===========================================

Introduction

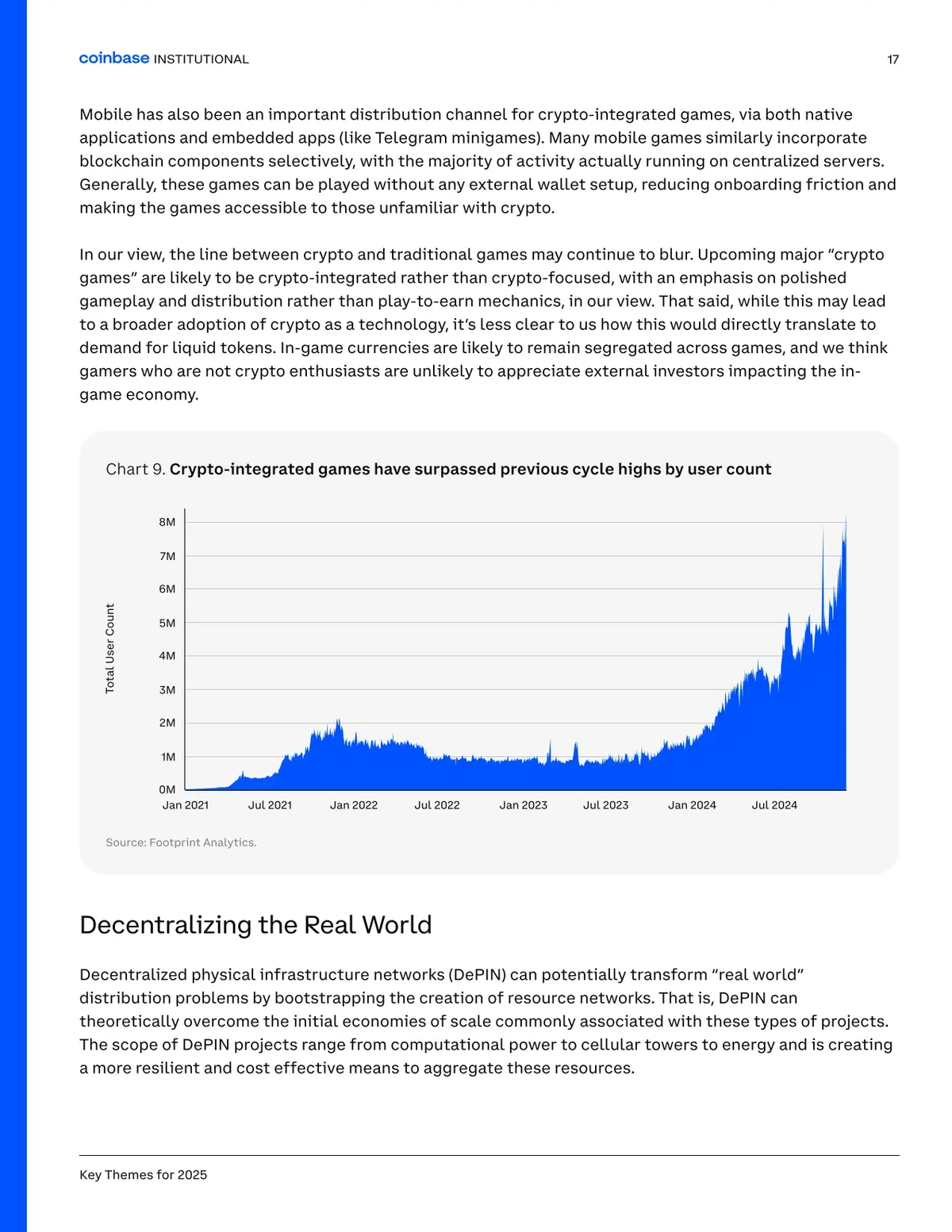

The popularity of derivatives in crypto trading has surged in recent years, with perpetual futures emerging as one of the most widely used instruments. Traders and investors are increasingly searching for clarity on how does perpetual futures work on Coinbase, given Coinbase’s reputation for security, compliance, and accessibility. Unlike traditional futures contracts, perpetual futures have no expiration date, making them ideal for traders looking to maintain long or short positions indefinitely while leveraging their capital.

