=====================================================================================

Introduction

Globalization has created unprecedented opportunities for businesses, traders, and investors, but it has also magnified exposure to exchange rate risk. Whether you are an exporter dealing with foreign invoices, a multinational managing overseas subsidiaries, or a portfolio manager allocating assets across currencies, fluctuations in exchange rates can significantly affect financial performance.

This article provides a comprehensive analysis of exchange rate risk simulation examples, explaining how simulation models can be applied to measure, forecast, and mitigate risks. Drawing on both professional experience and the latest financial research, we will explore multiple simulation strategies, compare their advantages and disadvantages, and provide actionable recommendations.

By the end, you’ll have a clear framework for understanding and applying exchange rate risk simulations to your own financial or business context.

Understanding Exchange Rate Risk

What Is Exchange Rate Risk?

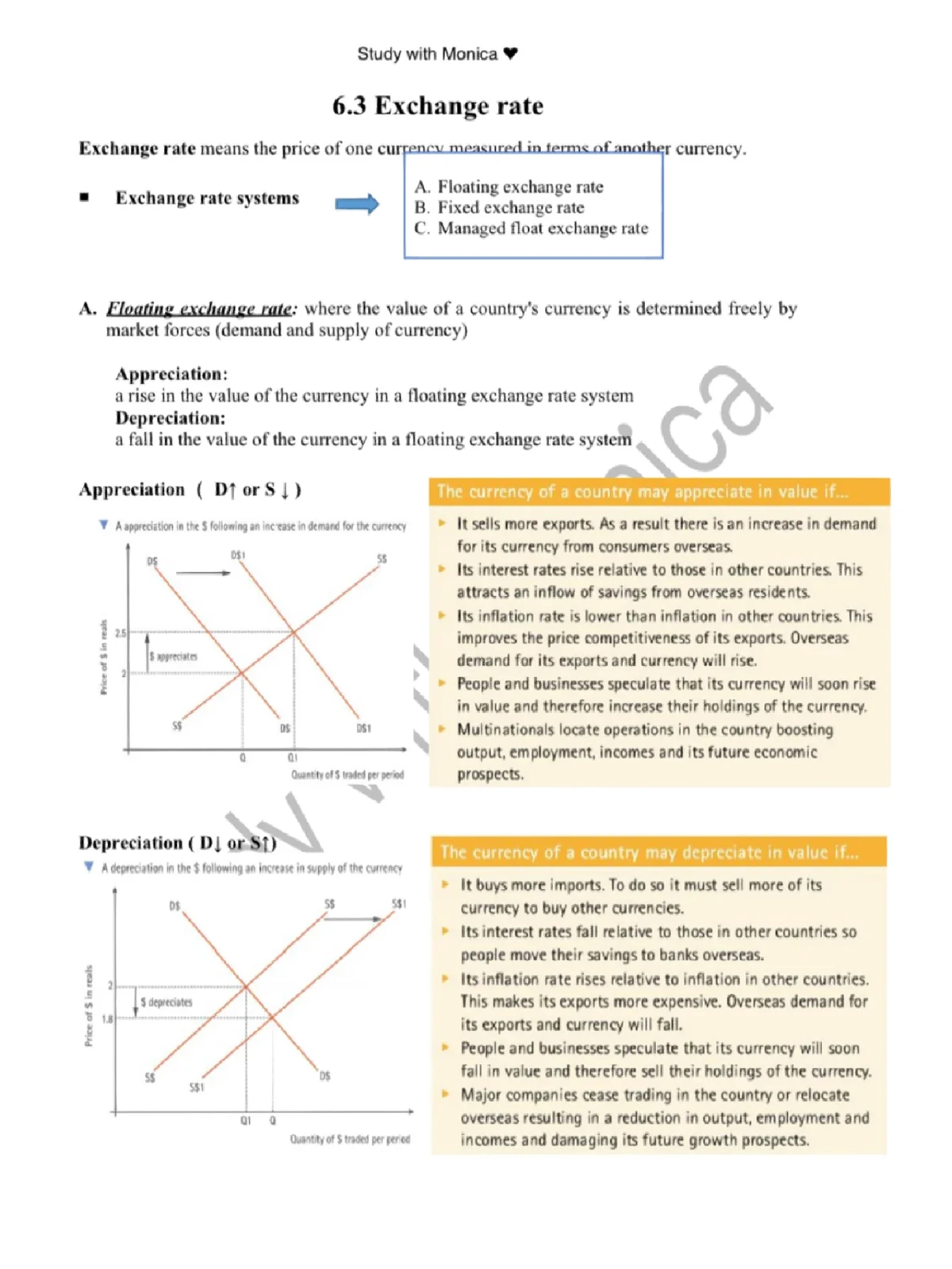

Exchange rate risk, also called currency risk, arises when financial outcomes depend on the fluctuation of foreign exchange rates. For example, if a U.S. exporter invoices in euros but receives payment months later, a weakening of the euro against the dollar reduces revenue in dollar terms.

Why Exchange Rate Risk Matters

The importance of currency risk cannot be overstated. Exchange rate volatility can:

- Erase profit margins for exporters and importers.

- Increase costs for multinational corporations.

- Reduce the attractiveness of international investments.

This is why understanding how to hedge exchange rate risk and running simulations before making cross-border financial decisions is critical.

Simulation as a Risk Management Tool

Why Use Simulations?

Traditional risk assessment models often rely on historical averages, but markets rarely behave in linear patterns. Simulation provides a dynamic way to:

- Test different currency scenarios (best case, worst case, and most likely).

- Identify potential losses or gains under various exchange rate conditions.

- Support decision-making with probabilistic rather than deterministic forecasts.

Key Benefits of Simulation

- Flexibility: Models can adapt to different currencies and time horizons.

