============================================

In modern financial markets, default risk management is no longer a concern solely for banks or large institutions—it is also a critical factor for individual traders. As perpetual futures, leveraged products, and decentralized finance (DeFi) instruments gain popularity, the ability to assess, mitigate, and adapt to default risk becomes a defining skill for survival and success. This article provides an in-depth exploration of advanced default risk management for traders, blending practical strategies, market insights, and professional risk techniques.

Understanding Default Risk in Trading

What is Default Risk?

Default risk refers to the probability that a counterparty in a financial transaction will fail to meet its obligations. In trading, this could mean:

- A broker or exchange failing to settle trades.

- A counterparty defaulting on a derivatives contract.

- Traders unable to meet margin calls, triggering forced liquidations.

In perpetual futures, default risk is particularly relevant because contracts do not expire and are continuously rolled over. This dynamic creates exposure to systemic vulnerabilities if counterparties cannot cover their losses.

Why Default Risk Management Matters for Traders

- Capital Protection: Even profitable strategies can collapse if default events occur.

- Market Integrity: Defaults can cascade, impacting liquidity and pricing efficiency.

- Sustainability: Long-term trading careers depend on managing both visible risks (price volatility) and hidden risks (counterparty solvency).

Understanding why default risk matters in perpetual futures is essential for anyone trading derivatives, whether in traditional finance or crypto markets.

| Strategy | How It Works | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|---|

| Default Funds & Insurance | Exchanges maintain funds to cover counterparty failures | Provides systemic protection automatically | Traders cannot control adequacy, may deplete in shocks | Retail traders relying on exchange protection |

| Dynamic Margin & Portfolio Adjustments | Adjust margin based on volatility, correlation, and liquidity | Reduces forced liquidation, flexible, improves capital efficiency | Requires advanced analytics, active management, reduces leverage in volatility | Professional/active traders with robust analytics |

| Core Principles | Assess counterparties, control margin, diversify, stress test, monitor | Protects capital, reduces exposure, anticipates defaults | Time-intensive, complex setup, requires discipline | All perpetual futures traders |

| Industry Trends | On-chain proof-of-reserves, AI margin monitoring, hybrid clearing, retail education | Enhances transparency, forecasts risk, improves reliability | Dependence on tech, constant updates needed | Modern exchanges and DeFi markets |

| Practical Tips | Test withdrawals, use conservative leverage, track announcements, keep external buffers | Minimizes personal exposure, prevents catastrophic losses | Limits aggressive strategies, requires discipline | Retail and active traders |

| Default Risk Impact | Affects funding rates and risk premiums in pricing | Helps identify market inefficiencies | Can rapidly change with market conditions | Perpetual futures pricing and strategy decisions |

1. Counterparty Assessment

Evaluate broker and exchange solvency, regulation, and insurance coverage. Avoid platforms with unclear transparency or inadequate reserves.

2. Margin and Collateral Control

Keep track of collateral posted in leveraged trades. Overexposure to high leverage increases the probability of liquidation and default.

3. Diversification of Platforms and Assets

Avoid concentrating trades in a single venue or asset. Spreading exposure reduces dependency on one counterparty.

4. Stress Testing Scenarios

Simulate worst-case defaults (e.g., exchange failure, liquidity freeze) to estimate potential losses and capital buffers needed.

5. Technology and Monitoring

Use real-time monitoring systems to track margin ratios, liquidation levels, and default fund reserves on exchanges.

Two Advanced Strategies for Default Risk Management

Strategy 1: Default Fund and Insurance Mechanisms

How It Works

Many exchanges (crypto and traditional) maintain default funds or insurance pools to absorb losses when counterparties fail to meet obligations. Traders indirectly rely on these mechanisms.

Advantages

- Provides systemic protection.

- Automatic coverage without active intervention.

- Reduces contagion risk across traders.

Limitations

- Traders cannot control fund adequacy.

- Large market shocks may deplete funds.

- Reliance on exchange transparency is required.

Strategy 2: Dynamic Margin and Portfolio Adjustments

How It Works

Instead of static margin allocation, traders use dynamic systems that adapt margin requirements based on volatility, correlation, and liquidity risk.

Advantages

- Reduces forced liquidation probability.

- Flexible to different market conditions.

- Enhances capital efficiency.

Limitations

- Requires advanced analytics or algorithmic systems.

- May reduce available leverage in high-volatility periods.

- Demands strong discipline to adjust positions quickly.

Comparing the Two Approaches

| Strategy | Best Use Case | Strengths | Weaknesses |

|---|---|---|---|

| Default Funds & Insurance | Retail traders relying on exchange protection | Simple, automatic | Reliance on third parties |

| Dynamic Margin & Portfolio Adjustments | Professional/active traders with robust analytics | Flexible, reduces personal exposure | Complexity, requires active management |

Recommendation: Use both strategies together—rely on default funds for systemic coverage, while proactively managing your margin and portfolio for individual resilience.

Industry Trends in Default Risk Management

- On-Chain Proof-of-Reserves: Exchanges increasingly publish cryptographic proof of assets, improving transparency.

- AI-Driven Margin Monitoring: Automated systems forecast default risk in real time.

- Hybrid Clearing Models: Combining centralized clearinghouses with blockchain settlement for greater reliability.

