=======================================================================

Perpetual futures trading has become one of the most dynamic and liquid markets, especially in the cryptocurrency space. For traders and quants, balancing risk and reward is critical when developing strategies. One of the most effective tools for this balance is mean-variance analysis (MVA), a classical framework rooted in modern portfolio theory. This article will provide an in-depth exploration of developing algorithms with mean-variance analysis for perpetual futures, covering strategies, tools, industry trends, and practical applications.

Introduction to Mean-Variance Analysis in Perpetual Futures

Mean-variance analysis, introduced by Harry Markowitz, is a quantitative framework that evaluates portfolios based on their expected returns (mean) and associated risks (variance). In the context of perpetual futures:

- Returns come from funding rate arbitrage, directional bets, or spread strategies.

- Risk arises from volatility, leverage, and market structure uncertainty.

Applying MVA to perpetual futures allows traders to optimize exposure, hedge positions, and control leverage effectively, offering a structured approach to trading in high-volatility environments.

Why Use Mean-Variance Analysis in Perpetual Futures?

Perpetual futures are unique because they don’t have expiry dates, and their pricing is linked to the underlying spot price through funding mechanisms. This creates both opportunities and risks:

- Funding rate cycles add an additional return stream.

- Leverage amplifies both potential gains and losses.

- Liquidity fluctuations affect execution and slippage.

By applying mean-variance analysis, traders can quantify trade-offs and create strategies that align with their risk tolerance. This is why many professionals emphasize why use mean-variance analysis in perpetual futures as a cornerstone of systematic trading.

Core Principles of Developing Algorithms with MVA

1. Defining the Objective Function

The algorithm must balance expected return (mean) against volatility (variance). Typically, this is expressed as:

U=E®−λ2Var®U = E® - \frac{\lambda}{2} Var®U=E®−2λVar®

Where UUU is the utility, E®E®E® is the expected return, Var®Var®Var® is the variance of returns, and λ\lambdaλ is the risk aversion coefficient.

2. Data Inputs

- Historical price data of perpetual futures and spot markets

- Funding rate history

- Order book depth and liquidity metrics

- Volatility indices and implied risk

3. Algorithm Design Considerations

- Incorporating real-time risk monitoring

- Adjusting position sizes dynamically

- Integrating leverage constraints

Methods of Using MVA in Perpetual Futures Algorithms

Method 1: Market-Neutral Funding Rate Arbitrage

This strategy involves going long perpetual futures while shorting the spot asset, or vice versa, to capture funding rate payments.

How MVA helps:

- Mean: Predict expected funding rates

- Variance: Account for volatility in price spreads

- Optimization: Adjust leverage and position size to maximize Sharpe ratio

Advantages:

- Low correlation with market direction

- Consistent yield during favorable funding cycles

Disadvantages:

- Profits shrink when funding converges to zero

- Requires robust execution to avoid slippage

Method 2: Trend-Following with Risk Balancing

Directional trading on perpetual futures can be enhanced with MVA by dynamically adjusting exposure.

How MVA helps:

- Mean: Estimate expected returns from momentum signals

- Variance: Model expected volatility under leverage

- Optimization: Allocate capital across multiple perpetual futures pairs to balance risk

Advantages:

- High upside during strong market trends

- Can scale with algorithmic execution

Disadvantages:

- Performance drops in sideways markets

- Risk of drawdowns with leverage mismanagement

Comparing Market-Neutral vs. Trend-Following Approaches

| Feature | Market-Neutral Arbitrage | Trend-Following with MVA |

|---|---|---|

| Return Profile | Stable, moderate | High upside, volatile |

| Risk | Funding rate dependency, liquidity risk | Directional exposure, leverage risk |

| Best Use Case | Stable funding environments | Strong trending markets |

| Suitability | Conservative and risk-averse investors | Aggressive traders with higher risk |

Recommendation: Market-neutral strategies are ideal for conservative, stable returns, while trend-following with MVA suits more aggressive traders seeking amplified performance during directional markets.

Practical Steps for Developing MVA-Based Algorithms

Step 1: Collect and Clean Data

Aggregate tick-level perpetual futures data, funding rates, and order book depth. Remove anomalies and outliers.

Step 2: Build Statistical Models

- Calculate expected returns for different strategies

- Estimate covariance matrices for multiple perpetual contracts

Step 3: Apply Optimization

Use quadratic programming solvers to find optimal allocations under leverage constraints.

Step 4: Backtesting and Simulation

Validate with historical data, stress-test during high-volatility periods (e.g., major liquidations).

Step 5: Live Deployment

Integrate with exchange APIs, implement risk monitoring dashboards, and automate stop-loss adjustments.

