===================================================

Perpetual futures have become one of the most dominant financial instruments in modern crypto and derivative markets. For both beginners and seasoned traders, understanding how perpetual futures work and mastering effective strategies is essential for long-term profitability. This comprehensive tutorial on perpetual futures trading provides in-depth explanations, expert strategies, and practical tips to help traders navigate this highly dynamic market.

Understanding Perpetual Futures

What Are Perpetual Futures?

Perpetual futures are derivative contracts similar to traditional futures, except they do not have an expiration date. Traders can hold positions indefinitely, provided they meet margin requirements. Unlike traditional futures, perpetual contracts use a funding rate mechanism to keep prices aligned with the underlying asset (e.g., Bitcoin or Ethereum).

Key Features of Perpetual Futures

- No Expiry Date: Traders can maintain positions without rolling contracts.

- Leverage: High leverage (often up to 100x) amplifies profits but also increases risks.

- Funding Rates: Regular payments exchanged between long and short traders keep prices close to the spot market.

- Liquidity: Perpetual futures are among the most liquid derivatives, especially in cryptocurrency exchanges.

Mechanics of Perpetual Futures

The Role of Funding Rates

Funding rates are small periodic payments exchanged between buyers and sellers. If the perpetual futures price is above the spot price, longs pay shorts. If it’s below, shorts pay longs. This ensures price convergence.

Margin and Leverage

Traders must deposit margin to open positions. With leverage, small capital can control large positions, but liquidation risks increase when prices move unfavorably.

Example Trade Scenario

Suppose Bitcoin trades at \(30,000. A trader opens a **long perpetual futures position** with 10x leverage using \)1,000 margin. The position size equals \(10,000. If Bitcoin rises 5%, the trader earns \)500 (50% profit on margin). Conversely, a 5% drop wipes out the position.

Key Strategies for Perpetual Futures Trading

1. Trend-Following Strategy

This approach involves opening positions in the direction of the market trend.

- Pros: Works well in strong bull or bear markets.

- Cons: Prone to false signals in sideways markets.

2. Mean-Reversion Strategy

Traders bet on price reverting to its average when the market becomes overextended.

- Pros: Effective in range-bound markets.

- Cons: Risky in strong trending conditions.

3. Hedging with Perpetual Futures

Institutions and experienced investors often use perpetual contracts to hedge spot positions. For example, holding Bitcoin while shorting perpetual futures reduces downside risk.

Comparing Trading Approaches

| Strategy | Best Market Type | Advantage | Risk Factor |

|---|---|---|---|

| Trend-Following | Trending markets | Captures large moves | False signals in chop |

| Mean-Reversion | Sideways/range-bound | Profitable in stable ranges | High losses in breakouts |

| Hedging | Any market | Reduces portfolio risk | Lower profitability compared to pure trading |

From my own experience, a hybrid approach combining trend-following with proper hedging provides the most sustainable results in perpetual futures trading.

Practical Tips for Risk Management

Position Sizing

Never allocate more than 2-3% of your capital on a single leveraged position.

Stop-Loss and Take-Profit

Always use automated risk controls to lock in gains and cut losses early.

Funding Rate Arbitrage

Advanced traders monitor funding rates to earn steady income by holding opposite positions in spot and perpetual markets.

Industry Trends in Perpetual Futures

- Increased Institutional Participation: Hedge funds and asset managers are adopting perpetual futures as hedging tools.

- Regulatory Developments: Global regulators are scrutinizing leverage limits and retail investor protections.

- AI & Quantitative Models: Algorithmic trading systems now dominate perpetual futures markets, increasing efficiency but also volatility.