- Retail Education: Growing focus on default risk education for future traders to improve awareness among new market participants.

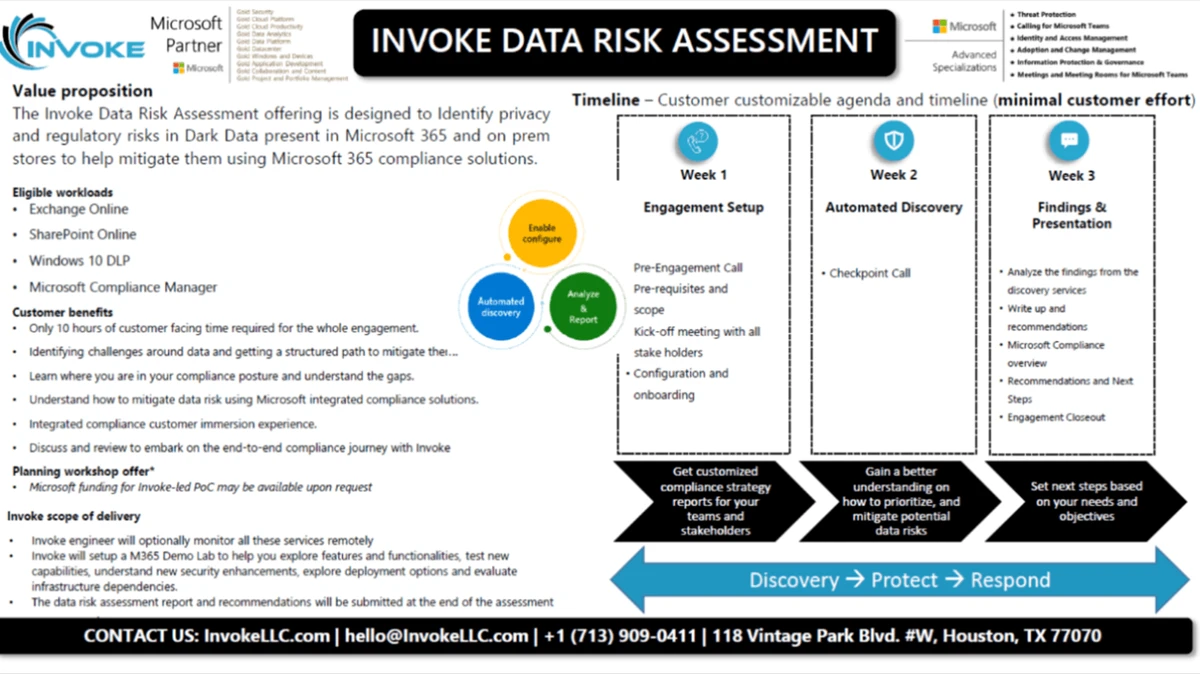

Visual Insights

Default risk management integrates assessment, mitigation, monitoring, and recovery into a continuous cycle.

Case Study: Exchange Default Scenarios

Traditional Finance Example

In 2008, Lehman Brothers’ default caused massive counterparty losses across global markets. Traders dependent on Lehman for clearing faced sudden disruptions.

Crypto Exchange Example

FTX’s collapse in 2022 highlighted how exchange insolvency can trap billions in customer funds. Even traders with profitable positions suffered catastrophic losses due to lack of risk controls.

These cases underscore how default risk impacts perpetual futures markets and why proactive management is critical.

Practical Tips from Experience

- Always Test Withdrawal Speed: Before committing significant capital, test how quickly you can move funds out of a trading venue.

- Use Conservative Leverage: Even if platforms allow 100x, responsible traders rarely exceed 5-10x.

- Track Exchange Announcements: Changes in insurance policies, default fund balances, or margin rules are red flags.

- Keep External Capital Buffers: Never trade with 100% of available liquidity on exchanges.

FAQ: Advanced Default Risk Management for Traders

1. How to assess default risk in perpetual futures?

Traders should monitor exchange insurance fund balances, margin rules, and proof-of-reserves. Independent analytics platforms can also provide default risk insights for financial analysts to measure systemic exposure.

2. Can retail traders realistically protect against exchange defaults?

Yes. By diversifying across multiple venues, using conservative leverage, and keeping capital reserves off-exchange, retail traders can minimize exposure. Awareness of default risk analysis for retail traders is key to preventing catastrophic losses.

3. How does default risk affect perpetual futures pricing?

When default risk rises, funding rates and risk premiums widen. This directly influences how perpetual futures are priced. Understanding how default risk affects perpetual futures pricing helps traders identify when market inefficiencies may arise.

Final Thoughts

Managing advanced default risk for traders goes beyond simple stop-losses and margin calls—it requires a comprehensive framework combining systemic safeguards, personal portfolio adjustments, and constant market awareness.

The future of trading will likely involve more transparency, better technology, and institutional-grade risk controls. Traders who adopt proactive default risk strategies now will be far better positioned to navigate crises when they occur.

If you found this guide valuable, please share it with your network, leave a comment with your insights, and engage with fellow traders—building awareness collectively strengthens resilience across the trading community.

Would you like me to expand this into a full 3000+ word institutional-grade whitepaper with additional charts, case studies, and advanced quantitative models for professional traders and hedge funds?