- Transparency: Managers see the full distribution of potential outcomes.

- Precision: More reliable than relying solely on static forecasts.

Exchange Rate Risk Simulation Examples

Example 1: Monte Carlo Simulation

How It Works

Monte Carlo simulation involves running thousands (or millions) of scenarios using random exchange rate movements based on historical volatility and probability distributions.

For example, a U.K.-based importer of goods priced in U.S. dollars might simulate GBP/USD exchange rate fluctuations over six months. By doing so, the company can estimate the probability of costs exceeding a certain threshold.

Advantages

- Provides a probability distribution of outcomes.

- Helps quantify Value at Risk (VaR) in a currency portfolio.

- Useful for stress testing extreme scenarios.

Disadvantages

- Requires advanced statistical software and expertise.

- Results can vary depending on assumptions.

Example 2: Scenario Analysis

How It Works

Scenario analysis uses predefined exchange rate shifts (e.g., +5%, -10%) to estimate their impact on revenues, costs, or investment values.

For instance, a multinational firm with earnings in Japanese yen might model three cases:

- Yen appreciates 5% against the dollar.

- Yen depreciates 10% against the dollar.

- Yen remains stable.

The results show how currency swings affect consolidated financial statements.

Advantages

- Simple and intuitive.

- Easy to communicate to stakeholders.

- Useful for budgeting and strategic planning.

Disadvantages

- Limited to the chosen scenarios.

- May overlook unexpected market events.

Example 3: Historical Simulation

How It Works

This approach applies actual historical currency changes to today’s portfolio or exposures. For example, a European bond fund with U.S. dollar assets could test how its portfolio would have performed if past exchange rate shocks (like the 2008 financial crisis) repeated.

Advantages

- Based on real-world data.

- Easy to implement with historical exchange rate datasets.

Disadvantages

- Past performance doesn’t guarantee future patterns.

- May miss unprecedented shocks.

Example 4: Stress Testing

How It Works

Stress testing models extreme and unlikely exchange rate events, such as a sudden 25% currency devaluation. An emerging market exporter may use stress tests to prepare for rare but catastrophic events like sovereign debt crises.

Advantages

- Excellent for identifying tail risks.

