=============================================

Introduction

In the fast-evolving world of crypto derivatives, perpetual futures trading performance metrics are a vital tool for traders, investors, and institutions who want to assess effectiveness, manage risks, and optimize strategies. Unlike traditional futures, perpetual futures have no expiration date, making them attractive but also more complex to measure. Understanding performance metrics not only helps traders evaluate profitability but also provides a structured framework for improving execution, risk management, and long-term consistency.

This article will explore the most important performance metrics for perpetual futures trading, compare different evaluation methods, discuss their pros and cons, and provide actionable insights to help both beginners and professionals refine their trading approaches.

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of an asset without owning it and without expiry. Instead of rolling contracts over, a funding rate mechanism ensures that perpetual futures prices remain closely aligned with spot market prices.

For traders, the advantages include flexibility, access to high leverage, and 24⁄7 liquidity. However, without proper risk management and tracking performance metrics, perpetual futures can lead to significant drawdowns. This is why how perpetual futures impact the market is a core question for analysts evaluating long-term trading sustainability.

Why Performance Metrics Matter in Perpetual Futures

Performance metrics go beyond tracking profit and loss. They help traders:

- Identify the risk-return balance of strategies

- Measure efficiency compared to benchmarks

- Manage drawdowns in volatile conditions

- Enhance consistency over large trading samples

For professional traders, metrics also support capital allocation decisions, algorithmic optimization, and investor reporting.

Core Perpetual Futures Trading Performance Metrics

1. Profit and Loss (PnL)

The most basic but essential metric is realized and unrealized profit and loss. It reflects trading outcomes but does not show efficiency or risk-adjusted results.

2. Return on Equity (ROE)

ROE measures how effectively a trader uses their capital. In leverage trading, high ROE can be achieved quickly, but sustainability is key.

3. Win Rate

The percentage of profitable trades compared to total trades. While useful, a high win rate without risk management may still result in losses.

4. Sharpe Ratio

This metric evaluates risk-adjusted returns by comparing excess return over volatility. A Sharpe ratio above 1 is generally favorable in perpetual futures trading.

5. Maximum Drawdown

Measures the largest peak-to-trough portfolio decline. This highlights downside risks and stress points for leveraged traders.

6. Average Trade Duration

This metric helps distinguish between scalpers, swing traders, and position traders, allowing them to optimize strategies based on holding periods.

7. Funding Rate Impact

Unique to perpetual futures, the funding rate can eat into profits or enhance returns. Monitoring funding costs is critical for long-term traders.

Comparing Two Methods of Evaluating Performance

Method 1: Traditional Performance Metrics

This method relies on simple measures like PnL, win rate, and ROE.

Pros: Easy to calculate, widely understood, beginner-friendly.

Cons: Ignores risk-adjusted measures and funding costs, may lead to overconfidence.

Method 2: Advanced Risk-Adjusted Metrics

This includes Sharpe ratio, Sortino ratio, maximum drawdown, and position efficiency metrics.

Pros: Provides deeper insights, accounts for volatility and risk, useful for institutional reporting.

Cons: Requires data analytics tools, may be complex for retail beginners.

Recommendation: The best approach is combining both methods—using traditional metrics for daily monitoring and advanced metrics for monthly/quarterly performance evaluations.

Industry Insights and Trends

Recent market data shows that professional traders and funds have increasingly adopted algorithmic dashboards to track perpetual futures trading performance metrics in real time. Platforms are integrating advanced analytics, such as volatility-adjusted returns and liquidity consumption.

Retail traders, on the other hand, are shifting from simply tracking PnL to adopting structured metrics, guided by resources such as step-by-step guide for perpetual futures trading to build a disciplined approach.

