=============================================================

Perpetual futures trading has grown into a vital component of the crypto derivatives market. For professional traders, leverage remains the single most powerful—yet dangerous—tool available. This article dives into professional traders’ leverage insights for perpetual futures, exploring strategies, industry best practices, and risk management lessons. We will also compare multiple approaches to leverage, examine market trends, and provide financial expertise that investors and bloggers alike can leverage (pun intended) to enhance their understanding.

Understanding Leverage in Perpetual Futures

Leverage in perpetual futures allows traders to control larger positions with smaller capital. A 10x leverage means a trader can control \(10,000 worth of contracts with just \)1,000 of margin. While this enhances returns, it also magnifies losses, leading to potential liquidation.

Professional traders view leverage not as a gambling mechanism but as a capital efficiency tool—a way to deploy funds strategically across multiple markets while keeping collateral requirements manageable.

For beginners, questions like how does leverage work for beginners in perpetual futures? often lead to confusion. The answer lies in discipline: start with low leverage (1x–3x), learn funding mechanics, and expand gradually.

Why Leverage Matters to Professionals

For experienced traders, leverage offers advantages that go beyond amplification:

- Liquidity flexibility: Capital can be distributed across multiple trades instead of being locked into one.

- Hedging efficiency: Institutions often hedge spot exposure with leveraged perpetual futures.

- Arbitrage opportunities: Professionals exploit funding rates and cross-exchange inefficiencies using high leverage.

Thus, leverage is not merely about speculation—it’s a strategic enabler for both institutional and retail market participants.

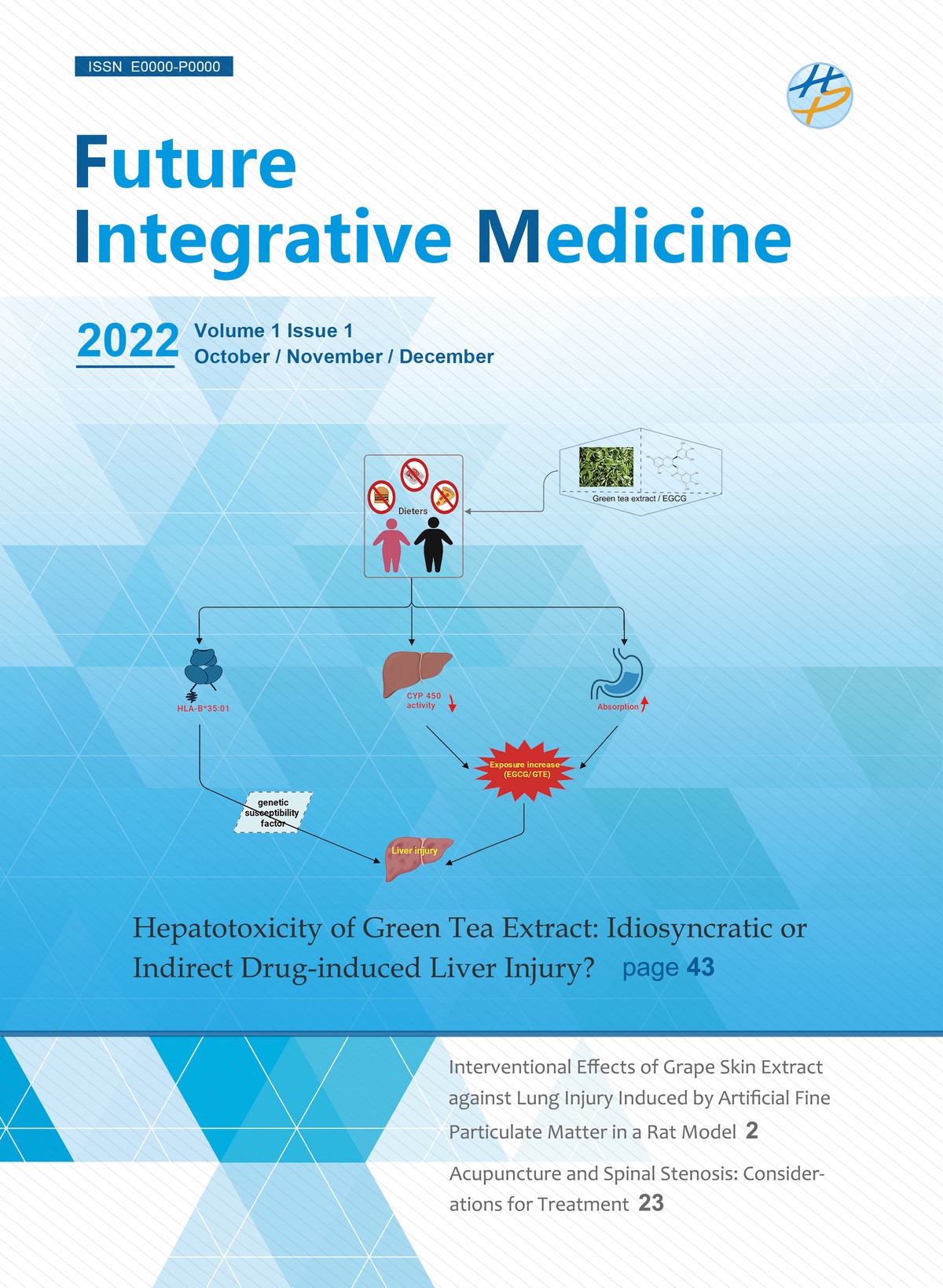

Two Core Leverage Strategies Used by Professional Traders

Professional traders typically rely on well-tested frameworks. Let’s break down two major approaches:

Strategy 1: Moderate Leverage with Trend Following

Professional traders often combine leverage with trend-following strategies using tools like moving averages, RSI, or market structure breakouts. Typically, they apply leverage in the 2x–5x range to balance capital efficiency and risk.