This article will provide a deep dive into the mechanics of perpetual futures on Coinbase, explore different strategies, compare pros and cons, and share expert insights. We will also naturally integrate related topics like how to trade perpetual futures on Coinbase and how to manage risks in perpetual futures on Coinbase to ensure readers gain practical, actionable knowledge.

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the future price of cryptocurrencies without owning the underlying asset. Unlike standard futures, which settle on a specific date, perpetual contracts roll over indefinitely. Their price is tethered to the spot market using a mechanism called the funding rate, which balances the positions of long and short traders.

Key Features of Perpetual Futures on Coinbase

- No Expiry Date: Positions can be held indefinitely, depending on margin requirements.

- Leverage Options: Coinbase allows varying levels of leverage (commonly up to 5x or more).

- Funding Rates: Traders pay or receive funding periodically to keep contract prices close to spot prices.

- Cash Settlement: All profits and losses are settled in stablecoins like USDC rather than crypto delivery.

| Topic | Description |

|---|---|

| What are Perpetual Futures? | Derivative contracts to speculate on crypto prices without owning assets. No expiration date. |

| Key Features on Coinbase | No expiry, leverage options, funding rates, and cash settlement in USDC. |

| How It Works on Coinbase | Step-by-step: market access, contract mechanics, leverage, margin, and risk controls. |

| Strategy 1: Trend Following | Use leverage to profit in trending markets. High risk of liquidation. |

| Strategy 2: Market Neutral Arbitrage | Hold spot crypto and short perpetual futures to earn funding payments. Requires large capital. |

| Best Practice | Start with trend-following strategies with risk management for beginners. |

| Risk Management | Use stop-loss, avoid high leverage, diversify, and monitor funding rates. |

| Advantages on Coinbase | Regulated, secure, accessible, and transparent platform for trading. |

| Common Mistakes | Overleveraging, ignoring funding rates, emotional trading, and no exit strategy. |

| Expert Tips | Start small, use educational resources, and track trades for improvement. |

| FAQ: Funding Rate | Fee exchanged between long and short traders to keep prices in line with the spot market. |

| FAQ: Losses Exceeding Investment | Losses can exceed initial margin if leverage is used without proper risk management. |

| FAQ: Beginners on Coinbase | Suitable for beginners with low leverage, education, and practice via paper trading. |

| FAQ: Coinbase vs Other Exchanges | Focus on compliance and transparency, with lower leverage caps and higher security. |

Coinbase integrates perpetual futures into its advanced trading platform, ensuring both compliance and user-friendliness. Here’s how it works step by step:

1. Market Access

Eligible users can access perpetual futures under the derivatives section. Coinbase ensures compliance with regulations, meaning availability may vary by jurisdiction.

2. Contract Mechanics

- Each contract tracks the price of a cryptocurrency, such as BTC or ETH.

- Funding rates are exchanged between long and short traders every 8 hours (or other defined intervals).

3. Leverage and Margin

- Users can select leverage (e.g., 2x, 3x, 5x).

- Margin requirements determine how much capital is locked for a position.

- If losses exceed available margin, liquidation occurs to protect the exchange’s risk.

4. Risk Controls

Coinbase employs advanced liquidation engines, insurance funds, and compliance systems to ensure market stability.

Visual breakdown of how perpetual futures work on Coinbase

Two Core Strategies for Trading Perpetual Futures

Strategy 1: Trend Following with Leverage

Traders use perpetual futures to amplify gains in trending markets. By identifying uptrends with indicators like EMA (Exponential Moving Average), traders can take leveraged long positions.

Advantages:

- Potential for significant profits with limited capital.

