==================================================

Perpetual futures are one of the most widely used derivatives in cryptocurrency and traditional finance markets. They offer traders leverage and continuous exposure without expiry. However, the hidden challenge lies in managing credit risk, which can significantly impact both individual and institutional investors. This comprehensive credit risk management guide for perpetual futures will provide traders with actionable frameworks, proven strategies, and practical tools to minimize risk and maximize long-term profitability.

Understanding Credit Risk in Perpetual Futures

What Is Credit Risk?

Credit risk refers to the possibility of counterparty default, margin shortfalls, or systemic insolvency in trading. In perpetual futures, this risk is heightened due to leverage, volatility, and liquidity imbalances.

Unlike traditional futures, perpetual contracts rely on funding rates and real-time settlement. This creates unique credit exposures, especially when markets move sharply against leveraged positions.

Why Credit Risk Matters in Perpetual Futures

Without proper credit risk management, even skilled traders can face liquidation, exchange insolvency, or counterparty defaults. Understanding why credit risk matters in perpetual futures trading ensures traders can protect capital, avoid unnecessary losses, and build resilient trading systems.

Core Components of Credit Risk

1. Counterparty Risk

Every perpetual futures contract involves exposure to the platform or clearinghouse. If the exchange fails to honor settlements, traders face direct credit losses.

2. Margin and Leverage Risk

High leverage magnifies small price changes. If traders cannot meet margin calls, forced liquidations may occur, impacting credit balances and overall exposure.

3. Systemic Risk

In extreme scenarios—such as exchange failures or liquidity crises—system-wide credit risk emerges, affecting all participants regardless of position.

Methods for Evaluating Credit Risk

Method 1: Quantitative Credit Risk Models

Quantitative methods involve statistical models, stress testing, and historical volatility analysis to measure credit exposure.

- Advantages: Data-driven, objective, and scalable.

- Disadvantages: May fail during unprecedented market shocks.

Method 2: Scenario-Based Risk Assessment

Scenario analysis simulates extreme market movements (e.g., 30% Bitcoin drop in an hour) to test portfolio resilience.

- Advantages: Helps traders prepare for worst-case situations.

- Disadvantages: Assumes hypothetical conditions, which may differ from real-world dynamics.

Recommended Approach

A hybrid model that combines quantitative measures with scenario-based stress testing provides the most comprehensive framework. This approach captures both historical data trends and tail risks.

Credit Risk Management Strategies

1. Margin and Collateral Optimization

Maintaining adequate margin buffers beyond the minimum reduces the chance of forced liquidation.

- Use stablecoins or highly liquid assets as collateral.

- Diversify margin across multiple exchanges.

2. Position Sizing and Leverage Discipline

Avoid excessive leverage. Institutional investors often cap leverage at 5x or below to maintain sustainable credit profiles. Retail traders should adopt similar discipline.

3. Diversification Across Platforms

Spreading exposure across multiple exchanges reduces dependency on a single counterparty, mitigating exchange-specific insolvency risks.

4. Using Risk Management Tools

Modern exchanges offer credit risk tools for experienced perpetual futures traders, such as portfolio margining, automated stop-loss systems, and liquidation alerts. These should be actively integrated into daily strategies.

How to Assess Credit Risk in Perpetual Futures

Many traders struggle with where to begin. A practical assessment framework involves:

- Evaluating the creditworthiness of the exchange (financial audits, proof-of-reserves).

- Reviewing historical liquidation records of the platform.

- Applying a stress test on personal portfolios.

This step-by-step process is aligned with industry best practices for managing credit risk in perpetual futures and ensures comprehensive protection.

Industry Trends in Credit Risk Management

Rise of On-Chain Proof-of-Reserves

Exchanges increasingly use blockchain transparency to prove solvency, improving counterparty risk evaluation.

AI-Powered Risk Monitoring

Machine learning models now monitor volatility, funding rates, and liquidation probabilities, allowing real-time risk alerts.

Institutional Adoption of Credit Risk Frameworks

Hedge funds and banks entering perpetual futures trading implement advanced credit risk assessment frameworks for perpetual futures, raising the industry standard.

Case Study: Credit Risk Management in 2022 Market Crash

During the 2022 crypto crash, several exchanges faced insolvency due to poor credit risk management. Traders who used:

- Low leverage,

- Collateral diversification,

- Scenario-based stress testing

were better positioned to withstand extreme volatility. This real-world case highlights the importance of proactive risk frameworks.

Practical Tips for Traders

- Maintain at least 30% more margin than the required minimum.

- Regularly update risk models with new volatility data.

- Use stop-losses and conditional orders to automate credit exposure controls.

- Keep funds in secure, diversified wallets outside exchanges when not actively trading.

