==================================================

Introduction

Institutional traders operate in an environment where portfolio optimization, capital preservation, and risk-adjusted returns define long-term success. One of the most powerful concepts in modern portfolio theory is the efficient frontier—a curve that represents the optimal balance between risk and return. This guide provides institutional traders with deep insights into applying efficient frontier modeling to enhance decision-making, manage risk, and maximize portfolio efficiency.

By exploring practical methods, comparing strategies, and offering real-world applications, this efficient frontier guide for institutional traders serves as both a technical and strategic resource for advanced market participants.

What Is the Efficient Frontier?

Core Definition

The efficient frontier, introduced by Harry Markowitz in 1952, is a graphical representation of portfolios that achieve the maximum expected return for a given level of risk—or, equivalently, the minimum risk for a given expected return.

Relevance for Institutions

Institutional traders—such as hedge funds, pension funds, and sovereign wealth funds—rely on efficient frontier models to:

- Allocate capital across asset classes.

- Optimize portfolios based on volatility and correlation.

- Improve performance reporting to stakeholders.

- Integrate risk-adjusted decision-making in long-term strategies.

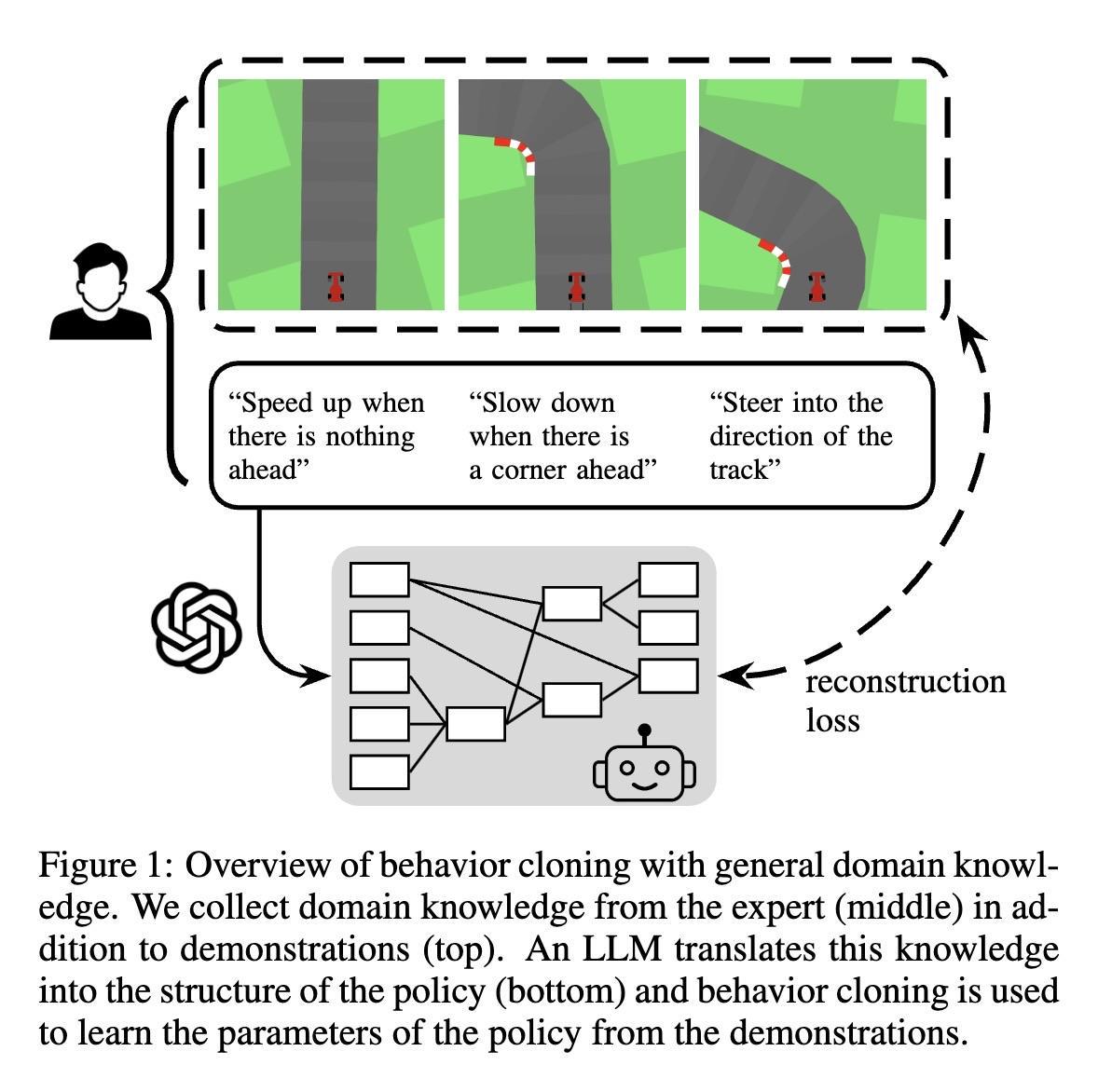

Efficient frontier curve illustrating optimal portfolio combinations

Why the Efficient Frontier Matters for Institutional Traders

Enhances Risk Management

The efficient frontier provides a quantitative framework for minimizing downside risk while maintaining desired returns.

Supports Regulatory and Fiduciary Duties

Institutions are often legally obligated to act in the best interest of their stakeholders, and applying efficient frontier principles demonstrates sound, evidence-based portfolio construction.

