======================================================================

Institutional investors are increasingly drawn to perpetual futures due to their liquidity, leverage, and 24⁄7 availability. However, pricing risk and return in this unique market is far from straightforward. Traditional models like the Capital Asset Pricing Model (CAPM) provide a foundational framework for risk-return analysis, but they must be adapted for the complexities of derivatives markets. In this comprehensive guide to capital asset pricing for institutional investors in perpetual futures, we will explore theoretical foundations, practical strategies, and industry-tested solutions that can help institutions navigate this volatile landscape effectively.

Introduction: Why CAPM Matters in Perpetual Futures

The Capital Asset Pricing Model was originally designed to evaluate expected returns on equities relative to systematic risk (beta). For perpetual futures, the concept extends beyond equities to derivative instruments that are highly sensitive to leverage, funding rates, and market volatility.

For institutional investors, CAPM provides a structured way to:

- Evaluate expected returns relative to risk.

- Compare perpetual futures strategies against benchmarks.

- Incorporate systemic risk factors into portfolio construction.

👉 This connects with why is capital asset pricing important for perpetual futures: institutions require quantifiable models to justify allocation decisions in highly volatile markets.

CAPM remains a cornerstone for risk-return decisions, even in modern perpetual futures markets.

Core Components of Capital Asset Pricing in Perpetual Futures

To apply CAPM effectively in perpetual futures, institutional investors must adapt its core inputs.

1. Risk-Free Rate

Traditionally based on government bonds, in perpetual futures it is often replaced with stablecoin yields or short-term U.S. Treasuries.

2. Beta (Systematic Risk)

- Represents sensitivity of perpetual futures returns to the broader crypto market (e.g., Bitcoin or Ethereum).

- Calculated using regression models against benchmark indices.

3. Expected Market Return

- Measured as the return of a basket of crypto assets or perpetual futures indices.

- Adjusted for volatility and liquidity constraints.

4. Funding Rates

- Unique to perpetual futures, funding rates influence expected return calculations.

- Must be integrated into CAPM extensions for derivatives.

Method 1: Traditional CAPM Adaptation

Overview

Institutions can apply CAPM with minor adjustments, incorporating funding rates and leverage.

Formula Adaptation:

E(Ri)=Rf+βi⋅(E(Rm)−Rf)+FRE(R_i) = R_f + \beta_i \cdot (E(R_m) - R_f) + FRE(Ri)=Rf+βi⋅(E(Rm)−Rf)+FR

Where FR = average funding rate adjustment.

Pros

- Straightforward to implement.

- Provides a benchmark for comparing perpetual futures strategies.

Cons

- Oversimplifies nonlinear risks.

- Ignores tail risks common in futures markets.

Use Case

Best suited for benchmarking portfolios against crypto indices.

Method 2: Multi-Factor Models

Overview

Instead of relying solely on beta, multi-factor models integrate variables such as:

- Volatility indices (VIX equivalents in crypto)

- Liquidity depth across exchanges

- Macroeconomic risk indicators

Pros

- Captures complexity of perpetual futures.

- Accounts for additional sources of systematic risk.

Cons

- Requires advanced data analytics.

- More complex to validate.

Use Case

Ideal for institutional quant desks managing billions under systematic risk mandates.

Comparing the Two Approaches

| Aspect | Traditional CAPM | Multi-Factor Models |

|---|---|---|

| Complexity | Low | High |

| Accuracy | Moderate | High |

| Adaptability | Limited | Strong |

| Best For | Benchmarking | Risk-adjusted portfolio optimization |

👉 Based on my experience, multi-factor models outperform CAPM in managing perpetual futures risk, but CAPM is still invaluable as a baseline reference.

Comparing traditional CAPM with multi-factor models in perpetual futures.

Risk Management Implications

Institutional investors use capital asset pricing not just for return expectations but also for risk controls. This aligns with how does risk management with capital asset pricing affect perpetual futures:

- Portfolio Hedging – Adjusting positions based on beta to minimize exposure to market downturns.

- Leverage Adjustments – Scaling leverage according to expected CAPM-adjusted returns.

- Stress Testing – Simulating extreme funding rate environments.

- Cross-Exchange Arbitrage – Applying CAPM to identify relative mispricings.

