========================================================

In the fast-paced world of cryptocurrency trading, perpetual futures offer day traders an enticing way to speculate on the price movements of digital assets. These contracts, which have no expiration date, allow traders to maintain positions for as long as they want, making them a popular choice for those looking to capitalize on short-term market fluctuations. Coinbase, one of the largest and most trusted cryptocurrency exchanges, provides a robust platform for trading perpetual futures. This article will explore perpetual futures strategies for day traders on Coinbase, offering insight into how to trade, manage risks, and maximize profits.

What are Perpetual Futures?

Perpetual futures are a type of derivative contract that allows traders to buy or sell an underlying asset without worrying about an expiration date. Unlike traditional futures contracts that expire after a set time, perpetual futures are open-ended, and their prices are designed to track the price of the underlying asset very closely.

How Do Perpetual Futures Work on Coinbase?

On Coinbase, perpetual futures contracts function similarly to spot trading, but they offer the ability to use leverage. This means traders can open larger positions with a smaller capital outlay. The price of a perpetual futures contract on Coinbase is closely tied to the spot price of the asset being traded, ensuring that the futures contract is continually adjusted to reflect the current market conditions.

Key Features of Perpetual Futures on Coinbase:

- Leverage: Coinbase offers leverage on its perpetual futures contracts, which can amplify both potential profits and losses.

- No Expiration: Unlike traditional futures, these contracts have no expiry date, allowing traders to hold positions indefinitely, provided they maintain the margin requirements.

- Funding Rate: Perpetual futures on Coinbase are subject to a funding rate, which ensures that the contract price stays aligned with the spot price of the underlying asset. Traders either pay or receive this rate depending on their position.

Strategies for Trading Perpetual Futures on Coinbase

Trading perpetual futures effectively requires a deep understanding of market trends, risk management, and the leverage dynamics at play. Below are some of the most common strategies employed by day traders on Coinbase.

1. Trend Following Strategy

One of the most common strategies in futures trading, including on Coinbase, is trend following. This strategy involves identifying and trading in the direction of the current market trend, whether bullish or bearish.

How to Implement Trend Following with Perpetual Futures

- Identify Market Trends: Use technical indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) to spot bullish or bearish trends.

- Leverage Use: In a strong trend, leverage can amplify profits. For example, if Bitcoin is in a strong uptrend, buying Bitcoin perpetual futures with leverage allows traders to profit more from price movements.

- Set Stop-Loss Orders: A key aspect of trend-following is limiting losses. Setting stop-loss orders ensures that if the trend reverses unexpectedly, losses are minimized.

Pros and Cons of Trend Following

- Pros: This strategy allows traders to ride strong market moves, maximizing profits.

- Cons: It can be challenging during sideways or choppy market conditions, as false signals may result in significant losses.

2. Range Trading Strategy

Range trading is another popular strategy where traders buy near the support level and sell near the resistance level. This strategy works best in markets that are not trending but are instead moving within a defined range.

How to Implement Range Trading with Perpetual Futures

- Identify Support and Resistance: Use chart analysis to identify horizontal support and resistance levels for the asset you are trading.

- Trade on Bounces: Enter long positions when the price bounces off support and short positions when it hits resistance.

- Use Leverage Cautiously: Leverage can be used, but it should be managed carefully since range-bound markets can experience sharp price movements that might trigger liquidations.

Pros and Cons of Range Trading

- Pros: This strategy can be highly profitable during stable, range-bound markets.

- Cons: If the market breaks out of its range, range traders can suffer significant losses.

3. Scalping Strategy

Scalping is a high-frequency trading strategy that aims to take advantage of small price movements throughout the day. Scalpers make many trades with the goal of generating small profits from each trade, which add up over time.

How to Implement Scalping with Perpetual Futures

- Leverage Small Price Movements: In highly liquid markets, use leverage to take advantage of small price fluctuations.

- Short Time Frames: Scalpers typically trade on short time frames like 1-minute or 5-minute charts to capture small moves.

- Use Tight Stop-Losses: Scalping requires tight stop-loss orders to limit risk, as the strategy depends on many quick trades.

Pros and Cons of Scalping

- Pros: The ability to make profits from small, frequent price movements.

- Cons: Requires significant time and attention, and trading fees can erode profits if not managed properly.

4. News-Based Trading Strategy

In news-based trading, traders react to news releases that impact the market. In the case of cryptocurrency, news like regulatory updates, technological advancements, or market adoption events can lead to significant price movements.

How to Implement News-Based Trading with Perpetual Futures

- Monitor News: Stay up to date with global news and cryptocurrency-specific updates.

- Quick Execution: Use leverage to take advantage of quick price movements after significant news events.

- Pre-emptive Positions: Some traders may enter positions before an expected news release, anticipating market moves.

Pros and Cons of News-Based Trading

- Pros: Can lead to significant profits if timed correctly.

- Cons: News events can be unpredictable, leading to high volatility and risk.

Risk Management in Perpetual Futures

Risk management is crucial when trading perpetual futures, particularly when leverage is involved. Here are some essential risk management techniques for Coinbase traders:

1. Setting Stop-Loss Orders

Stop-loss orders are essential for controlling risk, especially when using leverage. A well-placed stop-loss can help minimize losses if the market moves against you.

