=========================================================================

In the competitive world of hedge funds, the pursuit of alpha—excess returns above market benchmarks—remains the holy grail for professional managers. While markets are becoming more efficient and crowded with quantitative participants, extracting meaningful alpha insights for hedge fund managers requires a blend of innovative research, robust execution, and adaptive risk management. This comprehensive guide explores modern alpha generation techniques, compares methodologies, and provides actionable recommendations to enhance performance.

Understanding Alpha in Hedge Fund Context

What is Alpha?

Alpha measures the skill of an investment strategy or manager relative to market movements (beta). If a hedge fund generates positive returns above its expected benchmark-adjusted performance, it is said to produce positive alpha.

For hedge fund managers, alpha is not just a number—it reflects credibility, investor trust, and long-term survivability. Unlike beta, which can be replicated cheaply through index funds, alpha requires proprietary insights, advanced models, and often access to unique data.

Why Alpha Matters for Hedge Funds

- Investor Attraction – Institutional allocators consistently prioritize managers with proven alpha generation over long horizons.

- Fee Justification – Management fees are under pressure, but funds delivering alpha can justify performance fees.

- Portfolio Diversification – Alpha strategies reduce reliance on market cycles, making portfolios more resilient.

For further context, see our detailed breakdown of Why alpha matters in investment decisions, which highlights how alpha directly influences fund inflows and client retention.

Major Sources of Alpha for Hedge Fund Managers

1. Quantitative Alpha Signals

Modern hedge funds increasingly rely on quantitative methods to extract alpha from noisy markets.

Statistical Arbitrage

- Concept: Exploits short-term pricing inefficiencies between correlated securities.

- Strengths: Market-neutral, scalable across multiple asset classes.

- Weaknesses: Crowded trade; alpha decays rapidly as compe*****s replicate strategies.

Factor Models

- Concept: Alpha is decomposed into risk premia factors (value, momentum, quality, low volatility).

- Strengths: Academic backing, long-term persistence.

- Weaknesses: Factor crowding; regime shifts can erode profitability.

