=============================================

Introduction

In the evolving world of digital assets and derivative markets, perpetual futures opportunities for investors are becoming a central topic of discussion. Unlike traditional futures contracts, perpetual futures have no expiration date, offering flexibility, round-the-clock trading, and high liquidity. These contracts allow investors to hedge risks, speculate on price movements, and generate profits without the burden of contract rollovers.

This article provides an in-depth guide to perpetual futures: their mechanics, strategies, risks, and opportunities. Drawing from personal trading experience and the latest market trends, we will compare different approaches, highlight advantages and drawbacks, and suggest the most effective strategies for modern investors.

Understanding Perpetual Futures

What Are Perpetual Futures?

Perpetual futures are derivative contracts that mirror the structure of futures but without an expiry date. They are widely used in cryptocurrency markets, where investors can take long or short positions with leverage. Their unique funding rate mechanism ensures prices remain close to the spot market.

Why Perpetual Futures Have No Expiry

Unlike standard futures, perpetual contracts continuously roll over, eliminating the need to close and reopen positions. This design solves the inefficiency of traditional contracts and makes perpetuals highly attractive to both retail and institutional investors.

Key Benefits of Perpetual Futures for Investors

1. Leverage and Capital Efficiency

Perpetual futures enable traders to control larger positions with smaller capital outlays, magnifying both gains and losses. For disciplined investors, leverage becomes a powerful tool for capital efficiency.

2. 24⁄7 Global Access

Crypto perpetual futures trade continuously, offering global investors the opportunity to act on market news without waiting for exchanges to open.

3. Risk Management Opportunities

Investors can hedge their portfolios by shorting perpetual contracts during market downturns, reducing exposure without liquidating spot holdings.

How Do Perpetual Futures Work in Trading?

Perpetual futures rely on a funding rate mechanism: a periodic payment between long and short traders that keeps contract prices aligned with spot prices.

- When perpetual prices are higher than spot, longs pay shorts.

- When prices are lower, shorts pay longs.

This mechanism stabilizes markets and prevents significant deviations, offering fair opportunities for both bullish and bearish investors.

Strategies for Perpetual Futures Investors

Strategy 1: Hedging Spot Portfolios

Investors holding Bitcoin or Ethereum can hedge downside risks by shorting equivalent perpetual futures.

- Pros: Reduces exposure during volatile markets, avoids selling spot assets.

- Cons: Requires constant monitoring of funding rates.

Strategy 2: Funding Rate Arbitrage

This involves capturing profits from funding payments. By holding opposite positions in spot and perpetual markets, investors can earn yield from positive funding rates.

- Pros: Low market risk if executed properly.

- Cons: Funding rates fluctuate; requires access to both spot and futures exchanges.

Recommendation: For beginners, hedging is safer and easier. Advanced traders with strong capital management skills can explore funding arbitrage for consistent returns.

Where to Find Perpetual Futures Exchanges

Major crypto exchanges such as Binance, Bybit, OKX, and Deribit offer perpetual futures contracts with deep liquidity. For institutions, CME has also launched perpetual-like instruments for regulated exposure.

When selecting an exchange, consider:

- Regulatory compliance

- Security measures

- Liquidity depth

- Fee structures

Risk Management in Perpetual Futures

Over-Leverage Dangers

High leverage can wipe out portfolios in seconds during volatile swings. Stick to leverage levels that align with your risk tolerance.

Funding Rate Costs

Persistent positive funding rates can erode profits over time if holding long positions.

Exchange Risks

Security breaches or liquidation engine failures pose systemic risks. Diversifying across exchanges mitigates this risk.

