======================================

Perpetual futures have become one of the most popular instruments in the crypto market, offering traders flexibility, leverage, and the ability to profit in both rising and falling markets. For beginners and professionals alike, understanding how to start perpetual futures trading is essential to building a strong foundation, minimizing risks, and maximizing returns. This article provides an in-depth guide, blending practical experience, industry insights, and professional strategies to help you succeed in the perpetual futures landscape.

Understanding Perpetual Futures

What Are Perpetual Futures?

Perpetual futures are derivative contracts that, unlike traditional futures, do not have an expiration date. This means traders can hold their positions indefinitely as long as they maintain margin requirements. These contracts track the underlying asset’s price through a mechanism known as the funding rate, which balances long and short positions.

Why Perpetual Futures Are Popular

Perpetual futures are attractive for several reasons:

- No expiry date: Flexibility to hold trades as long as desired.

- Leverage options: Ability to amplify profits (and risks).

- Two-way trading: Traders can profit from both market uptrends and downtrends.

- High liquidity: Offered by major exchanges like Binance, Bybit, and OKX.

Perpetual futures contracts maintain price alignment with spot markets through funding rates.

Step 1: Preparing for Perpetual Futures Trading

Choosing a Reliable Exchange

Before you begin, selecting the right platform is critical. Look for:

- Strong security and regulatory compliance.

- High liquidity and volume.

- Advanced trading tools (e.g., trading bots, APIs).

- Educational resources for beginners.

For new traders, starting with exchanges that provide a beginner-friendly perpetual futures trading guide ensures fewer mistakes during the learning process.

Setting Up an Account and Funding

- KYC Verification: Complete identity checks for higher withdrawal limits.

- Deposit Funds: Start with stablecoins (USDT, USDC) for easier margin calculations.

- Enable Security: Two-factor authentication (2FA) and withdrawal whitelists are musts.

