=======================================================================

Perpetual futures trading has become one of the fastest-growing segments of the cryptocurrency market, attracting both retail and institutional traders. Unlike traditional futures contracts, perpetual futures have no expiration date, making them highly flexible for both speculative and hedging strategies. This article provides a comprehensive guide on why choose perpetual futures trading, explores strategies, compares their pros and cons, and offers practical insights for advanced and beginner traders alike.

Understanding Perpetual Futures Trading

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on the price of an asset—most commonly cryptocurrencies—without owning the underlying asset. The key distinction from traditional futures is that perpetual contracts do not expire, allowing traders to hold positions indefinitely.

The continuous nature of these contracts is maintained through a funding rate mechanism, which ensures the perpetual futures price closely tracks the spot market.

Why Are They Popular Among Traders?

The surge in adoption stems from their:

- Flexibility: No need to roll over contracts.

- Liquidity: Supported by most major exchanges with deep order books.

- Leverage: Ability to trade with high leverage (sometimes up to 100x).

- 24⁄7 Market Access: Crypto perpetual futures never close, unlike traditional equity or commodity futures.

Why Choose Perpetual Futures Trading Over Other Derivatives

Perpetual futures trading provides unique benefits that make it superior in many contexts.

1. No Expiration Date

Traditional futures require rolling over positions as contracts expire. Perpetual futures eliminate this need, simplifying portfolio management.

2. High Liquidity and Volume

The majority of crypto derivatives volume comes from perpetual contracts. High liquidity ensures tight spreads and lower slippage, benefiting day traders and institutions alike.

3. Better Risk Management

Perpetual futures allow for hedging spot holdings efficiently. For example, if you hold Bitcoin in your wallet but fear short-term volatility, you can open a short perpetual contract to offset risks.

4. Global Accessibility

Unlike stock futures markets, which are often limited by region and trading hours, perpetual futures are globally accessible with round-the-clock availability.

Comparing Two Core Strategies in Perpetual Futures Trading

To illustrate why perpetual futures are attractive, let’s compare two distinct trading strategies that analysts and advanced traders often use.

Strategy 1: Trend Following with Perpetual Futures

Approach: Traders open long or short perpetual positions based on prevailing market trends, confirmed by indicators such as moving averages or RSI.

Advantages:

- Profits from both rising and falling markets.

- Effective for medium- to long-term holding.

- Profits from both rising and falling markets.

Disadvantages:

- Requires patience and strong technical analysis.

- Risk of liquidation with leverage if market reverses.

- Requires patience and strong technical analysis.

Strategy 2: Market Neutral Funding Rate Arbitrage

Approach: Traders exploit differences in funding rates by holding opposing positions in the spot and perpetual markets.

Advantages:

- Lower directional risk compared to pure speculation.

- Generates consistent returns in volatile markets.

- Lower directional risk compared to pure speculation.

Disadvantages:

- Requires significant capital to lock positions.

- Lower return potential compared to trend following.

- Requires significant capital to lock positions.

Best Practice Recommendation: For traders seeking high-growth opportunities, trend following offers greater profit potential. For risk-averse investors or institutions, funding rate arbitrage provides steady yield with lower exposure.

Industry Trends Driving Perpetual Futures

- Institutional Adoption: Hedge funds and asset managers are increasingly using perpetual futures for hedging and arbitrage strategies.

- Integration with DeFi: Decentralized exchanges now offer perpetual futures with on-chain transparency.

- Improved Risk Controls: Modern exchanges implement auto-deleveraging and insurance funds to protect traders from extreme losses.

Practical Insights for Traders

How to Trade Perpetual Futures Safely

Many beginners overlook the risks of leverage. A good starting point is studying how to trade perpetual futures systematically—starting with low leverage and gradually scaling.

Risk Management Techniques

- Always use stop-loss orders.

- Limit leverage to 5x or less until experienced.

- Diversify contracts across multiple assets.

Where to Learn Perpetual Futures Trading

Professional traders recommend joining structured courses and following where to learn perpetual futures trading resources, including exchange tutorials, trading forums, and research reports.

