===========================================================

Perpetual futures have become one of the most popular derivatives in the cryptocurrency market, offering traders opportunities to speculate, hedge, and leverage positions without expiration dates. Coinbase, as one of the leading regulated exchanges, has introduced perpetual futures to meet both institutional and retail trading demands. However, with opportunity comes significant risk, making risk management solutions for perpetual futures on Coinbase an essential topic for any serious trader.

This article provides an in-depth guide to managing risks effectively when trading perpetual futures on Coinbase. It explores different strategies, compares approaches, shares practical insights, and answers key questions traders face when navigating this complex but rewarding market.

Understanding Perpetual Futures on Coinbase

What are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of cryptocurrencies without owning the underlying asset. Unlike traditional futures, they have no expiry date, and pricing is kept close to the spot market through a funding rate mechanism.

Why Use Perpetual Futures on Coinbase?

Coinbase offers perpetual futures with:

- Regulatory clarity compared to offshore exchanges.

- Institutional-grade security protecting client funds.

- Transparent fees and funding rate disclosures.

- Integration with spot markets, making hedging efficient.

For those new to this instrument, you may want to check how to trade perpetual futures on Coinbase to understand order placement, funding, and margin requirements.

Core Risks in Perpetual Futures Trading

1. Leverage Risk

Perpetual futures allow leverage (often up to 20x). While leverage amplifies gains, it also magnifies losses, potentially wiping out accounts quickly.

2. Liquidation Risk

If margin levels fall below maintenance requirements, Coinbase automatically liquidates positions to protect system integrity.

3. Funding Rate Risk

Funding payments, exchanged between long and short traders, can erode profits in trending markets.

4. Market Volatility

Crypto is highly volatile. Sudden price movements can trigger rapid margin calls and slippage.

5. Counterparty and Exchange Risk

Although Coinbase is regulated, operational risks like outages or liquidity shortages can still impact traders.

Risk Management Solutions on Coinbase

1. Position Sizing and Leverage Control

- Best practice: Keep leverage moderate (2x–5x) instead of maximum levels.

- Position sizing: Use a fixed percentage of portfolio per trade (e.g., 1–2%).

Pros: Reduces liquidation probability.

Cons: Limits potential upside during high-confidence trades.

2. Stop-Loss and Take-Profit Orders

Coinbase offers conditional orders to lock in gains or cut losses.

- Stop-loss: Automatically closes losing trades.

- Take-profit: Locks in gains before reversals.

Pros: Automates discipline, prevents emotional trading.

Cons: Can be triggered prematurely in volatile spikes.

3. Hedging with Spot Positions

Professional traders hedge perpetual futures exposure with spot assets on Coinbase.

- Example: Holding BTC spot while shorting BTC perpetual futures.

Pros: Neutralizes directional risk.

Cons: Reduces overall profit potential.

