========================================================

Introduction

Leverage is one of the most powerful tools in perpetual futures trading. It allows traders to amplify their market exposure with a fraction of the capital, making it particularly attractive for small-scale traders who aim to maximize potential returns. However, the leverage impact on small-scale perpetual futures traders is a double-edged sword. While leverage can enhance profits significantly, it also magnifies risks, leading to substantial losses if not managed properly.

In this comprehensive article, we will explore how leverage affects small-scale traders, compare different leverage strategies, and provide actionable insights backed by personal experience and industry trends. We will also integrate practical risk management solutions and explain how small traders can leverage effectively without falling into common pitfalls.

Understanding Leverage in Perpetual Futures

What is Leverage in Perpetual Futures?

Leverage allows traders to open positions larger than their account balance. For example, with 10x leverage, a trader can control \(10,000 worth of contracts with just \)1,000 of margin. This multiplier effect is particularly appealing to small-scale traders with limited capital.

Why Small-Scale Traders Use Leverage

- Capital efficiency: With limited funds, traders can still participate in high-volume markets.

- Potential for amplified profits: A 2% price move with 10x leverage results in a 20% gain.

- Access to larger positions: It allows small traders to compete with larger market players.

However, leverage also brings liquidation risks, which can wipe out accounts in seconds during high volatility.

Advantages and Disadvantages of Leverage for Small Traders

Benefits of Using Leverage

- Enhanced Profit Potential – Even with small capital, traders can achieve meaningful returns.

- Diversification – Instead of using all capital in one trade, traders can spread risk across multiple positions.

- Increased Market Participation – Small traders can take part in opportunities they otherwise couldn’t afford.

Drawbacks of Using Leverage

- Amplified Losses – Losses are magnified at the same rate as profits.

- High Liquidation Risk – Small capital often means lower tolerance for market swings.

- Emotional Pressure – Volatile outcomes increase stress and lead to impulsive decisions.

Real-World Example: High vs. Low Leverage

Imagine two small-scale traders, both with $1,000 in margin:

- Trader A (High Leverage 20x): Opens a $20,000 position. A 1% market move against them results in liquidation.

- Trader B (Low Leverage 5x): Opens a $5,000 position. The same 1% adverse move only causes a 5% loss, leaving room to adjust strategy.

This example shows why high leverage is tempting but extremely dangerous for small traders.

Strategies for Managing Leverage

Strategy 1: Conservative Low-Leverage Approach

Using 2x–5x leverage provides small traders with flexibility. It reduces liquidation risk while allowing meaningful exposure.

- Pros: More breathing room for volatility, better suited for long-term strategies.

- Cons: Smaller profits compared to high leverage.

Strategy 2: Aggressive High-Leverage Scalping

Some traders adopt 10x–20x leverage for short-term scalping trades, aiming to capture quick moves.

- Pros: High profit potential within minutes.

- Cons: Risk of instant liquidation if stop-losses aren’t strictly enforced.

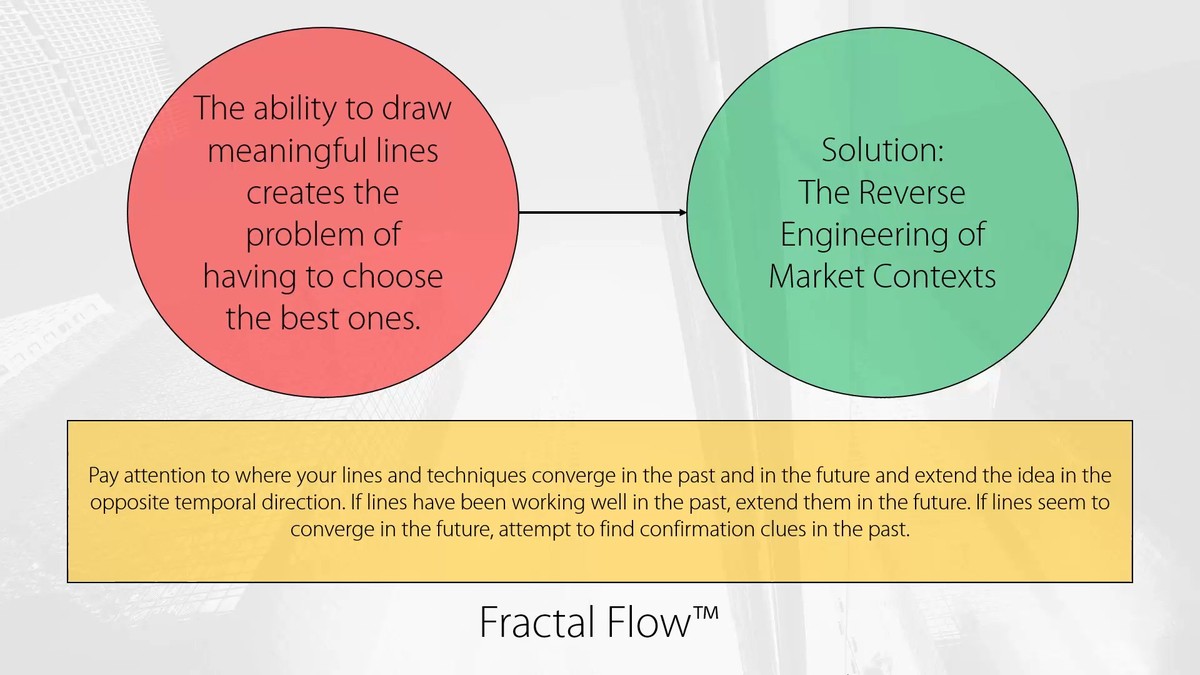

Recommendation: Small traders should start with a conservative leverage setup and gradually increase only when they have mastered risk management in perpetual futures.

