===========================================

Cryptocurrency markets are notoriously volatile, making risk management a critical skill for traders and investors. One of the most effective tools for managing exposure is hedging with Bitcoin perpetual futures. In this comprehensive guide, we’ll explore how to hedge with Bitcoin perpetual futures, compare strategies, analyze their pros and cons, and provide practical insights for effective implementation.

Introduction to Bitcoin Perpetual Futures

Bitcoin perpetual futures are derivatives contracts that allow traders to speculate or hedge on the price of Bitcoin without an expiry date. Unlike traditional futures, perpetual contracts remain open indefinitely, provided margin requirements are met.

They are widely used for:

- Risk management: Protecting against price swings.

- Leverage trading: Gaining exposure with smaller capital.

- Arbitrage opportunities: Exploiting funding rate differences.

For those new to derivatives, understanding how do Bitcoin perpetual futures work is essential. The contract price closely tracks the spot price due to funding payments exchanged between long and short traders.

Bitcoin perpetual futures track spot prices through funding mechanisms.

Why Use Bitcoin Perpetual Futures for Hedging

The primary reason to hedge is protection. Bitcoin’s volatility often exceeds traditional assets, with price swings of 10–20% occurring in a matter of hours. Hedging with perpetual futures allows investors to:

- Offset losses from spot positions

- Lock in profits at favorable levels

- Reduce portfolio drawdowns

- Smooth out returns for institutional portfolios

In practice, perpetual contracts act as insurance. For example, a long-term holder of Bitcoin can short perpetual futures to neutralize downside risk while maintaining their spot holdings.

This is one of the main reasons why use Bitcoin perpetual futures has become a key question for both retail and institutional participants.

Core Hedging Strategies with Bitcoin Perpetual Futures

1. Direct Short Hedge

A straightforward method where you short Bitcoin perpetual futures equal to your spot holdings.

Example:

- You own 1 BTC at $30,000.

- You short 1 BTC perpetual futures at $30,000.

- If BTC falls to \(25,000, your spot loses \)5,000 but your futures gain $5,000.

- Net exposure = 0 (perfect hedge).

Pros: Simple and effective for complete protection.

Cons: No upside participation if BTC rallies.

2. Partial Hedge

Instead of hedging the full exposure, hedge only part of the position.

Example:

- You own 1 BTC at $30,000.

- You short 0.5 BTC perpetual futures.

- If BTC falls to \(25,000, you lose \)5,000 on spot but gain $2,500 on futures.

- Net loss = $2,500, but if BTC rises, you still profit.

Pros: Balance between risk reduction and upside participation.

Cons: Still vulnerable to large downside moves.

3. Dynamic Hedge

Adjusting futures positions as Bitcoin price moves. Traders rebalance daily or weekly depending on volatility.

Pros: Flexible, maximizes efficiency.

Cons: Requires constant monitoring and advanced execution tools.

Comparison of direct, partial, and dynamic hedging with Bitcoin perpetual futures.

Practical Considerations in Hedging

Funding Rates

Perpetual futures use funding rates to keep contract prices in line with spot prices. Traders must pay or receive funding based on market positioning. Understanding how to calculate Bitcoin perpetual futures funding is critical, as it impacts the cost of hedging.

