=======================================================================================

Introduction

Among the most innovative instruments in the digital asset world, perpetual futures for cryptocurrency enthusiasts stand out as both exciting and challenging. These contracts, unlike traditional futures, do not expire. Instead, they rely on funding mechanisms to keep their prices closely aligned with the spot market. For crypto traders, this innovation has created opportunities for leverage, hedging, and arbitrage. However, perpetual futures also bring significant risks that demand deep understanding and disciplined execution.

This comprehensive guide will provide enthusiasts, from curious beginners to experienced traders, with a detailed overview of perpetual futures. We will explore how they work, strategies for trading them, risk management tools, and actionable insights drawn from real-world market behavior.

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of a cryptocurrency without owning the underlying asset. Unlike traditional futures with a set expiration date, perpetual contracts can be held indefinitely, as long as the trader maintains sufficient margin.

The absence of expiration makes them highly attractive to crypto enthusiasts, particularly those seeking flexibility and continuous exposure.

How perpetual futures remain tied to the spot market via funding rates

How Perpetual Futures Work

Perpetual futures are kept in line with the spot price using a funding rate mechanism. At set intervals (e.g., every 8 hours), traders either pay or receive funding depending on whether they are long or short, and how the perpetual price compares to the spot price.

Key Mechanics

- Leverage: Traders can open positions worth 5x, 10x, or even 100x their collateral.

- Funding Payments: If the perpetual price is above spot, longs pay shorts; if below, shorts pay longs.

- No Expiry: Unlike quarterly futures, positions can be maintained indefinitely.

For more technical details, enthusiasts can explore what are perpetual futures contracts to understand their structural design.

Why Perpetual Futures Attract Cryptocurrency Enthusiasts

Benefits

- Leverage Opportunities: Small capital can control larger positions.

- 24⁄7 Trading: Available round-the-clock, matching the nature of crypto markets.

- Hedging Utility: Investors can protect their spot holdings by shorting perpetual futures.

- Arbitrage Potential: Traders exploit differences between spot and perpetual prices.

Risks

- Liquidation Risk: High leverage magnifies potential losses.

- Funding Rate Volatility: Unexpected costs can erode profits.

- Emotional Overtrading: Enthusiasts may overexpose themselves in volatile markets.

Trading Strategies with Perpetual Futures

Strategy 1: Directional Trading with Leverage

Crypto enthusiasts often use perpetual futures to amplify directional bets on Bitcoin, Ethereum, or altcoins.

Advantages:

- Potential for outsized gains with limited capital.

- Ability to go long or short easily.

Disadvantages:

- Risk of liquidation if price moves sharply against the position.

- Funding fees can eat into profits during prolonged holding periods.

Strategy 2: Hedging Spot Holdings

Investors who hold significant spot crypto often hedge by opening short perpetual futures positions. This protects against downside risk without selling the underlying assets.

Advantages:

- Provides downside protection during volatile markets.

- Preserves long-term investment exposure.

Disadvantages:

- Continuous funding payments can reduce hedge effectiveness.

- Requires careful monitoring and adjustment.

Strategy 3: Funding Rate Arbitrage

Arbitrage traders exploit differences between perpetual contract prices and spot market prices. By going long spot and short perpetuals (or vice versa), they capture funding payments.

Advantages:

- Relatively low risk compared to speculative trades.

- Profits are predictable if executed correctly.

Disadvantages:

- Requires significant capital to yield meaningful returns.

- Profits are highly dependent on market volatility.

Recommendation

For cryptocurrency enthusiasts, the best strategy depends on their profile:

- Short-term speculators may find directional leveraged trades appealing.

- Long-term holders benefit more from hedging strategies.

- Advanced traders can explore arbitrage for consistent returns.

However, all enthusiasts should first study how to avoid risks in perpetual futures, ensuring disciplined risk management before execution.

Risk Management in Perpetual Futures

Key Techniques

- Leverage Control: Avoid using maximum leverage; stay within 3x–5x for manageable risk.

- Stop-Loss Orders: Set clear exit points to prevent total liquidation.

- Diversification: Don’t allocate all capital to perpetual contracts.

- Monitoring Funding Rates: Factor in costs before holding positions long-term.