Step 2: Core Concepts in Perpetual Futures

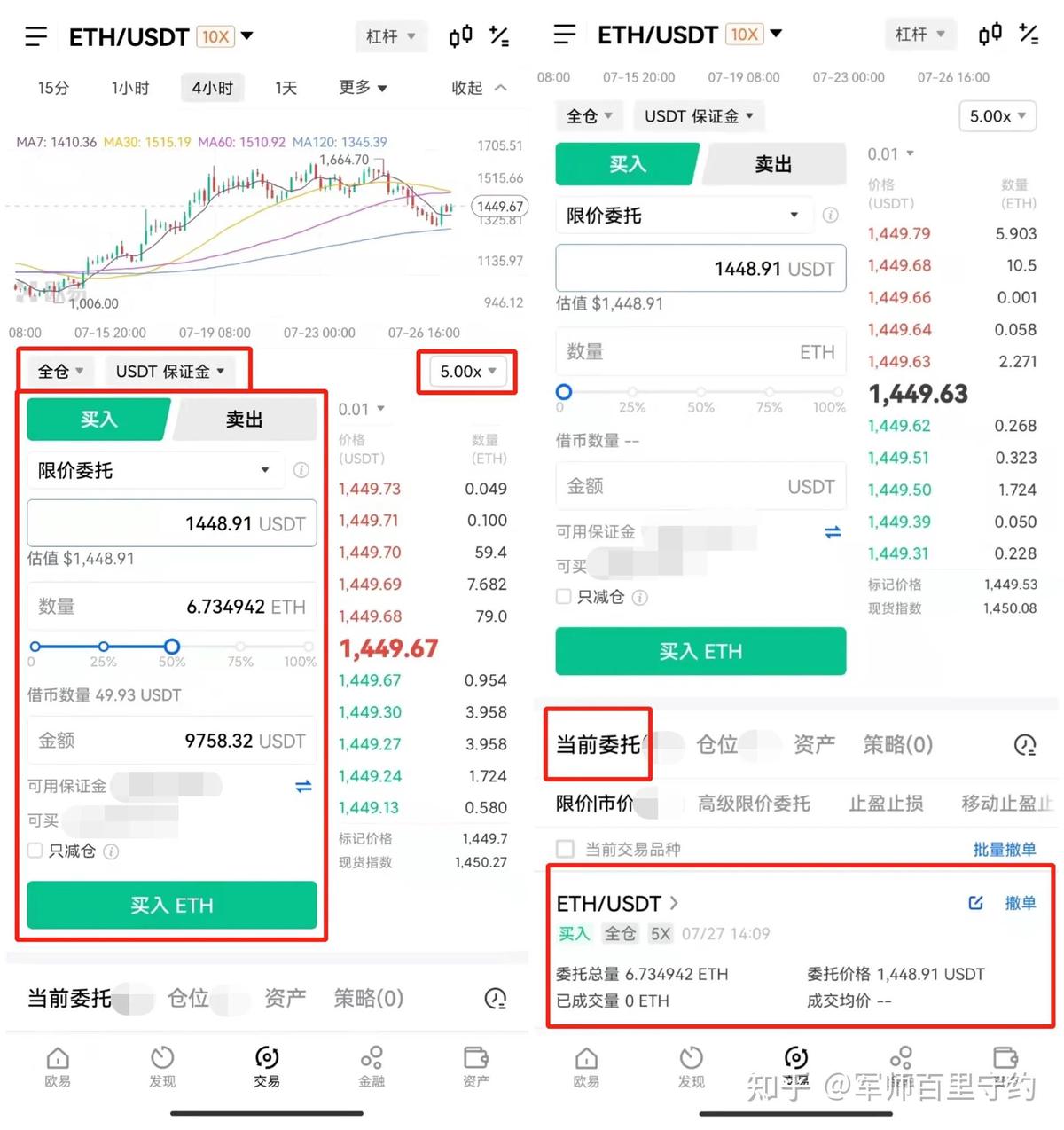

Margin and Leverage

- Isolated Margin: Risk is limited to the margin of that specific position.

- Cross Margin: Shares margin across positions, potentially reducing liquidation risks.

- Leverage: While high leverage (e.g., 50x or 100x) may seem tempting, it significantly increases liquidation risks.

Funding Rates

Funding rates keep perpetual prices close to spot prices.

- Positive rate: Longs pay shorts.

- Negative rate: Shorts pay longs.

Understanding how to manage funding costs is vital for profitability.