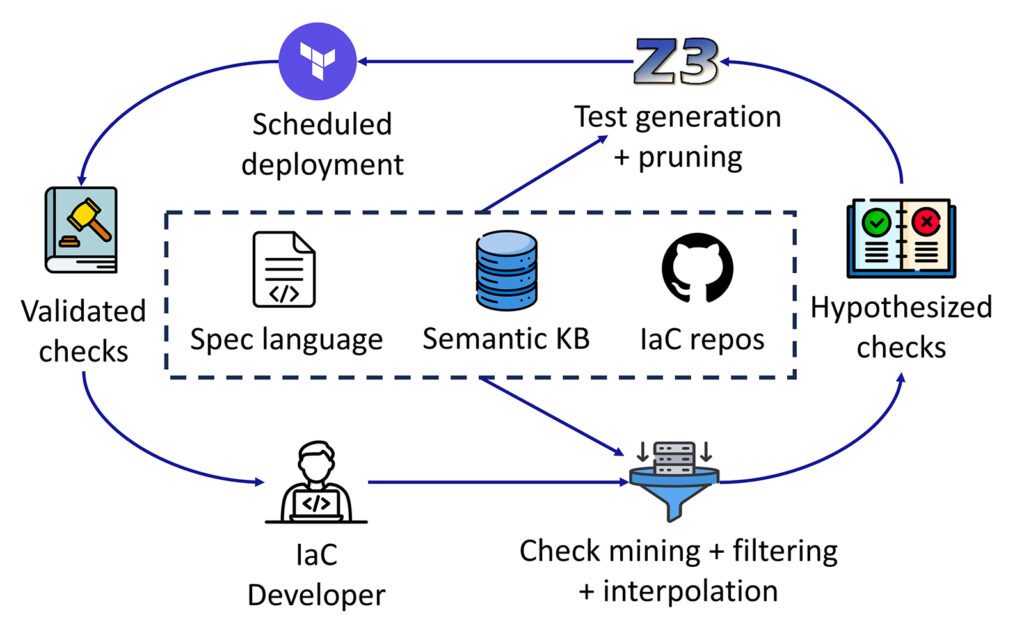

Mean-variance optimization framework applied to perpetual futures

Industry Trends in MVA for Perpetual Futures

- AI Integration: Combining deep reinforcement learning with MVA for adaptive strategies.

- Cross-Exchange Arbitrage: Optimizing across multiple venues with different funding dynamics.

- Crypto-Specific Risk Models: Incorporating liquidation cascades and liquidity crunches into variance estimates.

- Retail Accessibility: Platforms now provide mean-variance analysis tools for crypto traders in perpetual futures, lowering entry barriers.

How Does Mean-Variance Analysis Impact Perpetual Futures Trading?

Mean-variance analysis impacts perpetual futures trading by:

- Providing quantitative metrics for risk-return trade-offs.

- Helping traders manage leverage without overexposure.

- Enabling multi-asset portfolio optimization across BTC, ETH, and altcoin perpetuals.

Understanding how does mean-variance analysis impact perpetual futures trading is crucial for anyone developing systematic strategies in this domain.

Challenges of Implementing MVA in Perpetual Futures

- Non-Normal Returns: Perpetual futures often exhibit fat tails and skewness.

- Leverage-Induced Risks: Small miscalculations can cause liquidation.

- Funding Rate Uncertainty: Predicting future funding dynamics remains complex.

- Infrastructure Costs: Real-time execution requires advanced data pipelines.

FAQs About Developing Algorithms with MVA for Perpetual Futures

1. Can mean-variance analysis work in highly volatile crypto markets?

Yes, but adjustments are needed. Standard MVA assumes normally distributed returns, which may not hold in crypto. Incorporating robust covariance estimation and downside risk measures improves accuracy.

2. Is mean-variance analysis suitable for retail traders in perpetual futures?

Absolutely. With simplified tools and lower capital, mean-variance analysis for retail investors in perpetual futures can help manage leverage and optimize exposure. However, execution efficiency and risk controls are critical.

3. How can mean-variance analysis improve perpetual futures returns?

By systematically allocating capital to strategies with the best risk-adjusted returns, MVA enhances the Sharpe ratio and reduces unnecessary drawdowns. This structured optimization often outperforms discretionary trading.

Conclusion

Developing algorithms with mean-variance analysis for perpetual futures bridges classical portfolio theory and modern crypto derivatives trading. By leveraging MVA in strategies like funding rate arbitrage and trend-following, traders can optimize risk and return, adapt to volatility, and build scalable systems.

As the perpetual futures market evolves, MVA will remain a critical tool for quants, institutions, and retail traders alike. The key lies in combining traditional models with modern analytics to navigate one of the most volatile yet rewarding financial frontiers.

💡 If this article helped you understand how to apply MVA in perpetual futures, share it with your peers, leave a comment on your strategies, and let’s build a more data-driven trading community together.