficiencies between perpetual and spot markets.

- Effective in range-bound markets.

Drawbacks:

- High risk during strong trending markets.

- Requires tight stop-loss management.

- High risk during strong trending markets.

3. Funding Rate Arbitrage

Since perpetual futures employ funding rates to align prices with spot, traders can exploit imbalances. A common strategy is to take opposite positions in spot and perpetual futures to earn funding payments while maintaining a market-neutral stance.

Advantages:

- Low directional risk.

- Steady returns during extreme funding rate cycles.

- Low directional risk.

Drawbacks:

- Requires capital on multiple platforms.

- Profits depend on funding volatility and liquidity.

- Requires capital on multiple platforms.

4. Hedging Strategy

Institutional traders often use perpetual futures to hedge spot bitcoin exposure. For example, a fund holding large amounts of BTC may short perpetual futures to lock in profits or protect against downturns.

Advantages:

- Effective risk management.

- Provides flexibility without liquidating core holdings.

- Effective risk management.

Drawbacks:

- Costs associated with funding rates.

- Imperfect hedges during high volatility.

- Costs associated with funding rates.

Comparing the Strategies

| Strategy | Best Market Conditions | Strengths | Weaknesses |

|---|---|---|---|

| Trend-Following | Strong directional trends | Easy to implement, scalable | Struggles in choppy markets |

| Mean-Reversion | Sideways/range-bound | Profits from inefficiencies | Risky in trending markets |

| Funding Rate Arbitrage | High funding volatility | Low directional risk, consistent income | Capital intensive, exchange risks |

| Hedging | Volatile markets with large BTC exposure | Strong protection, risk mitigation | Funding costs, imperfect hedge |

Different strategies fit distinct market conditions—knowing when to apply them is key to success.

Risk Management in Bitcoin Perpetual Futures Trading

Leverage and Position Sizing

Using leverage amplifies both profits and losses. Conservative position sizing ensures traders avoid liquidation risk in volatile markets.

Stop-Loss and Take-Profit Levels

Implementing stop-loss orders protects against extreme downside, while take-profit orders secure gains during favorable moves.

Monitoring Funding Rates

High funding rates can erode profitability over time. Traders must account for funding costs when holding long-term positions.

Platform Selection

Choosing where to trade bitcoin perpetual futures matters. Different exchanges vary in liquidity, fees, and risk management systems.

