====================================

Introduction

In recent years, perpetual futures contracts have become one of the most widely traded instruments in the cryptocurrency and derivatives markets. For traders, institutions, and hedge funds, they offer the ability to speculate on asset prices with leverage, without worrying about expiry dates. This makes them highly attractive compared to traditional futures.

In this article, we will answer the question “What are perpetual futures contracts?”, explore their mechanics, benefits, risks, and strategies, and provide a professional guide to help both beginners and advanced traders navigate this powerful financial instrument.

What Are Perpetual Futures Contracts?

Definition

A perpetual futures contract is a type of derivative agreement that allows traders to speculate on the price of an asset—such as Bitcoin, Ethereum, or other cryptocurrencies—without an expiry date. Unlike traditional futures, which have a settlement date, perpetual futures can be held indefinitely as long as margin requirements are met.

Key Features

- No expiration date: Traders can hold positions as long as they want.

- Leverage: Allows traders to control a large position with a relatively small margin.

- Funding rate mechanism: A system that ensures perpetual futures prices remain close to the underlying spot market price.

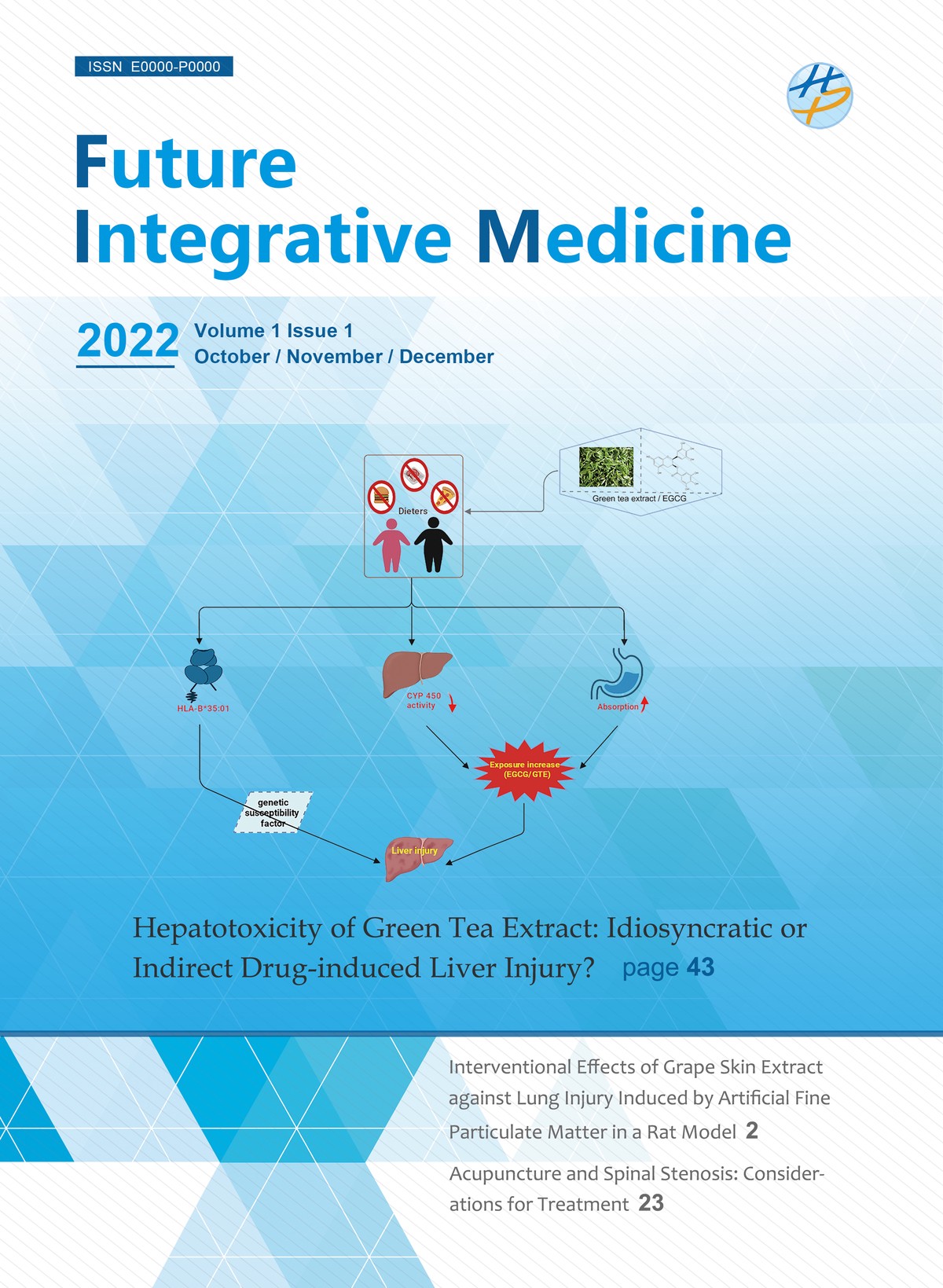

Perpetual futures contract structure

How Perpetual Futures Work

Perpetual futures operate similarly to traditional futures, but with key differences:

- Mark Price & Index Price: The contract is linked to an index price derived from the average spot price across major exchanges.