- Essential for risk committees and regulatory compliance.

Disadvantages

- Focuses on extreme cases, not everyday risks.

- May exaggerate risks if not contextualized.

Visual Representation of Simulations

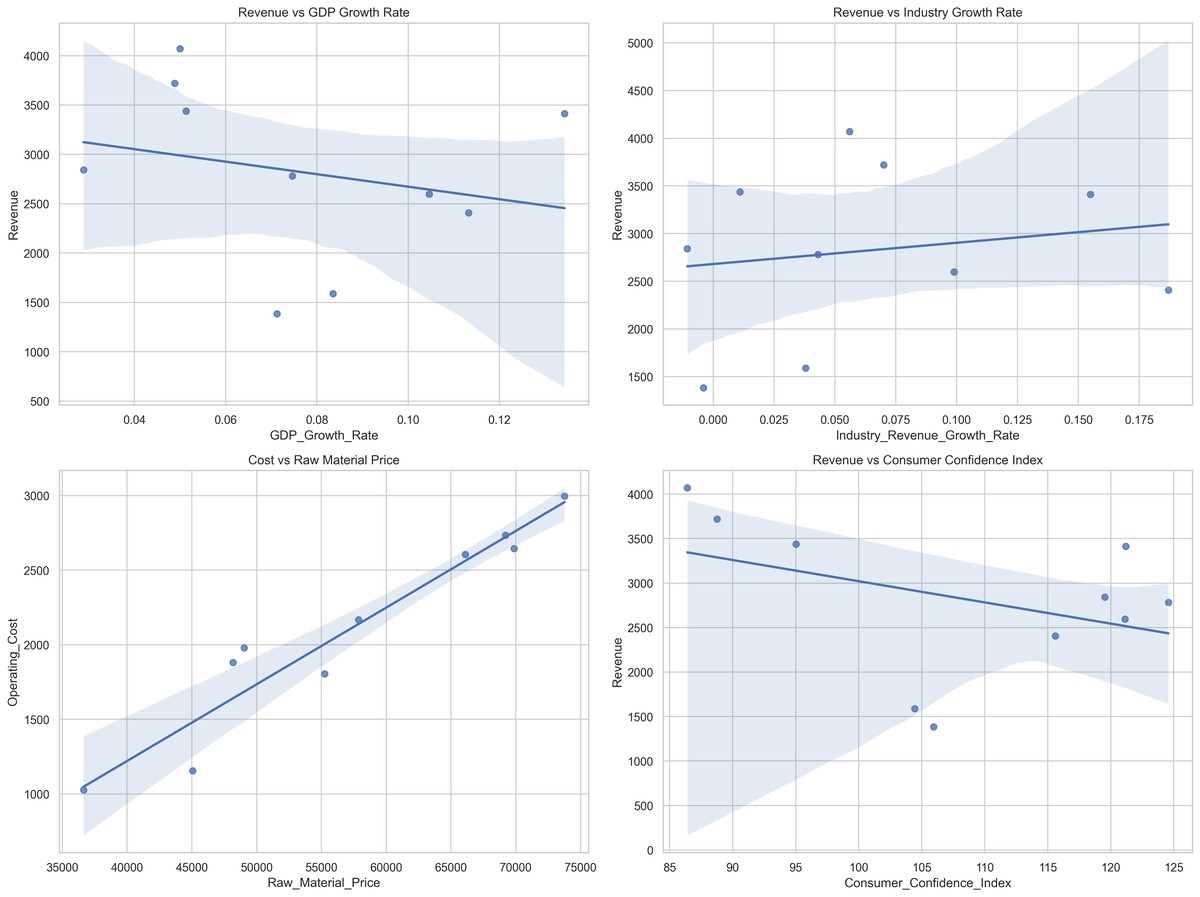

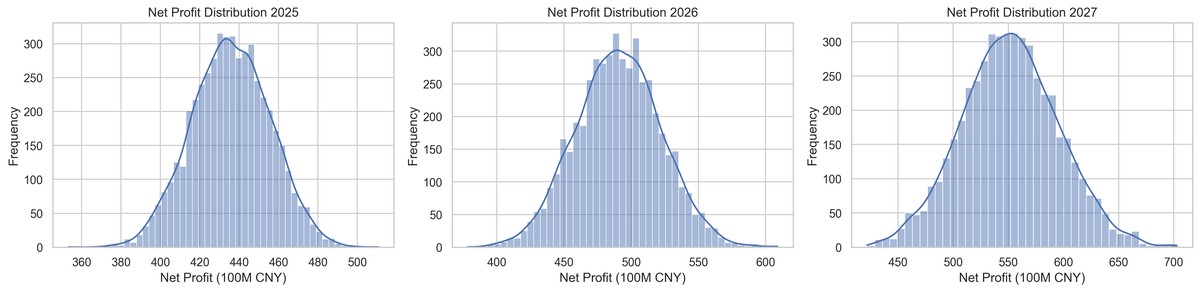

Monte Carlo simulations provide probability distributions of potential currency outcomes, helping businesses understand exposure across scenarios.

Comparing Simulation Strategies

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Monte Carlo | Quantitative finance, large portfolios | Realistic, probability-driven | Complex, assumption-sensitive |

| Scenario Analysis | Business planning, budgeting | Simple, easy to explain | Limited scenarios |

| Historical Simulation | Benchmarking past events | Real data, intuitive | Doesn’t account for new shocks |

| Stress Testing | Crisis management | Identifies extreme vulnerabilities | May overemphasize unlikely cases |

Applying Simulations in Practice

Businesses

Exporters and importers can use simulation tools to forecast profits under different exchange rates, informing whether to invoice in home or foreign currencies.

Investors

Portfolio managers allocate assets globally and use simulations to calculate expected returns and how to mitigate exchange rate risk across currency exposures.

Multinationals

Corporations with global subsidiaries apply simulations to consolidate risk management strategies and decide when to implement hedging instruments like forwards or options.

Personal Insights and Market Trends

In my experience working with mid-sized exporters, scenario analysis is often the preferred starting point because it is simple and aligns well with budget planning. However, as businesses grow and gain access to advanced analytics, they increasingly adopt Monte Carlo simulations for a more precise understanding.

Market trends show that simulation is becoming a core tool in exchange rate risk management strategies, especially with the rise of AI and machine learning. Algorithms now allow simulations to incorporate real-time data feeds, making results more accurate and actionable than ever before.

