======================================

Introduction

In financial decision-making, effective scenario analysis techniques are indispensable tools for investors, traders, and risk managers. By modeling different possible futures, scenario analysis allows organizations and individuals to anticipate risks, test strategies, and identify hidden opportunities. In today’s volatile environment—shaped by economic uncertainty, geopolitical tensions, and rapidly evolving markets—scenario analysis has evolved into a core component of strategic planning and portfolio management.

Having used scenario analysis both in corporate finance and trading environments, I have observed how effective techniques can make the difference between proactive decisions and reactive damage control. This article explores what scenario analysis is, the most effective methodologies, their strengths and weaknesses, and best practices for implementation.

What Is Scenario Analysis?

Definition

Scenario analysis is the process of evaluating potential future outcomes by considering different combinations of variables and events. Instead of relying solely on historical data, it creates hypothetical scenarios to stress-test assumptions.

Core Purpose

- Identify risks before they materialize.

- Test investment and business strategies under various conditions.

- Improve decision-making by incorporating uncertainty.

Applications

- Trading: Evaluating the impact of market volatility, interest rates, and political risk.

- Corporate Strategy: Planning for supply chain disruptions or regulatory changes.

- Portfolio Management: Assessing resilience under bull, bear, and extreme stress markets.

The scenario planning process visualized as a structured cycle.

Key Effective Scenario Analysis Techniques

1. Deterministic Scenario Modeling

Deterministic scenarios are structured around clearly defined assumptions (e.g., interest rates rise by 1%, oil prices drop 15%).

- Pros: Easy to understand and communicate to stakeholders.

- Cons: Oversimplifies uncertainty and ignores probability distributions.

2. Probabilistic Scenario Analysis

This approach uses probability distributions (such as Monte Carlo simulations) to model thousands of potential outcomes.

- Pros: Captures uncertainty more realistically, offering a spectrum of possible results.

- Cons: Requires technical expertise and computational resources.

3. Stress Testing

Stress testing involves modeling extreme, low-probability events (e.g., financial crises, pandemics, geopolitical conflicts).

- Pros: Helps identify vulnerabilities that standard models overlook.

- Cons: May exaggerate risks and cause overly conservative strategies.

4. Qualitative Scenario Planning

Relies on expert judgment, narratives, and qualitative inputs to craft plausible future scenarios.

- Pros: Captures nuances that quantitative models may miss.

- Cons: Subjective, harder to validate with data.

5. Integrated Risk-Management Scenario Analysis

Combines quantitative simulations with qualitative assessments, directly linking to how to integrate scenario analysis with risk management.

- Pros: Offers holistic risk evaluation.

- Cons: Time-consuming and resource-intensive.

Comparing Two Popular Approaches

Monte Carlo Simulation vs. Stress Testing

Monte Carlo Simulation

- Runs thousands of random trials to project potential portfolio outcomes.

- Best for capturing the range of normal volatility.

- Example: Modeling daily S&P 500 returns under varying interest rates.

Stress Testing

- Focuses on rare but high-impact events (e.g., a 2008-style financial meltdown).

- Best for preparing against tail-risk scenarios.

- Example: Assessing portfolio resilience during a sudden 30% equity market drop.

Best Practice Recommendation: Use both Monte Carlo simulations and stress tests. Monte Carlo provides probability-weighted expectations, while stress tests reveal hidden vulnerabilities under extreme conditions.

