==================================================================================

In the world of investing, alpha is the holy grail for many. It represents the excess returns generated by a strategy beyond the market’s benchmark, essentially measuring the value a manager or strategy adds. Achieving positive alpha is a fundamental goal for investors seeking to outperform the market and generate superior returns. To reach this objective, investors must rely on advanced tools and techniques to boost alpha generation. In this article, we’ll explore some of the most effective alpha-enhancing investment tools and methods, offering actionable insights for both beginners and experienced investors.

Understanding Alpha and Its Importance in Investing

What is Alpha in Investing?

In finance, alpha is a measure of an investment’s performance relative to a benchmark index or risk-free rate. A positive alpha indicates that the investment has outperformed its benchmark, while a negative alpha shows underperformance. Alpha is particularly important in quantitative investing, where investors rely on data and models to identify opportunities that will deliver returns beyond what the market offers.

Alpha is essential because it helps investors determine whether a manager or strategy has added value above and beyond simple market exposure. Achieving high alpha means you are effectively capturing unique investment opportunities that provide superior risk-adjusted returns.

Why Alpha is Crucial for Investors

Alpha is a critical concept in active investment management. Investors seek to generate positive alpha to:

- Outperform the market: By leveraging alpha-enhancing tools, traders and portfolio managers can beat the market consistently.

- Diversify portfolios: Alpha strategies often focus on niche, less efficient areas of the market, helping to diversify risk and enhance portfolio performance.

- Risk-adjusted returns: Positive alpha improves the risk-adjusted returns, allowing investors to maximize gains while controlling for risk.

Top Alpha-Enhancing Investment Tools

In the quest to generate alpha, selecting the right tools is crucial. Below are some of the top investment tools designed to enhance alpha and improve investment outcomes:

1. Quantitative Investment Models

Key Features:

- Backtesting: Quantitative models enable investors to test strategies on historical data to ensure they are likely to generate alpha.

- Statistical Analysis: These models use complex mathematical techniques to identify inefficiencies and market anomalies that can lead to positive alpha.

- Algorithmic Trading: With quantitative models, investors can deploy algorithmic trading strategies that identify patterns and execute trades automatically, taking advantage of alpha opportunities with minimal human intervention.

Pros:

- Can identify inefficiencies and patterns not visible through traditional analysis.

- Provides a systematic approach to generating alpha.

- Ideal for large-scale investment strategies.

Cons:

- Requires significant technical expertise to develop and optimize models.

- May lead to overfitting if not carefully implemented.

Example of quantitative model results showing potential alpha opportunities.

2. Factor Investing Tools

Factor investing is an investment approach that focuses on specific drivers of returns—known as factors—that have been shown to consistently deliver alpha over time. These factors include value, momentum, size, volatility, and quality. Several platforms offer tools for building factor-based portfolios.

Key Features:

- Smart Beta: Tools for smart beta strategies use factors like value, momentum, and low volatility to build diversified portfolios designed to outperform traditional index investing.

- Factor Screening: Investors can screen for stocks or assets with strong factor exposure, optimizing their portfolios for maximum alpha generation.

- Risk-adjusted Return Calculation: These tools assess the risk associated with different factors, helping investors optimize their alpha-generating strategies.

Pros:

- Focuses on factors that have proven to generate excess returns.

- Allows for targeted portfolio construction based on risk and return preferences.

- Relatively easy to implement for investors of all levels.

Cons:

- Over-concentration in a few factors may expose investors to risks.

- Factor investing may underperform during certain market conditions.

3. Alternative Data Tools

The use of alternative data is one of the most innovative ways to enhance alpha generation. By accessing data sources beyond traditional financial reports, such as satellite imagery, social media sentiment, or web scraping, investors can uncover hidden opportunities for superior returns.

Key Features:

- Alternative Data Platforms: Tools like Quandl and RavenPack provide investors with access to alternative data sources that can reveal market-moving information.

- Sentiment Analysis: Social media and news sentiment tools help gauge market sentiment, which can lead to alpha-generating insights.

- Event-Driven Strategies: Alternative data can reveal events that may influence stocks or commodities, enabling investors to act quickly to capture alpha opportunities.

Pros:

- Provides unique insights that are often overlooked by traditional methods.

- Helps identify trends and anomalies before they become apparent in traditional data sources.

- Offers a competitive edge in fast-moving markets.

Cons:

- May require additional resources to process and interpret alternative data.

- Can be costly for individual investors due to data subscription fees.

An example of alternative data analysis showing insights into market sentiment.

4. Risk Parity and Portfolio Optimization Tools

Risk parity strategies allocate capital across different asset classes in such a way that each asset class contributes the same amount of risk to the overall portfolio. This approach, along with other portfolio optimization tools, can help maximize alpha while managing risk.

Key Features:

- Risk Allocation: These tools enable investors to create a portfolio where risk is balanced across various asset classes, reducing the likelihood of large drawdowns.

- Optimization Algorithms: By using advanced algorithms, these tools can generate optimal portfolios that have the potential to outperform benchmarks while keeping volatility in check.