Frequently Asked Questions (FAQ)

1. How can traders evaluate credit risk in perpetual futures?

Traders can evaluate credit risk by combining exchange due diligence, historical volatility analysis, and stress testing portfolios against extreme scenarios. Using both quantitative risk models and scenario-based analysis provides a balanced assessment.

2. What factors influence credit risk in perpetual futures?

Key factors include exchange solvency, leverage levels, margin adequacy, market volatility, and systemic risks. Traders should especially monitor funding rates and liquidation thresholds, as these directly affect credit exposure.

3. What are the best practices for managing credit risk in perpetual futures?

Best practices include:

- Keeping leverage conservative (below 5x).

- Using diversified collateral.

- Applying automated liquidation alerts.

- Conducting regular risk audits to adapt strategies to changing market conditions.

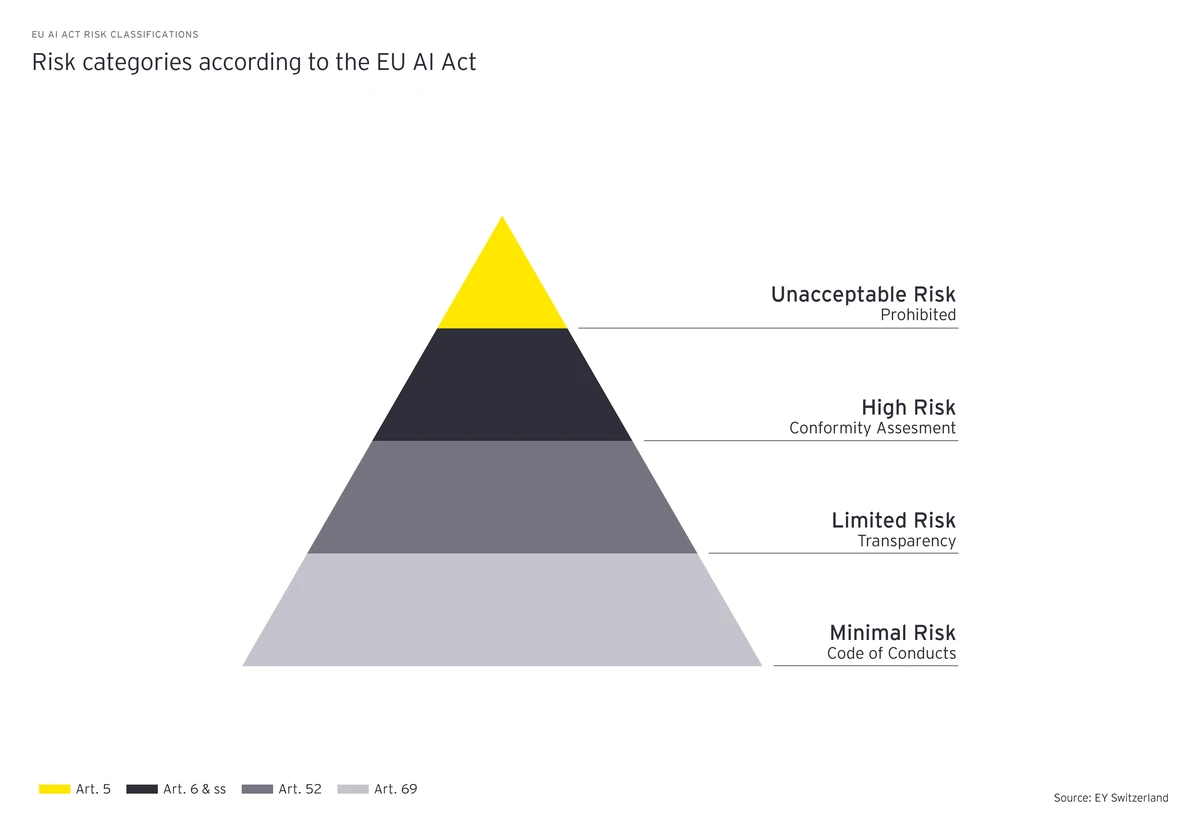

Visual Insights

Credit risk factors in perpetual futures trading

Conclusion: Building Resilient Futures Trading Through Credit Risk Management

Credit risk management in perpetual futures is not optional—it is the foundation of sustainable trading. By combining quantitative models, scenario-based stress testing, and practical tools, traders can minimize exposure and safeguard profits.

If you are a retail trader starting out, begin with credit risk education for perpetual futures novices and gradually adopt advanced strategies as your portfolio grows. Institutions, on the other hand, must establish robust frameworks that ensure long-term resilience.

👉 Share this guide with fellow traders, comment with your experiences, and let’s build a community where risk awareness drives smarter trading decisions.

Would you like me to expand this into a PDF trading manual with detailed frameworks and sample Excel templates for credit risk assessment?