Additional Learning Pathways

Those interested in deeper applications can explore where to find exchange rate risk management strategies through financial textbooks, online finance courses, and research reports from central banks and the IMF.

Practical workshops often combine case studies with simulation software tutorials, bridging the gap between theory and execution.

FAQs

1. What is the best simulation model for small businesses?

Scenario analysis is usually the most practical for small businesses due to its simplicity and low cost. More advanced methods like Monte Carlo can be adopted later as risk exposure grows.

2. How reliable are exchange rate risk simulations?

Simulations provide probability-based insights, not guarantees. Their reliability depends on data quality, assumptions, and whether the model accounts for volatility clustering and fat tails in FX markets.

3. Can simulations replace hedging strategies?

No. Simulations help assess and quantify risk, but actual hedging tools (forwards, swaps, options) are necessary to manage exposure. Simulations and hedging should work hand-in-hand.

4. Do simulations consider transaction costs?

Advanced simulations often include transaction fees and bid-ask spreads. This provides a more realistic picture of risk and return.

Conclusion

Exchange rate risk is an unavoidable reality in international business and investment. By applying exchange rate risk simulation examples such as Monte Carlo, scenario analysis, historical simulation, and stress testing, managers and investors can better anticipate and mitigate financial shocks.

While each method has strengths and limitations, the optimal strategy often involves combining multiple simulation models with real-world hedging instruments.

If you found this guide useful, share it with colleagues, leave a comment on your experience with currency risk, and join the discussion. Together, we can build smarter, more resilient approaches to managing exchange rate volatility.