- Effective during strong bullish or bearish market phases.

- Potential for significant profits with limited capital.

Disadvantages:

- High risk of liquidation if the trend reverses.

- Requires careful position sizing.

- High risk of liquidation if the trend reverses.

Strategy 2: Market Neutral with Funding Rate Arbitrage

Experienced traders may exploit funding rates by holding spot crypto while simultaneously shorting perpetual futures, earning funding payments over time.

Advantages:

- Low exposure to price volatility.

- Generates steady yield in certain market conditions.

- Low exposure to price volatility.

Disadvantages:

- Complex strategy requiring large capital.

- Funding rates are not guaranteed and may flip unexpectedly.

- Complex strategy requiring large capital.

Best Practice Recommendation

For most beginners and intermediate traders, trend-following with strict risk management is a safer starting point on Coinbase. Market-neutral strategies are better suited for advanced users with deeper capital reserves and risk tolerance.

Risk Management in Coinbase Perpetual Futures

Trading perpetual futures without a clear risk framework can lead to rapid losses. Practical techniques include:

- Use Stop-Loss Orders: Automatically limit downside.

- Keep Leverage Low: Beginners should avoid max leverage to reduce liquidation risks.

- Diversify Positions: Avoid putting all margin capital into one contract.

- Monitor Funding Rates: Costs can eat into profits if ignored.

Exploring guides such as how to manage risks in perpetual futures on Coinbase helps traders build strong foundations in risk control.

Effective risk management strategies for perpetual futures

Advantages of Trading Perpetual Futures on Coinbase

- Regulated Environment: Coinbase prioritizes compliance, unlike many offshore exchanges.

- Security: Strong custody systems protect user assets.

- Accessibility: Beginner-friendly interface alongside professional-grade tools.

- Transparency: Clear funding rate structures and real-time data.

Common Mistakes Beginners Make

- Overleveraging: Using 10x leverage on small accounts often ends in liquidation.

- Ignoring Funding Rates: Leads to hidden losses.

- Chasing Volatility: Emotional trades during sharp moves often backfire.

- No Exit Strategy: Holding positions indefinitely without planning.

Expert Tips for Trading on Coinbase

- Start with small positions to learn the mechanics.

- Use educational resources like Coinbase webinars and tutorials.

- Track trades in a journal to improve decision-making.

- Explore resources such as how to trade perpetual futures on Coinbase for step-by-step methods.

FAQ: How Does Perpetual Futures Work on Coinbase?

1. What is the funding rate in Coinbase perpetual futures?

The funding rate is a fee exchanged between long and short traders, ensuring perpetual contracts track the spot market price. If funding is positive, longs pay shorts, and vice versa.

2. Can I lose more money than I invest?

Yes, if you trade with leverage and don’t manage risk, losses can exceed initial margin. However, Coinbase’s liquidation systems reduce extreme negative balances.

3. Are perpetual futures on Coinbase suitable for beginners?

Yes, but only with low leverage and proper education. Beginners should start with paper trading or small allocations before scaling up.

4. How do perpetual futures differ on Coinbase compared to other exchanges?

Coinbase focuses on compliance and transparency, often offering lower leverage caps but higher security compared to offshore platforms.

Comparison of perpetual futures and spot trading

Conclusion

Understanding how does perpetual futures work on Coinbase is crucial for anyone looking to expand their crypto trading toolkit. These instruments provide flexibility, leverage, and opportunities for both speculation and hedging. While powerful, perpetual futures require disciplined risk management, especially for beginners.

By starting with trend-following strategies, managing leverage responsibly, and leveraging resources like how to trade perpetual futures on Coinbase and how to manage risks in perpetual futures on Coinbase, traders can navigate Coinbase’s futures markets more confidently.

💡 Found this article helpful? Share it with your network, comment with your trading experiences, and help others discover safe and effective ways to trade perpetual futures on Coinbase! 🚀