====================================================

Introduction

Perpetual futures have become one of the most widely used instruments in crypto and derivatives markets due to their flexibility, leverage, and lack of expiration dates. However, with these advantages come significant risks, especially during periods of extreme volatility. To address these uncertainties, traders and investors increasingly rely on scenario analysis—a systematic method for evaluating how different market conditions might impact positions, strategies, and portfolios.

In this article, we will provide a comprehensive guide on how to apply scenario analysis to perpetual futures, discuss practical methods, compare strategies, and demonstrate how investors can integrate this technique into a robust risk management framework. By the end, you will understand not only the theory but also actionable steps to use scenario analysis effectively in your trading.

What is Scenario Analysis in Perpetual Futures?

Scenario analysis is a risk management technique that evaluates how trading outcomes change under varying assumptions about market conditions. In the context of perpetual futures, this often involves testing positions against multiple price paths, volatility levels, funding rate changes, and liquidity events.

Key Elements of Scenario Analysis

- Price Shocks: Simulating sudden upward or downward moves in the underlying asset.

- Leverage Impact: Assessing how different leverage levels magnify potential gains or losses.

- Funding Rate Variations: Modeling scenarios where funding costs significantly affect profitability.

- Liquidity Stress: Evaluating what happens if order book depth dries up during extreme volatility.

Scenario analysis provides traders with a roadmap of potential outcomes rather than a single forecast, making it especially useful in highly volatile instruments like perpetual futures.

Why Apply Scenario Analysis to Perpetual Futures?

Perpetual futures can amplify both profits and losses. Without proper preparation, traders can experience rapid liquidation. Scenario analysis provides a structured way to anticipate such risks.

- Risk Awareness: Identifies vulnerabilities in leveraged positions.

- Strategic Planning: Helps traders design entry, exit, and stop-loss levels.

- Capital Protection: Highlights worst-case outcomes to prevent account wipeouts.

- Improved Decision-Making: Removes guesswork and builds confidence in trading strategies.

For traders seeking deeper insights, understanding why scenario analysis is important in trading reveals how it enhances resilience and consistency across strategies.

Methods of Applying Scenario Analysis

1. Deterministic Scenario Analysis

This method involves creating predefined “what-if” cases based on fixed assumptions.

Example: A trader long 2 BTC in perpetual futures might test three cases:

- Price drops 10% in 24 hours.

- Price increases 15% within a week.

- Price remains flat, but funding rates rise significantly.

- Price drops 10% in 24 hours.

Advantages:

- Simple to implement.

- Provides clear insights into specific outcomes.

- Simple to implement.

Disadvantages:

- Limited flexibility.

- May overlook extreme tail risks.

- Limited flexibility.

2. Probabilistic Scenario Analysis (Monte Carlo Simulations)

This method generates multiple possible future paths using statistical models.

Example: A Monte Carlo simulation might model 10,000 possible BTC price paths under varying volatility, interest rates, and liquidity constraints. The trader can then evaluate probabilities of liquidation, maximum drawdown, or expected returns.

Advantages:

- Captures a wide range of outcomes.

- Provides probabilistic risk metrics.

- Captures a wide range of outcomes.

Disadvantages:

- Requires advanced tools and statistical knowledge.

- Computationally intensive.

- Requires advanced tools and statistical knowledge.

Comparing the Two Methods

| Aspect | Deterministic Scenarios | Probabilistic (Monte Carlo) |

|---|---|---|

| Complexity | Low | High |

| Use Case | Beginners, simple setups | Advanced, institutional |

| Risk Coverage | Limited cases | Broad distribution |

| Decision Support | Clear, but narrow | Rich, but complex |

👉 Recommendation: Retail traders often start with deterministic analysis for its simplicity, while professionals and institutions benefit more from probabilistic simulations for a holistic risk view.

How to Perform Scenario Analysis Step by Step

- Define Objectives: Decide whether the focus is risk management, profit maximization, or hedging.

- Set Variables: Choose key drivers (price, leverage, funding rates, volatility).

- Build Scenarios: Create deterministic or probabilistic cases.

- Run Simulations: Apply models using spreadsheets, trading platforms, or specialized tools.

- Interpret Results: Evaluate outcomes such as drawdowns, liquidation probabilities, and risk/reward ratios.

- Adjust Strategy: Modify leverage, stop-losses, or position size based on findings.

