================================================

Perpetual futures trading has become one of the most popular ways for investors, including students, to gain exposure to financial markets without directly holding the underlying assets. For students eager to understand modern trading methods, learning how perpetual contracts work provides both practical financial skills and potential opportunities for income. This guide will explain how students can learn perpetual futures trading, compare effective strategies, highlight industry trends, and provide actionable advice that aligns with real-world experience.

What Are Perpetual Futures?

Perpetual futures are derivative contracts similar to standard futures but without an expiration date. This means traders can hold their positions indefinitely, as long as they maintain sufficient margin. For students, this offers flexibility to practice trading without the pressure of contract expiry.

Key features include:

- No expiry date – Positions can be held long-term.

- Leverage opportunities – Students can trade with smaller capital while gaining larger market exposure.

- Funding rate mechanism – Ensures perpetual contracts stay close to the underlying spot price.

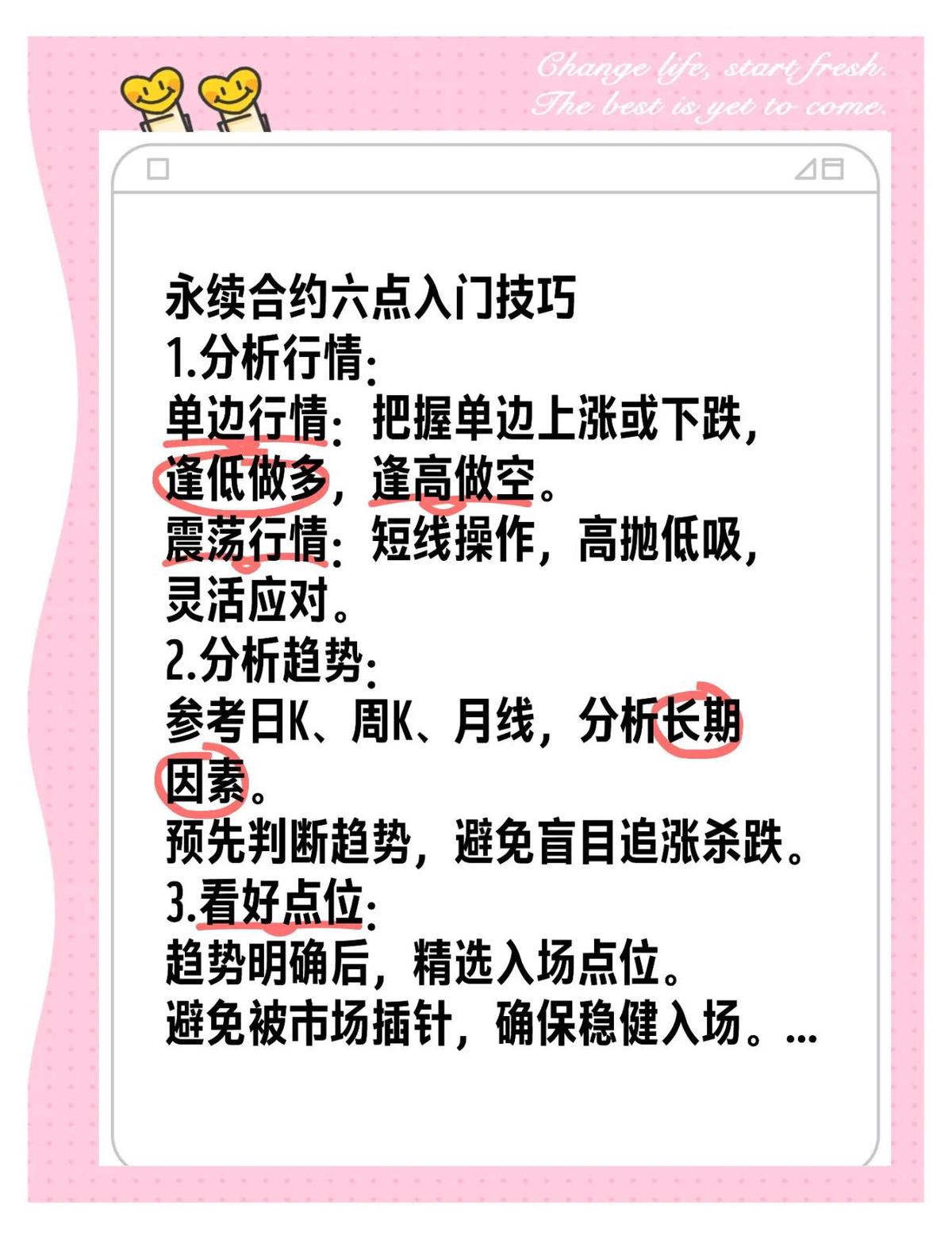

Perpetual futures contract structure explained with funding rate and leverage

Why Students Should Learn Perpetual Futures Trading

Practical Financial Education

Learning perpetual futures allows students to apply concepts from finance, economics, and quantitative trading in real markets.