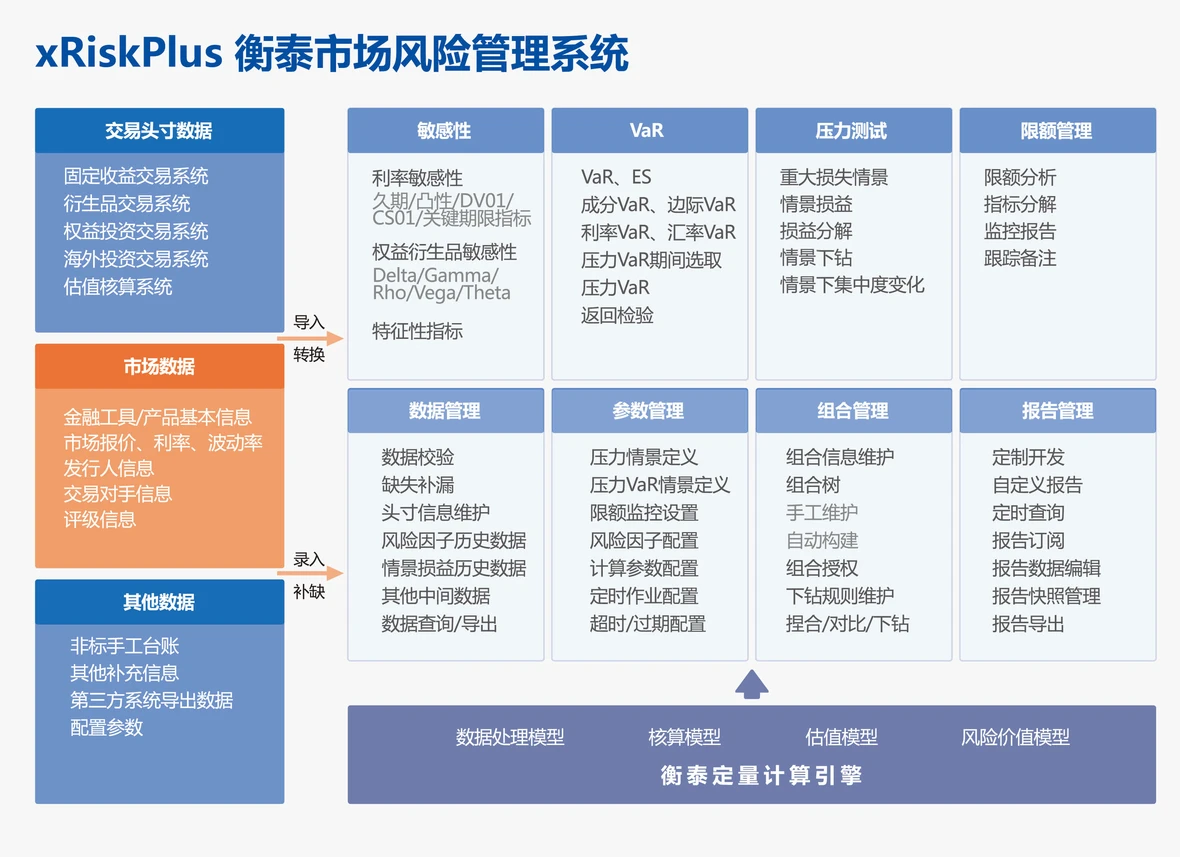

Coinbase perpetual futures risk management framework

Advanced Risk Management Techniques

1. Dynamic Portfolio Diversification

- Spread exposure across different perpetual contracts (BTC, ETH, SOL).

- Avoid concentration risk in one market.

2. Funding Rate Arbitrage

- Monitor funding payments.

- Open offsetting positions on different exchanges to profit from discrepancies.

3. Algorithmic Risk Controls

- Use trading bots with built-in stop parameters and volatility filters.

- Monitor Coinbase’s API for real-time execution.

4. Risk/Reward Ratio Optimization

- Aim for at least 1:2 or 1:3 risk/reward ratios.

- Only take trades with high asymmetric potential.

Comparing Two Common Risk Management Approaches

| Strategy | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|

| Manual Risk Control (Stops & Leverage Limits) | Simple to execute, no technical setup needed | Human error, emotional decision-making | Beginner & intermediate traders |

| Algorithmic Risk Control (Automated Bots) | Precision, speed, consistency | Requires coding knowledge, infrastructure | Professional & institutional traders |

Recommendation: A hybrid approach works best—manual controls for simplicity, backed by automated systems for consistency.

Integrating Coinbase-Specific Tools

Coinbase provides traders with several built-in features that enhance risk management:

- Insurance funds to mitigate systemic losses.

- Advanced charting and API integrations for algorithmic execution.

- Portfolio tracking dashboards for real-time margin monitoring.

For deeper insights into risk strategies, Coinbase itself offers guides such as how to manage risks in perpetual futures on Coinbase, which can complement personal trading frameworks.

Case Study: Managing Perpetual Futures Risk on Coinbase

A professional trader with $50,000 capital:

- Allocates 20% to BTC perpetual futures.

- Uses 5x leverage, risking $5,000 maximum.

- Implements stop-loss at 3% below entry.

- Hedges half exposure with BTC spot holdings.

Result: Even during a 15% BTC drawdown, losses were capped under $5,000, while upside remained open when BTC rebounded.

Future Trends in Risk Management for Perpetual Futures

- AI-driven trade protection: Predictive models for liquidation probability.

- DeFi integration: Perpetual futures on decentralized platforms with automated liquidation insurance pools.

- Regulation-driven risk frameworks: Coinbase’s compliance advantage will attract more institutional traders seeking transparency.