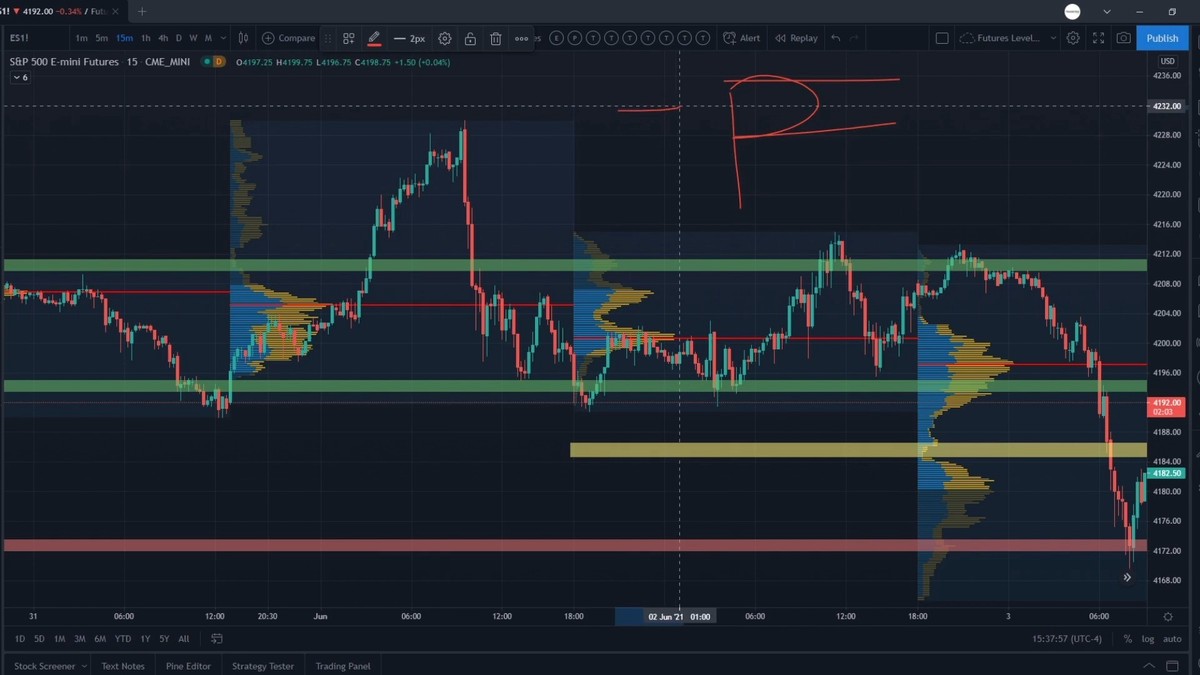

Visual Representation of Perpetual Futures Mechanism

Perpetual futures funding mechanism helps align contract prices with spot market values.

FAQs on Perpetual Futures Trading

1. Is perpetual futures trading suitable for beginners?

Yes, but beginners should start with low leverage (2x–3x) and practice on demo accounts first. While perpetual futures are attractive, high volatility can lead to liquidation if not managed carefully.

2. How does the funding rate affect my trading profits?

Funding rates are payments between long and short traders. If you hold a long position when funding is positive, you pay shorts; if it’s negative, shorts pay longs. Understanding this mechanism is critical to long-term profitability.

3. What is the biggest risk in perpetual futures trading?

The largest risks are over-leverage and sudden volatility spikes. A market swing of just 1% can wipe out over-leveraged positions. Traders should always manage risk with stop-losses and avoid emotional decision-making.

Conclusion: Why Choose Perpetual Futures Trading

Perpetual futures trading is a versatile, liquid, and globally accessible tool for traders of all levels. Whether your goal is speculation, hedging, or arbitrage, these contracts offer unmatched flexibility compared to traditional futures.

From my own trading experience, the ability to remain in a position indefinitely without contract rollover is a game-changer. Coupled with robust liquidity and innovation in the crypto space, perpetual futures are poised to remain at the core of crypto trading strategies for years to come.

If you’ve gained insights from this guide, feel free to share it on social media, comment with your experiences, and exchange strategies with other traders. Collective learning is the fastest path to mastering perpetual futures.

Would you like me to also create a SEO meta description and title tag for this article so you can directly use it for publishing?