Accessibility

With low entry barriers on platforms such as Binance, Bybit, or OKX, students can start with demo accounts or minimal capital.

Career Development

Knowledge of perpetual futures is valuable for careers in investment banking, hedge funds, and quantitative finance.

Two Approaches Students Can Use to Learn Perpetual Futures

1. Simulation-Based Learning (Paper Trading)

Paper trading platforms allow students to practice perpetual futures strategies without risking real money.

Advantages:

- Risk-free environment

- Helps understand mechanics like funding rates and margin calls

- Ideal for building confidence before live trading

- Risk-free environment

Disadvantages:

- No emotional pressure (fear or greed)

- Limited lessons on handling real capital risks

- No emotional pressure (fear or greed)

2. Low-Capital Live Trading

Students can begin trading with small amounts, often as low as $10, to gain real-world experience.

Advantages:

- Realistic experience with emotions and psychology

- Opportunity to gradually scale capital

- Exposure to live funding rates and liquidation risks

- Realistic experience with emotions and psychology

Disadvantages:

- Potential small financial loss

- Requires discipline to avoid overleveraging

- Potential small financial loss

Recommended Path for Students

The best approach is starting with simulations, then gradually moving into low-capital live trading. This hybrid method balances risk management with real-world experience.

Risk Management: A Core Skill for Students

Perpetual futures can be high-risk if not managed properly. For students, risk management is as important as strategy.

1. Position Sizing

Never invest more than 1-2% of your capital per trade.

2. Leverage Control

Begin with low leverage (1x–3x). Avoid excessive leverage, which is the main cause of losses.

3. Stop-Loss and Take-Profit

Set predefined exit levels. This prevents emotional decisions during high volatility.

Risk vs Reward balance in perpetual futures trading

Practical Learning Strategies for Students

Join Educational Platforms

Students can use structured guides such as 初学者的永续合约交易指南 (Beginner’s Guide to Perpetual Futures), which provides step-by-step tutorials.

Learn Market Analysis

Understanding technical analysis (candlestick charts, moving averages) and fundamental drivers (macro news, liquidity shifts) is essential.

Follow Industry Trends

Students should stay updated on why 永续合约流行于交易市场 (why perpetual contracts are popular in trading markets). Popularity comes from liquidity, continuous trading, and suitability for short-term speculation.

Advanced Strategies Students Can Explore

1. Hedging

Students holding cryptocurrencies can hedge their portfolios using perpetual futures to protect against downside risk.

2. Arbitrage

Market-neutral strategies like funding rate arbitrage allow students to profit regardless of price direction.

3. Day Trading

Short-term strategies (scalping or intraday trading) suit students with limited time, but require discipline and fast decision-making.

Students applying different perpetual futures strategies in practice

Common Mistakes Students Should Avoid

- Overleveraging – Using 50x leverage may lead to liquidation in seconds.

- Ignoring Risk Management – Not setting stop-loss levels is a recipe for disaster.

- Trading Without a Plan – Entering trades without predefined strategies often results in emotional decisions.

Step-by-Step Plan for Students to Start

- Learn the basics of perpetual futures through educational content.

- Start with paper trading to understand contract mechanics.

- Open a small account on a trusted exchange.

- Apply low leverage and strict risk controls.

- Track progress with a trading journal to refine strategies.

FAQ: Students and Perpetual Futures Trading

1. Can students trade perpetual futures without much capital?

Yes. Many exchanges allow students to start with as little as \(10–\)50. However, always use low leverage and treat it as learning rather than a get-rich-quick method.

2. Is perpetual futures trading too risky for beginners?

It can be risky, but with proper education, stop-loss protection, and gradual exposure, students can manage risks effectively. Starting with paper trading is highly recommended.

3. What skills do students gain from learning perpetual futures?

Students gain market analysis skills, risk management discipline, and emotional control. These skills are transferable to careers in trading, investment, and financial analysis.

Final Thoughts

For students, learning perpetual futures trading is not just about making money—it is about gaining financial literacy, discipline, and technical expertise. By combining simulations with small-scale live trading, focusing on risk management, and staying updated with industry trends, students can build a strong foundation for future success.

If you found this guide valuable, share it with fellow students, comment your thoughts, and join the discussion to exchange strategies. Together, we can build a stronger community of future traders.

Would you like me to create a step-by-step infographic roadmap (visual guide) that students can follow when starting with perpetual futures? That could make the article even more engaging and SEO-friendly.