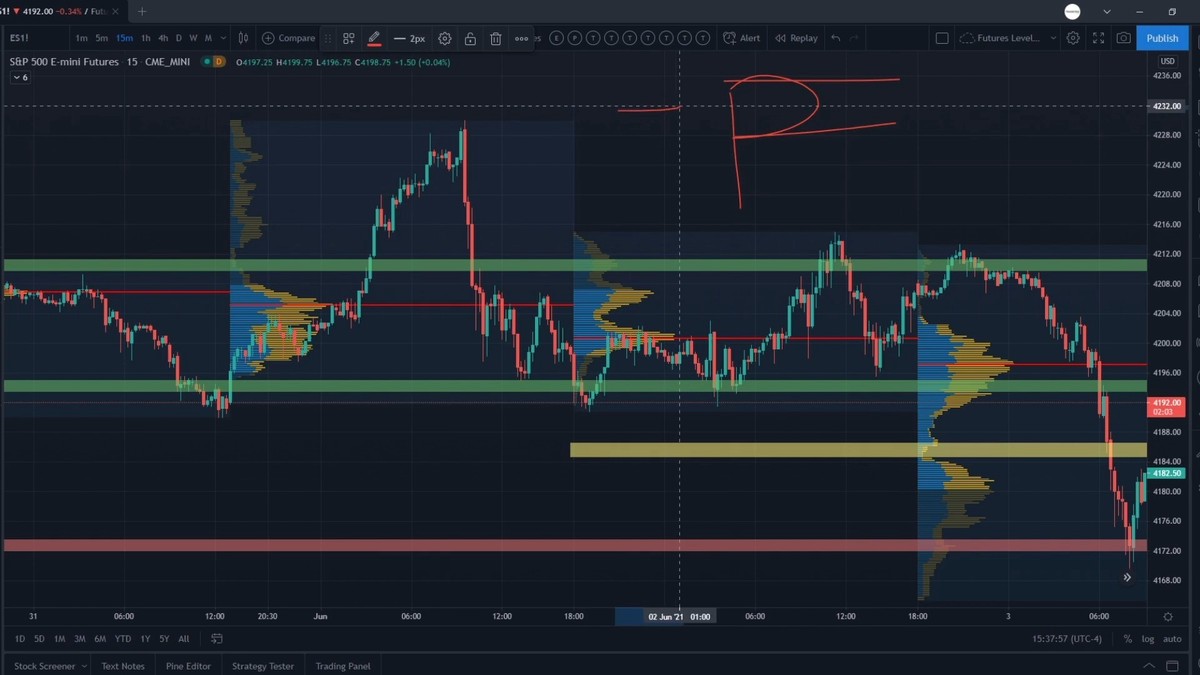

Visual Insights

Example of a trading dashboard tracking key perpetual futures metrics

Balancing risk and return in perpetual futures trading

Practical Strategies for Applying Metrics

Short-Term Scalpers

- Focus on win rate, trade duration, and ROE

- Minimize funding rate exposure

Swing Traders

- Track Sharpe ratio, max drawdown, and PnL stability

- Optimize position sizing based on volatility

Institutional and Professional Traders

- Emphasize risk-adjusted metrics

- Use advanced analytics dashboards

- Benchmark against peers or indices

FAQ

1. What is the most important performance metric for perpetual futures traders?

It depends on your style. Scalpers may prioritize win rate and ROE, while long-term traders should focus on Sharpe ratio and drawdown control. A balanced approach using multiple metrics is recommended.

2. How do funding rates affect trading performance?

Funding rates can significantly impact profitability. Positive funding can benefit long traders, while negative funding helps shorts. Monitoring funding impact as part of performance metrics ensures hidden costs are not overlooked.

3. Can beginners track advanced performance metrics?

Yes, many platforms now provide built-in analytics that calculate Sharpe ratio, ROE, and drawdowns automatically. Beginners can start with simple metrics but should gradually adopt advanced ones to refine strategies.

Conclusion

Understanding and applying perpetual futures trading performance metrics is essential for achieving consistent success in leveraged markets. Traders who only look at profits may overlook risks, while those who adopt a comprehensive metric framework gain deeper insights into strategy sustainability.

By combining traditional and advanced evaluation methods, monitoring funding costs, and adapting metrics to specific trading styles, both retail and institutional traders can improve decision-making and long-term profitability.

If you found this article valuable, share it with fellow traders, leave your comments, and join the discussion on how performance metrics are shaping the future of perpetual futures trading.

Would you like me to also create a downloadable Excel template for tracking these metrics, so traders can start applying them directly in their daily trading routine?