====================================================

Introduction: Why Risk Management Matters in Coinbase Perpetual Futures

Perpetual futures have quickly become one of the most popular instruments for crypto traders, and Coinbase’s platform has opened the door for both retail and institutional investors to engage with these products. However, with great opportunity comes significant risk. The inherent leverage, volatility, and 24⁄7 trading environment make risk management in perpetual futures on Coinbase not just a recommendation but a survival requirement.

This comprehensive guide will explore the core principles of risk management, advanced strategies, and real-world case studies. We’ll compare different approaches, highlight their strengths and weaknesses, and offer practical advice for implementing a risk management framework that aligns with your trading style and capital allocation.

Understanding Perpetual Futures on Coinbase

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of an asset without an expiry date. Unlike standard futures, they don’t require rolling over contracts; instead, they use a funding rate mechanism to keep the perpetual price in line with the spot market.

Why Coinbase?

Coinbase is known for regulatory compliance, user-friendly interfaces, and strong security. This makes it an attractive choice for both novice and professional traders looking to explore perpetual futures trading strategies on Coinbase.

Key Risks in Coinbase Perpetual Futures

- Leverage risk: Amplifies gains and losses.

- Liquidation risk: Forced liquidation occurs if collateral falls below margin requirements.

- Volatility risk: Crypto markets are notoriously volatile, impacting perpetual futures more severely than traditional instruments.

- Liquidity risk: Thin order books may lead to slippage and poor fills.

Core Principles of Risk Management in Perpetual Futures

Principle 1: Position Sizing

Properly sizing positions based on account equity and volatility is crucial. Risking more than 1–2% of capital per trade can expose traders to unnecessary liquidation risks.

Principle 2: Stop-Loss Discipline

Implementing stop-loss orders reduces exposure to rapid price swings. This is particularly important on Coinbase, where perpetual contracts operate 24⁄7 without market halts.

Principle 3: Leverage Moderation

Even though Coinbase allows leverage, using maximum leverage is rarely sustainable. Experienced traders often cap leverage at 3x–5x, balancing risk with opportunity.

Principle 4: Diversification Across Assets

Avoid concentration risk by trading multiple pairs. Managing correlated exposure across Bitcoin, Ethereum, and altcoin perpetuals reduces downside risk.

Strategies to Manage Risks in Coinbase Perpetual Futures

Strategy 1: Hedging with Cross-Asset Perpetual Futures

Hedging is one of the most effective ways to manage risk in perpetual futures. For example, a trader holding a long position in Ethereum spot could short Ethereum perpetuals on Coinbase to protect against downside moves.

Advantages:

- Reduces exposure to sudden market reversals.

- Works well for institutional and retail traders.

Disadvantages:

- Requires careful monitoring of funding rates.

- Can reduce profit potential in strong uptrends.

Strategy 2: Stop-Loss and Trailing Stops

Stop-loss orders automatically exit trades when the market moves against a position, while trailing stops adjust dynamically as prices move favorably.

Advantages:

- Automates risk control.

- Helps lock in profits during favorable moves.

Disadvantages:

- Can be triggered by temporary volatility (“stop hunting”).

- Requires optimal placement to avoid premature exits.

Strategy 3: Volatility-Based Position Adjustments

Instead of fixed-size trades, some traders adjust their exposure based on market volatility. For instance, during high-volatility periods, traders reduce position sizes to lower risk.

Advantages:

- Adapts risk dynamically to market conditions.

- Prevents oversized losses in high-volatility environments.

Disadvantages:

- May result in lower gains during stable trends.

- Requires strong statistical models or volatility indicators.

Comparing Risk Management Approaches

| Strategy | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Hedging | Long-term investors, institutions | Protects against large drawdowns | Funding costs reduce net returns |

| Stop-Loss/Trailing Stops | Active traders, day traders | Automates exits and locks in profits | Risk of premature liquidation |

| Volatility-Based Sizing | Quant and systematic traders | Adapts to market environment | Complex to implement for beginners |

Recommendation: For most Coinbase users, combining stop-loss discipline with moderate hedging offers the most balanced risk management approach.

Real-World Case Study: Coinbase Futures During Market Crash

During the May 2021 Bitcoin crash, many perpetual traders faced mass liquidations across exchanges. On Coinbase, traders who implemented tight stop-loss orders and cross-hedges managed to preserve capital, while those overleveraged without safeguards faced forced liquidation. This underscores the importance of risk management discipline in perpetual futures.

Best Practices for Managing Risk on Coinbase

- Regularly Monitor Funding Rates – Positive or negative funding can erode returns.

- Use Partial Liquidation Features – Coinbase allows partial liquidations to reduce complete wipeouts.

- Maintain Adequate Collateral – Over-collateralizing positions helps avoid margin calls.

- Integrate Technical and Fundamental Analysis – For example, use order book depth and macro signals before entering leveraged positions.

- Educate Continuously – Resources such as how to trade perpetual futures on Coinbase provide valuable insights for ongoing learning.

