=========================================================

Introduction

In modern financial markets, perpetual futures have emerged as one of the most dynamic instruments, combining the flexibility of futures contracts with the continuous pricing nature of spot markets. For economists, understanding capital asset pricing for economists in perpetual futures is crucial, as it provides both a theoretical framework and practical strategies for managing risk, valuing assets, and optimizing portfolios in volatile markets.

This comprehensive guide explores the application of the Capital Asset Pricing Model (CAPM) in perpetual futures trading, analyzes different strategies for risk and return optimization, and provides insights into how economists, traders, and institutions can incorporate this model into decision-making processes. By the end, you’ll gain a deeper understanding of not only the theory but also the tactical execution required for effective perpetual futures trading.

Understanding the Capital Asset Pricing Model (CAPM)

The Core Formula of CAPM

The CAPM provides a way to determine the expected return of an asset:

E(Ri)=Rf+βi⋅(E(Rm)−Rf)E(R_i) = R_f + \beta_i \cdot (E(R_m) - R_f)E(Ri)=Rf+βi⋅(E(Rm)−Rf)

Where:

- E(R_i) = Expected return on asset i

- R_f = Risk-free rate

- β_i = Beta, or asset’s sensitivity to market risk

- E(R_m) = Expected return of the overall market

In perpetual futures markets, CAPM is adapted to account for the continuous funding rates and the leverage dynamics inherent in the contracts.

Why CAPM Matters for Perpetual Futures

- Pricing Efficiency: Helps economists identify whether perpetual contracts are overvalued or undervalued relative to expected market returns.

- Risk Assessment: Enables a systematic evaluation of market exposure, particularly when perpetual futures have high volatility.

- Portfolio Optimization: Assists in aligning futures contracts with long-term capital allocation strategies.

| Aspect | Key Points |

|---|---|

| CAPM Formula | E(Ri)=Rf+βi·(E(Rm)−Rf) |

| Variables | E(Ri): expected return; Rf: risk-free rate; βi: beta; E(Rm): market return |

| Importance in Perpetuals | Pricing efficiency, risk assessment, portfolio optimization |

| Risk in Perpetuals | Funding rates, leverage, spot tracking |

| Case Example | Bitcoin perpetual vs crypto index beta |

| Strategy 1 | Market-neutral hedging with CAPM |

| Pros (S1) | Reduces volatility, exploits funding inefficiencies |

| Cons (S1) | Needs monitoring, lower returns |

| Strategy 2 | Leverage optimization with CAPM |

| Pros (S2) | Higher returns, structured leverage use |

| Cons (S2) | Amplifies losses, sensitive to errors |

| Recommended | Market-neutral hedging more sustainable |

| Macro Factors | Inflation, monetary policy, geopolitical risks |

| Behavioral Overlay | Retail sentiment, herd behavior distort CAPM |

| Time Horizon | Short-term: entry decisions; Long-term: portfolio design |

| FAQ 1 | Beta from returns vs index, adjust for funding/leverage |

| FAQ 2 | CAPM fails with speculation, inefficiencies |

| FAQ 3 | Retail: use with TA & risk tools, not alone |

| Conclusion | CAPM adapts to perpetuals, key for economists |

Risk and Beta in Perpetual Futures

Unlike equities, perpetual futures do not expire, but they involve funding payments that adjust based on the difference between futures and spot prices. This mechanism influences how beta is calculated. Economists must assess how perpetual futures track the underlying spot markets and whether leverage amplifies systemic risk.

