==============================================================

Professional investors are increasingly looking toward perpetual futures on Coinbase as a tool to optimize returns, hedge risk, and gain access to highly liquid crypto derivatives markets. Unlike traditional futures contracts with expiry dates, perpetual futures are designed to mimic the spot market while offering flexibility in leverage and trading strategies. This article provides a comprehensive perpetual futures guide for professional investors on Coinbase, covering strategies, execution methods, risk management, and industry insights.

Understanding Perpetual Futures on Coinbase

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow investors to speculate on the price of an asset without owning it, and unlike standard futures, they never expire. Instead, a funding rate mechanism keeps the contract price aligned with the spot market.

For professional investors, this means:

- Continuous Exposure: No need to roll over contracts.

- Leverage Opportunities: Capital efficiency with leverage up to 10x or higher (depending on Coinbase rules and regulatory frameworks).

- Risk Hedging: Manage portfolio volatility by shorting perpetuals while holding spot assets.

Why Professional Investors Choose Coinbase

Coinbase has become a preferred platform for institutional and professional investors because of:

- Regulatory credibility: As a U.S.-listed company, Coinbase offers greater transparency and compliance than offshore exchanges.

- Deep liquidity: Access to a large pool of global traders ensures tighter spreads and lower slippage.

- Advanced tools: Professional trading interfaces, API integrations, and institutional custody services.

Key Benefits of Perpetual Futures for Professional Investors

1. Portfolio Hedging

Institutional portfolios often carry long exposure to crypto assets. By using perpetual futures, investors can create delta-neutral strategies to reduce volatility.

Example: A hedge fund holding \(10M in Bitcoin spot may short \)10M worth of Bitcoin perpetual futures to protect against downside moves without liquidating its spot holdings.

2. Leverage for Capital Efficiency

Perpetual futures on Coinbase allow traders to take larger positions without committing full capital. Professional traders often use cross-margin and isolated margin strategies to balance leverage with risk exposure.

3. Access to 24⁄7 Global Markets

Unlike traditional futures markets that follow exchange hours, perpetual futures trade around the clock, offering flexibility for global investors who need constant market exposure.

Two Professional Strategies for Trading Perpetual Futures on Coinbase

Strategy 1: Market-Neutral Arbitrage

How It Works

- Go long spot Bitcoin.

- Go short perpetual futures of the same value.

- Collect the funding rate when positive.

Advantages

- Low directional risk: Market-neutral, profit relies on funding payments.

- Stable returns: Ideal for institutions seeking predictable yield.

Disadvantages

- Funding volatility: Returns depend on funding rate cycles.

- Capital intensive: Requires significant spot holdings.

Strategy 2: Trend-Following with Leverage

How It Works

- Use technical indicators (moving averages, RSI, or order book depth) to identify strong momentum.

- Take a leveraged perpetual futures position in the trend direction.

Advantages

- High return potential in trending markets.

- Efficient capital allocation with leverage.

Disadvantages

- High liquidation risk in volatile reversals.

- Requires active monitoring and precise execution.

Coinbase-Specific Features Professional Investors Should Know

Where to Find Perpetual Futures on Coinbase

Coinbase offers perpetual futures within its Coinbase Advanced trading platform. Professional investors can also integrate via API connections for algorithmic trading and execution across multiple pairs like BTC-PERP, ETH-PERP, and other altcoins.

How to Manage Risks in Perpetual Futures on Coinbase

Risk management is critical when using leverage. On Coinbase, professionals often implement:

- Stop-loss orders: Automatic exit points to cap losses.

- Portfolio margining: Risk-based capital allocation across multiple assets.

- Dynamic position sizing: Adjusting leverage based on volatility and liquidity.

By combining these tools, professional traders can ensure sustainable participation in volatile perpetual futures markets.

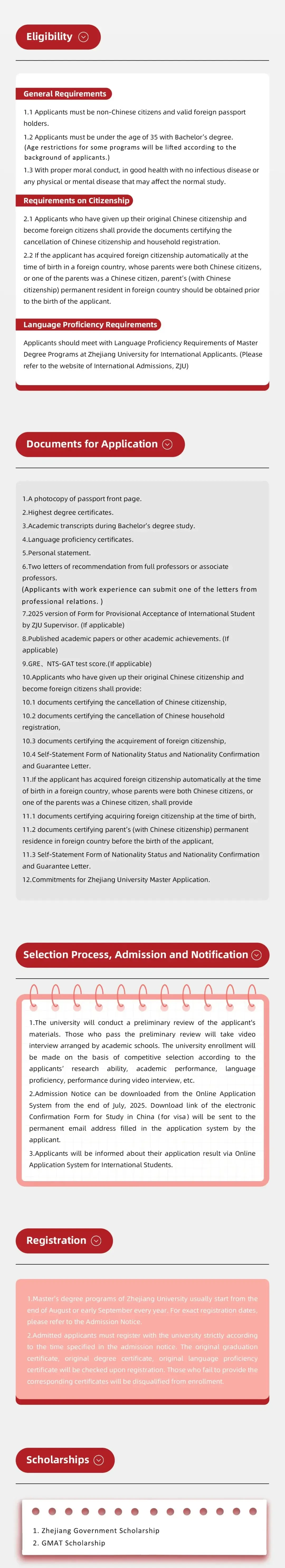

Visual Insights into Coinbase Perpetual Futures

Coinbase Advanced perpetual futures interface for professional traders

Industry Trends: Why Perpetual Futures Are Gaining Momentum

Institutional Adoption

More funds and asset managers are turning to perpetual futures for hedging and liquidity management. Coinbase’s regulatory standing makes it a strong choice for institutions wary of compliance risks.

Integration with Algorithmic Trading

Professional investors increasingly deploy quant strategies (statistical arbitrage, liquidity provision, funding rate optimization) through Coinbase APIs, leveraging its reliable infrastructure.

Global Liquidity Flows

The rise of perpetual futures volume indicates a migration from unregulated exchanges to more compliant platforms like Coinbase, reflecting a broader maturation of crypto derivatives markets.

Frequently Asked Questions (FAQ)

1. How does funding rate impact professional investors on Coinbase?

Funding rates ensure perpetual prices track spot markets. For professionals, a positive funding rate benefits short positions, while a negative one benefits longs. Active monitoring of funding cycles is essential to optimize yield strategies.

2. What leverage should professional investors use on Coinbase perpetual futures?

While Coinbase offers leverage up to 10x, most professional investors limit exposure to 2x–5x for capital efficiency without excessive liquidation risk. Higher leverage is generally used only for short-term tactical trades.

3. Can perpetual futures be integrated into institutional portfolios on Coinbase?

Yes. Many funds use perpetuals for hedging, arbitrage, and synthetic exposure to crypto assets without directly holding them. Coinbase’s custody solutions and APIs make it suitable for portfolio integration at scale.

Conclusion: The Professional Investor’s Guide to Coinbase Perpetual Futures

Perpetual futures are a powerful instrument for professional investors seeking capital efficiency, hedging tools, and 24⁄7 exposure to the crypto markets. Coinbase’s transparent regulatory standing, liquidity depth, and institutional-grade tools position it as a top choice for sophisticated perpetual futures strategies.

By combining market-neutral arbitrage with trend-following leverage plays, professionals can balance stable returns with high-performance opportunities. Effective risk management remains essential, ensuring that perpetual futures serve as a value-added component of a diversified investment strategy.

Share your thoughts:

Have you integrated perpetual futures into your trading strategy on Coinbase? Comment below and share this guide with fellow professional investors to encourage discussion and exchange of best practices.