===============================================================================

Bitcoin perpetual futures have become one of the most popular instruments in the crypto derivatives market. They allow traders and investors to speculate on the price of Bitcoin without owning the asset directly, offering both flexibility and high leverage. However, a common question remains: when to invest in Bitcoin perpetual futures? Timing is everything in financial markets, and entering the market at the right moment can significantly impact profitability.

In this comprehensive guide, we will explore key timing strategies, compare different approaches, provide expert insights on risk management, and answer common questions from traders. By the end, you’ll have a clear framework to decide the best moments to allocate capital into Bitcoin perpetual futures.

Understanding the Nature of Bitcoin Perpetual Futures

Before deciding when to invest, it’s essential to understand what perpetual futures are. Unlike traditional futures contracts that expire on a specific date, Bitcoin perpetual futures do not have an expiry. Instead, they use a funding mechanism to keep the contract price close to the spot price.

Traders use them for:

- Speculation: Leveraged bets on Bitcoin’s price movement.

- Hedging: Protecting existing portfolios against downside risk.

- Arbitrage: Exploiting price discrepancies between spot and futures markets.

To go deeper into their structure and settlement, you can explore how do bitcoin perpetual futures work, which provides detailed mechanics for better understanding.

Factors That Influence the Right Time to Invest

Timing isn’t random—it’s shaped by a combination of market conditions, volatility, and macroeconomic forces.

1. Market Volatility Cycles

Bitcoin is known for its price volatility. High volatility presents opportunities for short-term traders, while low volatility may favor longer-term positions.

- High Volatility Periods: Suitable for scalpers and day traders using leverage.

- Low Volatility Periods: Best for swing traders who expect a breakout.

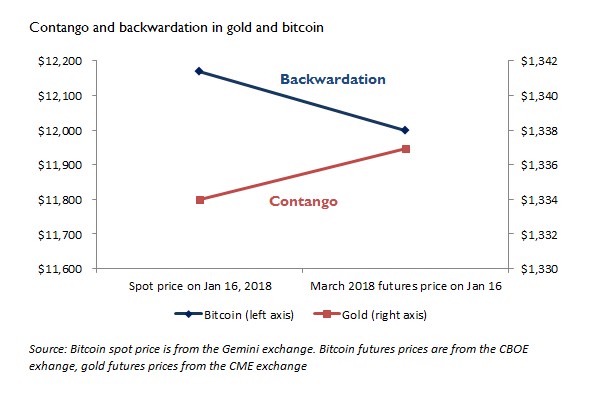

2. Funding Rate Trends

The funding rate determines whether long or short traders pay a fee.

- Positive Funding Rate: Market sentiment is bullish. A contrarian investor might short the market.

- Negative Funding Rate: Market sentiment is bearish. It can be an opportunity to go long at lower costs.

3. Macroeconomic Events

Events like interest rate decisions, inflation reports, or regulatory news can heavily influence Bitcoin. Entering the perpetual futures market around these times requires caution but also offers strong opportunities.

4. Bitcoin Halving and Market Cycles

Historically, Bitcoin’s halving cycles (every four years) have been major drivers of bull markets. Investing in perpetual futures during these cycles may enhance returns if timed well.

Strategy 1: Technical Timing Approach

This method relies on chart analysis, indicators, and trading signals.

1. Moving Averages (MA)

Traders often enter perpetual futures positions when Bitcoin’s price crosses above the 200-day MA (bullish) or below it (bearish).

2. RSI (Relative Strength Index)

- RSI < 30: Oversold conditions; potential entry for long positions.

- RSI > 70: Overbought conditions; potential entry for short positions.

3. Volume Analysis

A surge in trading volume often signals stronger trend continuation, making it a favorable entry time.

Advantages:

- Clear entry/exit points.

- Works for short-term trading.

Disadvantages:

- False signals in highly volatile environments.

- Requires constant monitoring.

Strategy 2: Fundamental & Macro Timing Approach

This strategy focuses on broader market cycles and fundamentals rather than technical signals.

1. Market Sentiment Indicators

Tracking the Fear & Greed Index helps identify extremes in trader psychology.

- Extreme Fear: Potential buying opportunity.

- Extreme Greed: Possible signal to reduce positions.

2. Global Liquidity Conditions

When central banks print money (quantitative easing), risk assets like Bitcoin often rise. Perpetual futures can be a strategic investment during these phases.

3. Institutional Inflows

Monitoring when institutional players, such as ETFs and hedge funds, increase Bitcoin exposure can help retail traders align positions.

Advantages:

- Long-term oriented.

- Aligns with major market cycles.

Disadvantages:

- Less precise entry points.

- Requires patience and broader data analysis.

Comparing the Two Approaches

| Aspect | Technical Timing | Fundamental Timing |

|---|---|---|

| Best For | Day traders, scalpers | Swing traders, long-term investors |

| Tools Used | Charts, RSI, MA, volume | Macroeconomic events, institutional flows |

| Risk Level | Higher due to leverage | Moderate, depends on cycle timing |

| Time Commitment | High (constant monitoring) | Lower (macro view) |

Recommendation: For beginners, a blended strategy—using technical indicators for precision and macro analysis for context—is often the most effective.

Case Study: Trading During the 2021 Bull Market

In early 2021, Bitcoin surged above $30,000. Traders who entered perpetual futures after confirming breakout signals (technical analysis) and considering macro factors like institutional adoption (fundamental analysis) achieved significant gains.

However, those who entered late in the rally without timing discipline often faced liquidations when corrections occurred. This highlights why timing matters as much as strategy.

Risk Management: The Core of Timing

Even if you identify the right time, poor risk management can erase profits.

- Use Stop-Loss Orders: Always define maximum loss per trade.

- Leverage Carefully: Beginners should avoid high leverage (20x+).

- Diversify Entries: Scale into positions instead of entering all at once.

- Track Funding Costs: Over time, funding payments can eat into profits.

For a deeper understanding, check the bitcoin perpetual futures risk management guide, which explains structured methods to control losses.

Visual Guide to Timing Bitcoin Perpetual Futures

Bitcoin market cycle showing entry and exit opportunities for perpetual futures traders.

Frequently Asked Questions (FAQ)

1. Is it better to invest in Bitcoin perpetual futures during bull or bear markets?

It depends on your strategy. Bull markets favor long positions with momentum, while bear markets provide opportunities for shorting. Perpetual futures allow profits in both directions if timing is right.

2. How much capital should I allocate to Bitcoin perpetual futures?

Experts recommend no more than 5-10% of your portfolio due to leverage risks. Start small and gradually scale up as you gain experience.

3. Can I use Bitcoin perpetual futures for hedging long-term holdings?

Yes. Many investors hedge spot Bitcoin positions by shorting perpetual futures. This protects against downside risk while keeping long-term exposure intact.

Final Thoughts

Knowing when to invest in Bitcoin perpetual futures is both an art and a science. Technical strategies provide short-term precision, while fundamental strategies ensure alignment with broader cycles. A hybrid approach, combined with strict risk management, is often the most effective path.

Bitcoin perpetual futures remain a powerful tool for speculation, hedging, and arbitrage. By carefully analyzing timing factors—volatility, funding rates, and macro conditions—you can significantly improve your trading success.

Engage & Share

If you found this guide valuable, share it with fellow traders and investors. Comment below with your own timing strategies or lessons from trading Bitcoin perpetual futures—your insights could help others avoid costly mistakes.

Would you like me to also create three ready-to-post social media snippets (Twitter, LinkedIn, and Reddit versions) to maximize traffic and sharing for this article?