=========================================

In today’s interconnected global economy, students are more likely than ever to face exchange rate risk—whether they are studying abroad, investing in foreign assets, paying international tuition fees, or traveling. Understanding exchange rate risk awareness for students is no longer just a financial topic for professionals; it has become a crucial life skill for young people who aim to navigate academic, financial, and career opportunities across borders.

This article explores why exchange rate risk matters for students, compares different strategies to manage it, and provides actionable solutions based on personal experience and the latest global financial trends.

What Is Exchange Rate Risk?

Exchange rate risk, also known as currency risk, refers to the potential financial loss caused by fluctuations in foreign exchange rates. For students, these fluctuations can directly impact:

- Tuition fees (if paying in a foreign currency).

- Living expenses abroad (food, rent, transportation).

- Scholarship or grant values (if received in another currency).

- Study abroad program costs (including travel and housing).

- Savings or investments in foreign markets.

Without proper awareness, students may find themselves under unexpected financial pressure when exchange rates move unfavorably.

Why Exchange Rate Risk Awareness Matters for Students

- Budgeting Accuracy: Exchange rate changes can disrupt monthly budgets. A 5–10% fluctuation could mean hundreds of dollars in additional costs per semester.

- Financial Planning for Study Abroad: Students planning long-term stays must anticipate variations in living costs.

- Investment Opportunities: Many students today invest in cryptocurrencies, ETFs, or stocks abroad, where exchange rate risk directly affects returns.

- Future Career Planning: Students in fields like finance, international business, or economics must develop practical skills in understanding exchange rate risk.

For deeper insights, you can explore why does exchange rate risk matter, especially for young professionals and students entering globalized industries.

Common Scenarios Where Students Face Exchange Rate Risk

1. Paying Tuition Fees Abroad

If a U.S. student pays tuition in euros, and the euro appreciates, the cost in dollars increases unexpectedly.

2. Living Expenses in a Foreign Country

Daily costs can rise when the local currency strengthens against the student’s home currency.

3. Scholarships or Grants in Foreign Currency

Scholarship funds might lose value when converted, reducing the financial support available.

4. Travel and Exchange Programs

Students engaging in internships, exchange programs, or research abroad often budget in advance—yet sudden currency fluctuations may cause cost overruns.

Two Key Strategies for Students to Manage Exchange Rate Risk

Strategy 1: Forward Planning with Fixed Exchange Tools

Students can use currency forward contracts or prepaid tuition exchange programs to lock in exchange rates for future payments.

Advantages:

- Predictable costs help with accurate budgeting.

- Eliminates uncertainty in tuition payments and rent.

Disadvantages:

- Limited flexibility if exchange rates move in a favorable direction.

- Requires access to financial services that may not always be student-friendly.

Strategy 2: Diversification of Currency Holdings

Students can hold part of their funds in the foreign currency they will use. For example, an American student preparing to study in the UK can gradually exchange U.S. dollars into British pounds.

Advantages:

- Spreads risk by avoiding conversion at a single point in time.

- Allows students to take advantage of favorable fluctuations.

Disadvantages:

- Requires careful planning and monitoring.

- May incur additional fees for multiple transactions.

Recommended Approach for Students

The most effective approach is a hybrid strategy: lock in large predictable costs (like tuition) using forward planning, while diversifying everyday expenses gradually. This balances security with flexibility, ensuring students don’t overspend due to unfavorable currency swings.

Practical Methods for Exchange Rate Risk Awareness

Monitoring Tools and Apps

Students can track real-time exchange rates using platforms like XE, Wise, or Revolut. Many apps offer alerts for rate changes.

Financial Education

Learning how to hedge exchange rate risk is not just for professionals—students can use simple hedging strategies like pre-purchasing foreign currency or using multi-currency bank accounts.

Case Example: Student in Europe

A U.S. student studying in Germany fixed tuition payments using a forward contract but diversified living costs by gradually converting dollars to euros. The hybrid method saved nearly $1,200 over a year compared to peers who converted funds at the last minute.