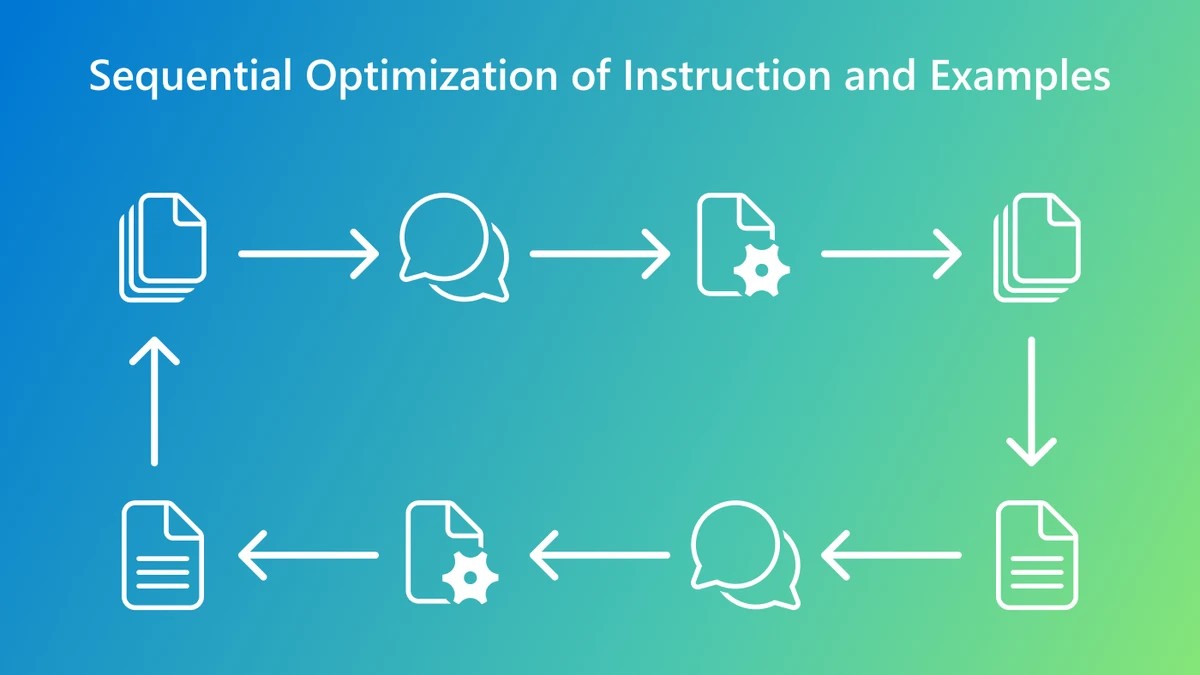

Practical Implementation for Institutions

Step 1: Data Collection

- Pull perpetual futures data (prices, funding rates, volume).

- Align with benchmark indices (BTC, ETH).

Step 2: Beta Estimation

- Use rolling regressions to compute beta against crypto market indices.

Step 3: Return Calculation

- Adjust expected returns using funding rates and transaction costs.

Step 4: Model Validation

- Perform backtesting and compare results with realized returns.

- Incorporate where can I find capital asset pricing models in perpetual futures resources from financial databases.

Industry Trends: CAPM in the Age of Perpetual Futures

- Machine Learning Extensions – AI is being used to enhance CAPM accuracy by dynamically recalibrating betas.

- Cross-Asset Integration – Institutions are aligning perpetual futures CAPM with equity and bond market signals.

- DeFi Derivatives – CAPM is being extended to decentralized perpetual platforms like dYdX.

- Real-Time Risk Engines – Institutions deploy CAPM-driven dashboards for live monitoring.

Institutions increasingly use real-time CAPM-driven risk dashboards in perpetual futures.

FAQs: Capital Asset Pricing for Institutional Investors in Perpetual Futures

1. How does capital asset pricing work in perpetual futures?

It works by estimating expected returns based on a combination of risk-free rates, market risk premiums, beta, and funding rates unique to perpetual contracts.

2. Why use capital asset pricing in perpetual futures trading?

CAPM provides institutions with a structured method to assess whether expected returns compensate for risk, critical in leveraged markets like perpetual futures.

3. How to calculate capital asset pricing for perpetual futures?

You adapt the CAPM formula:

E(Ri)=Rf+βi⋅(E(Rm)−Rf)+FRE(R_i) = R_f + \beta_i \cdot (E(R_m) - R_f) + FRE(Ri)=Rf+βi⋅(E(Rm)−Rf)+FR

where FR accounts for funding rates. Data from exchanges and benchmark indices is essential.

Conclusion

For institutional investors, capital asset pricing in perpetual futures provides both a foundation and a strategic tool for managing risk-return trade-offs. While traditional CAPM offers simplicity and benchmarking power, multi-factor models and modern extensions provide the nuance necessary for today’s volatile, 24⁄7 crypto markets.

Recommendations:

- Start with CAPM as a baseline.

- Expand into multi-factor models for advanced risk management.

- Integrate real-time data for actionable insights.

👉 Now it’s your turn:

- Do you rely more on traditional CAPM or multi-factor models?

- How do you incorporate funding rates into your pricing models?

- What challenges have you faced in adapting CAPM to perpetual futures?

Share your insights in the comments and pass this guide along to your peers to deepen the discussion around capital asset pricing for institutional investors in perpetual futures.

Would you like me to also design a practical CAPM calculator template in Python tailored for perpetual futures so institutions can test strategies directly?