===============================================================================

Introduction

The efficient frontier resource library has become an essential tool for traders, investors, and portfolio managers who want to maximize returns while minimizing risk. The efficient frontier, a concept derived from modern portfolio theory (MPT), illustrates the set of optimal portfolios that offer the highest expected return for a given level of risk. For both traditional and crypto markets, access to a well-structured efficient frontier resource library helps professionals explore strategies, backtest models, and apply optimization tools effectively.

In this article, we will provide a comprehensive overview of how to use efficient frontier resources, compare different strategies, and highlight the best approaches for modern traders. By the end, you will not only understand the fundamentals but also gain actionable insights on applying these tools in practice.

What Is the Efficient Frontier?

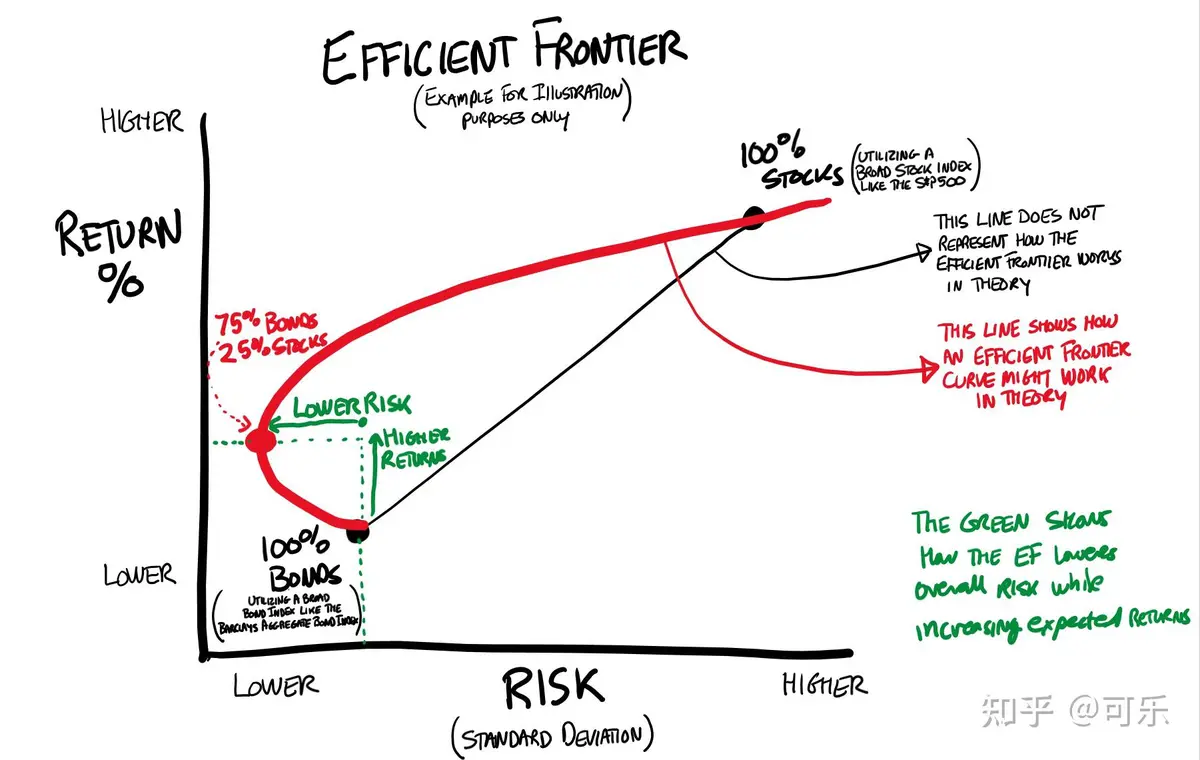

The efficient frontier is a graphical representation of investment portfolios that achieve the best possible balance between risk and return. It is built upon key assumptions of modern portfolio theory:

- Investors are rational and risk-averse.

- Returns follow a probability distribution.

- Diversification reduces unsystematic risk.

On a risk-return chart, the efficient frontier is typically an upward-sloping curve. Portfolios below this curve are inefficient, while those on the curve provide optimal allocations.

Why Build an Efficient Frontier Resource Library?

An efficient frontier resource library is not just a collection of academic papers or formulas—it is a practical toolkit for investors. It may include:

- Educational guides on calculating efficient frontiers.

- Optimization software and calculators.

- Data sets for portfolio backtesting.

- Case studies from hedge funds and institutional investors.

- Tutorials and workshops for hands-on training.

Such a library enables professionals to apply theory to real-world trading and investing.

Key Components of an Efficient Frontier Resource Library

1. Theoretical Foundations

A good resource library must cover the core principles of modern portfolio theory, utility functions, covariance, correlation, and risk-return dynamics.

2. Tools and Calculators

Interactive calculators and modeling software allow traders to simulate efficient frontiers quickly. These tools are especially useful in crypto markets, where volatility is high and data is dynamic.

3. Case Studies and Examples

Real-world applications highlight how hedge funds, institutional traders, or retail investors have used the efficient frontier to optimize their portfolios.

4. Step-by-Step Tutorials

Practical walkthroughs, such as step-by-step efficient frontier tutorial, help investors replicate models and gain confidence in their decision-making.

Methods for Applying Efficient Frontier Strategies

Method 1: Traditional Portfolio Optimization

This method focuses on balancing stocks, bonds, and commodities. Using historical data, traders compute covariance matrices and simulate efficient frontiers.

Pros:

- Widely studied and supported by extensive research.

- Reliable for long-term investment horizons.

Cons:

- Assumes normally distributed returns, which may not hold true.

- Less effective in highly volatile markets like crypto.

