=======================================================

Perpetual contracts have become one of the most popular instruments in cryptocurrency and derivatives trading. They offer traders the ability to speculate on price movements without an expiration date, giving unparalleled flexibility. However, to maximize returns, individual traders need to adopt optimized strategies that balance profitability and risk. In this guide, we will explore how individuals can optimize perpetual contract returns, combining proven techniques, industry insights, and practical experience to create a comprehensive strategy.

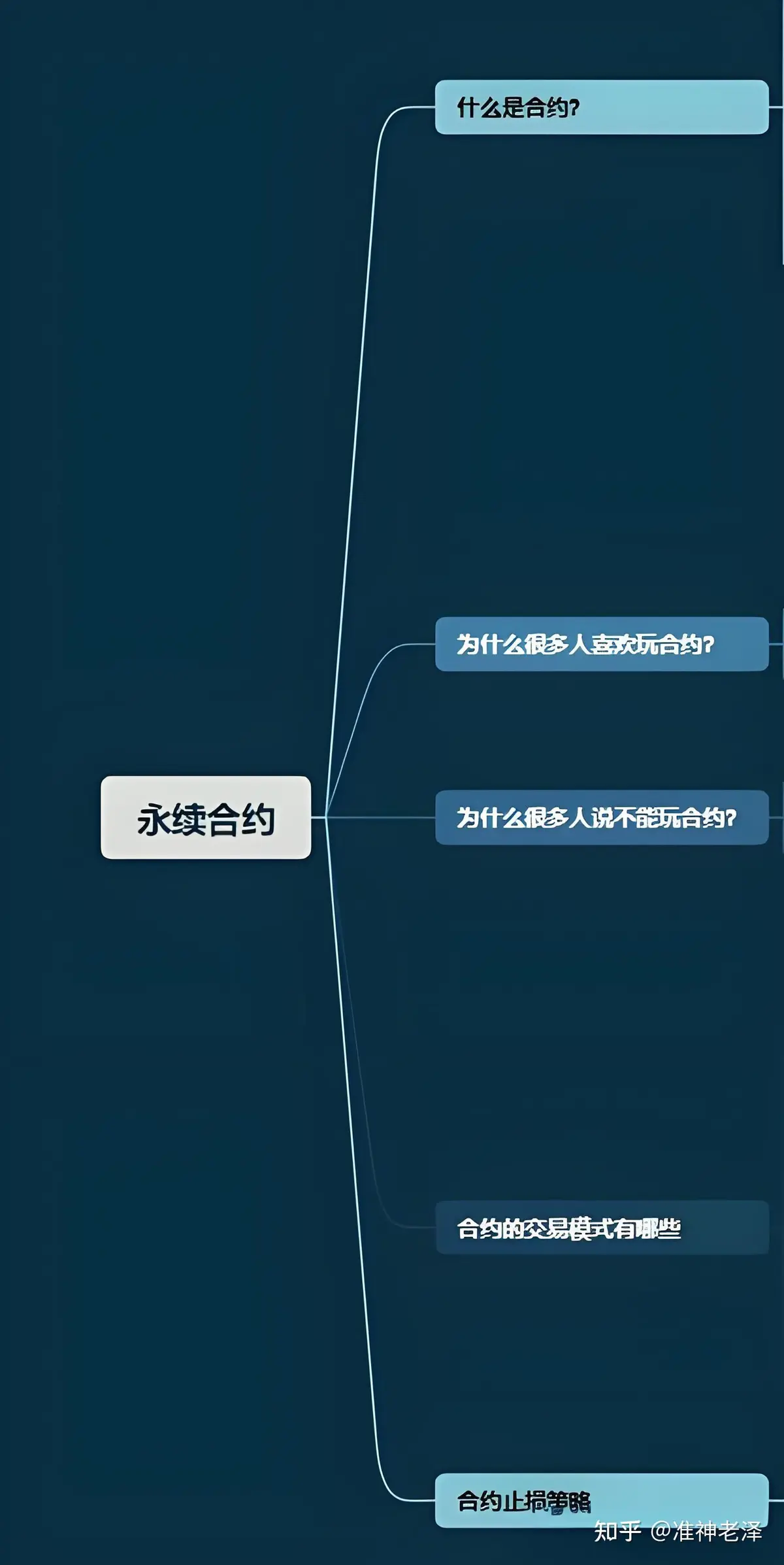

Understanding Perpetual Contracts

What Are Perpetual Contracts?

Perpetual contracts are derivative products that allow traders to speculate on the price of an asset without owning it directly. Unlike traditional futures, perpetual contracts do not have a maturity date. Instead, they use a funding rate mechanism to keep prices anchored to the spot market.

Key Features of Perpetual Contracts

- No expiration date – Positions can be held indefinitely.

- Leverage – Traders can amplify returns (and risks) using borrowed capital.

- Funding rate payments – Longs and shorts pay each other periodically to keep prices in line.

- High liquidity – Perpetuals are among the most traded derivatives globally.