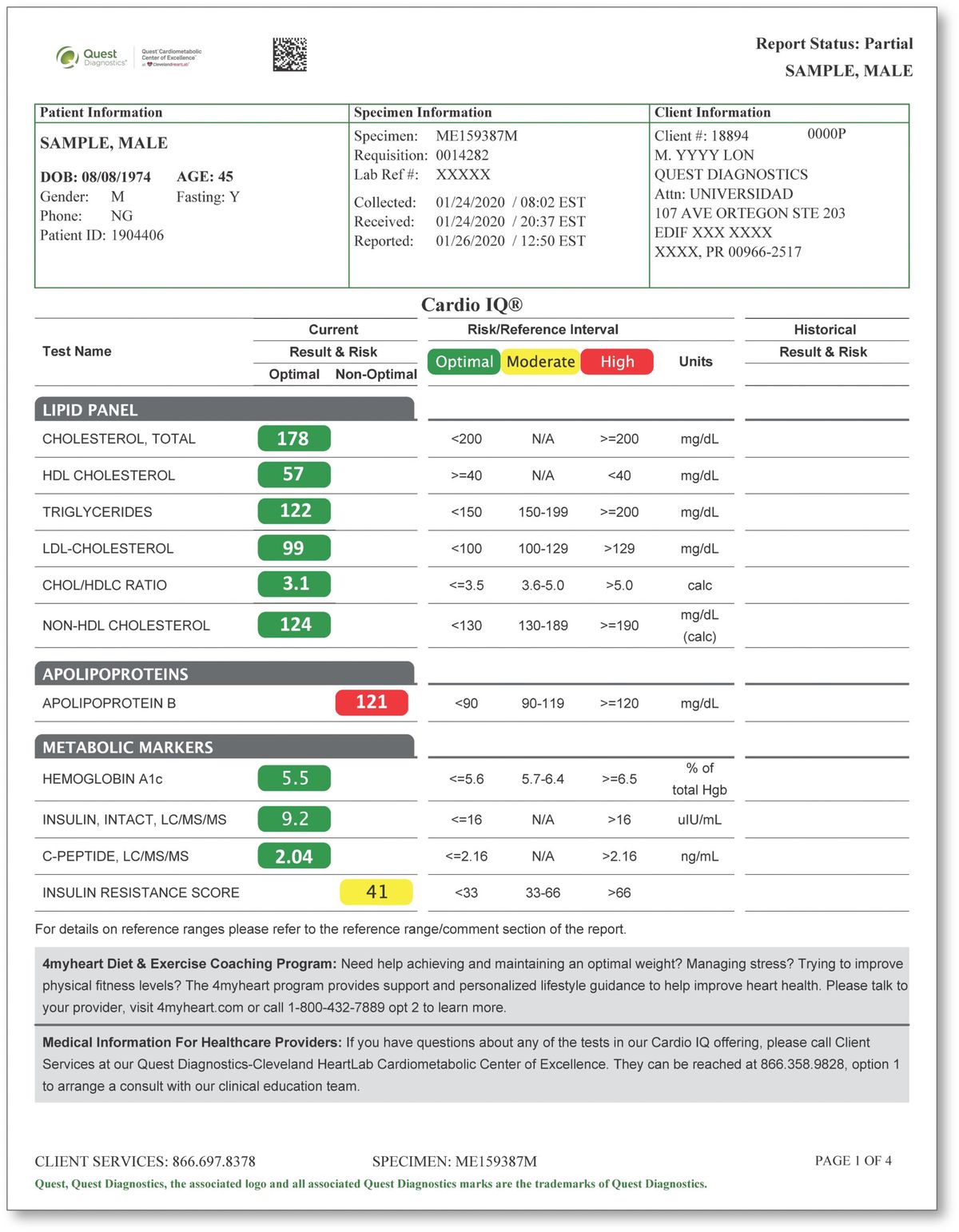

Visual Guide: How Exchange Rate Risk Affects Students

Illustration showing how currency fluctuations affect tuition fees, daily costs, and savings for students.

Exchange Rate Risk Awareness in the Context of Global Trends

- Digital Banking Growth: Students now use multi-currency wallets like Wise or Revolut, making it easier to hold multiple currencies.

- Cryptocurrency Exposure: Some students diversify by holding crypto assets, but these come with higher volatility compared to fiat currencies.

- Inflationary Pressures: Global inflation adds another layer of uncertainty to currency values, making awareness more critical.

Risk Management Best Practices for Students

- Budget with a Cushion: Always allow 10–15% extra funds to cover currency fluctuations.

- Use Student-Friendly Financial Products: Multi-currency bank accounts, prepaid tuition services, and educational remittance platforms.

- Stay Informed: Follow exchange rate updates through news sources or apps.

- Seek Advice: Many universities offer financial counseling services for international students.

FAQ: Exchange Rate Risk Awareness for Students

1. How can students calculate exchange rate risk before studying abroad?

Students can estimate exchange rate risk by comparing current rates with historical averages. Simple tools like online calculators or even Excel models can simulate potential fluctuations. Learning how to calculate exchange rate risk allows students to prepare realistic financial plans.

2. What is the best way to protect tuition fees from exchange rate risk?

The safest method is to use forward contracts or university payment plans that allow fixing rates in advance. This ensures tuition fees remain predictable, regardless of currency volatility.

3. Can students benefit from exchange rate fluctuations?

Yes. If a home currency strengthens, students pay less in tuition or living costs. However, this benefit is uncertain, and relying on favorable movements is risky. A balanced approach—locking in major expenses while leaving room for flexibility—works best.

Conclusion: Building Exchange Rate Risk Awareness Early

For students, exchange rate risk awareness is not just about avoiding losses—it is about building financial resilience, budgeting skills, and global literacy. By combining forward planning with diversification, students can confidently manage study abroad costs and international investments.

The earlier students build awareness of exchange rate risks, the better equipped they will be for academic, financial, and career success in a globalized world.

If you found this article helpful, share it with classmates, study abroad groups, or financial planning communities. Your experience with exchange rate risk might inspire others to make smarter financial choices.

Would you like me to create a student-focused exchange rate risk budgeting template (Excel/Google Sheets) that readers can directly use to plan tuition and living costs abroad?