Step 3: Trading Strategies for Beginners

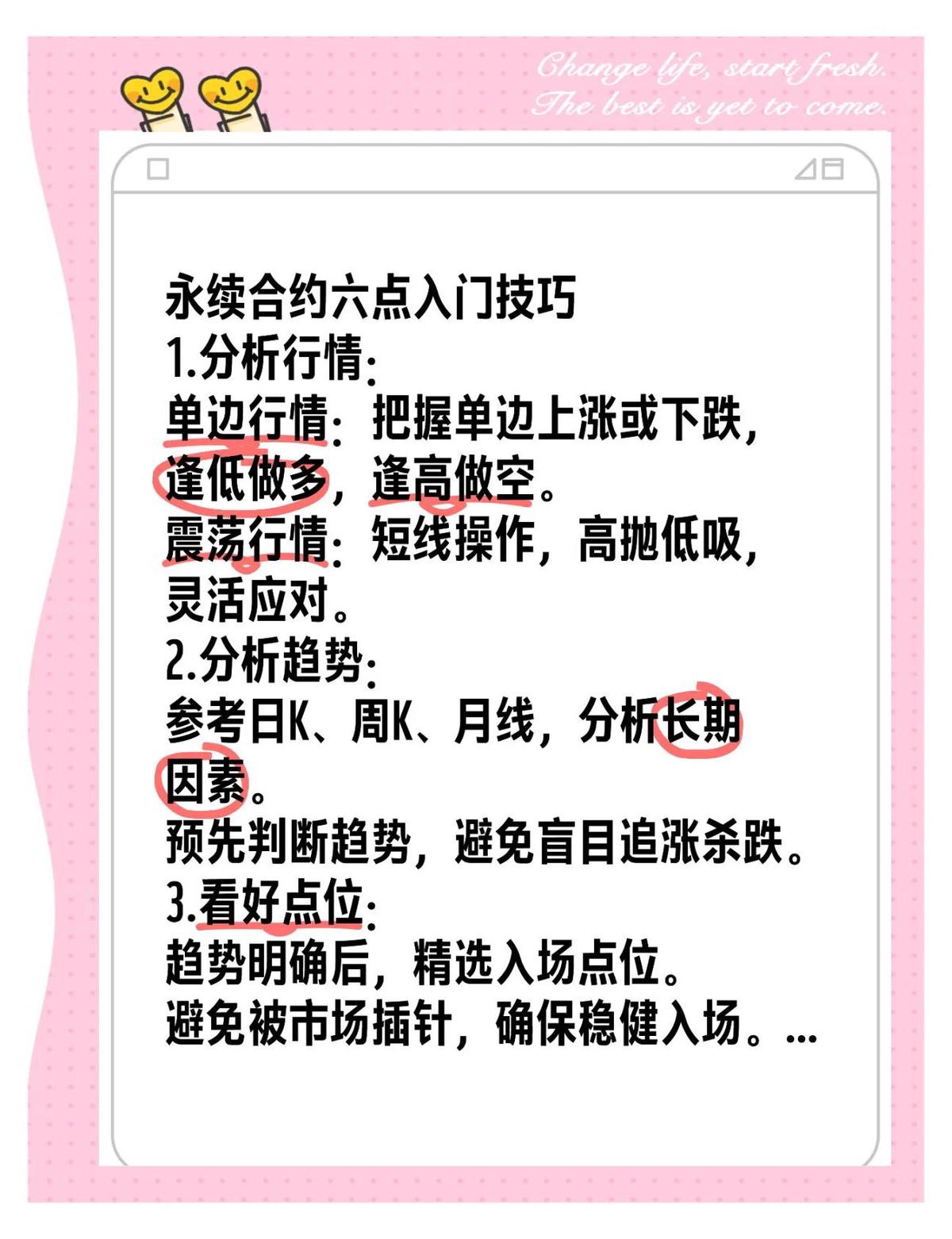

Strategy 1: Trend-Following

This method involves entering trades in the direction of the prevailing trend.

- Pros: High success in strong market conditions, aligns with momentum.

- Cons: Vulnerable to sudden reversals.

Strategy 2: Mean Reversion

Traders bet that prices will return to their average after sharp moves.

- Pros: Effective in sideways markets.

- Cons: Risky in strong trending markets.

Comparing these two approaches:

- Trend-following works best in volatile, directional markets.

- Mean reversion is better suited for ranging conditions.

Recommendation: Beginners should start with trend-following strategies using conservative leverage to limit risk.

Trend-following vs. mean reversion strategies in perpetual futures trading.

Step 4: Advanced Trading Methods

Arbitrage Opportunities

Using funding rate arbitrage, traders take opposite positions in spot and perpetual markets to earn risk-free returns.

Hedging Strategies

Professional traders and companies use perpetual futures to hedge risks in volatile markets. For instance, a crypto business holding Bitcoin can short perpetual futures to lock in profits and reduce downside risks.

This aligns with 如何管理永续合约交易风险 (how to manage perpetual futures trading risk), ensuring traders don’t expose themselves to unnecessary losses.

Step 5: Risk Management Essentials

Setting Stop-Loss and Take-Profit Levels

Automated exit strategies prevent emotional trading mistakes.

Diversification

Don’t put all your margin into one position. Spread across multiple assets to reduce exposure.

Position Sizing

Risk only a small percentage of capital (e.g., 1–2%) per trade.

Emotional Discipline

Many beginners lose money not because of bad strategies, but due to emotional decisions. Patience and discipline are key.

Step 6: Tools and Resources for Success

Analytical Tools

- TradingView: For technical charting.

- On-chain analysis tools: Glassnode, CryptoQuant.

Educational Platforms

- Crypto exchange academies often provide tutorials and simulated trading.

- Communities and forums help new traders learn from others’ mistakes.

This reflects 在哪里可以交易永续合约 (where to trade perpetual futures), highlighting that most large exchanges offer demo accounts for practice.

FAQ: Perpetual Futures Trading

1. Is perpetual futures trading suitable for beginners?

Yes, but with caution. Beginners should start small, use low leverage, and prioritize learning over profits. Many exchanges offer demo accounts, which are excellent for practice without risking real capital.

2. How much leverage should I use when starting?

It’s recommended to use 2x–5x leverage initially. While platforms allow much higher leverage, starting conservatively helps avoid early liquidations and builds trading confidence.

3. How do funding rates affect my profits?

Funding rates can either reduce or add to your returns. For example, if you’re long during a period of high positive funding, you will pay shorts regularly. Monitoring and timing trades around funding rates can significantly improve profitability.

Conclusion

Learning how to start perpetual futures trading requires mastering fundamentals, practicing disciplined strategies, and carefully managing risks. Whether you adopt trend-following, arbitrage, or hedging methods, the key is to trade with patience, use proper tools, and never overexpose your capital.

Roadmap for successful perpetual futures trading journey.

If you found this guide useful, share it with your trading peers, comment below with your questions, and spread the knowledge to help others avoid common pitfalls. Together, we can create a smarter trading community.