Method 2: Crypto and Perpetual Futures Optimization

With the rise of digital assets, traders now explore how to apply the efficient frontier to crypto portfolios and perpetual futures contracts. Tools like where to apply efficient frontier in perpetual trading guide traders toward effective allocation.

Pros:

- Accounts for new asset classes with high growth potential.

- Useful for hedging risk in perpetual futures markets.

Cons:

- Requires frequent rebalancing due to high volatility.

- Data sets may be less reliable compared to equities.

Recommendation

For long-term investors, the traditional portfolio optimization method still offers strong reliability. However, for modern traders—especially those in crypto—the efficient frontier in perpetual futures provides superior adaptability. Ideally, investors should build hybrid models that combine traditional assets with crypto exposures.

How to Build Your Own Efficient Frontier Resource Library

- Collect Academic and Industry Research – Use whitepapers, journal articles, and hedge fund reports.

- Adopt Software Tools – Leverage efficient frontier modeling software and online calculators.

- Backtest Regularly – Test your strategies across different market conditions.

- Educate Continuously – Attend workshops and subscribe to efficient frontier training programs.

Practical Example: Applying the Efficient Frontier in Perpetual Futures

Imagine a trader managing a portfolio of Bitcoin, Ethereum, and perpetual futures contracts. By plotting risk-return combinations, they can identify an optimal allocation where BTC provides stability, ETH adds growth, and futures offer leverage.

This aligns directly with the concept of how to find efficient frontier in perpetual futures, where data-driven optimization maximizes efficiency even in fast-moving markets.

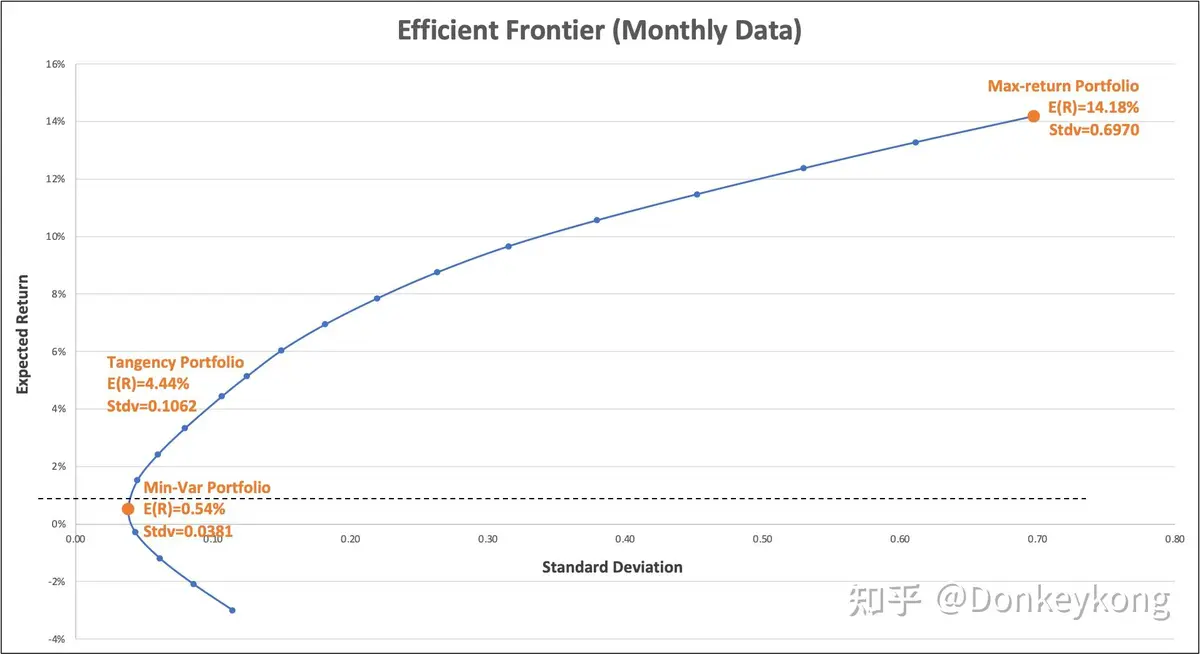

Visualizing the Efficient Frontier

Below is a simple representation of an efficient frontier curve:

Efficient frontier curve showing optimal portfolio allocation choices.

Latest Industry Trends in Efficient Frontier Research

- AI and Machine Learning Integration – Algorithms now help estimate covariance and correlations dynamically.

- Crypto Market Expansion – Efficient frontier applications in digital assets are rapidly growing.

- Risk Parity Models – Alternative frameworks complement traditional efficient frontier strategies.

FAQ Section

1. What is the main purpose of an efficient frontier resource library?

The main purpose is to provide a structured collection of theoretical knowledge, calculators, tutorials, and case studies that help traders and investors optimize risk-return trade-offs.

2. Can I apply efficient frontier analysis to crypto portfolios?

Yes. In fact, applying efficient frontier analysis to crypto portfolios has become increasingly popular. The high volatility of digital assets makes optimization tools essential for managing downside risk.

3. How often should I rebalance my portfolio when using efficient frontier strategies?

It depends on your trading style. Long-term investors may rebalance quarterly or annually, while perpetual futures traders may need daily or weekly adjustments due to fast-changing market dynamics.

Conclusion

The efficient frontier resource library is a powerful toolkit for investors seeking to balance risk and return effectively. By leveraging theoretical foundations, practical tools, and industry case studies, traders can make more informed decisions.

Whether you are a traditional investor, a retail trader, or a crypto enthusiast, building and applying efficient frontier knowledge is essential to remain competitive.

If you found this guide valuable, consider sharing it with fellow traders, leaving a comment, or discussing your favorite strategies. Your insights could help others optimize their portfolios and make better investment decisions.

Would you like me to also create a visual infographic summarizing the efficient frontier resource library for easier social media sharing?