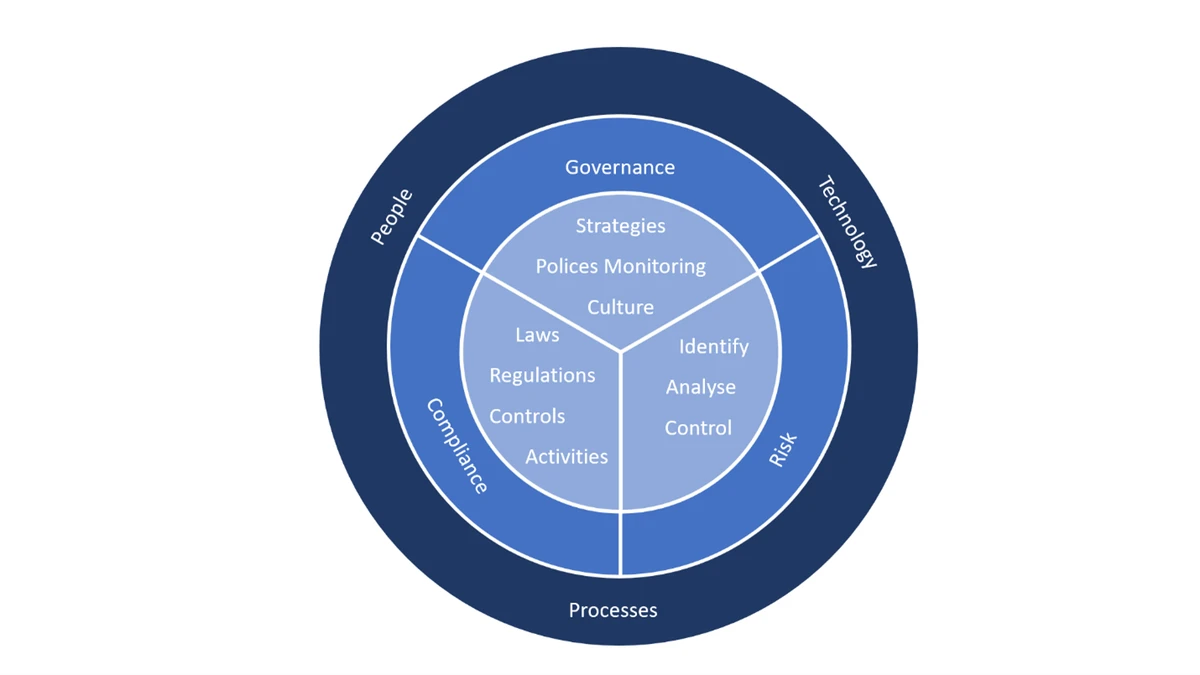

Visualizing Perpetual Futures Concepts

Perpetual futures trading involves leverage, funding rates, and continuous alignment with spot prices.

How to Get Started with Perpetual Futures

For beginners, one of the most searched topics is how to trade perpetual futures. The key steps include:

- Choosing a reliable exchange with strong liquidity and security.

- Practicing with demo accounts before committing real capital.

- Learning to read funding rate structures and market depth.

Similarly, traders often ask where to learn perpetual futures trading. Structured online courses, exchange tutorials, and mentorship from experienced traders are excellent starting points.

Common Mistakes to Avoid

- Overusing Leverage: High leverage magnifies losses.

- Ignoring Funding Rates: Neglecting funding payments can erode profits over time.

- Failing to Manage Emotions: Fear and greed lead to irrational decisions.

FAQ: Perpetual Futures Trading

1. What makes perpetual futures different from traditional futures?

Unlike traditional futures, perpetual contracts have no expiry date. Instead, they rely on funding rates to keep prices in line with the spot market. This makes them more flexible for long-term trading and hedging.

2. How risky is perpetual futures trading?

The risk depends on leverage and risk management. While perpetual futures offer high profit potential, traders face liquidation risks if they misuse leverage. Proper stop-loss settings and disciplined trading reduce risks.

3. Can beginners succeed in perpetual futures trading?

Yes, but only if they start small, use low leverage, and spend significant time learning. Many exchanges provide tutorials and demo trading environments to help beginners gain experience safely.

Conclusion

Perpetual futures are powerful instruments that provide unmatched flexibility and opportunities in modern trading. This comprehensive tutorial on perpetual futures trading has explored core mechanics, key strategies, and practical tips. For traders who want long-term success, the best path is a disciplined approach—blending strategy, risk management, and continuous learning.

If you found this guide helpful, feel free to share it with your trading community, leave a comment, or ask questions below. Let’s build a knowledge-sharing ecosystem that helps every trader grow.

Would you like me to also create a step-by-step infographic summarizing perpetual futures mechanics (funding rate, leverage, hedging) so the tutorial is more visual and easier to share on social media?