========================================================

Perpetual futures have become one of the most popular instruments for crypto traders who want to speculate, hedge, or leverage their positions without worrying about expiration dates. Among the major exchanges, Coinbase has recently introduced perpetual futures with a user-friendly interface and robust security features, attracting both beginners and professional traders. This article offers step-by-step tutorials for perpetual futures on Coinbase, explores trading strategies, highlights key risks, and provides actionable insights based on experience and industry trends.

Whether you’re new to derivatives or an experienced trader, this guide will help you build a strong foundation for trading perpetual futures confidently.

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of an underlying asset (like Bitcoin or Ethereum) without an expiration date. Unlike traditional futures, perpetual futures use a funding mechanism to keep their prices close to the spot market.

Key features include:

- No expiry date.

- Leverage options (e.g., 5x, 10x, 20x depending on market and exchange).

- Funding rates paid between long and short traders.

- Margin requirements for opening and maintaining positions.

Why Trade Perpetual Futures on Coinbase?

Coinbase offers several advantages for perpetual futures traders:

- Regulated environment – Coinbase is licensed in multiple jurisdictions, giving traders more confidence.

- Low latency execution – Important for day traders and algorithmic strategies.

- Risk management tools – Including stop-loss, take-profit, and portfolio margin options.

- Beginner-friendly interface – Clear design makes it easier to learn.

- Global access – Supports multiple fiat currencies and crypto assets.

For those asking where to find perpetual futures on Coinbase, the perpetual contracts can be accessed under the “Derivatives” or “Futures” tab in the Coinbase Advanced interface.

Step-by-Step Tutorials for Perpetual Futures on Coinbase

Below is a practical tutorial divided into stages for clarity.

Step 1: Setting Up Your Coinbase Account

- Register and verify your Coinbase account with KYC requirements.

- Enable 2FA security to protect funds.

- Deposit fiat or crypto into your Coinbase wallet.

- Navigate to Coinbase Advanced (previously Coinbase Pro for professional traders).

Step 2: Accessing the Perpetual Futures Market

- Go to the Futures tab.

- Choose the trading pair you’re interested in (e.g., BTC-PERP, ETH-PERP).

- Review contract specifications: tick size, funding intervals, leverage options.

Step 3: Funding Your Futures Wallet

- Transfer funds from your spot wallet to your futures wallet.

- Decide whether to use cross margin (shared margin across positions) or isolated margin (separate margin per position).

- Confirm transfer and check available balance.

Step 4: Placing an Order

- Market Order – Executes instantly at the best price.

- Limit Order – Allows you to set the exact price.

- Stop Order – Triggers only when the market hits a certain level.

Example:

- You believe BTC will rise from $30,000.

- Place a long position with 10x leverage using a limit order at $30,100.

- Set a stop-loss at \(29,500 and a **take-profit** at \)31,200.

Step 5: Monitoring and Managing Positions

- Use the Position Panel to track PnL (profit and loss).

- Watch the funding rate every 8 hours (positive or negative payments).

- Adjust leverage or close positions as needed.

Step 6: Closing Your Trade

- Close manually through the “Close Position” button.

- Use conditional orders to automate exit strategies.

- Always review realized PnL and funding fees.