- Funding Rate: A periodic fee exchanged between long and short traders to keep the contract price close to the spot price.

- Margin & Liquidation: Traders must maintain sufficient margin to keep positions open, or they risk liquidation.

For readers who want to go deeper, you can check How perpetual futures work, which explains the mechanism in greater detail.

Advantages of Perpetual Futures

1. Flexibility

Since contracts do not expire, traders can maintain positions for days, weeks, or months without rollover.

2. High Liquidity

Top exchanges such as Binance, Bybit, and OKX provide deep liquidity, making perpetuals ideal for both retail and institutional traders.

3. Leverage Opportunities

With leverage ranging from 2x to 100x, traders can magnify profits from even small price movements.

Risks of Trading Perpetual Futures

1. Liquidation Risk

High leverage can lead to rapid liquidation if the market moves against a position.

2. Funding Rate Volatility

Funding rates may swing significantly during market stress, eating into profits.

3. Market Manipulation

In thinly traded assets, whales can manipulate funding rates or prices.

Risk management in perpetual futures

Popular Trading Strategies with Perpetual Futures

1. Trend Following

Traders go long in uptrends and short in downtrends, using perpetuals to maintain positions without expiry.

Pros: Captures long-term market movements.

Cons: Requires patience and strong risk management.

2. Hedging

Institutions and hedge funds use perpetual futures to hedge spot holdings. For example, holding Bitcoin while shorting BTC perpetual contracts.

Pros: Protects portfolios from downside risk.

Cons: Funding fees may erode hedge profitability.

3. Arbitrage Trading

Traders exploit price differences between spot and perpetual markets, or across exchanges.

Pros: Lower risk compared to directional bets.

Cons: Requires speed, capital, and advanced execution systems.

4. Scalping & Day Trading

Short-term traders use perpetual futures for intraday volatility, entering and exiting within hours.

Pros: High profit potential from rapid moves.

Cons: High stress, transaction costs, and funding fees.

Comparison: Perpetual Futures vs. Traditional Futures

| Feature | Perpetual Futures | Traditional Futures |

|---|---|---|

| Expiry Date | None | Fixed (monthly/quarterly) |

| Leverage Availability | High (up to 100x) | Moderate (typically lower) |

| Pricing Mechanism | Funding rate | Convergence at expiry |

| Suitability | Crypto markets, active traders | Commodities, equities, institutions |

Best Practices for Trading Perpetual Futures

- Use Risk Management: Apply stop-losses and manage leverage wisely.

- Monitor Funding Rates: Always factor funding costs into long-term positions.

- Stay Informed: Track market sentiment and liquidity shifts.

- Diversify Strategies: Combine hedging, trend following, and arbitrage where possible.

This ties into Perpetual futures risk management strategies, which explain in detail how professional traders mitigate risks.

Trading strategies with perpetual futures

Latest Trends in Perpetual Futures

- Institutional Adoption: Hedge funds and asset managers are integrating perpetual futures for both speculation and hedging.

- Cross-Margin Systems: Advanced exchanges now allow multiple assets as collateral.

- Regulatory Focus: Regulators are increasing oversight of perpetual futures to protect retail investors.

- AI-Powered Trading: Machine learning models are being applied to perpetual futures trading systems.

Frequently Asked Questions (FAQ)

1. What is the difference between perpetual futures and margin trading?

Perpetual futures are derivatives with leverage and funding rates, while margin trading involves borrowing funds to trade spot assets. Perpetuals allow continuous exposure without owning the underlying asset.

2. How do funding rates affect my position?

If you are long and the funding rate is positive, you pay fees to shorts. If it’s negative, shorts pay you. This mechanism ensures the perpetual contract stays close to spot prices.

3. Are perpetual futures suitable for beginners?

Yes, but only with caution. Beginners should start with low leverage, small positions, and thorough education. Learning resources such as Perpetual futures for beginners can provide step-by-step insights.

Conclusion

So, what are perpetual futures contracts? They are innovative derivatives that allow traders to speculate on asset prices without expiry, combining flexibility with leverage. While they provide opportunities for trend following, hedging, and arbitrage, they also carry significant risks due to leverage and funding fees.

For long-term success, traders must balance opportunity with discipline, integrating sound risk management and strategy diversification. Whether you are a retail trader exploring short-term trades or an institutional player seeking advanced hedging tools, perpetual futures remain one of the most dynamic instruments in modern finance.

Future of perpetual futures trading

💬 Now it’s your turn! Do you prefer perpetual futures over traditional futures? Share your opinion in the comments and forward this guide to your trading community to spark insightful discussions.