======================================================

The rapid growth of perpetual futures markets has created enormous opportunities for retail and institutional traders alike. However, these opportunities come with risks that extend far beyond simple price volatility. One of the most underappreciated yet critical dimensions of risk is credit risk for individual perpetual futures investors. Understanding, assessing, and mitigating credit risk is essential to building a sustainable trading strategy.

This comprehensive guide explains what credit risk means in the context of perpetual futures, explores different strategies for managing it, highlights best practices, and answers frequently asked questions.

Understanding Credit Risk in Perpetual Futures

What is Credit Risk?

Credit risk in perpetual futures refers to the possibility that a counterparty—whether an exchange, broker, or liquidity provider—fails to meet its obligations. For individual investors, this could mean being unable to withdraw profits, delayed settlement, or even total loss of margin deposits if the platform defaults.

Why Credit Risk Matters for Retail Investors

Unlike price risk, which is visible on trading charts, credit risk is hidden. Even if a trader predicts market direction correctly, poor exchange practices or weak financial safeguards can cause losses. This is why why credit risk matters in perpetual futures trading is a core question every investor should consider before committing capital.

Types of Credit Risk in Perpetual Futures

- Exchange Default Risk – When the platform managing perpetual futures becomes insolvent or fraudulent.

- Counterparty Risk – Failure of trading partners or liquidity providers.

- Clearing and Settlement Risk – Errors or failures in order processing, margin calls, or fund transfers.

- Systemic Risk – Market-wide failures triggered by events like exchange hacks, mass liquidations, or regulatory shutdowns.

Key Factors Influencing Credit Risk

1. Exchange Reputation and Regulation

Highly regulated exchanges generally offer more robust protections. Offshore, lightly regulated platforms may promise higher leverage but expose traders to higher default risk.

2. Collateral and Margin Requirements

Exchanges that undercollateralize positions increase the chance of cascading liquidations. Strong margin systems reduce systemic risk.

3. Insurance Funds and Safeguards

Many exchanges maintain insurance funds to cover losses from bankrupt traders. The size and transparency of these funds influence overall credit risk.

4. Liquidity and Market Depth

As highlighted in how credit risk impacts perpetual futures, deep liquidity reduces slippage and lowers the chance of default during volatile market conditions.

Strategies for Managing Credit Risk

Strategy 1: Stick to Regulated Exchanges

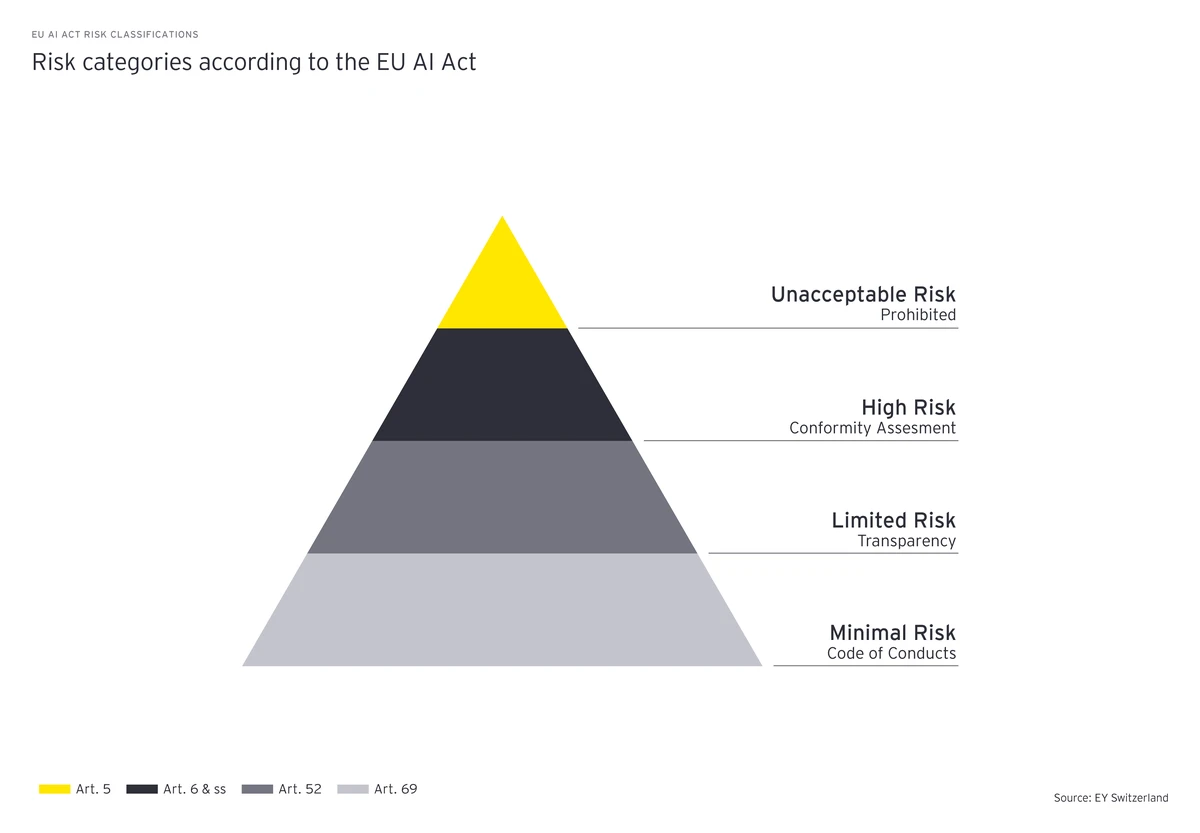

Investors can prioritize exchanges licensed under reputable jurisdictions (e.g., U.S., EU, Singapore).

Pros:

- Strong legal frameworks and consumer protection.

