===================================================================================

Introduction

In today’s globalized economy, exchange rate risk is a critical consideration for businesses, investors, and traders engaged in international transactions. This risk, which arises due to fluctuations in the value of one currency relative to another, can have significant financial implications. Forecasting exchange rate risk effectively is essential for making informed decisions, hedging against potential losses, and optimizing international investments.

In this article, we will explore exchange rate risk forecasting models, discussing the various techniques used to predict and manage currency fluctuations. We will compare different approaches, highlight their strengths and weaknesses, and provide actionable insights to help stakeholders make the best use of these models in their operations. Additionally, we will discuss the importance of hedging and strategies for managing exchange rate risks.

Understanding Exchange Rate Risk

What is Exchange Rate Risk?

Exchange rate risk, also known as currency risk, refers to the potential financial losses resulting from unfavorable changes in exchange rates. This risk can affect various entities, including multinational companies, investors, and traders, especially those engaged in cross-border transactions. For example, a company that exports goods to a foreign market may lose revenue if the foreign currency depreciates relative to its domestic currency.

There are three primary types of exchange rate risk:

- Transaction Risk: Occurs when there is a mismatch between the timing of foreign currency transactions and exchange rate changes.

- Translation Risk: Arises when a company’s financial statements, denominated in foreign currencies, are converted into the home currency.

- Economic Risk: The long-term risk that changes in exchange rates will affect a company’s market value, competitive position, or future cash flows.

Why Exchange Rate Risk Matters

Exchange rate fluctuations can impact financial performance in a variety of ways:

- Profit margins: Fluctuations in exchange rates can directly affect the profit margins of exporters and importers.

- Investment value: Currency risk can erode or enhance the value of investments in foreign assets or securities.

- Hedging costs: Companies may need to spend additional resources on hedging to mitigate exchange rate risk, impacting profitability.

Effective forecasting models help manage this risk by providing insights into potential future movements in exchange rates, allowing businesses and investors to make data-driven decisions.

Exchange Rate Risk Forecasting Models

1. Econometric Models

How They Work

Econometric models use statistical techniques to analyze historical data and identify patterns or relationships between exchange rates and various economic variables. These models rely on regression analysis, time-series analysis, and other statistical tools to forecast future exchange rates based on past trends and economic indicators.

Advantages

- Data-driven approach: Econometric models are based on actual data, making them reliable for predicting future trends.

- Flexibility: These models can incorporate a wide range of variables, such as interest rates, inflation, and economic growth.

- Widely used: Econometric models have been extensively tested and refined over time, making them a trusted forecasting tool.

Disadvantages

- Assumption-based: Many econometric models rely on assumptions about the relationship between economic variables, which may not always hold true.

- Sensitivity to data quality: The accuracy of predictions depends on the quality and accuracy of historical data.

- Complexity: Building and interpreting these models can require a high level of expertise.

Best Use Case

Econometric models are best suited for businesses and investors who need to forecast exchange rates based on macroeconomic data over a medium to long-term horizon.

2. Machine Learning Models

How They Work

Machine learning (ML) models use algorithms to identify patterns in large datasets and make predictions. These models can analyze vast amounts of data and learn from past market behavior to forecast exchange rate movements. Techniques such as neural networks, support vector machines, and random forests are often applied in exchange rate forecasting.

Advantages

- Adaptability: ML models can continuously learn from new data, improving their predictions over time.

- Handle complex data: Machine learning can process large, unstructured datasets (e.g., news sentiment, social media posts) alongside traditional economic data.

- Accuracy: When properly trained, ML models can deliver highly accurate forecasts.

Disadvantages

- Data dependency: Machine learning models require large amounts of data for training, which may not always be available or reliable.

- Overfitting: If not properly tuned, ML models may overfit the data, leading to poor generalization and inaccurate predictions.

- Black-box nature: Many machine learning models, particularly neural networks, operate as “black boxes,” making it difficult to understand the underlying decision-making process.

Best Use Case

Machine learning models are particularly useful for those who need to make short-term or real-time exchange rate predictions based on complex datasets, such as high-frequency trading or investors using real-time news and social media data to inform their decisions.

3. Monte Carlo Simulation

How It Works

Monte Carlo simulations use random sampling techniques to simulate a wide range of possible outcomes based on historical data and probabilistic models. By running thousands of simulations, this method helps forecast the likelihood of different exchange rate scenarios and their potential impact on risk exposure.

Advantages

- Comprehensive risk assessment: Monte Carlo simulations can account for a wide range of scenarios, including extreme market conditions.

- Flexibility: These models can be adapted to any type of risk analysis, including transaction, translation, and economic risks.

- Clear visualization: Results are presented as probability distributions, making it easier to understand the range of potential outcomes.

Disadvantages

- Computationally intensive: Monte Carlo simulations require significant computational power, especially when analyzing large datasets or running many simulations.

- Reliance on assumptions: The accuracy of simulations depends on the underlying assumptions about market conditions and volatility.

Best Use Case

Monte Carlo simulations are ideal for multinational corporations or investors who need to assess the impact of exchange rate fluctuations on their portfolios or financial operations under different market conditions.

Hedging Exchange Rate Risk

1. Forward Contracts

A forward contract allows businesses to lock in an exchange rate for a future date, helping to mitigate the risk of unfavorable currency movements. Forward contracts are customized agreements between two parties and are often used by exporters and importers.

Advantages

- Fixed exchange rate: Provides certainty about future costs and revenues.

- No upfront costs: No initial payment is required, unlike options contracts.

Disadvantages

- Lack of flexibility: If exchange rates move in favor of the business, the forward contract may result in missed opportunities.

- Credit risk: There is a risk that the counterparty may default.

