==================================================================

Perpetual futures trading has gained immense popularity due to its ability to provide traders with a chance to trade without any expiry dates. However, it also comes with its own set of risks and challenges. If not properly managed, these pitfalls can lead to substantial losses. In this comprehensive guide, we will explore the most common pitfalls in perpetual futures trading and provide actionable strategies to mitigate these risks.

Understanding Perpetual Futures

Before delving into the potential pitfalls, it’s essential to understand the basics of perpetual futures trading.

What Are Perpetual Futures?

A perpetual futures contract is a type of derivative that allows traders to speculate on the price movement of an asset without having to worry about an expiration date. Unlike traditional futures contracts, which have a settlement date, perpetual futures are designed to be held indefinitely, provided margin requirements are met.

These contracts are widely used in cryptocurrency markets but are also available for other assets such as commodities and indices. The primary advantage of perpetual futures is that they offer flexibility in terms of position management.

Why Perpetual Futures Trading Is Popular

Perpetual futures trading is popular because it combines the best features of traditional futures and spot trading:

- Leverage: Traders can control large positions with a relatively small initial margin.

- Liquidity: Since there’s no expiration, perpetual futures tend to have deep liquidity.

- No Expiry: Traders don’t need to worry about contract rollover, unlike with traditional futures.

- Hedging and Speculation: They are useful for both hedging and speculative trading strategies.

However, these advantages also come with significant challenges and risks.

Common Pitfalls in Perpetual Futures Trading

1. Over-Leveraging

Over-leveraging is one of the most common pitfalls in perpetual futures trading. Leverage allows traders to magnify their returns, but it also amplifies losses. In highly volatile markets, a small price movement can lead to significant losses if leverage is too high.

How Over-Leveraging Happens:

- High Margin Ratios: Many traders use 10x, 20x, or even higher leverage without fully understanding the risks.

- Market Volatility: Cryptocurrencies, for example, can experience rapid and unpredictable price movements.

How to Avoid Over-Leveraging:

- Start with Low Leverage: If you’re new to perpetual futures trading, begin with low leverage (e.g., 2x to 3x) to better understand market movements.

- Risk Management: Use stop-loss orders and take-profit levels to limit your exposure. Implement a clear risk-reward ratio.

- Calculate Margin Requirements: Always be aware of your margin levels and adjust your leverage accordingly.

2. Ignoring Funding Fees

In perpetual futures trading, traders are required to pay or receive funding fees periodically. These fees ensure that the perpetual contract price stays in line with the underlying asset’s spot price. The funding rate can either be positive or negative, depending on market conditions.

The Pitfall:

- Traders often overlook these fees, especially when holding positions over the long term. If the funding fee is consistently high, it can eat into potential profits or even lead to losses.

How to Avoid the Pitfall:

- Monitor Funding Rates: Regularly check the funding rates of the exchange you are trading on. If the rates are too high, it may be worth reconsidering your position.

- Short-Term Positions: If you plan to hold a position for an extended period, ensure that the funding fees do not outweigh your potential profit.

3. Chasing the Market

Traders often make the mistake of chasing the market, particularly after a significant price move. This happens when traders jump into a position too late in the hope that the price will continue to move in their favor.

The Pitfall:

- FOMO (Fear of Missing Out): This emotional response leads traders to enter positions impulsively, without a solid strategy or technical analysis.

How to Avoid the Pitfall:

- Use Technical Analysis: Base your trades on a well-defined trading strategy. Utilize indicators like RSI, MACD, and moving averages to identify the optimal entry and exit points.

- Avoid FOMO: Stick to your trading plan and resist the temptation to enter trades based solely on market hype.

4. Failing to Use Stop-Loss Orders

One of the most common mistakes traders make is not using stop-loss orders or not placing them at appropriate levels. A stop-loss order automatically triggers when the price hits a predetermined level, helping to limit losses.

The Pitfall:

- Without a stop-loss, traders expose themselves to the risk of significant losses, especially in volatile markets where prices can swing rapidly.

How to Avoid the Pitfall:

- Always Use Stop-Loss: Every position should have a stop-loss order in place to prevent devastating losses.

- Dynamic Stop-Loss: Adjust stop-loss levels as the trade moves in your favor, locking in profits as the price rises.

5. Lack of Diversification

Another pitfall is the lack of diversification in trading strategies. Many traders focus on a single asset or market, neglecting the fact that a diversified portfolio can reduce risk.

The Pitfall:

- Single Asset Exposure: Relying on one asset or market can increase your exposure to market swings and unexpected events.

How to Avoid the Pitfall:

- Diversify Your Portfolio: Spread your risk across multiple assets, such as different cryptocurrencies, commodities, or stock indices.

- Utilize Different Strategies: Combine various trading strategies, such as trend-following and mean-reversion, to balance your risk.