Liquidity and Slippage

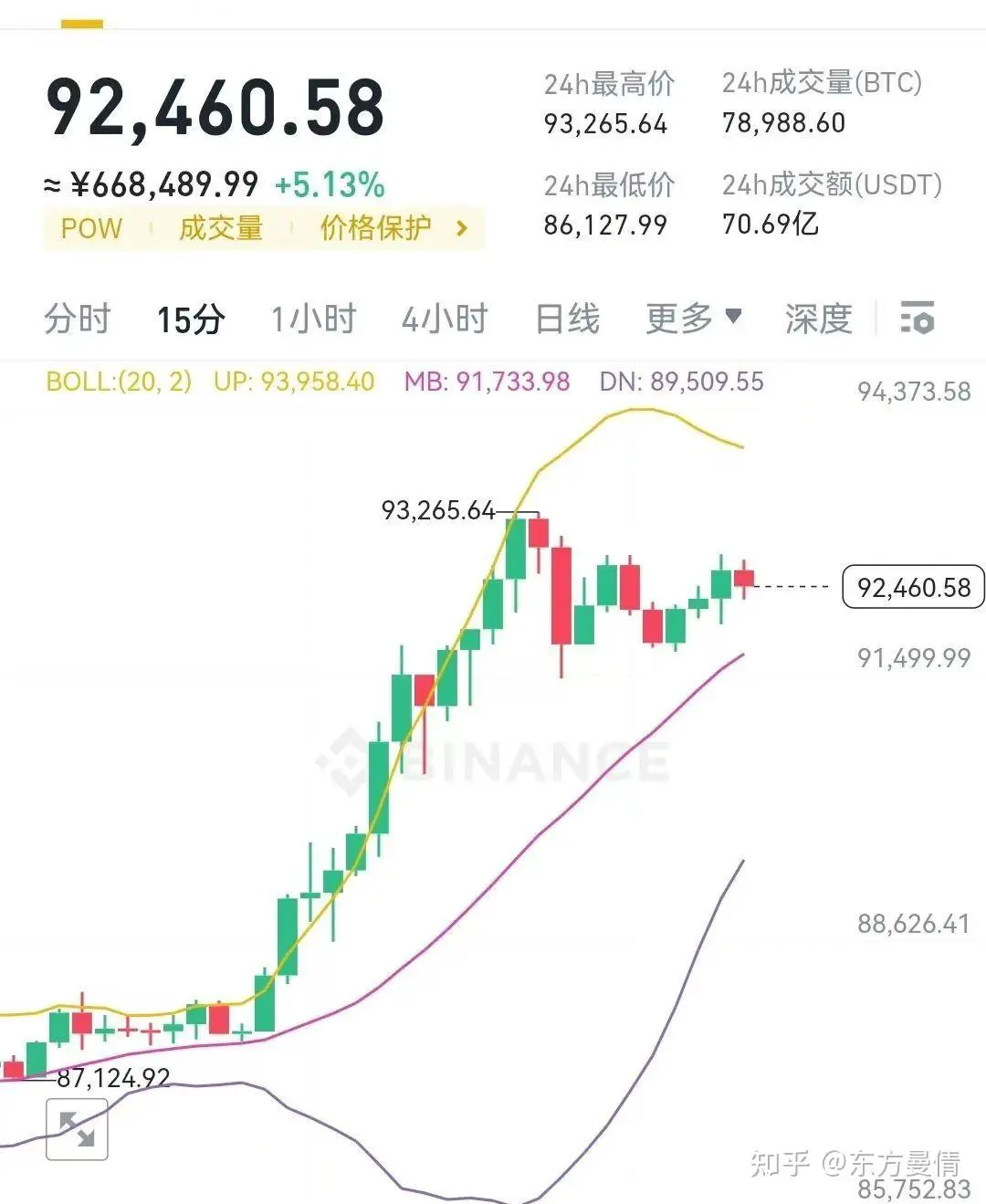

Large positions may face slippage. Always hedge on exchanges with high liquidity such as Binance, OKX, or Bybit.

Leverage Risks

While hedging may involve leverage, improper use increases liquidation risk. Keep leverage low when hedging.

Regulation and Security

Choose exchanges compliant with regulations and with strong security protocols.

Case Studies: Hedging with Perpetual Futures

Case 1: Institutional Hedge

A crypto hedge fund holding 1,000 BTC used perpetual short positions to lock in profits before a major Fed announcement. When Bitcoin dropped 15%, the hedge protected $4.5M in value.

Case 2: Retail Trader Hedge

A retail investor with 2 BTC used a 50% partial hedge. The market dropped 20%, and the investor absorbed only half the loss while still participating in recovery.

These examples highlight how Bitcoin perpetual futures for risk managers provide tailored solutions for different profiles.

Pros and Cons of Hedging with Bitcoin Perpetual Futures

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Risk Reduction | Protects against sudden crashes | Can eliminate upside gains |

| Flexibility | Hedge full, partial, or dynamically | Requires constant monitoring |

| Cost Efficiency | Lower capital requirements due to leverage | Funding rate payments may accumulate |

| Accessibility | Widely available across major exchanges | Exposure to counterparty and exchange risks |

Advanced Hedging Insights

- Cross-Market Hedging: Using Bitcoin perpetuals to hedge altcoin exposure.

- Hedging Funding Rate Arbitrage: Exploiting differences between long and short funding payments.

- Portfolio Hedging: Combining perpetual futures with options for layered protection.

For professionals, integrating Bitcoin perpetual futures market analysis with hedging strategies ensures optimal execution.

Effective hedging combines perpetual futures with market analysis and portfolio strategies.

FAQs on Hedging with Bitcoin Perpetual Futures

1. How do I know when to hedge with Bitcoin perpetual futures?

Hedging is most effective during periods of high volatility, before key economic events, or when your portfolio has large unrealized gains that you want to protect.

2. What’s the cost of hedging with perpetual futures?

The main cost is the funding rate. Depending on market sentiment, you may pay or receive funding every 8 hours. Over time, this can significantly impact hedging efficiency.

3. Can I use perpetual futures to hedge a diversified crypto portfolio?

Yes. Many traders hedge Bitcoin exposure to offset correlated movements across altcoins, since Bitcoin typically drives overall market sentiment.

Conclusion

Learning how to hedge with Bitcoin perpetual futures is essential for anyone managing significant crypto exposure. From direct short hedges to dynamic strategies, perpetual futures provide flexibility and efficiency in risk management.

By understanding funding rates, liquidity, and the pros and cons of each approach, traders can build robust strategies that protect capital while allowing upside participation.

If you found this guide useful, share it with fellow traders, leave a comment with your favorite hedging technique, and join the conversation about smarter crypto risk management.

Would you like me to also create a downloadable hedge strategy checklist PDF so you can apply these Bitcoin perpetual futures techniques step by step?