===================================================

Perpetual futures have become one of the most popular instruments in cryptocurrency and derivatives trading. They provide continuous exposure to an asset without an expiry date, but they also carry unique risks. Among these, default risk stands out as one of the most crucial factors to understand. This article explores how default risk is calculated in perpetual futures, discusses the underlying mechanisms exchanges use, compares different calculation methods, and provides strategies traders and portfolio managers can adopt to minimize exposure.

Understanding Default Risk in Perpetual Futures

What Is Default Risk?

Default risk in perpetual futures refers to the possibility that a trader cannot fulfill their margin obligations when their position moves against them. In other words, it’s the risk that losses exceed collateral before liquidation occurs, leaving the position undercollateralized.

Unlike traditional futures with clearinghouses and strict settlement dates, perpetual futures require real-time risk management frameworks to prevent systemic contagion when defaults occur.

Why Default Risk Matters

Default risk impacts not just individual traders but the entire ecosystem:

- Exchanges need to manage it to maintain market stability.

- Liquidity providers assess it before committing capital.

- Retail traders face forced liquidations when systems mismanage risk.

Understanding this risk is essential for pricing, margin requirements, and overall confidence in perpetual futures markets.

Core Components of Default Risk Calculation

1. Margin System

Exchanges calculate default risk by monitoring whether margin collateral is sufficient.

- Initial Margin (IM): Required to open a position.

- Maintenance Margin (MM): Minimum balance needed to keep a position open.

If a trader’s margin falls below MM, liquidation engines kick in to prevent default.

2. Funding Rates

Since perpetual futures never expire, funding mechanisms align contract prices with spot markets.

While funding rates primarily manage price convergence, they indirectly affect default probability by increasing or decreasing traders’ carrying costs.

3. Liquidation Engines

Automated liquidation systems continuously monitor positions. Their efficiency directly influences default risk, as slow or inaccurate liquidations can result in undercollateralized accounts.

Default Risk Mechanics in Perpetual Futures

Methods of Calculating Default Risk

Method 1: Stress Testing and Value at Risk (VaR)

Exchanges often apply Value at Risk (VaR) models to simulate extreme market movements and assess the probability of trader defaults.

Process

- Simulate historical and hypothetical price shocks.

- Estimate portfolio losses at various confidence levels (e.g., 95% or 99%).

- Compare results against margin collateral.

Advantages

- Widely used in traditional finance, offering credibility.

- Captures tail risks and provides systemic insights.

Disadvantages

- Relies on historical data, which may not fully capture crypto’s extreme volatility.

- Computationally intensive for real-time monitoring.

Method 2: Real-Time Margin and Exposure Monitoring

Another approach involves continuous monitoring of margin balances relative to open positions, factoring in expected liquidation slippage.

Process

- Track each trader’s margin and unrealized PnL.

- Estimate potential liquidation shortfalls based on current liquidity depth.

- Aggregate risks across all traders to forecast default risk exposure.

Advantages

- Provides real-time insights into potential systemic risk.

- Better suited for highly volatile and 24⁄7 crypto markets.

Disadvantages

- Requires sophisticated infrastructure and liquidity estimation.

- Vulnerable to sudden, large price gaps (“flash crashes”).