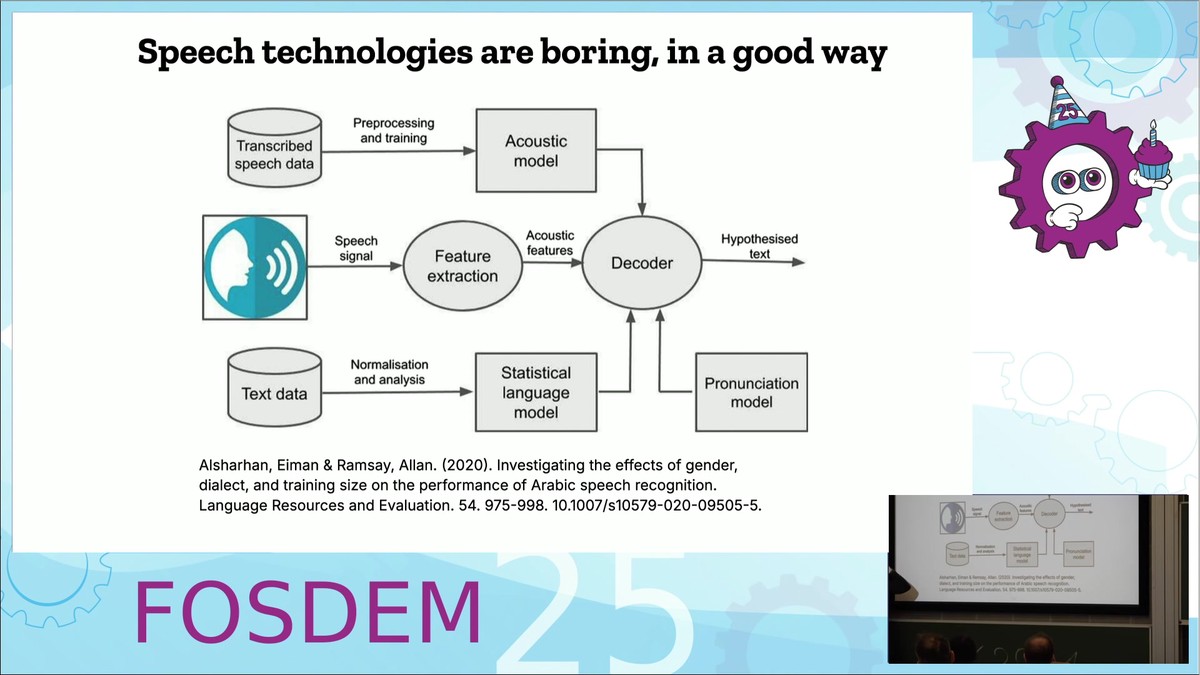

Visual Guide to Scenario Analysis Process

Scenario analysis workflow applied to perpetual futures trading

Integrating Scenario Analysis with Risk Management

Scenario analysis is most effective when integrated with a broader risk framework. Traders often pair it with position sizing models, portfolio diversification, and stop-loss systems.

For example, an investor might use deterministic scenarios to test the effect of a 20% price drop while also applying Monte Carlo simulations to understand long-term risk distributions. This hybrid approach balances simplicity with statistical rigor.

This aligns closely with how scenario analysis improves trading strategies by converting insights into concrete actions, such as adjusting leverage or rebalancing portfolios.

Case Study: Applying Scenario Analysis to BTC Perpetual Futures

Imagine a trader holding a long 5x leveraged position in BTC perpetual futures at $60,000:

- Scenario 1 (Bearish): Price drops 20% → Position faces near-liquidation without protective stop-loss.

- Scenario 2 (Neutral): Price stays flat → Funding costs erode profitability over time.

- Scenario 3 (Bullish): Price rises 15% → Leverage amplifies profit, but volatility spikes increase liquidation risk.

Through scenario analysis, the trader realizes that holding the same leverage across all cases is unsustainable. The solution is reducing leverage to 2x and implementing stop-loss orders.

Scenario Analysis for Institutional vs. Retail Investors

- Retail Traders: Benefit from simple, rule-based scenario planning. Tools like Excel or built-in exchange calculators are sufficient.

- Institutional Investors: Employ advanced probabilistic models, often integrated into financial modeling frameworks, to test portfolios across asset classes.

Both groups gain from the process, but the scale and sophistication vary.

FAQs

1. How accurate is scenario analysis for perpetual futures?

Scenario analysis does not predict the future; it frames possible outcomes. Its accuracy depends on the quality of assumptions and inputs. When combined with live monitoring, it significantly improves preparedness.

2. Can beginners use scenario analysis effectively?

Yes. Beginners should start with deterministic analysis, testing simple scenarios like “What if BTC drops 10%?” Over time, they can progress to probabilistic models. Platforms offering scenario analysis for beginner traders often provide guided workflows.

3. Which tools are best for scenario analysis in perpetual futures?

- Spreadsheets: Useful for small-scale deterministic scenarios.

- Monte Carlo Software (e.g., Python, R): Ideal for probabilistic analysis.

- Trading Platforms: Some exchanges now integrate risk simulators directly for perpetual futures.

Conclusion

Applying scenario analysis to perpetual futures transforms trading from reactive speculation into proactive risk management. By testing multiple scenarios—whether through deterministic cases or probabilistic simulations—traders gain clarity, protect capital, and enhance strategy performance.

The best approach often combines both methods: simple “what-if” scenarios for short-term readiness, and Monte Carlo simulations for long-term planning. This balanced approach ensures traders are prepared for the unpredictable nature of perpetual futures.

If this guide helped you, share it with fellow traders and join the discussion below: How do you apply scenario analysis in your own trading strategy?

Would you like me to also draft a downloadable Excel template for performing deterministic scenario analysis on perpetual futures positions, so readers can apply it instantly?