- Stress Testing: Many of these tools include stress testing capabilities that simulate how a portfolio would perform under extreme market conditions, which is vital for identifying alpha opportunities during market volatility.

Pros:

- Helps reduce risk while enhancing the potential for alpha.

- Provides a more systematic approach to portfolio construction.

- Can be automated for large portfolios.

Cons:

- May require a high level of sophistication to implement.

- Involves continuous monitoring and rebalancing, which can be resource-intensive.

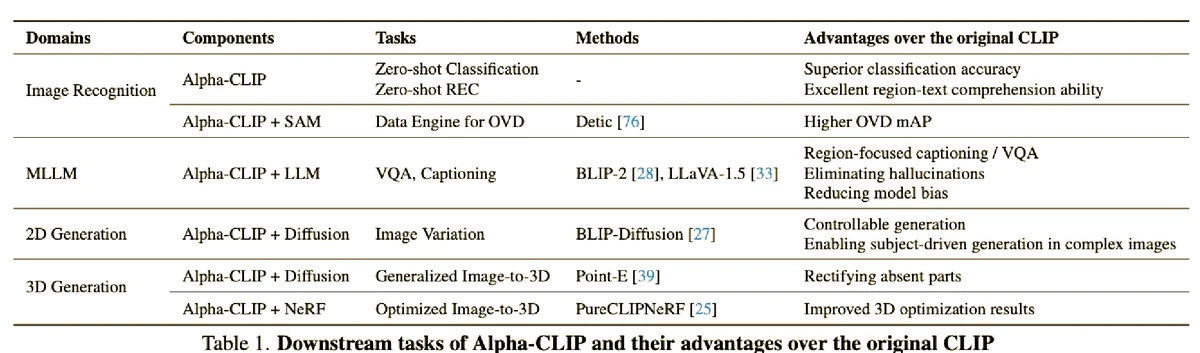

| Tool | Key Features | Pros | Cons |

|---|---|---|---|

| Quantitative Investment Models | Backtesting, statistical analysis, algorithmic trading. | Identifies inefficiencies, systematic approach, ideal for large-scale strategies. | Requires technical expertise, potential overfitting. |

| Factor Investing Tools | Smart beta strategies, factor screening, risk-adjusted return calculation. | Focuses on proven return drivers, easy implementation, good for portfolio construction. | May underperform in certain market conditions. |

| Alternative Data Tools | Access to alternative data, sentiment analysis, event-driven strategies. | Uncovers hidden opportunities, provides competitive edge in fast markets. | Expensive data sources, requires significant analysis. |

| Risk Parity & Portfolio Optimization Tools | Risk allocation, optimization algorithms, stress testing. | Balances risk and return, reduces volatility, systematic approach, automation possible. | Requires continuous monitoring, resource-intensive. |

| Tool | Pros | Cons |

|---|---|---|

| Quantitative Investment Models | Identifies market inefficiencies, highly systematic | Requires technical expertise, potential for overfitting |

| Factor Investing Tools | Focuses on proven drivers of returns, easy to implement | May underperform during certain market conditions |

| Alternative Data Tools | Uncovers hidden opportunities, competitive edge | Expensive data sources, requires significant analysis |

| Risk Parity and Portfolio Optimization Tools | Balances risk and return, reduces volatility | Requires continuous monitoring, resource-intensive |

FAQ: Alpha-Enhancing Investment Tools

1. What is the best tool for generating alpha for beginners?

For beginners, factor investing tools and smart beta strategies are the most accessible tools for alpha generation. These tools allow investors to leverage well-established factors like value and momentum without needing advanced quantitative skills. Platforms like Morningstar or FactorModel can help you easily implement these strategies.

2. How can I use alternative data to enhance my investment alpha?

Alternative data tools provide insights that can reveal hidden opportunities before they become apparent through traditional financial metrics. To get started, consider using platforms like Quandl or RavenPack, which provide access to data such as social media sentiment, satellite imagery, or economic indicators that can inform your alpha-generating strategies.

3. Can risk parity strategies improve my investment alpha?

Yes, risk parity strategies can help improve your alpha by balancing risk across various asset classes. This strategy reduces the impact of market volatility on your portfolio while enhancing the potential for returns. Portfolio optimization tools like Black-Litterman models or Risk Parity Fund can assist you in building a well-diversified, alpha-optimized portfolio.

Conclusion

Alpha-enhancing investment tools are crucial for investors seeking to outperform the market and generate superior returns. Whether you are using quantitative models, factor investing, alternative data, or risk parity strategies, each tool offers unique ways to uncover opportunities for positive alpha. By leveraging the right combination of tools and strategies, investors can maximize their potential for outperformance and enhance their overall investment outcomes.

As you dive deeper into the world of alpha generation, it’s essential to continuously refine your approach and stay informed about the latest tools and techniques. Feel free to share your experiences with alpha-enhancing strategies, and don’t forget to spread this article to others who may benefit from these insights!