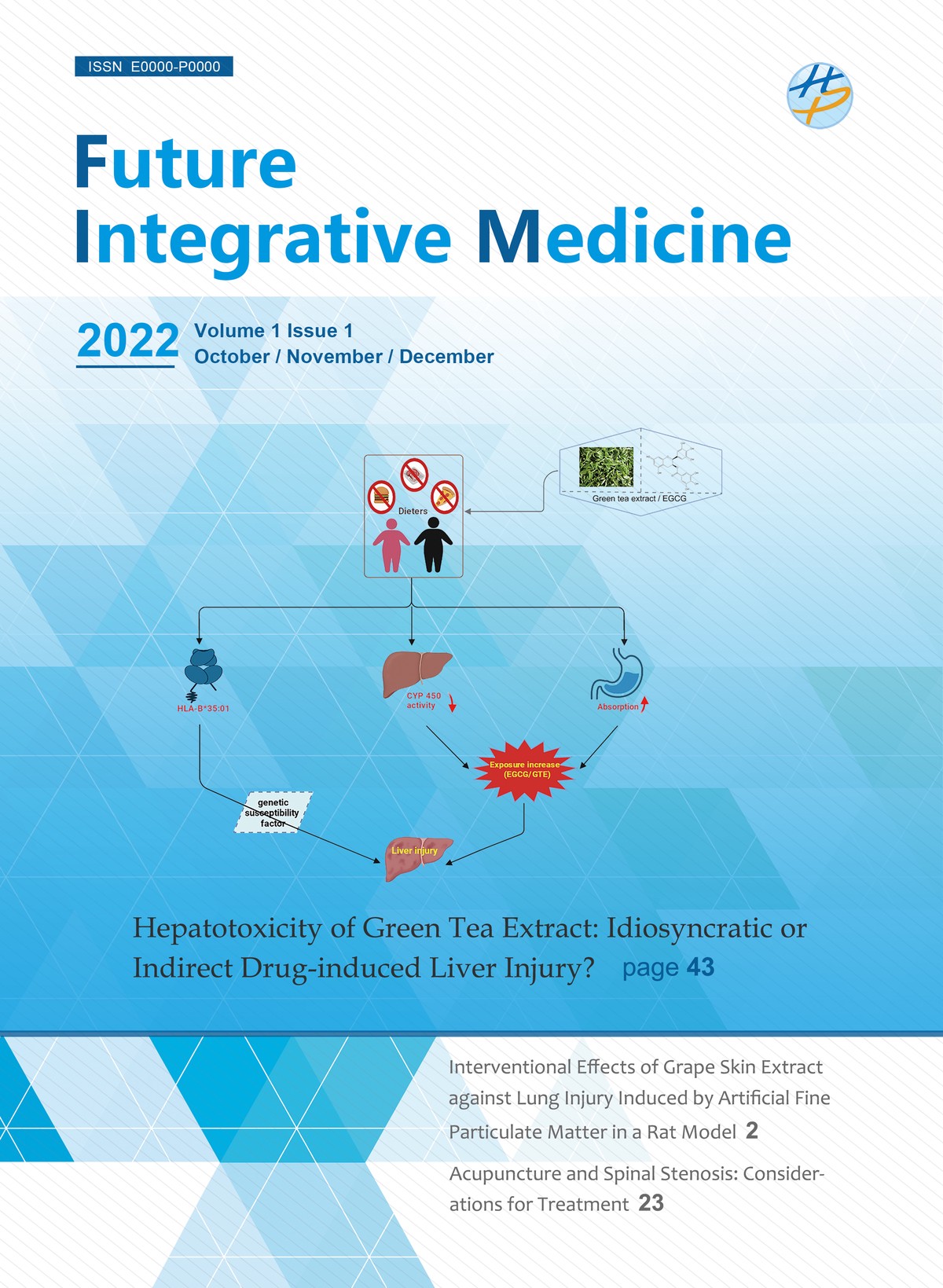

Case Example: Using CAPM in Crypto Perpetual Futures

Suppose an economist analyzes Bitcoin perpetual futures. By estimating the beta of Bitcoin against a broader crypto index, they can project the expected return under CAPM and compare it to the funding rate-adjusted cost of holding the perpetual contract.

This creates a benchmark for whether the futures contract provides adequate compensation for risk.