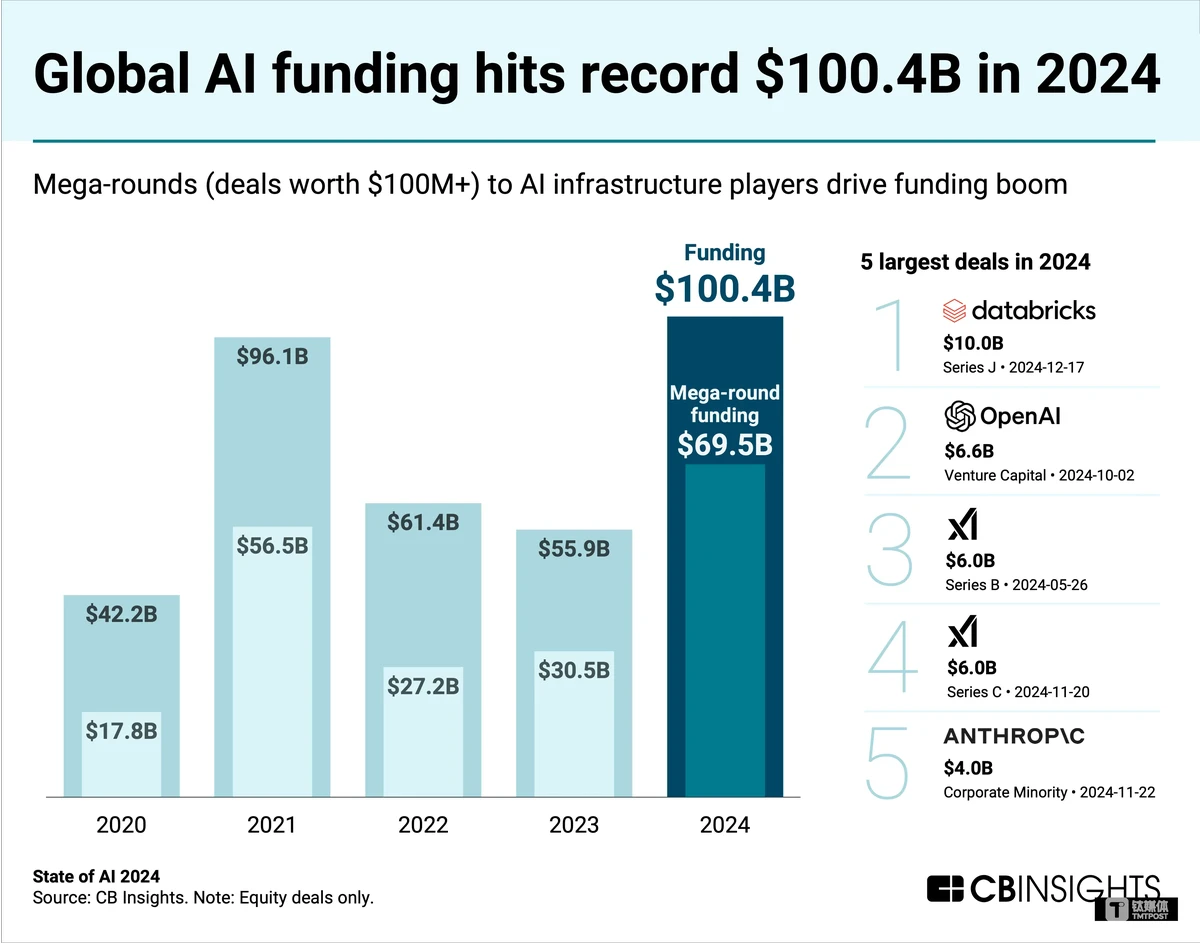

Visual Insights

Illustration of risk management framework in perpetual futures trading

FAQ: Risk Management in Coinbase Perpetual Futures

1. What leverage level is safe to use on Coinbase perpetual futures?

While Coinbase may allow higher leverage, experienced traders recommend using 3x–5x leverage for balanced risk and reward. Beginners should start even lower until they gain confidence.

2. How can I avoid liquidation in perpetual futures?

To avoid liquidation, maintain higher collateral levels, use stop-loss orders, and avoid excessive leverage. Monitoring funding rates also helps in preventing negative carry costs.

3. Should I hedge my positions when trading perpetual futures on Coinbase?

Yes. Hedging with offsetting futures positions is a common institutional strategy. It may limit upside potential, but it significantly reduces downside risks, especially during volatile events.

Conclusion: Building a Sustainable Risk Management Framework

Trading perpetual futures on Coinbase offers tremendous opportunities, but without effective risk management, even the best strategies can fail. By combining position sizing, stop-loss orders, leverage moderation, and hedging techniques, traders can preserve capital while maximizing profitability.

Whether you’re just learning through where to find perpetual futures on Coinbase or are an advanced trader refining your execution, the key takeaway is simple: risk management is the foundation of long-term success in perpetual futures trading.

If you found this guide useful, share it with fellow traders, comment with your strategies, and let’s build a stronger community of risk-aware Coinbase futures traders.

Would you like me to expand this into a step-by-step workbook with detailed Coinbase screenshots, showing exactly how to implement stop-losses, hedges, and volatility-based sizing?