========================================

Introduction

In recent years, perpetual futures have become one of the most popular financial instruments in cryptocurrency and derivatives markets. Traders from retail investors to hedge funds often ask: why choose perpetual futures for trading instead of spot or traditional futures? The answer lies in their unique structure, continuous funding mechanism, and flexibility for both speculation and hedging.

This article provides an in-depth exploration of perpetual futures, explaining their benefits, strategies, risks, and comparisons to other products. By integrating professional insights, personal trading experience, and industry trends, we will uncover why perpetual futures are increasingly essential in modern trading portfolios.

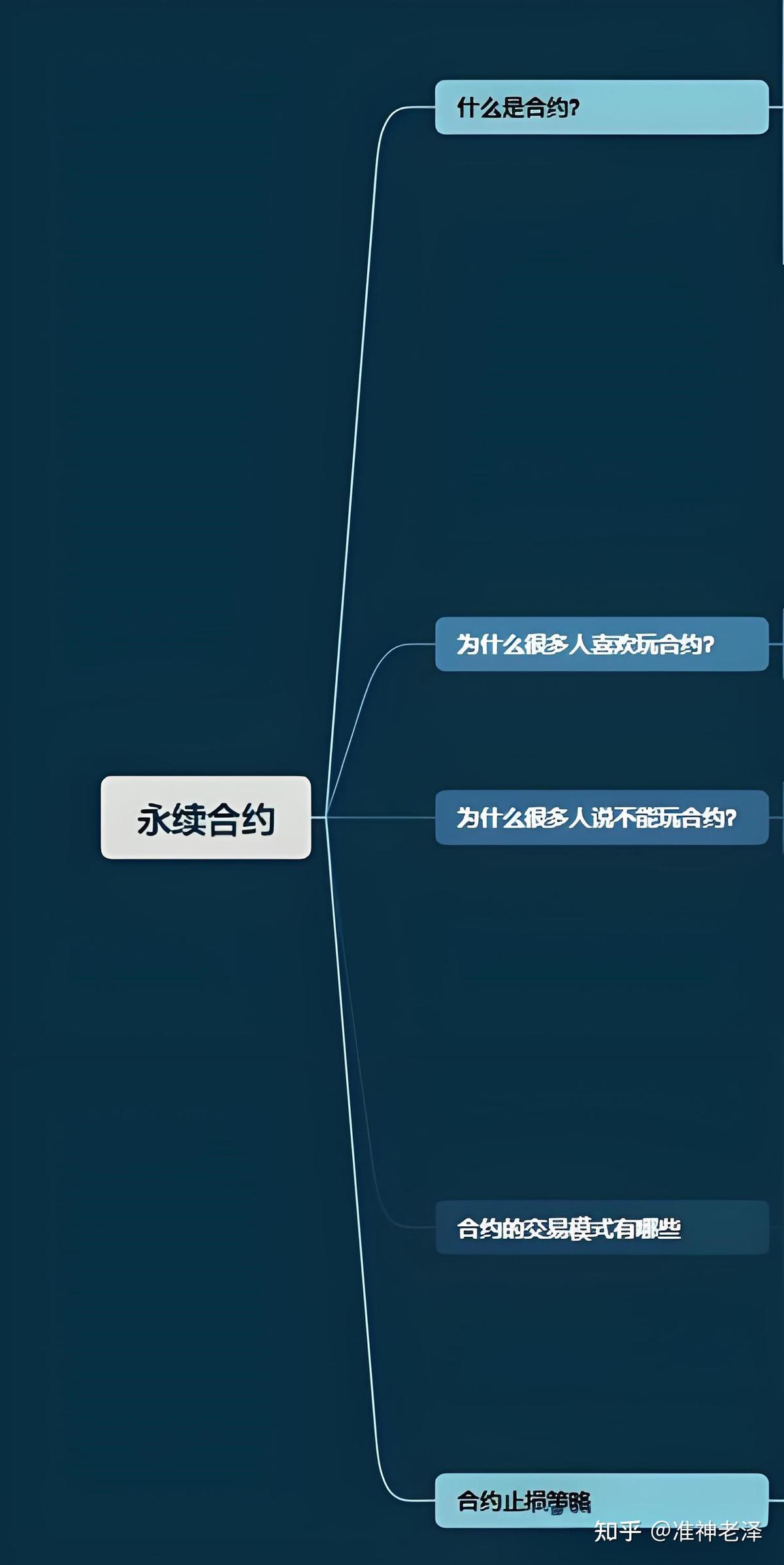

What Are Perpetual Futures?