Facilitates Multi-Asset Allocation

From equities and fixed income to derivatives and alternatives, efficient frontier models allow for integrated, cross-asset portfolio optimization.

This ties closely with why efficient frontier is important in perpetual futures, as derivatives markets rely heavily on precise risk-return trade-offs.

Core Components of Efficient Frontier Modeling

1. Expected Returns

Forecasts derived from historical data, forward-looking macro models, or quantitative signals.

2. Standard Deviation (Volatility)

A measure of risk, capturing the variability of returns.

3. Correlation Between Assets

Correlation drives diversification benefits. Portfolios with low or negative correlations achieve superior positions on the efficient frontier.

4. Risk-Free Rate

Often proxied by government bonds, this anchors models for calculating Sharpe ratios and excess returns.

Methods for Constructing the Efficient Frontier

1. Mean-Variance Optimization (MVO)

The traditional approach, using expected returns, variances, and covariances to plot the frontier.

- Pros: Straightforward, mathematically elegant, well-documented.

- Cons: Highly sensitive to input assumptions, often unstable in real markets.

2. Black-Litterman Model

An advanced method that integrates market equilibrium with investor views.

- Pros: Produces more stable portfolios, allows customization, widely used by institutional funds.

- Cons: More complex, requires strong quantitative expertise.

Recommendation: Institutions should blend MVO for baseline modeling with Black-Litterman for practical implementation, reducing sensitivity while retaining flexibility.

Efficient Frontier Applications in Institutional Trading

Equity Portfolios

Balancing high-growth stocks with defensive sectors to optimize returns relative to volatility.

Fixed Income Portfolios

Combining corporate bonds, treasuries, and emerging market debt to manage interest rate and credit risk.

Alternatives and Hedge Funds

Integrating private equity, commodities, and real estate to capture diversification benefits.

Perpetual Futures Integration

Using efficient frontier modeling for derivatives allows traders to structure leverage and margin allocation more effectively. This connects with how to calculate efficient frontier with perpetual futures, giving traders tools to manage leveraged risk while maximizing returns.

Efficient Frontier and Market Trends

AI-Powered Optimization

Machine learning enhances frontier modeling by dynamically adjusting to real-time data and regime shifts.

ESG Integration

Institutions increasingly incorporate environmental, social, and governance (ESG) metrics into efficient frontier construction.

Crypto and Digital Assets

The rise of Bitcoin, Ethereum, and tokenized assets introduces new volatility dynamics, requiring frontier modeling tailored to high-risk environments.

Efficient frontier shifts when digital assets are integrated into portfolios

Challenges in Applying the Efficient Frontier

- Input Instability – Small changes in assumptions can dramatically shift results.

- Non-Normal Returns – Real-world asset returns often have fat tails and skewness.

- Liquidity Constraints – Institutional positions cannot always be rebalanced seamlessly.

- Regulatory Oversight – Portfolios must balance efficiency with compliance.

- Black Swan Events – Frontier models struggle in extreme crises.

Case Studies

Hedge Fund Diversification

A global hedge fund added commodities and emerging market equities into its portfolio, improving its efficient frontier position and reducing exposure to equity drawdowns.

Pension Fund Risk Management

A pension fund used Black-Litterman modeling to balance its exposure to corporate bonds and equities, aligning returns with long-term liabilities.

Crypto Hedge Desk

An institutional crypto desk applied frontier modeling across Bitcoin, Ethereum, and stablecoin-yield products, achieving higher Sharpe ratios than traditional crypto allocations.

Best Practices for Institutional Efficient Frontier Use

- Combine Quantitative and Qualitative Inputs – Use macroeconomic insights alongside statistical models.

- Stress Test Models – Simulate crisis scenarios to evaluate portfolio resilience.

- Use Rolling Windows – Update frontier calculations regularly to adapt to regime changes.

- Incorporate Real-World Constraints – Factor in transaction costs, liquidity, and leverage limits.

- Leverage Advanced Software – Tools like MATLAB, R, and Python streamline frontier optimization.

FAQ: Efficient Frontier Insights for Institutional Traders

1. How often should institutions rebalance portfolios using the efficient frontier?

Most institutions rebalance quarterly or semi-annually, but high-frequency desks may update frontier calculations daily. The key is aligning rebalance frequency with investment horizon and transaction cost constraints.

2. Is the efficient frontier applicable in volatile markets like crypto?

Yes, but with modifications. Traditional MVO assumes normal return distributions, which crypto markets rarely follow. Adjustments for skewness, fat tails, and regime shifts are essential.

3. What software tools are best for institutional efficient frontier modeling?

Commonly used platforms include MATLAB, R (with the PortfolioAnalytics package), and Python libraries (PyPortfolioOpt). For large-scale funds, proprietary systems with integrated market data are preferred.

Conclusion

The efficient frontier remains a cornerstone of institutional portfolio management, guiding capital allocation, diversification, and risk-return optimization. For institutional traders, combining mean-variance optimization with advanced models like Black-Litterman, integrating real-world constraints, and leveraging AI-driven insights ensures portfolios remain robust in dynamic markets.

As institutions expand into perpetual futures, digital assets, and ESG-focused strategies, efficient frontier modeling will evolve—but its principles will remain essential for competitive advantage.

👉 Share this guide with peers, comment with your institution’s approach to efficient frontier modeling, and join the conversation on advancing institutional portfolio strategies.

Would you like me to expand this article into a step-by-step efficient frontier tutorial with Python code examples for institutional backtesting?