Risk Management Practices

Position Sizing

Small traders must avoid committing all capital to a single position. Risking only 1–2% of total equity per trade prevents catastrophic losses.

Stop-Loss and Take-Profit Rules

Strict stop-loss levels protect traders from unexpected swings. Equally, setting take-profit targets locks in gains before reversals occur.

Diversification with Leverage

Instead of leveraging heavily into one asset, small traders can diversify across multiple perpetual futures contracts.

Industry Trends Affecting Small Traders

- AI-powered leverage calculators now help traders determine optimal ratios.

- Exchange risk controls such as auto-deleveraging (ADL) protect against cascading liquidations.

- Educational platforms are improving awareness, answering questions like “How much leverage is safe in perpetual futures?” and offering structured guides.

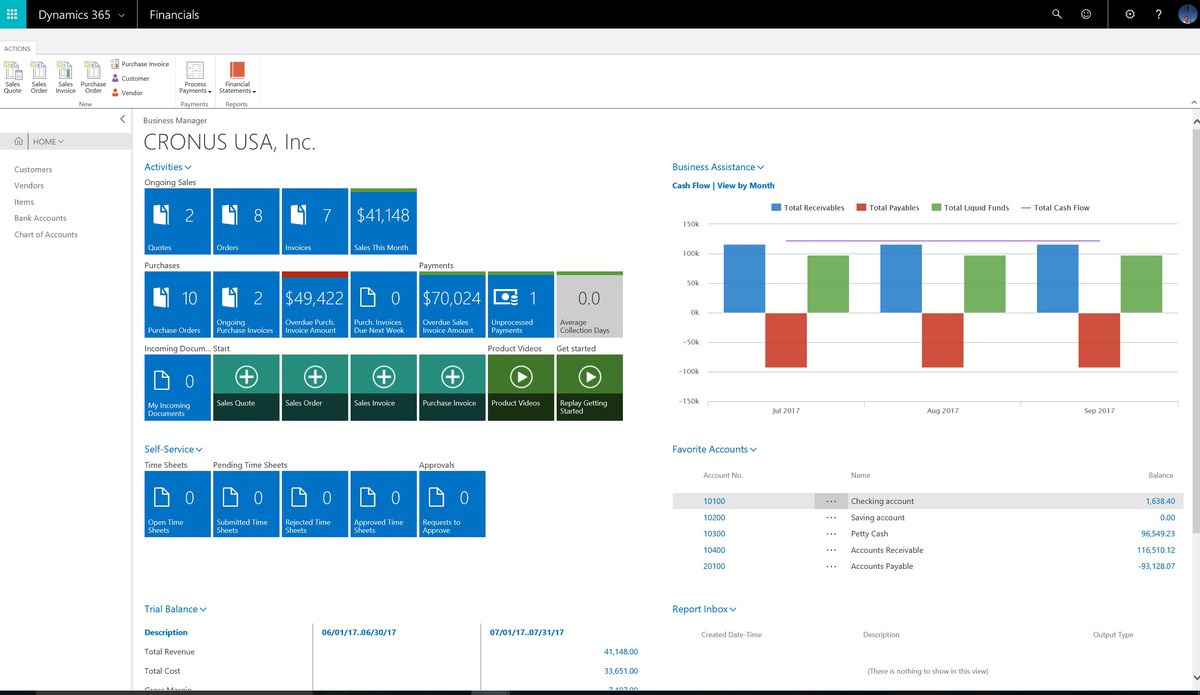

Visual Insights

Leverage Risk-Reward Balance

Leverage impact increases both profit and liquidation risk, making balanced strategies essential for small-scale perpetual futures traders.

Integrating Knowledge with Internal Resources

Many new traders ask: “How does leverage affect risk in perpetual futures?” The answer lies in understanding that higher leverage compresses your liquidation threshold, making even minor price swings dangerous. On the other hand, low leverage increases resilience and allows better adjustment.

For beginners seeking structured learning, resources like Guide for beginners on leverage in perpetual futures provide an excellent foundation to understand margin mechanics, position sizing, and practical applications.

FAQ: Small-Scale Traders and Leverage

1. How much leverage is safe for small-scale perpetual futures traders?

For beginners, 2x–5x leverage is recommended. It balances exposure and risk, giving room to adjust trades without instant liquidation.

2. Can small traders make consistent profits with leverage?

Yes, but only with disciplined risk management. Traders who set strict stop-losses, diversify trades, and avoid emotional decisions tend to survive longer and gradually grow capital.

3. What tools can help small traders manage leverage effectively?

- Leverage calculators for optimal ratio selection.

- Trading bots with automated stop-loss/take-profit settings.

- Risk dashboards on exchanges that display liquidation thresholds in real-time.

Conclusion

The leverage impact on small-scale perpetual futures traders is significant, offering both opportunities and risks. While high leverage may provide quick gains, it exposes traders to severe liquidation risks. A balanced approach—starting with low leverage, using strict risk management, and gradually exploring advanced strategies—is the most sustainable path.

If you’re a small trader, consider experimenting cautiously, learning from conservative strategies first, and then scaling up as your experience and capital grow.

Call to Action

If you found this article insightful, share it with fellow traders, leave your thoughts in the comments, and discuss your own leverage experiences. The more we exchange ideas, the better prepared small-scale traders will be to thrive in perpetual futures markets.