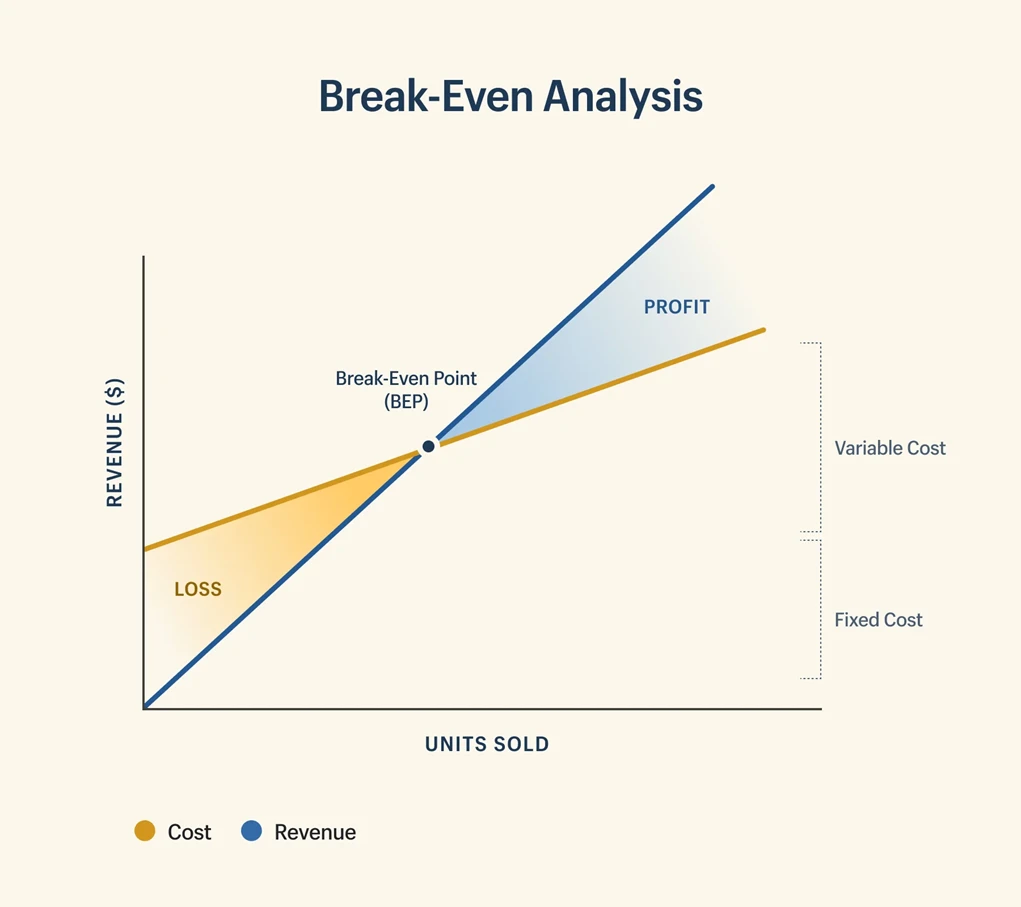

Monte Carlo simulations provide a range of potential outcomes, helping advisors understand portfolio risk.

Scenario Analysis in Trading

Scenario analysis has become especially relevant for traders using derivatives and perpetual futures. For instance, traders often explore how does scenario analysis improve trading strategies by simulating price movements, leverage effects, and volatility spikes.

- Short-Term Traders: Use intraday scenario testing to prepare for sudden volatility.

- Swing Traders: Model medium-term macroeconomic shifts.

- Institutional Investors: Apply multi-year geopolitical and economic scenarios.

By applying these techniques, traders gain an edge in anticipating both opportunities and risks.

Modern Trends in Scenario Analysis

1. AI-Driven Simulations

Artificial intelligence is being used to process massive datasets and build highly adaptive scenarios.

2. ESG and Climate Risk Scenarios

Scenario analysis now includes environmental, social, and governance (ESG) risks, especially for long-term investors.

3. Real-Time Adaptive Scenarios

Big data enables real-time scenario adjustments based on changing market inputs.

4. Widespread Educational Resources

Investors can easily access professional training and guides—for example, where to learn scenario analysis techniques—to sharpen their skills.

Case Studies

Case Study 1: 2008 Financial Crisis

Firms that conducted stress tests for housing market collapse adjusted their portfolios earlier, avoiding massive losses.

Case Study 2: Oil Price Shocks

Energy companies running deterministic and probabilistic scenarios prepared hedging strategies before price swings, securing cash flow.

Case Study 3: COVID-19 Pandemic

Organizations with pandemic-related scenarios were better prepared for supply chain disruptions and rapid market sell-offs.