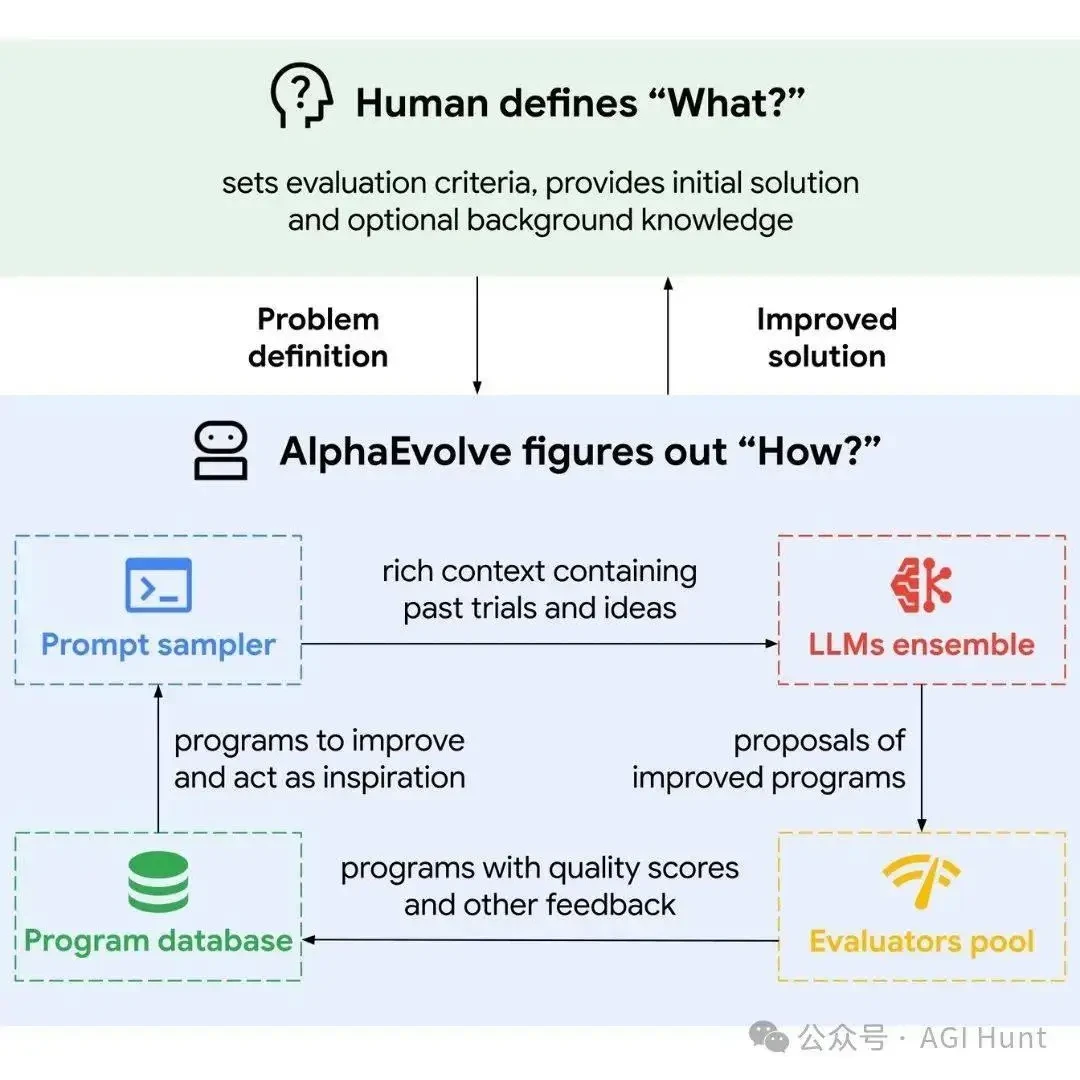

Quantitative alpha model illustrating multi-factor decomposition for hedge fund portfolios.

2. Fundamental-Driven Alpha

Despite the dominance of quants, discretionary strategies remain relevant.

Event-Driven Strategies

- Concept: Capture inefficiencies around corporate actions—M&A, spin-offs, earnings surprises.

- Strengths: Less correlated with broad market moves, high payoff potential.

- Weaknesses: Risk of deal breaks, litigation, and regulatory hurdles.

Deep Value Investing

- Concept: Identifies undervalued companies overlooked by the market.

- Strengths: Longer investment horizon, compounding potential.

- Weaknesses: Requires patience; short-term underperformance risk.

Visual representation of hedge fund event-driven alpha generation process.

| Category | Details |

|---|---|

| Definition of Alpha | Excess returns above market benchmarks; measures manager skill. |

| Importance of Alpha | Attracts investors, justifies fees, enhances portfolio diversification. |

| Quantitative Alpha Sources | Statistical arbitrage, factor models using alternative and high-frequency data. |

| Strengths of Quant Alpha | Market-neutral, scalable, academically backed, systematic risk control. |

| Weaknesses of Quant Alpha | Crowded trades, rapid alpha decay, sensitive to regime shifts. |

| Fundamental Alpha Sources | Event-driven strategies, deep value investing, discretionary approaches. |

| Strengths of Fundamental | Less correlated with markets, high payoff potential, long-term compounding. |

| Weaknesses of Fundamental | Deal breaks, litigation risk, patience required, short-term underperformance. |

| Comparative Insights | Quant: scalable, data-driven; Fundamental: judgment-based, traditional. |

| Advanced Techniques | Machine learning, NLP, alternative data integration, satellite/web/credit data. |

| Risk Management | Alpha vs. beta distinction, risk budgeting, stress testing, optimize per-risk contribution. |

| Case Studies | Quant fund: 3.5% alpha, diversified factors; Event-driven fund: 5% alpha, regulatory sensitivity. |

| Best Practices | Diversify sources, innovate with AI/data, focus on execution, maintain transparency. |

| FAQ Highlights | Measure with multi-factor regression; watch for crowding, overfitting, regime shifts; AI complements analysis. |

| Conclusion | Sustainable alpha requires blending quantitative, fundamental, and risk-aware strategies; remain adaptive. |

| Dimension | Quantitative Alpha | Fundamental Alpha |

|---|---|---|

| Data Dependency | High-frequency, alternative datasets | Financial statements, qualitative insights |

| Scalability | Easily applied across multiple markets | Limited by analyst bandwidth |

| Risk Control | Systematic, rule-based | Judgment-driven, less standardized |

| Alpha Decay Risk | High due to competition | Lower, but subject to behavioral biases |

| Investor Perception | Innovative, technology-driven | Traditional, easier to communicate |

Recommendation: A hybrid model combining systematic screening with discretionary overlays often delivers the most robust alpha insights for hedge fund managers.