Perpetual contract mechanics: balance between leverage, liquidity, and funding rates

Core Principles for Optimizing Perpetual Contract Returns

1. Effective Leverage Management

Using leverage wisely is the foundation of maximizing returns. High leverage can amplify gains, but it can also lead to liquidation. For individuals, a balance is crucial.

- Low to moderate leverage (2x–5x): Provides flexibility and reduces liquidation risks.

- Dynamic leverage adjustment: Lower leverage in volatile markets, increase slightly in stable conditions.

- Avoid all-in strategies: Keep margin reserves to sustain adverse price swings.

2. Risk Management and Stop-Loss Discipline

One of the most overlooked aspects of perpetual trading is risk management. Without a well-defined stop-loss, a single trade can wipe out months of gains.

- Stop-loss placement: Place stops slightly beyond key support or resistance levels.

- Position sizing: Never risk more than 1–2% of total capital per trade.

- Portfolio diversification: Trade multiple assets instead of focusing solely on one.

Strategies to Maximize Perpetual Contract Returns

Strategy 1: Trend-Following with Funding Rate Optimization

How It Works

Trend-following strategies involve identifying momentum in the market and aligning trades with it. In perpetual contracts, funding rates play a key role: traders can benefit not only from price movement but also from funding payments.

Enter trades during confirmed trends: Use moving averages, RSI, or MACD for signals.

Monitor funding rates:

- When rates are positive and high, shorts earn funding from longs.

- When rates are negative, longs benefit.

- When rates are positive and high, shorts earn funding from longs.

Exit strategy: Gradually take profit as trend matures to lock in gains.

Pros

- Combines directional trading with passive funding income.

- Works best in strong market conditions.

Cons

- Vulnerable to sudden trend reversals.

- Requires continuous monitoring of funding rates.

Strategy 2: Market-Neutral Arbitrage

How It Works

Market-neutral arbitrage involves simultaneously going long and short in different markets or instruments to profit from price discrepancies.

- Example: Go long in perpetual contracts and short in spot futures if perpetuals trade at a premium.

- Delta-neutral setups: Maintain a balanced portfolio where directional risk is minimized.

- Focus: Capture funding payments or arbitrage spreads.

Pros

- Minimizes market risk.

- Generates consistent returns in volatile conditions.

Cons

- Requires higher capital.

- Lower profit margins compared to directional strategies.

Comparing the Two Strategies

| Aspect | Trend-Following with Funding Optimization | Market-Neutral Arbitrage |

|---|---|---|

| Risk Level | Moderate to High | Low to Moderate |

| Capital Requirement | Medium | High |

| Return Potential | High (with leverage) | Moderate but consistent |

| Market Conditions | Best in trending markets | Effective in all markets |

| Complexity | Beginner-friendly with learning curve | Advanced strategy |

For most individuals, trend-following with funding optimization offers higher potential returns with manageable complexity. Market-neutral arbitrage is more suited for professionals or those with significant capital reserves.

Practical Tips for Individuals

Daily Routine to Enhance Performance

- Check funding rates before entering positions.

- Review market news and major macroeconomic events.

- Use technical tools for entry signals.

- Update stop-losses as positions move into profit.

- Review performance weekly to optimize strategy.

A well-structured trading dashboard helps optimize perpetual contract returns

Integrating Broader Learning

To further strengthen trading performance, individuals can explore structured resources. For instance, if you are still new to derivatives, it is worth understanding 如何在交易中使用永续合约, as this builds a solid foundation before optimizing returns. Similarly, advanced traders may benefit from 永续合约的风险管理策略, which provides deeper insights into hedging and capital preservation.

FAQ: How to Optimize Perpetual Contract Returns

1. Should I always use leverage to maximize returns?

Not necessarily. While leverage increases profit potential, it also raises liquidation risks. Beginners should start with low leverage (1x–3x) and increase gradually as experience grows.

2. How important is the funding rate in perpetual trading?

Extremely important. Funding rates can either enhance or erode profits significantly. For example, holding a long position in a highly positive funding environment may cost you more than the trade’s profit. Smart traders align positions with favorable funding conditions.

3. What is the best strategy for beginners?

Trend-following strategies combined with strict stop-loss rules are most effective for beginners. They are easier to implement, don’t require large capital, and can help new traders learn how perpetual contracts behave.

Conclusion: Building a Sustainable Path to Profits

For individuals, optimizing perpetual contract returns is not just about chasing the highest leverage or the biggest wins. It’s about creating a structured system that combines trend-following insights, funding rate awareness, and disciplined risk management. Market-neutral arbitrage offers an advanced alternative for those with higher capital, but most individuals will find consistent growth through controlled trend-based strategies.

If you found this guide useful, share it with your trading community, comment with your own experiences, and let’s build a smarter approach to perpetual contract trading together.

Would you like me to also create infographic-style visuals (market-neutral vs. trend-following comparison, funding rate impact) so the article is more engaging for readers?