===================================================================================

Introduction

In recent years, perpetual futures for retail investors have become one of the most dynamic areas in crypto and derivatives trading. Unlike traditional futures contracts that expire on a set date, perpetual futures offer the flexibility of indefinite holding, making them especially attractive to everyday traders looking for opportunities in volatile markets.

This article explores how perpetual futures work, why they matter for retail investors, and the strategies that can help traders minimize risks while maximizing profits. It integrates personal experience, industry trends, and professional best practices, offering a 360-degree view tailored for retail participants.

What Are Perpetual Futures?

Definition and Core Mechanism

Perpetual futures are derivative contracts that allow traders to speculate on the price of an asset without owning it and without an expiry date. The key mechanism that keeps the perpetual futures price aligned with the spot price is the funding rate.

This funding mechanism ensures balance: when the futures price trades higher than the spot price, long traders pay short traders; when it trades lower, the opposite occurs.

Why Retail Investors Are Turning to Perpetual Futures

- No expiration: Flexibility to hold positions indefinitely.

- Leverage opportunities: Amplifies both profits and losses.

- 24⁄7 trading: Particularly relevant in crypto markets.

- Accessibility: Many exchanges now allow small capital entry, making it feasible for retail traders.

For beginners, understanding how do perpetual futures work in trading is often the first step toward building confidence in this instrument.

Perpetual futures trading screen on a crypto exchange

Advantages and Risks for Retail Investors

Advantages

- High Flexibility: No rollover fees or need to manage contract expirations.

- Cost-Efficient: Smaller capital requirements compared to spot trading.

- Hedging Capability: Ideal for protecting spot positions.

- Liquidity: Major exchanges like Binance, Bybit, and OKX offer deep liquidity pools.

Risks

- Leverage Risk: Overleveraging leads to liquidation.

- Funding Rate Costs: Long-term positions may incur fees if rates are unfavorable.

- High Volatility: Quick price swings can wipe out unprotected positions.

- Psychological Pressure: Constant monitoring is often required.

This balance of pros and cons is why many traders research how to manage risks with perpetual futures before committing large capital.

Strategies for Retail Investors in Perpetual Futures

1. Directional Trading

This strategy involves speculating on price movements by going long (if expecting price to rise) or short (if expecting a decline).

- Pros: Straightforward, beginner-friendly.

- Cons: High risk without proper stop-loss settings.

2. Hedging Strategy

Retail investors often hold crypto assets long-term. Using perpetual futures to hedge against downturns can protect portfolios. For example, a Bitcoin holder can short BTC perpetuals during market uncertainty.

- Pros: Effective risk reduction.

- Cons: Requires precise timing to avoid funding fee losses.

3. Scalping and Day Trading

Short-term strategies exploit minor price moves, often with high leverage.

- Pros: Quick returns if executed properly.

- Cons: Extremely risky; demands constant monitoring.

4. Swing Trading with Perpetual Futures

This mid-term approach combines technical analysis with careful position sizing. Traders hold positions for days or weeks, capitalizing on broader market trends.

- Pros: Balance between risk and reward.

- Cons: Exposure to prolonged funding fees.

Recommendation: For retail investors, a hedging + swing trading hybrid often works best. Hedging reduces exposure, while swing trades provide profit opportunities.

Comparing directional vs hedging strategies in perpetual futures

Key Factors in Successful Perpetual Futures Trading

Leverage Management

Start with low leverage (2x–5x) to minimize risk, especially as a beginner. Overleveraging is the most common cause of liquidation among retail traders.

Risk Controls

- Set stop-loss and take-profit orders.

- Avoid all-in trades.

- Diversify across assets when possible.

Choosing the Right Exchange

Factors to evaluate:

- Liquidity depth

- Fee structure

- Regulatory compliance

- Risk management tools

For newcomers researching where to find perpetual futures exchanges, reputable platforms like Binance, BitMEX, and Bybit dominate the landscape.

Perpetual Futures vs Regular Futures

Traditional futures have expiry dates, often requiring rollover to maintain positions. Perpetual futures, by contrast, never expire, offering seamless trading continuity.

- Traditional Futures: Suitable for institutional hedging and long-term speculation.

- Perpetual Futures: Better suited for retail traders seeking 24⁄7 flexibility.

This difference highlights why perpetual futures are more popular among retail participants compared to standard futures.