Advantages:

- Sustainable over long-term trading.

- Aligns with broader market momentum.

- Suitable for explaining in blogs and guides for retail readers.

Disadvantages:

- Vulnerable to sideways or consolidating markets.

- Lower profit potential compared to high-leverage strategies.

Strategy 2: High-Leverage Scalping with Strict Risk Controls

This approach uses 10x–50x leverage, typically for intraday scalping. Professionals rely on micro-movements in BTC, ETH, or altcoin perpetual markets, often holding positions for minutes.

Advantages:

- Significant returns in short timeframes.

- Requires smaller price movement for profitability.

- Works well in high-volatility environments.

Disadvantages:

- Extremely high risk of liquidation.

- Requires fast execution and strong discipline.

- Unsuitable for beginners or casual traders.

Comparing the Two Approaches

| Feature | Moderate Leverage (Trend Following) | High-Leverage Scalping |

|---|---|---|

| Leverage Range | 2x–5x | 10x–50x |

| Time Horizon | Days to weeks | Minutes to hours |

| Risk of Liquidation | Low to moderate | Very high |

| Suitability for Beginners | Yes | No |

| Suitability for Professionals | Yes | Yes (advanced only) |

Professionals often combine both methods, using moderate leverage for core positions and high leverage for tactical trades.

Leverage strategies comparison chart

Risk Management Insights from Professionals

Professional traders emphasize risk management over aggressive returns. The following insights help balance leverage and capital protection:

- Position sizing: Never allocate more than 2–5% of total capital per trade.

- Stop-loss discipline: Always place stop-loss orders relative to leverage ratio.

- Diversification: Avoid concentrating leverage into a single crypto asset.

- Funding rate awareness: High leverage positions may become costly if funding rates are unfavorable.

For those exploring how to calculate leverage ratio in perpetual futures, professionals recommend factoring in both position size and liquidation thresholds to avoid overexposure.

Institutional vs. Retail Leverage Approaches

Institutional Investors

Institutions typically use low to moderate leverage (1x–5x) with larger capital. Their goal is hedging, risk balancing, and portfolio optimization.

Retail Investors

Retail traders often chase higher leverage (10x–100x). While this can yield fast profits, the liquidation risk is immense. The professional advice for retail is: start small, focus on risk-adjusted returns, not absolute gains.

This ties into insights from institutional investors’ approach to leverage in perpetual futures, where professionals prioritize sustainability over short-term speculation.

Industry Trends in Leveraged Perpetual Futures

- AI-enhanced risk management: More platforms integrate machine learning to auto-adjust leverage.

- Dynamic margin requirements: Exchanges adjust leverage limits in volatile conditions.

- Retail education push: More guides and tutorials, such as where to learn about leverage in perpetual futures, are emerging to reduce reckless trading.

- Cross-market leverage tools: Professionals increasingly use leverage across both crypto and forex perpetual contracts for diversification.

Case Study: A Professional Trader’s Leverage Setup

One trader, managing $2M in capital, structures leverage like this:

- Core BTC position: 3x leverage, held for weeks.

- ETH tactical trades: 10x leverage, held for hours.

- Altcoin scalping: 20x leverage, held for minutes.

By diversifying leverage application, the trader achieves steady long-term growth while still capturing short-term opportunities.

Leverage allocation example for professional traders

Frequently Asked Questions (FAQ)

1. How much leverage is safe in perpetual futures?

For most traders, 2x–5x leverage is considered safe, balancing risk and returns. High leverage (20x+) is only suitable for short-term professionals with strong discipline.

2. Why do professionals avoid maximum leverage?

While 100x leverage exists, liquidation occurs with tiny price swings. Professionals avoid it because sustainability and capital preservation are more important than chasing instant profits.

3. How does leverage affect risk in perpetual futures?

Leverage increases both potential profit and loss. For example, a 5% market move against you at 20x leverage results in liquidation. Professionals treat leverage as a risk multiplier, not just a profit enhancer.

Conclusion: Professional Leverage Insights for Sustainable Trading

Professional traders’ leverage insights for perpetual futures show us one truth: leverage is a tool, not a lottery ticket. Professionals use it with discipline, blending moderate long-term positions with selective high-leverage trades.

By applying strong risk management principles, leveraging education, and monitoring market dynamics, traders can build sustainable profitability instead of chasing reckless gains.

Professional leverage insights conclusion

💡 If you found this breakdown valuable, share it with your trading community, comment with your own leverage experiences, and let’s build a smarter trading culture together.

Would you like me to create a visual step-by-step leverage setup guide in perpetual futures that traders and bloggers can repurpose for their platforms?