Definition

Perpetual futures are derivative contracts that, unlike traditional futures, have no expiration date. This means traders can hold positions indefinitely, provided they meet margin requirements.

Key Characteristics

- Continuous funding rate mechanism keeps perpetual futures prices aligned with the spot market.

- High leverage availability, often ranging from 10x to 100x depending on the platform.

- Liquidity concentration, as perpetual contracts often dominate trading volumes on crypto exchanges.

Why Choose Perpetual Futures Over Other Instruments

1. Flexibility for Long and Short Positions

Perpetual futures allow traders to profit from both rising and falling markets. Unlike spot trading, where you can only benefit if the asset appreciates, perpetual futures enable two-way exposure.

2. No Expiry Dates

Traditional futures contracts settle monthly or quarterly, forcing traders to roll over positions. Perpetual futures eliminate this constraint, giving traders more control and lower transaction costs.

3. Leverage Opportunities

Leverage magnifies returns (and risks). Many platforms offer leverage as high as 50x or more, allowing capital-efficient exposure to markets. For example, a trader with \(1,000 margin could open a \)50,000 position.

4. High Liquidity

Major exchanges report billions of dollars in daily perpetual futures volume. High liquidity means tighter spreads, faster execution, and reduced slippage.

Liquidity in perpetual futures markets often surpasses spot and dated futures.

Comparing Trading Strategies in Perpetual Futures

Strategy 1: Trend-Following with Leverage

How It Works

- Traders use technical indicators like moving averages and breakout levels.

- Positions are taken in the direction of the prevailing trend, often with leverage.

Pros

- Maximizes profits during strong market moves.

- Works well in high-volatility crypto environments.

Cons

- Susceptible to sudden reversals.

- Requires strict stop-loss management.

Strategy 2: Funding Rate Arbitrage

How It Works

- Traders exploit the funding rate mechanism.

- If perpetual futures trade above spot, shorts pay longs; if below, longs pay shorts.

- Arbitrageurs simultaneously long spot and short perpetual futures (or vice versa).

Pros

- Generates low-risk, consistent returns.

- Popular among quantitative hedge funds.

Cons

- Requires large capital and low transaction fees.

- Not suitable for beginners without robust execution systems.

Recommendation

For beginners, trend-following with leverage is easier to understand and implement, though risk management is critical. For professionals and institutions, funding rate arbitrage provides stable income streams with minimal market exposure.

Risk Management in Perpetual Futures

Margin and Liquidation Risks

High leverage means small price moves can trigger liquidation. Traders should carefully monitor margin ratios and avoid over-leveraging.

Volatility and Slippage

Crypto markets are notorious for rapid price swings. Limit orders and risk-adjusted position sizing are essential.

Funding Rate Costs

Holding positions long-term can accumulate funding fees. Traders must evaluate whether anticipated gains exceed funding expenses.

Key risks include margin calls, volatility shocks, and cumulative funding costs.

Practical Applications

- Hedging: Institutions and businesses use perpetual futures to lock in prices against crypto exposure.

- Day Trading: Active traders capitalize on intraday volatility.

- Quantitative Strategies: Automated systems optimize entries, funding arbitrage, and cross-exchange spreads.

This explains why perpetual futures are more suitable for short-term trading compared to traditional futures, where rollovers and expiry constraints add friction.

FAQs

1. Why are perpetual futures popular in trading markets?

Perpetual futures dominate trading volumes because of leverage, liquidity, and flexibility. They also enable both retail traders and institutions to express short-term market views without the need to manage contract rollovers.

2. How to start perpetual futures trading safely?

Beginners should begin with low leverage (e.g., 2x-3x), trade small positions, and follow guides like beginner’s perpetual futures trading tutorials. Many exchanges also offer testnets for practice.

3. How can I manage perpetual futures trading risk?

Effective risk management includes setting stop-losses, diversifying trades, monitoring funding costs, and not committing the entire portfolio to leveraged contracts. Professional traders often use hedging strategies and quantitative models to mitigate exposure.

Conclusion

So, why choose perpetual futures for trading? The answer is clear: perpetual contracts offer unmatched flexibility, leverage, liquidity, and strategic diversity. Whether you are a beginner seeking speculative opportunities or an institution managing portfolio risk, perpetual futures present a versatile and powerful instrument.

By combining practical strategies like trend-following and funding arbitrage with robust risk management, traders can harness perpetual futures as an effective tool in their portfolios.

If you found this article insightful, share it with fellow traders, join the discussion in the comments, and let’s build a stronger trading knowledge community together.

Would you like me to also create a comparison chart infographic showing “Perpetual Futures vs Spot vs Traditional Futures” so that readers can visualize the differences more clearly?