Two Key Strategies for Economists Using CAPM in Perpetual Futures

1. Market-Neutral Hedging with CAPM

Approach: Economists apply CAPM to calculate expected returns, then take offsetting positions in perpetual futures and the underlying spot asset.

Advantages:

- Reduces exposure to systemic volatility.

- Captures inefficiencies when funding rates deviate from expected CAPM returns.

- Reduces exposure to systemic volatility.

Drawbacks:

- Requires continuous monitoring of funding rate fluctuations.

- Lower absolute returns due to neutral positioning.

- Requires continuous monitoring of funding rate fluctuations.

2. Leverage Optimization with CAPM Benchmarks

Approach: CAPM is used as a guide to determine appropriate leverage levels in perpetual futures based on expected excess returns over the risk-free rate.

Advantages:

- Maximizes returns when CAPM signals strong upside.

- Provides economists with a structured framework for capital allocation.

- Maximizes returns when CAPM signals strong upside.

Drawbacks:

- Amplifies downside risks in volatile markets.

- Sensitive to estimation errors in beta and expected market return.

- Amplifies downside risks in volatile markets.

Recommended Strategy

While both strategies have merit, market-neutral hedging with CAPM is more sustainable for economists and institutional players because it prioritizes risk-adjusted returns rather than aggressive leverage. This aligns with long-term economic principles of stability and measured growth.

Internal Knowledge Links

Economists often ask: “How does capital asset pricing work in perpetual futures?” The answer lies in adapting CAPM assumptions to funding rates and continuous pricing models, ensuring relevance to derivatives that do not expire.

Additionally, understanding why capital asset pricing is important for perpetual futures helps traders and analysts recognize its role in rational pricing, portfolio alignment, and volatility management in these high-risk instruments.

Visual Insight

CAPM projected returns compared with perpetual futures performance and funding rates

Advanced Considerations for Economists

Incorporating Macro Factors

Economists should integrate inflation rates, monetary policy shifts, and geopolitical risks into CAPM inputs when analyzing perpetual futures. Unlike equities, perpetuals are highly sensitive to funding costs that shift with liquidity and macro events.

Behavioral Finance Overlay

Perpetual futures markets—particularly in crypto—often deviate from CAPM predictions due to retail-driven sentiment and herd behavior. Economists must adjust models by incorporating behavioral factors into beta estimations.

Long-Term vs. Short-Term Use

- Short-term: CAPM helps traders decide whether to take or avoid positions in volatile perpetual markets.

- Long-term: Provides a structured economic lens for portfolio design and capital allocation across perpetual and traditional markets.

FAQ

1. How can economists calculate beta for perpetual futures?

Beta is calculated by comparing the returns of the perpetual contract to a market index, such as a crypto composite index. Economists must adjust for leverage and funding rates since perpetual futures inherently differ from equities.

2. Why does CAPM sometimes fail in perpetual futures markets?

CAPM assumes market efficiency and rational investor behavior. Perpetual futures—especially in crypto—are influenced by funding imbalances, retail speculation, and sudden liquidity shocks. These factors can lead to deviations from CAPM predictions.

3. Should retail traders rely on CAPM in perpetual futures trading?

While CAPM provides a solid framework, retail traders should not rely on it exclusively. It works best when combined with technical analysis, risk management tools, and market sentiment analysis. Economists, however, find CAPM valuable for structuring models and ensuring consistency.

Conclusion

The study of capital asset pricing for economists in perpetual futures bridges theory with real-world practice. By adapting CAPM principles to funding rates, leverage, and continuous trading environments, economists gain a robust framework for analyzing risk, return, and market efficiency.

While both leverage-based optimization and market-neutral strategies are useful, the latter offers more stability and sustainability for professional economists. As perpetual futures markets continue to evolve, mastering CAPM-based analysis will remain a crucial skill.

Call to Action

Have you applied CAPM in perpetual futures trading before? Share your insights in the comments, forward this guide to fellow economists, and let’s expand the conversation on how theory meets practice in one of the fastest-evolving markets.