===========================================================

In the ever-evolving world of cryptocurrency, perpetual futures have become an increasingly popular trading product. While they offer the potential for substantial profits, they also come with significant risks. For cautious investors, especially those new to the crypto space or seeking more conservative strategies, navigating perpetual futures on platforms like Coinbase can be daunting. In this article, we will provide expert advice for cautious investors looking to trade perpetual futures on Coinbase, outlining strategies, risk management techniques, and best practices.

What Are Perpetual Futures?

Before diving into the strategies and advice, it’s crucial to understand what perpetual futures are. Unlike traditional futures contracts, which have expiration dates, perpetual futures are designed to be held indefinitely. This means they allow traders to speculate on the price of cryptocurrencies without worrying about an expiry date. They are highly popular among crypto traders for their flexibility and continuous exposure to price movements.

On Coinbase, perpetual futures offer leveraged positions, meaning that you can trade with more capital than you initially deposit. However, this leverage can amplify both gains and losses, making them a double-edged sword for cautious investors.

Key Features of Perpetual Futures on Coinbase:

- No expiration date: Positions can be held indefinitely, allowing for long-term speculation.

- Leverage: Traders can use leverage to multiply their exposure to price movements, which can result in higher returns (but also higher risk).

- Funding rates: These are periodic payments exchanged between long and short positions based on the difference between the perpetual futures price and the spot price of the asset. They can either work in your favor or against you, depending on market conditions.

Why Cautious Investors Should Consider Perpetual Futures on Coinbase

For cautious investors, Coinbase offers a relatively user-friendly interface and several features that can mitigate some of the risks associated with perpetual futures. Perpetual futures allow investors to profit from both rising and falling markets. This flexibility is crucial for cautious investors, as it provides opportunities to adapt to varying market conditions.

However, caution is essential when trading with leverage, as the potential for significant losses is high. With this in mind, let’s explore some effective strategies and risk management tips that can help mitigate these risks.

Strategies for Cautious Investors

1. Start with Small Positions

One of the simplest and most effective strategies for cautious investors is to start with small positions. Leverage can amplify both profits and losses, but using a smaller leverage ratio—especially when you’re just getting started—can reduce the risk. A good rule of thumb is to begin with low leverage (e.g., 2x or 3x) and gradually increase exposure as you become more comfortable.

Why This Works:

- Reduces risk: Small positions prevent large losses in case the market moves against you.

- Lower emotional impact: Less risk means less emotional stress, which can help maintain a level-headed approach to trading.

2. Utilize Stop-Loss and Take-Profit Orders

A crucial tool for risk management when trading perpetual futures is the stop-loss and take-profit orders. These orders help to automatically close your position at a predetermined price, thereby limiting potential losses or locking in profits.

How to Use:

- Stop-Loss: Set a stop-loss order at a price below your entry point (for long positions) to protect against significant losses.

- Take-Profit: Set a take-profit order at a price level where you are happy with your gains. This helps to secure profits in a volatile market.

Why This Works:

- Prevents emotional decision-making: Automatic execution of orders can help avoid impulsive trading decisions.

- Provides clear risk management: By defining entry and exit points, you can control risk exposure in any market condition.

3. Use Hedging Techniques

For cautious investors, hedging can be a valuable strategy. This involves opening positions that offset potential losses in other positions. For example, if you hold a long position in Bitcoin via perpetual futures, you could open a short position to hedge against a potential market downturn.

Why This Works:

- Risk reduction: Hedging can help protect against adverse market movements.

- Increased flexibility: Investors can adjust positions in real-time based on market sentiment.

Risk Management Tips for Cautious Investors

1. Understand Leverage and Margin Requirements

Leverage is both a tool and a risk factor. On Coinbase, traders can use leverage to amplify their positions. However, using high leverage increases the risk of liquidation, especially in a volatile market like crypto. Cautious investors should always use low leverage and ensure they understand margin requirements thoroughly before placing any trades.

Key Considerations:

- Always check your available margin and ensure you are not overexposed to risk.

- Consider using leverage ratios of 2x or 3x, rather than higher leverage levels, to reduce the risk of forced liquidation.

2. Monitor Funding Rates

Funding rates are periodic payments exchanged between long and short positions. They are based on the difference between the price of the perpetual futures contract and the spot market price of the cryptocurrency. For cautious investors, it’s essential to keep an eye on funding rates, as they can significantly impact profitability, especially in long-term positions.

Why It’s Important:

- Funding rates can eat into profits: If you hold a position for an extended period and funding rates are high, your profitability may diminish.

- Plan your exit: Be aware of when your position might become unprofitable due to unfavorable funding rates, and plan accordingly.