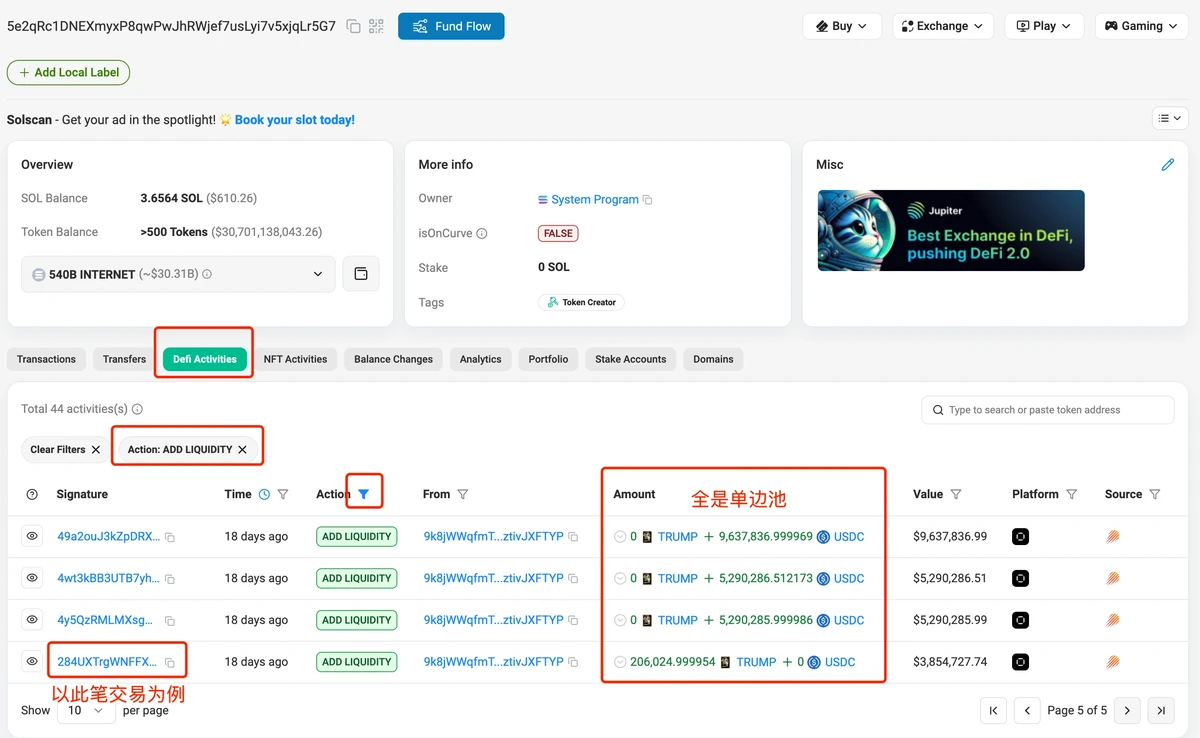

Coinbase Perpetual Futures Trading Dashboard

Strategies for Trading Perpetual Futures

There are multiple strategies traders use. Here, we’ll compare two of the most common approaches.

Strategy 1: Trend Following

How it works: Traders enter positions in the direction of the market trend, using indicators like moving averages, RSI, or MACD.

Pros:

- Simple and effective for beginners.

- Works best in strong trending markets.

Cons:

- Prone to false signals during sideways markets.

- Requires strict stop-loss discipline.

Strategy 2: Mean Reversion

How it works: Traders bet that price will return to its average after large moves. Bollinger Bands and VWAP are common tools.

Pros:

- Effective in range-bound markets.

- Helps capture small but consistent profits.

Cons:

- High risk if market breaks out instead of reverting.

- Requires constant monitoring.

Which Strategy to Choose?

For beginners, trend-following combined with risk management solutions for perpetual futures on Coinbase is more suitable. Advanced traders may diversify with mean reversion and arbitrage.

Key Risks in Perpetual Futures Trading

- Leverage Amplification – While leverage boosts potential profit, it also magnifies losses.

- Funding Rate Costs – Long-term positions may suffer from negative funding rates.

- Volatility – Crypto markets can swing sharply, hitting stop-losses quickly.

- Overtrading – Emotional decisions lead to unnecessary losses.

Best Practices Before You Start

- Always start with low leverage (2x–3x).

- Use demo accounts or paper trading to practice.

- Apply stop-loss orders consistently.

- Keep track of funding rates.

- Follow perpetual futures for beginners on Coinbase guides before scaling up.

FAQ: Step-by-Step Tutorials for Perpetual Futures on Coinbase

1. How do perpetual futures work on Coinbase?

Perpetual futures work by tracking the price of the underlying asset without expiry. A funding mechanism ensures the contract price stays close to the spot market. Traders can go long or short with leverage.

2. What’s the best leverage to start with?

Beginners should start with low leverage (2x–3x) to minimize liquidation risks. Experienced traders might use higher leverage but must apply strict stop-loss rules.

3. Can I trade perpetual futures on Coinbase without prior futures experience?

Yes, but it’s recommended to study guides like how to trade perpetual futures on Coinbase and practice with smaller amounts. Understanding margin, leverage, and funding rates is essential before trading larger positions.

Final Thoughts

Learning step-by-step tutorials for perpetual futures on Coinbase is critical for traders who want to diversify their strategies in crypto markets. By starting small, applying strong risk management, and using structured trading plans, you can gradually master perpetual futures.

As Coinbase continues to enhance its derivatives offering, traders gain access to a secure, regulated, and user-friendly platform for futures trading.

If this guide was helpful, share it with your trading community or leave a comment below. Which perpetual futures strategy are you planning to try first—trend following or mean reversion? Let’s discuss!

Would you like me to expand this into a practical walkthrough with Python code examples for automating perpetual futures trades on Coinbase Advanced API?