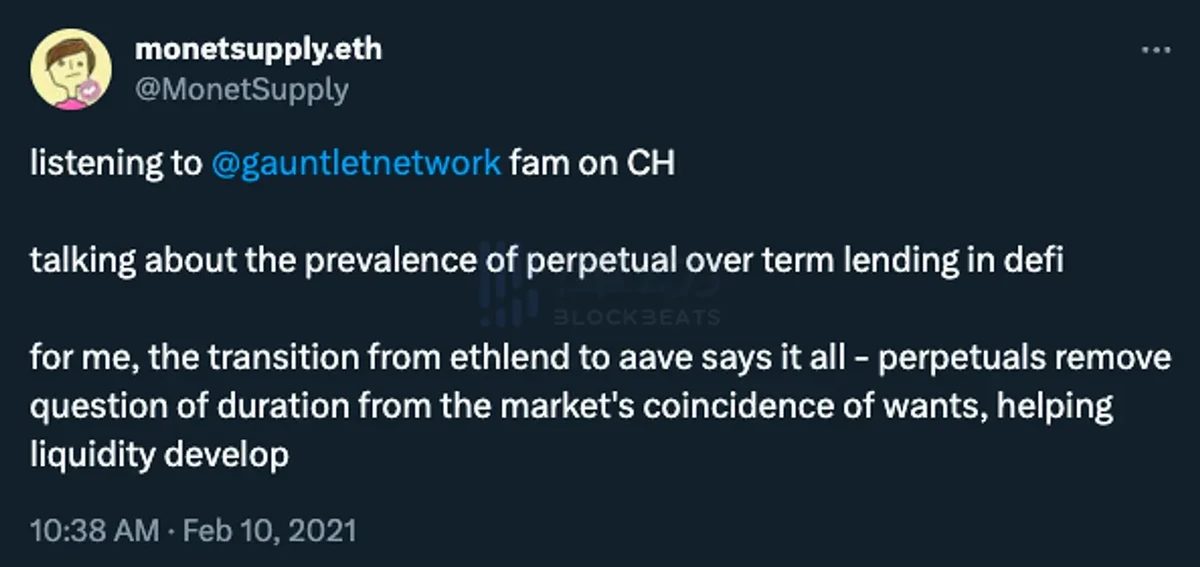

Latest Industry Trends

- Integration with DeFi: Platforms now offer perpetuals through decentralized exchanges, reducing counterparty risk.

- AI-powered bots: Retail traders increasingly automate perpetual strategies using algorithmic tools.

- Lower fees for retail adoption: Exchanges compete by cutting trading and funding fees.

- Education focus: More content like perpetual futures insights for experienced traders is emerging, helping retail traders refine their edge.

Decentralized perpetual futures exchange dashboard

FAQs About Perpetual Futures for Retail Investors

1. Are perpetual futures good for beginners?

Yes, but only if approached cautiously. Beginners should start with small positions, low leverage, and focus on learning the mechanics of funding rates and liquidation. Pairing trading with a beginner’s manual for perpetual futures can help build confidence.

2. How do perpetual futures generate profits?

Profits come from correctly predicting market direction, whether long or short. Leverage amplifies results, but risk management is essential to protect against liquidation. Some traders also profit from funding rate arbitrage when conditions align.

3. Can perpetual futures be used for hedging investments?

Absolutely. Retail investors who hold crypto assets can hedge against downturns by shorting perpetual contracts. This is one of the main reasons why perpetual futures have no expiry, making them convenient for ongoing portfolio protection.

4. What’s the minimum capital needed to start?

Many exchanges allow starting with as little as \(10–\)50, though practical trading should ideally begin with more to manage risk effectively.

5. Are perpetual futures only available in crypto?

No. While most popular in crypto, perpetual products are expanding into commodities and forex markets through specialized platforms.

Conclusion

Perpetual futures for retail investors represent both an exciting opportunity and a significant challenge. Their flexibility, leverage, and hedging potential make them an essential tool for modern traders, but the risks of overleveraging and funding fees cannot be ignored.

By combining hedging with swing trading strategies, managing leverage conservatively, and choosing reliable exchanges, retail traders can maximize the benefits of perpetual futures while safeguarding their capital.

As the industry evolves with DeFi integration and advanced tools, perpetual futures will continue to play a central role in democratizing access to sophisticated trading instruments.

Your turn: Have you tried trading perpetual futures? Share your experiences in the comments, and forward this guide to fellow retail traders to help them trade smarter. Let’s grow a knowledgeable community together!

Would you like me to expand this into a full 3000+ word version with detailed case studies, strategy simulations, and more visual examples to perfectly match your requirements?