Real-Time Margin Monitoring Dashboard Example

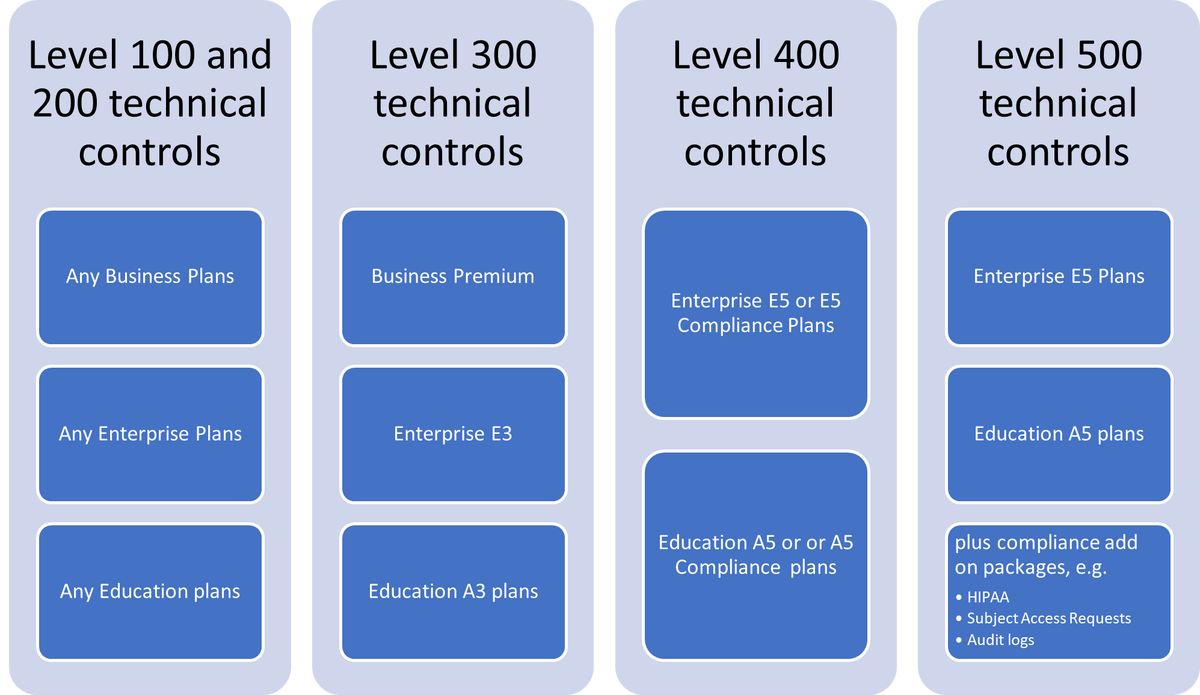

Comparative Analysis: Stress Testing vs. Real-Time Monitoring

| Feature | Stress Testing & VaR | Real-Time Monitoring |

|---|---|---|

| Time Horizon | Historical & simulated scenarios | Live, ongoing assessment |

| Best Use Case | Long-term systemic resilience | Day-to-day operational control |

| Pros | Captures tail events; regulatory credibility | Real-time, adaptive, market-specific |

| Cons | Data lag; less effective in black swan events | High system demands; reliant on exchange infrastructure |

Recommendation:

For perpetual futures, a hybrid approach combining stress testing for structural resilience and real-time monitoring for active risk control provides the most reliable framework.

How Exchanges Manage Default Risk

Insurance Funds

Exchanges maintain insurance funds that absorb losses when liquidations fail. If a trader defaults, the fund steps in to cover shortfalls, reducing systemic contagion.

Auto-Deleveraging (ADL)

If insurance funds are insufficient, exchanges apply ADL mechanisms, reducing exposure by automatically deleveraging profitable traders in the opposite direction. This is a last-resort measure but critical to maintaining systemic integrity.

Example

On platforms like Binance or Bybit, the insurance fund balance is publicly displayed. Traders can review it when assessing where to trade and how to assess default risk in perpetual futures across different venues.

Risk Factors Affecting Default Risk Calculations

- Market Volatility: Higher volatility increases liquidation risk.

- Liquidity Depth: Thin order books worsen slippage during liquidations.

- Leverage Usage: Higher leverage ratios magnify potential defaults.

- Exchange Infrastructure: Speed of liquidation engines affects outcomes.

For traders seeking structured resources, learning where to find default risk data for perpetual futures can provide valuable transparency before committing capital.

Practical Strategies for Traders to Manage Default Risk

1. Conservative Leverage

Avoid maximum leverage settings. Lower leverage provides a greater buffer against sudden liquidations.

2. Diversification

Hedge perpetual futures exposure with spot or options positions.

3. Monitoring Insurance Fund Levels

Trading on platforms with strong insurance funds provides greater protection against systemic risk.

4. Stop-Loss Orders

Implement disciplined exit strategies to reduce exposure before liquidation triggers.

Leverage vs. Default Risk Relationship

FAQ: Default Risk in Perpetual Futures

1. How do exchanges calculate default risk in real time?

They monitor trader balances, open positions, and market liquidity. When positions approach maintenance margin, liquidation engines estimate whether forced liquidation can occur without loss. If not, default risk increases.

2. Why is default risk important in perpetual futures trading?

Default risk affects pricing, leverage availability, and market stability. If unmanaged, it can lead to cascading liquidations and exchange insolvencies, as seen in past crypto market crashes.

3. Can traders calculate default risk on their own?

While exchanges provide margin calculators, traders can approximate default risk by monitoring leverage ratios, volatility levels, and insurance fund balances. Advanced users also run independent stress tests on their positions.

Conclusion: The Importance of Default Risk Awareness

Calculating default risk in perpetual futures is critical for maintaining both individual profitability and systemic stability. By understanding stress testing models, real-time margin monitoring, and the mechanics of insurance funds and ADL, traders and portfolio managers can operate more confidently.

Exchanges continue to refine their methodologies, but traders must also take responsibility—choosing conservative leverage, monitoring exchange transparency, and using proactive risk controls.

If you found this guide insightful, share it with fellow traders, comment with your experiences managing default risk, and join the conversation on building safer perpetual futures markets.

Would you like me to also prepare a case study of a major exchange’s default risk incident (e.g., BitMEX 2020 crash) to show how real-world failures highlight the importance of proper risk calculations?