2. Currency Options

Currency options give the holder the right (but not the obligation) to exchange currencies at a specified rate at or before a certain date. This is ideal for businesses seeking flexibility in their hedging strategy.

Advantages

- Flexibility: Currency options allow businesses to benefit from favorable movements in exchange rates.

- Limited downside risk: The maximum loss is limited to the premium paid for the option.

Disadvantages

- Upfront cost: Currency options require a premium to be paid, making them more expensive than forwards.

- Complexity: Managing options strategies requires more expertise.

Frequently Asked Questions (FAQ)

1. What factors should be considered when choosing an exchange rate forecasting model?

When selecting an exchange rate forecasting model, factors such as the time horizon (short-term vs. long-term forecasts), the type of data available (macroeconomic vs. real-time data), and the level of accuracy required should be considered. Additionally, the complexity of the model and the cost of implementation are important considerations.

2. Can machine learning models be used for all types of exchange rate forecasting?

Machine learning models are most effective for forecasting short-term exchange rate movements, particularly when large datasets (such as news articles, social media sentiment, and market data) are involved. However, they may not always perform as well for long-term forecasts, where traditional econometric models might be more appropriate.

3. How can businesses mitigate exchange rate risk in volatile markets?

Businesses can mitigate exchange rate risk by using hedging strategies such as forward contracts or currency options, and by diversifying their operations across multiple markets. Forecasting models also play a critical role in helping businesses anticipate currency movements and adjust their strategies accordingly.

Conclusion

Effectively forecasting exchange rate risk is essential for businesses, traders, and investors who operate in international markets. By leveraging a combination of econometric models, machine learning techniques, and Monte Carlo simulations, stakeholders can gain valuable insights into future currency movements and make informed decisions. Additionally, robust hedging strategies can further reduce the exposure to exchange rate volatility.

Understanding how to forecast exchange rate risk and manage its impact is vital for maintaining financial stability and seizing global opportunities. Share your thoughts or ask questions in the comments below to join the conversation and deepen your understanding of this essential aspect of international finance.

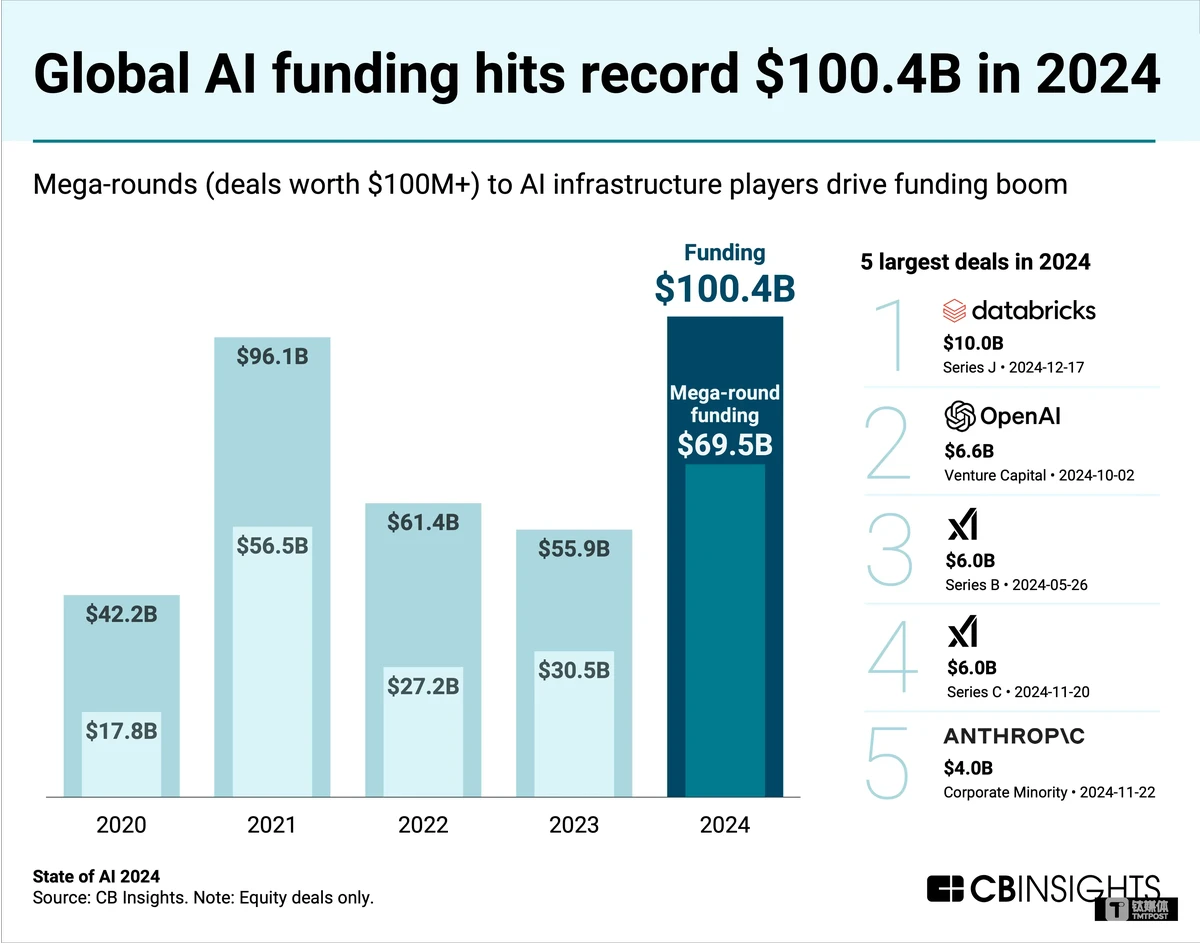

Visualizing the impact of exchange rate risk on global markets