- Transparent reporting and audits.

Cons:

- Higher fees and stricter KYC processes.

- Limited leverage compared to offshore platforms.

Strategy 2: Diversify Across Multiple Platforms

Rather than relying on a single exchange, distribute funds across two or more platforms.

Pros:

- Reduces single-point-of-failure risk.

- Increases access to diverse products and arbitrage opportunities.

Cons:

- More complex to manage accounts.

- Higher cumulative fees.

Expert Recommendation

Based on experience, the best practice is a hybrid approach: keep the bulk of capital on a reputable, regulated exchange while allocating smaller amounts to secondary platforms for diversification. This ensures both security and flexibility.

Risk vs return tradeoff in perpetual futures credit risk management

Advanced Risk Mitigation Techniques

1. Monitor Exchange Proof of Reserves

Choose exchanges that publish third-party audits verifying 1:1 asset backing.

2. Use Stablecoins Carefully

While stablecoins provide hedging benefits, their issuers also carry credit risk. Always verify collateralization claims.

3. Implement Personal Risk Controls

- Set maximum capital exposure per exchange.

- Regularly withdraw profits to external wallets.

- Use stop-loss and position sizing rules to minimize forced liquidations.

4. Utilize Credit Risk Analytics Tools

Specialized tools and third-party analytics provide reports on exchange solvency and risk exposure. This ties directly to how to assess credit risk in perpetual futures, helping investors make data-driven decisions.

Comparing Two Major Approaches

Approach A: Conservative (Regulation-First)

- Focus only on highly regulated exchanges.

- Lower leverage, higher compliance.

- Ideal for long-term safety seekers.

Approach B: Opportunistic (Diversification-First)

- Split capital across regulated and unregulated exchanges.

- Higher leverage, more opportunities.

- Suited for experienced traders with strict risk controls.

Recommendation: Beginners should lean toward Approach A, while experienced traders can cautiously combine both.

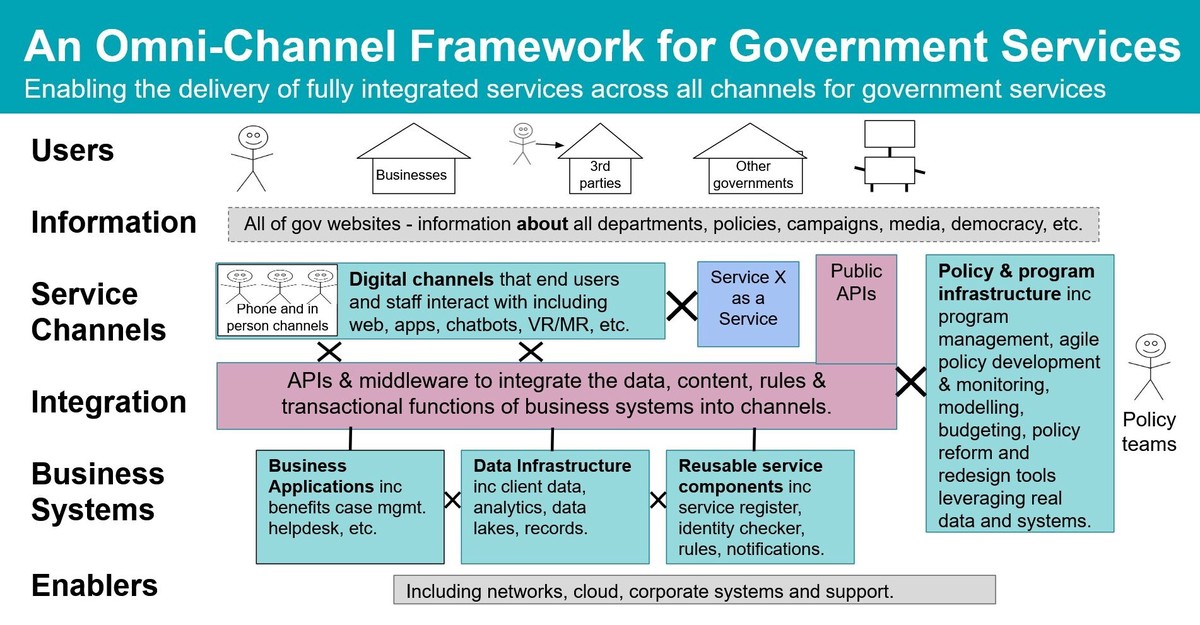

Exchange selection framework for managing credit risk

FAQ: Credit Risk for Perpetual Futures Investors

1. How can individual investors assess credit risk in perpetual futures?

Check whether the exchange is regulated, review its proof of reserves, analyze insurance fund transparency, and test withdrawal speed with small amounts before committing significant capital.

2. Is credit risk higher on decentralized perpetual futures platforms?

Not necessarily. While decentralized platforms eliminate custodial risk, they introduce smart contract vulnerabilities. Audited, open-source protocols tend to reduce such risks but still require cautious capital allocation.

3. What happens if an exchange defaults?

If an exchange becomes insolvent, recovery depends on jurisdiction, regulation, and whether insurance funds exist. In many cases, funds may be lost entirely—making prevention and careful platform selection critical.

Conclusion: Building a Safer Trading Future

Credit risk for individual perpetual futures investors is an often-overlooked yet vital element of trading success. Unlike market volatility, credit risk cannot be hedged away with simple stop-loss orders. It requires careful due diligence, ongoing monitoring, and smart diversification strategies.

The safest approach blends regulatory security with cautious diversification. Always remember: even the best trading strategy is worthless if the platform holding your funds fails.

💬 What do you think? Have you faced challenges with exchange trustworthiness in perpetual futures trading? Share your story in the comments, and don’t forget to share this guide with fellow traders to help them stay protected from hidden credit risks.