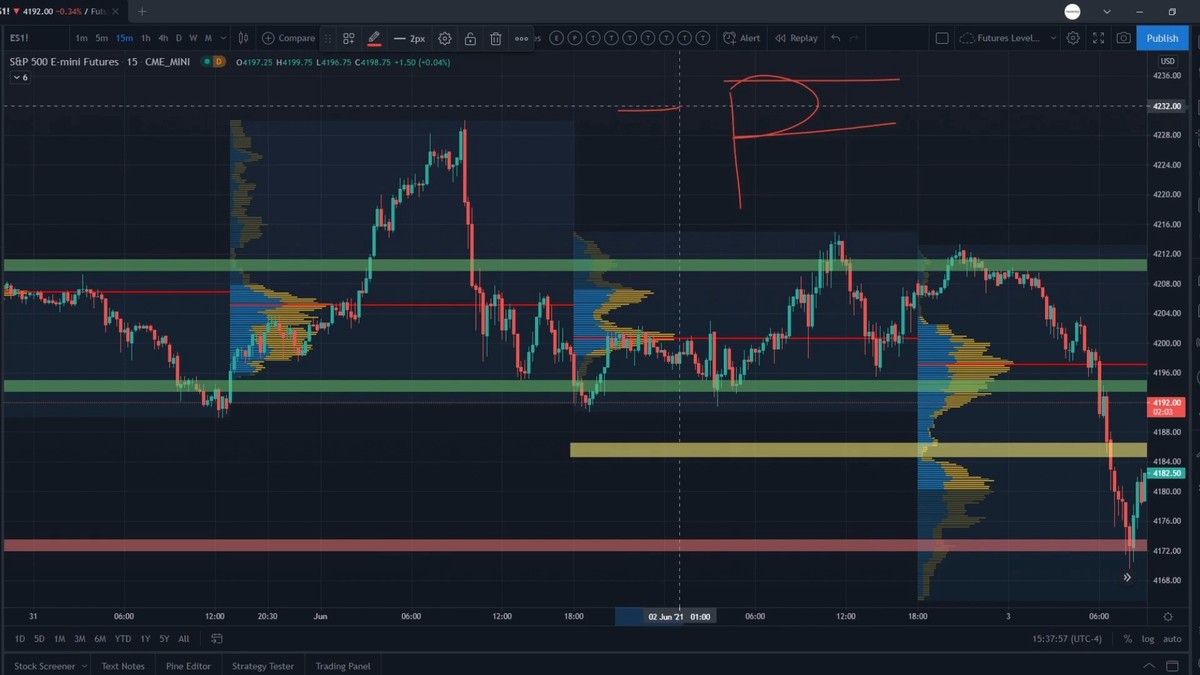

Visualizing common mistakes in perpetual futures trading and how to avoid them.

Risk Management in Perpetual Futures Trading

1. Position Sizing

Position sizing is crucial to ensure that your trades are within your risk tolerance. Risking too much on a single trade can quickly wipe out your account.

Best Practices:

- Fixed Risk Per Trade: Limit each trade’s risk to a small percentage of your total capital (e.g., 1-2%).

- Adjust Position Size: Calculate your position size based on your stop-loss and the total amount you’re willing to risk.

2. Using Hedging Techniques

Hedging can be a valuable strategy in perpetual futures trading to reduce risk. By holding opposing positions in different markets or assets, traders can protect themselves from significant price fluctuations.

Hedging Strategies:

- Cross-Market Hedging: Trade in markets that are correlated or have inverse correlations to offset risk.

- Options Hedging: Use options contracts alongside perpetual futures to protect your position.

3. Regularly Review Your Portfolio

In the fast-moving world of perpetual futures, market conditions can change rapidly. Traders should regularly assess their portfolio and adjust positions based on new data.

Steps:

- Review Your Trades: Regularly check whether your positions are still aligned with your trading strategy.

- Monitor Market News: Stay updated with economic and geopolitical news that could impact the assets you are trading.

FAQ: Common Pitfalls in Perpetual Futures Trading

1. How can I avoid over-leveraging in perpetual futures?

To avoid over-leveraging, start with low leverage and ensure you understand the risks. It’s also crucial to implement stop-loss orders and avoid holding positions during extreme market volatility.

2. Are perpetual futures suitable for beginners?

Perpetual futures can be complex and risky, making them more suited for experienced traders. However, beginners can start with lower leverage and practice on demo accounts before engaging in live trading.

3. What’s the best way to manage risk in perpetual futures?

The best way to manage risk is by using position sizing, stop-loss orders, and hedging strategies. Diversifying your trades and regularly reviewing your portfolio can also help mitigate potential losses.

Conclusion

While perpetual futures trading offers substantial opportunities, it also comes with its risks. Over-leveraging, ignoring funding fees, and emotional trading are just some of the common pitfalls in perpetual futures trading that can lead to significant losses. By implementing proper risk management, using stop-loss orders, and diversifying your positions, you can reduce the likelihood of these mistakes. Remember, a disciplined approach combined with solid strategy and continuous learning is key to succeeding in perpetual futures trading.

If you found this article helpful, share it with your trading community or leave a comment below with your experiences and tips for perpetual futures trading!