Risk management is essential for success in perpetual futures trading

Market Trends and Insights

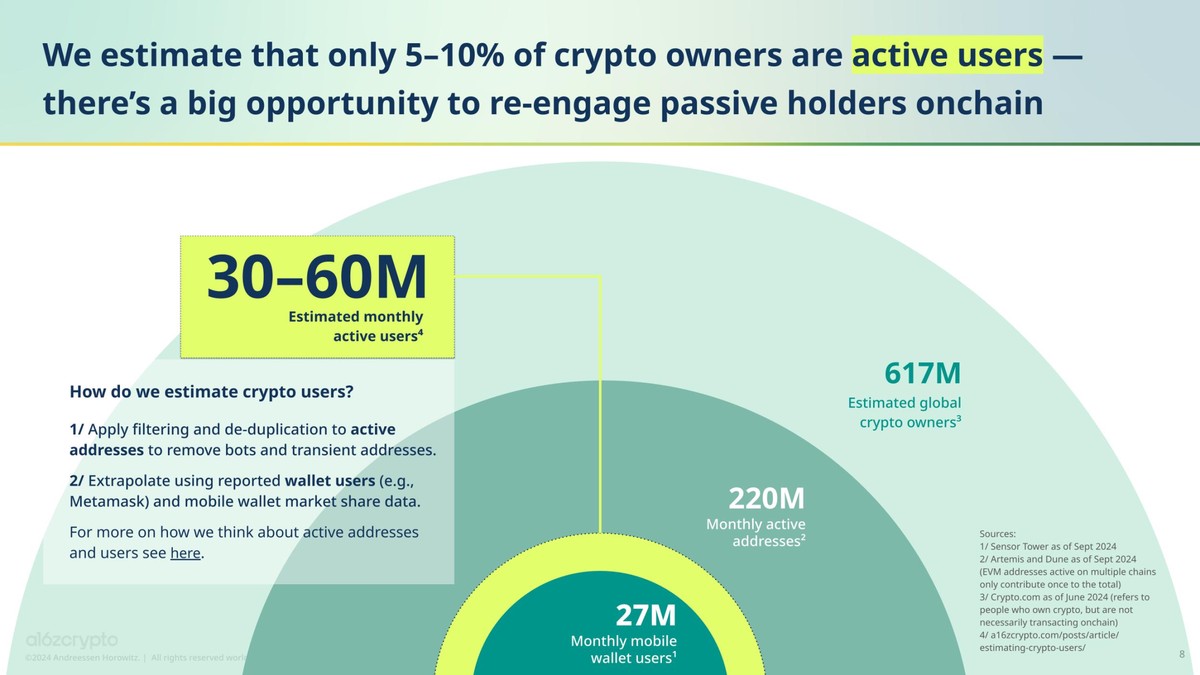

Growing Popularity

Perpetual futures now dominate crypto derivatives volumes, with exchanges like Binance, Bybit, and OKX reporting billions in daily trading.

Institutional Involvement

Hedge funds and professional desks increasingly use perpetual futures to manage risk or gain exposure, signaling growing market maturity.

Retail Enthusiasm

Enthusiasts are drawn by the accessibility and gamified experience, though this often leads to over-leverage and liquidations.

FAQ: Perpetual Futures for Cryptocurrency Enthusiasts

1. Are perpetual futures suitable for beginners?

Beginners can use perpetual futures, but they should start with low leverage (1x–2x) and prioritize learning over profit-seeking. Enthusiasts should also practice with demo accounts before trading live capital.

2. How do funding rates impact profitability?

Funding rates can significantly affect long-term positions. If you hold a long perpetual contract in an overheated market, frequent funding payments may erode your profits. Always calculate expected fees in advance.

3. What’s the best way to manage risk when trading perpetual futures?

The most effective approach is to combine strict position sizing, stop-loss placement, and moderate leverage. Enthusiasts should also keep part of their portfolio in stable assets to cushion against high volatility.

Conclusion

Perpetual futures for cryptocurrency enthusiasts offer immense opportunities, from leveraged trading to sophisticated hedging and arbitrage. Their flexibility and accessibility make them a cornerstone of modern crypto markets. However, the same features that make them attractive also pose significant risks. By balancing enthusiasm with discipline, employing structured risk management, and selecting strategies aligned with their goals, traders can fully leverage the potential of perpetual futures.

If this guide provided you with valuable insights, share it with fellow enthusiasts, join the discussion in crypto communities, and let others learn how to master perpetual futures responsibly.