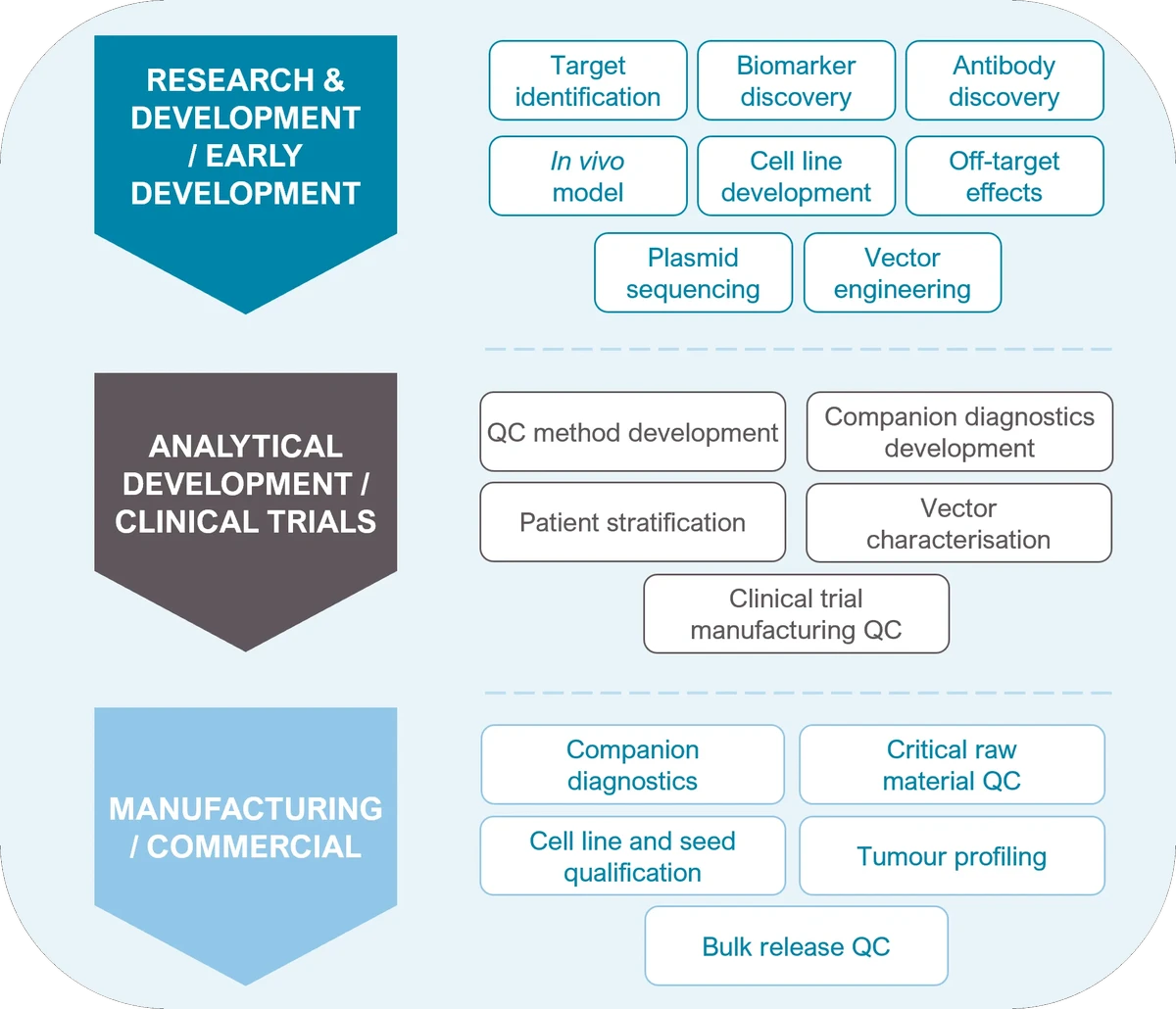

Scenario analysis is integrated into corporate strategy, trading, and risk management.

Best Practices for Effective Scenario Analysis

- Combine Quantitative and Qualitative Methods: Use numbers but also expert narratives.

- Focus on Relevance: Build scenarios tied to your portfolio, industry, or strategy.

- Update Regularly: Outdated scenarios are dangerous. Keep them fresh with current data.

- Engage Stakeholders: Ensure decision-makers understand the implications.

- Test Extreme Events: Don’t just plan for the likely—prepare for the unlikely too.

FAQs

1. What are the most effective scenario analysis techniques for traders?

The most effective methods are Monte Carlo simulations for capturing daily volatility and stress testing for rare but catastrophic events. Traders benefit by balancing both approaches in their strategy.

2. How often should scenario analysis be updated?

At minimum, quarterly updates are recommended. However, in volatile markets, real-time updates or monthly reviews are best. Scenario analysis is only as valuable as the timeliness of its data.

3. Can scenario analysis prevent losses completely?

No, it cannot eliminate losses. Instead, it reduces the likelihood of being blindsided by unexpected events. It helps traders and investors prepare contingency plans that minimize damage.

4. Why is scenario analysis important in trading?

Scenario analysis gives traders foresight. By simulating market movements, they can position portfolios for resilience and capitalize on opportunities others overlook.

Conclusion

Effective scenario analysis techniques are critical for navigating financial uncertainty. Whether through deterministic models, probabilistic simulations, or stress testing, scenario analysis empowers traders, investors, and corporate managers to make informed, resilient decisions.

The most successful practitioners use a hybrid approach, combining data-driven simulations with qualitative insights to capture both measurable probabilities and contextual nuance.

💡 What scenario analysis techniques have you found most useful in your work or trading? Share your experiences below and forward this article to peers who want to strengthen their risk management strategies.