3. Diversify Your Portfolio

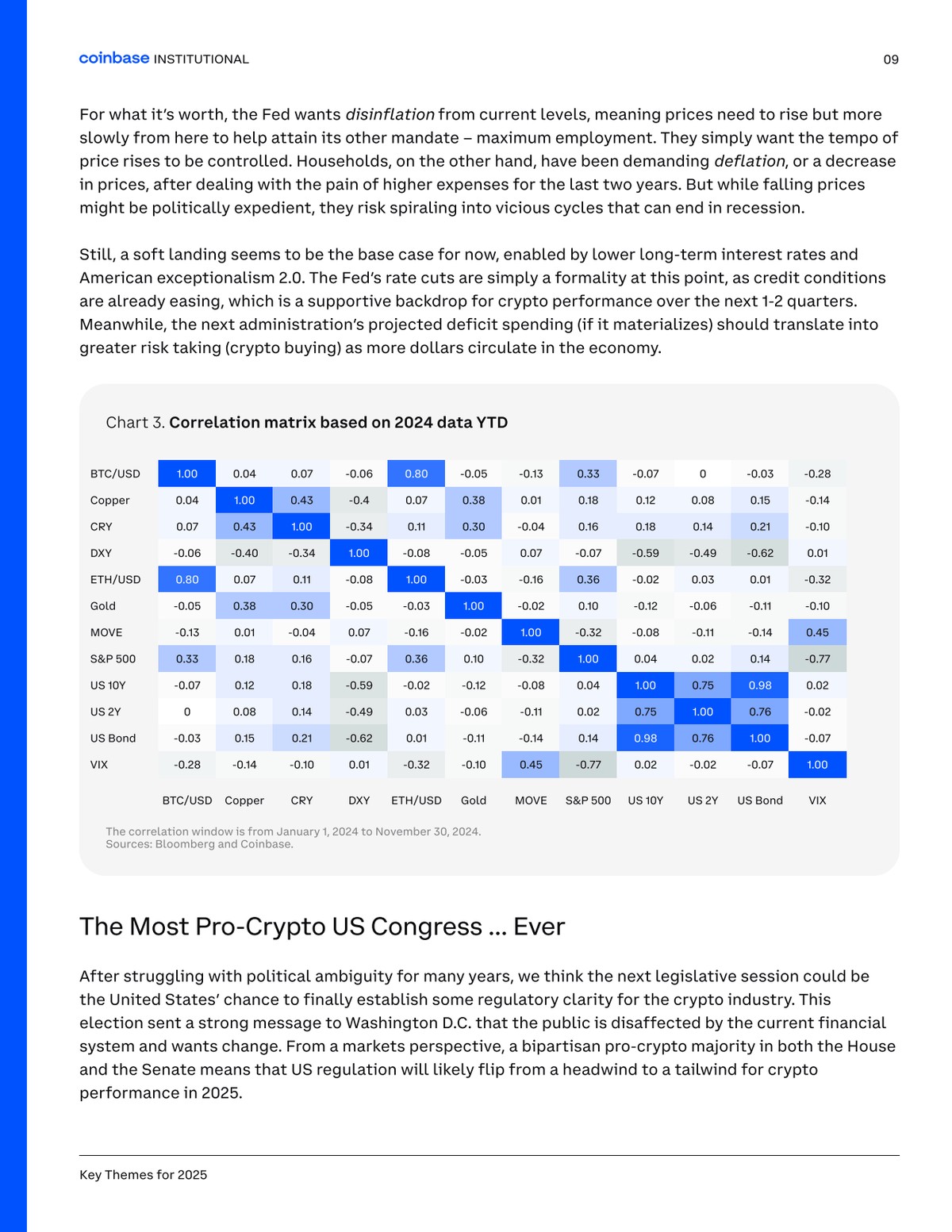

While it might be tempting to focus exclusively on crypto futures, diversification is a key strategy for risk-averse investors. By spreading your investments across different asset classes (stocks, bonds, commodities, etc.), you can reduce the overall risk of your portfolio. Additionally, consider allocating only a small portion of your total portfolio to perpetual futures on Coinbase.

Why This Works:

- Minimizes exposure to a single asset: Diversification helps spread risk across different markets and reduces the impact of a single asset’s performance on your portfolio.

- Helps balance volatility: Cryptocurrencies can be extremely volatile, and diversification provides a buffer against market swings.

How to Analyze Perpetual Futures Market on Coinbase

Analyzing the perpetual futures market on Coinbase requires both technical and fundamental analysis. For cautious investors, focusing on technical indicators and market sentiment can help inform your trading decisions.

Key Technical Indicators:

- Moving Averages: Use moving averages to identify trends and potential entry or exit points.

- RSI (Relative Strength Index): This helps determine whether an asset is overbought or oversold, indicating potential price reversals.

- Bollinger Bands: Use Bollinger Bands to assess volatility and identify potential price breakouts or breakdowns.

Market Sentiment:

Keep an eye on overall market sentiment, particularly social media platforms like Twitter and Reddit, which can provide early signals of large price movements. Coinbase also offers integrated market analytics that can help track trends and sentiment.

FAQ: Common Questions About Perpetual Futures for Cautious Investors

1. How can I limit my losses when trading perpetual futures on Coinbase?

To limit your losses, always use stop-loss orders to automatically close your position if the market moves against you. Additionally, starting with small positions and low leverage will reduce your overall exposure to risk.

2. Is it necessary to use leverage when trading perpetual futures on Coinbase?

No, leverage is not mandatory. In fact, for cautious investors, it’s often recommended to trade without leverage or with minimal leverage to avoid the risk of liquidation and excessive losses.

3. How can I stay updated on market trends for perpetual futures?

Stay informed by regularly monitoring Coinbase’s market analysis tools, and consider following crypto-related news and sentiment analysis platforms. Additionally, technical indicators like RSI and Moving Averages can provide key insights into market trends.

Conclusion

Perpetual futures on Coinbase offer a unique opportunity for cautious investors to profit from the crypto market, but they come with inherent risks, especially when using leverage. By starting small, utilizing stop-loss and take-profit orders, understanding funding rates, and diversifying your portfolio, you can manage risk while participating in this exciting market. Always remember to proceed with caution, and continuously educate yourself to make informed decisions.