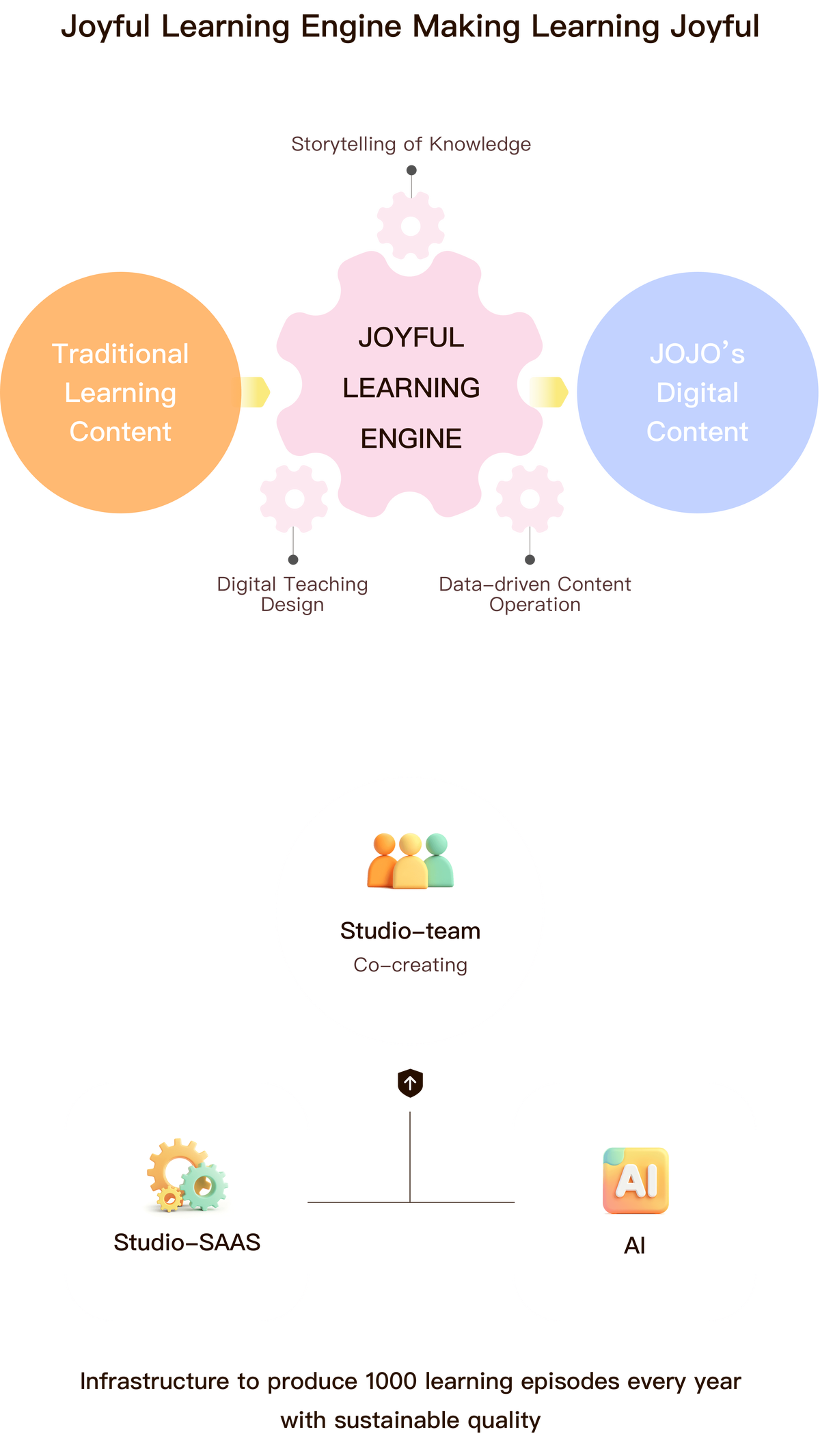

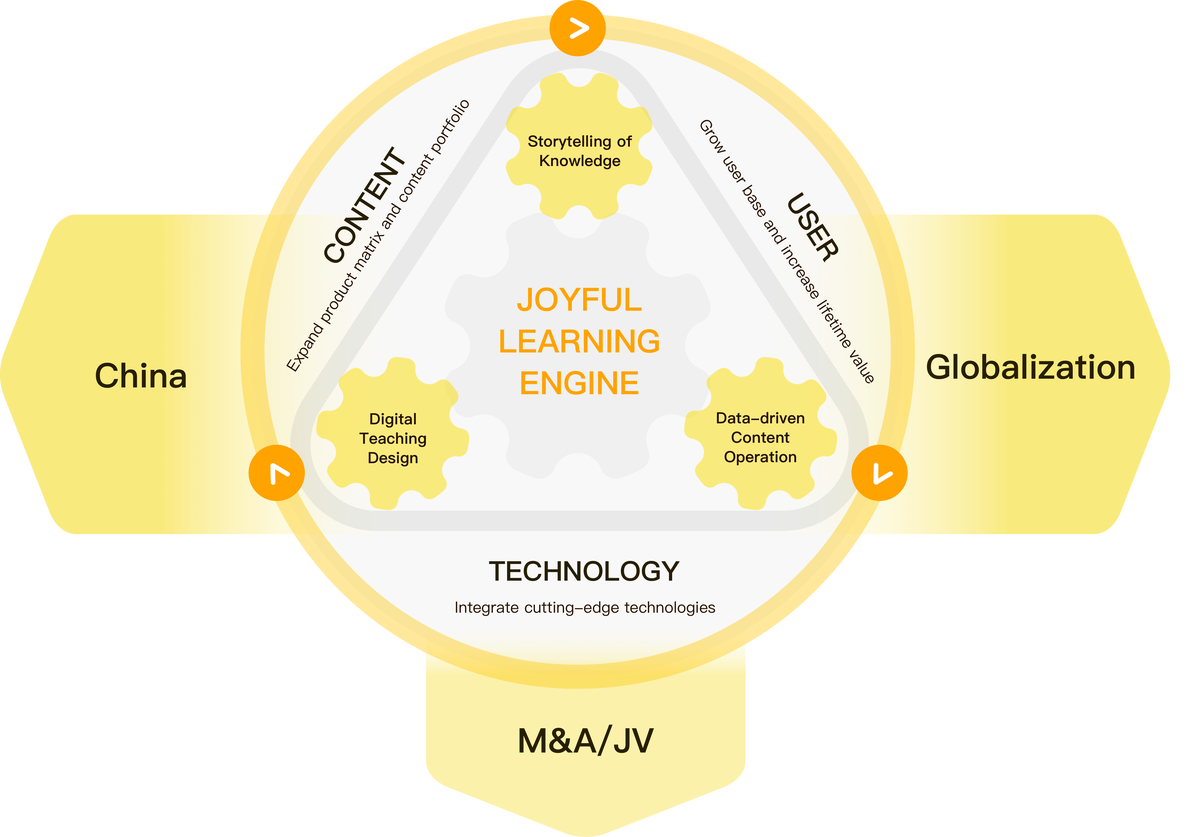

Visualization: Investor Opportunities in Perpetual Futures

The above graphic illustrates perpetual futures as a bridge between speculation, hedging, and arbitrage, offering investors multiple ways to optimize strategies.

Perpetual Futures vs. Regular Futures

| Feature | Perpetual Futures | Regular Futures |

|---|---|---|

| Expiration Date | None | Fixed expiry dates |

| Funding Mechanism | Yes (funding rate between traders) | No |

| Market Availability | 24⁄7 | Limited by exchange trading hours |

| Typical Use Case | Crypto trading, short-term speculation | Commodities, equities, risk hedging |

Understanding how perpetual futures differ from regular futures helps investors decide when to use each instrument.

Latest Trends in Perpetual Futures

1. Institutional Adoption

Institutions are increasingly using perpetuals for hedging digital asset exposure, signaling maturity in this market segment.

2. Cross-Exchange Arbitrage

Traders are exploiting funding rate differences across platforms, optimizing yields with algorithmic trading strategies.

3. Integration with DeFi

Decentralized perpetual platforms like dYdX are challenging centralized exchanges, offering on-chain transparency and non-custodial trading.

Common Mistakes Investors Should Avoid

- Overusing leverage without risk control.

- Ignoring funding rate dynamics.

- Trading on illiquid exchanges with high slippage.

- Failing to implement stop-loss orders.

FAQ: Perpetual Futures Opportunities for Investors

1. How are perpetual futures priced?

Perpetual futures are priced close to the spot market using a funding rate mechanism. This ensures that perpetual contracts do not drift too far from the underlying asset’s value.

2. Why use perpetual futures in investing?

Perpetual futures are useful for hedging, leveraging capital, and arbitrage strategies. They allow investors to stay exposed to markets without rolling over contracts, making them efficient for long-term and short-term plays.

3. How to manage risks with perpetual futures?

Effective risk management includes limiting leverage, setting stop-loss orders, monitoring funding rates, and diversifying exchanges. Experienced investors also balance perpetual positions with spot holdings to minimize exposure.

Conclusion

Perpetual futures are transforming how investors approach trading and portfolio management. With no expiry date, flexible leverage, and continuous trading, they open doors to speculation, hedging, and arbitrage opportunities.

For cautious investors, hedging strategies offer protection during market downturns. For advanced traders, funding rate arbitrage provides consistent returns if managed wisely. By following best practices in perpetual futures trading, investors can leverage these instruments to strengthen portfolios and seize opportunities in fast-moving markets.

Final Call-to-Action

Have you traded perpetual futures before, or are you considering adding them to your strategy? Share your experiences in the comments, and if you found this article insightful, please share it with your network—let’s help more investors understand the power and risks of perpetual futures!