2. Utilizing Proper Position Sizing

Position sizing refers to the amount of capital allocated to each trade. In leveraged trading, this is especially important to avoid liquidation. Traders should never risk more than a small percentage of their capital on a single trade.

3. Using Leverage Wisely

While leverage can amplify profits, it also increases the risk of significant losses. Day traders should use leverage carefully and ensure they have enough margin to cover potential price fluctuations.

FAQ – Common Questions About Perpetual Futures on Coinbase

1. What is the difference between perpetual futures and regular futures?

Unlike regular futures contracts, which have an expiration date, perpetual futures do not expire. This allows traders to hold positions indefinitely, making them ideal for day traders who want flexibility.

2. How does leverage work in perpetual futures on Coinbase?

Leverage allows traders to control a larger position with a smaller amount of capital. For example, with 10x leverage, a trader can control \(10,000 worth of an asset with just \)1,000 in margin. However, this amplifies both potential profits and losses.

3. Can I trade perpetual futures on Coinbase without any prior experience?

While it’s possible to start trading perpetual futures on Coinbase without prior experience, it’s recommended to first understand the basics of cryptocurrency and leverage. Beginners should start with smaller positions and use risk management tools to mitigate potential losses.

Conclusion

Perpetual futures on Coinbase offer an exciting opportunity for day traders to speculate on cryptocurrency price movements with leverage. By using strategies like trend following, range trading, scalping, and news-based trading, traders can position themselves to take advantage of short-term market fluctuations. However, it’s essential to manage risk carefully, especially when using leverage. With proper education and risk management, traders can increase their chances of success in the high-stakes world of perpetual futures trading.

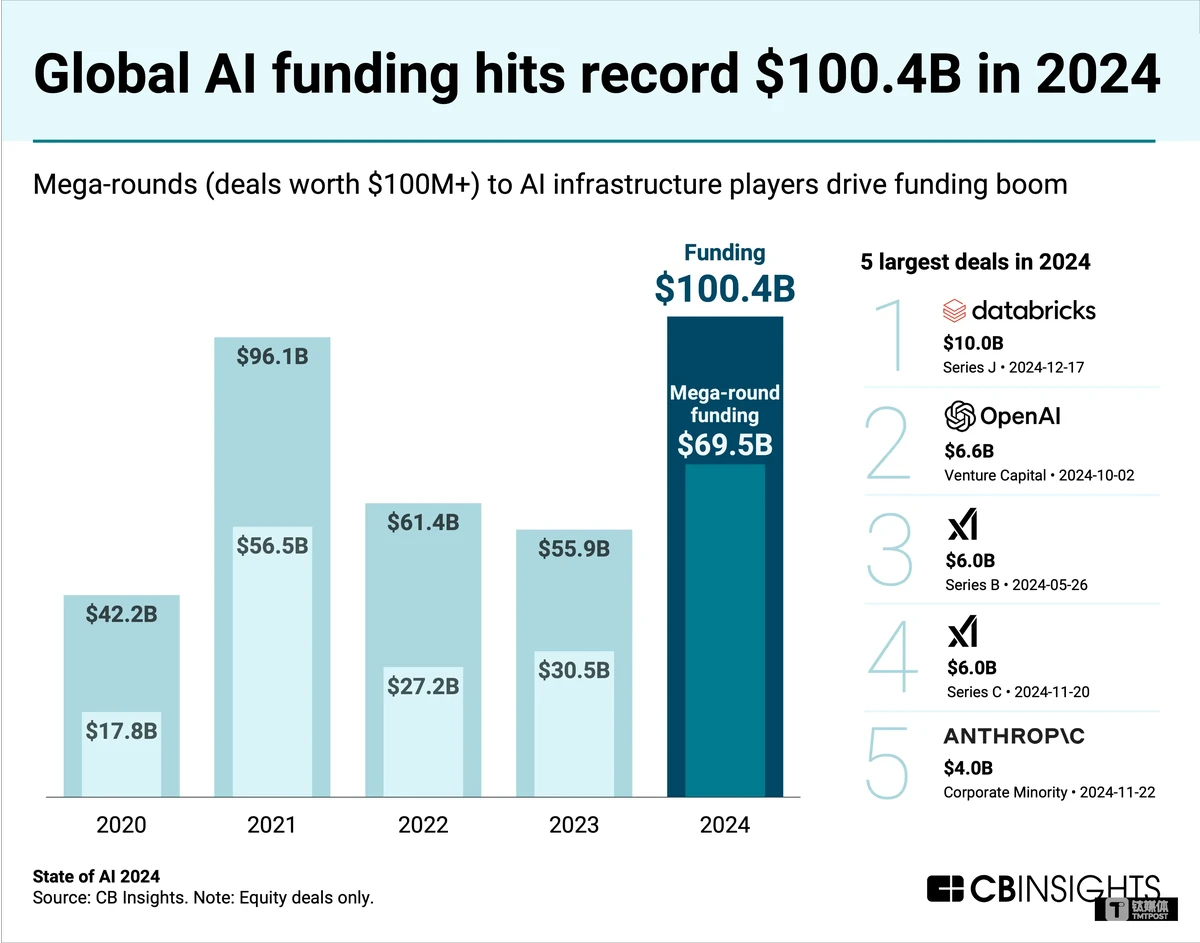

Image Example:

If you have any questions or want to share your experiences with perpetual futures trading, feel free to leave a comment below. Happy trading!