Advanced Alpha Enhancement Techniques

Machine Learning for Alpha Signals

- Neural networks uncover nonlinear patterns in price and alternative data.

- Natural Language Processing (NLP) enhances sentiment analysis from earnings calls and filings.

Alternative Data Integration

- Satellite imagery for supply chain analysis.

- Web traffic data for consumer demand forecasting.

- Credit card transaction data for retail performance insights.

For deeper coverage, explore Where to find the best alpha strategies, which outlines emerging data-driven techniques across hedge fund ecosystems.

Risk Management in Alpha Generation

Alpha vs. Beta Misattribution

A critical challenge for hedge fund managers is distinguishing genuine alpha from disguised beta exposure. For example, a long-biased portfolio in a bull market may appear to generate alpha but is merely capturing market beta.

Alpha Risk Budgeting

- Allocate alpha sources across uncorrelated strategies.

- Use scenario stress testing to evaluate alpha persistence.

- Optimize alpha contribution per unit of risk.

Example of risk-adjusted alpha contribution visualization in portfolio management.

Real-World Case Studies

Case Study 1: Quant Hedge Fund with Multi-Factor Alpha

A global equity hedge fund integrated momentum, value, and quality factors while overlaying machine learning sentiment scores. This diversification reduced drawdowns during volatile markets and sustained 3.5% annualized alpha over five years.

Case Study 2: Event-Driven Hedge Fund

A discretionary fund specializing in merger arbitrage achieved 5% annualized alpha but suffered during regulatory crackdowns on large M&A deals, demonstrating the importance of adaptive strategy shifts.

Best Practices for Hedge Fund Managers Seeking Alpha

- Diversify Alpha Sources – Avoid over-reliance on one strategy; blend quantitative and discretionary approaches.

- Continuously Innovate – Incorporate alternative data, AI, and advanced analytics.

- Focus on Execution – Transaction cost analysis and slippage reduction can preserve fragile alpha.

- Transparency with Investors – Communicate alpha attribution clearly to maintain trust.

Frequently Asked Questions (FAQ)

1. How can hedge fund managers reliably measure alpha?

The most robust method is to use multi-factor regression models that strip out known systematic risks. By comparing residual performance against expected beta-adjusted returns, managers can isolate genuine alpha. Stress testing across regimes ensures accuracy.

2. What are the biggest risks to alpha generation?

The main risks include strategy crowding, model overfitting, regime changes, and data quality issues. Overcrowded trades often compress spreads, eroding alpha. Additionally, shifts in monetary policy or market structure can render previously profitable signals obsolete.

3. Should hedge funds rely more on AI for alpha insights?

AI and machine learning are powerful tools but not silver bullets. They should complement—not replace—traditional financial analysis. Over-reliance without interpretability can create “black-box” risks, making it harder to explain alpha to investors and regulators.

Conclusion: Building Sustainable Alpha

In today’s hyper-competitive landscape, generating consistent alpha requires a balance between innovation and discipline. Hedge fund managers who successfully integrate quantitative sophistication, fundamental insight, and risk-aware execution are more likely to outperform peers.

Alpha is not static; it evolves with market cycles, technology, and investor behavior. Managers must remain agile, adaptive, and transparent to maintain credibility and deliver long-term success.

Strategic roadmap for alpha-driven hedge fund performance.

Join the Discussion

Do you believe quantitative methods or fundamental insights will dominate alpha generation in the next decade? Share your thoughts in the comments, and don’t forget to share this article with your network of hedge fund professionals to spark a broader discussion.