Market Outlook and Industry Trends

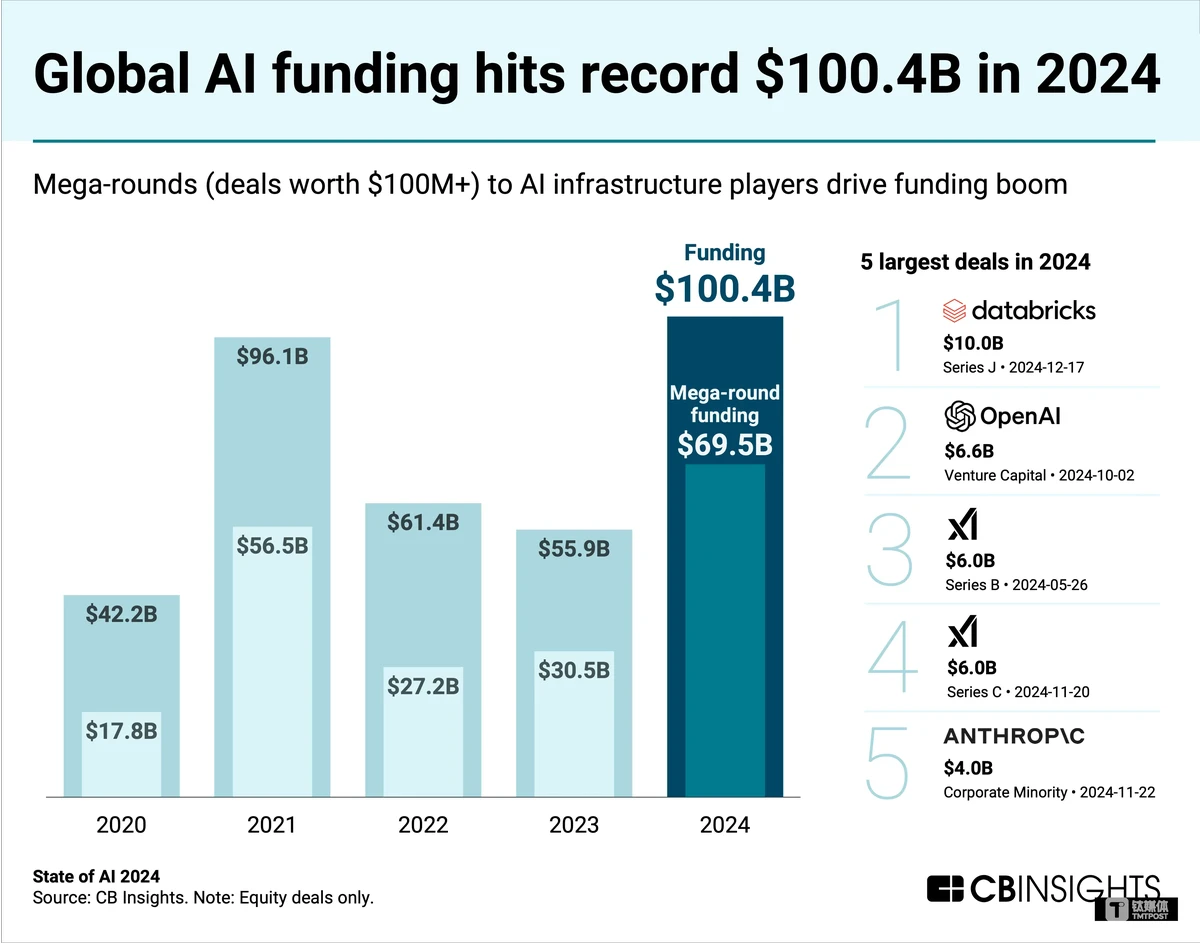

Institutional Adoption

More institutions now use perpetual futures for both speculation and hedging, driving liquidity growth.

Algorithmic and Quant Strategies

Automated trading systems increasingly dominate perpetual markets, applying advanced quantitative models for execution and arbitrage.

Regulation and Compliance

Global regulators are increasing scrutiny of derivative markets. Enhanced compliance requirements may reshape liquidity and trading behavior.

The future of bitcoin perpetual futures will be shaped by institutional adoption and evolving regulations.

FAQs on Bitcoin Perpetual Futures Trading Strategies

1. What is the best strategy for beginners?

For beginners, a trend-following strategy combined with strict risk management is often the best starting point. It’s easier to learn, less complex than arbitrage, and helps traders build discipline.

2. How do funding rates affect trading strategies?

Funding rates can significantly impact profitability. For example, when rates are positive, long positions pay shorts, which can make holding longs expensive. Traders often incorporate funding rate analysis into their decision-making to avoid hidden costs.

3. Can bitcoin perpetual futures be used for long-term investing?

While designed for short- to medium-term speculation, perpetual futures can be part of a hedging or yield-enhancing strategy for long-term holders. However, ongoing funding payments make them less suitable as pure buy-and-hold instruments.

Conclusion

Mastering bitcoin perpetual futures trading strategies requires a clear understanding of market mechanics, disciplined risk management, and the ability to adapt strategies to shifting conditions. Whether using trend-following, mean-reversion, funding rate arbitrage, or hedging, traders can align their approach with personal risk tolerance and market outlook.

If you found this guide valuable, please share it with fellow traders, comment with your own strategies, or engage in discussion to expand the trading community’s collective knowledge.

Would you like me to extend this article with a step-by-step tutorial (with charts) on how to set up a bitcoin perpetual futures trade on a major exchange like Binance or Bybit? That could make the content even more actionable for readers.