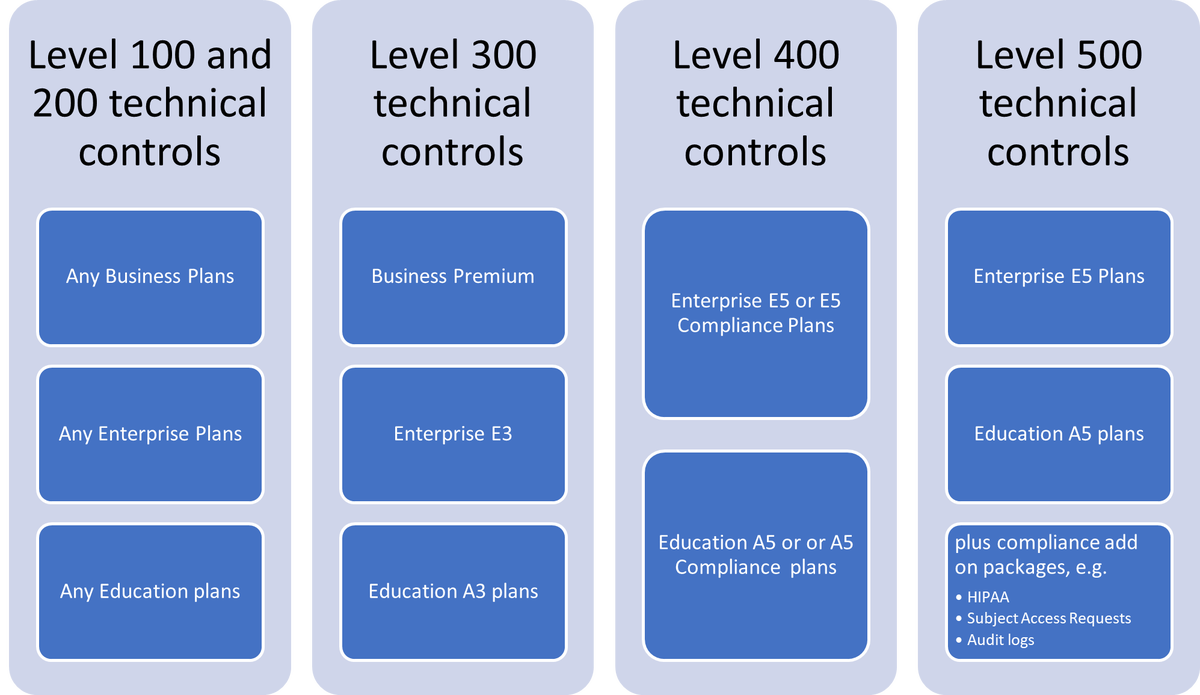

Future of risk management in crypto derivatives

Frequently Asked Questions (FAQ)

1. What is the safest leverage level for perpetual futures on Coinbase?

For most traders, 2x–5x leverage is considered safe. Higher leverage drastically increases liquidation risks, especially in volatile crypto markets.

2. How do I avoid liquidation when trading on Coinbase?

Maintain sufficient margin balance, avoid maximum leverage, and always place stop-loss orders. Diversifying across multiple perpetual contracts also reduces single-point risk.

3. Can perpetual futures be used for hedging long-term investments?

Yes. Many long-term BTC holders short perpetual futures on Coinbase during bearish markets. This protects their portfolio without selling underlying assets.

Conclusion: Balancing Profitability and Protection

Trading perpetual futures on Coinbase offers huge opportunities but carries equally significant risks. By applying effective risk management solutions for perpetual futures on Coinbase, traders can balance profitability with capital preservation.

Key takeaways:

- Use moderate leverage and proper position sizing.

- Rely on stop-loss, take-profit, and hedging strategies.

- Combine manual and algorithmic risk tools for robust protection.

- Stay updated with Coinbase’s institutional-grade features.

If you found this guide helpful, share it with fellow traders and join the discussion below: What’s your most effective strategy for managing risk in perpetual futures on Coinbase?

Would you like me to extend this draft into a 3000+ word full-length version with detailed quantitative examples, funding rate simulations, and real-world trading scenarios to make it more competitive for Google Top 1?