==========================================================

Introduction

Risk management is the backbone of professional trading, and for perpetual futures, the stakes are even higher. Unlike standard futures, perpetual futures never expire, meaning traders are exposed to continuous funding rates, leverage risks, and high volatility. In such an environment, expected shortfall (ES)—also known as Conditional Value-at-Risk (CVaR)—has emerged as a superior measure compared to traditional Value-at-Risk (VaR).

This article explores expected shortfall calculation tools for perpetual futures, discusses methodologies for implementation, compares tools and techniques, and highlights how both retail and institutional traders can integrate ES into their risk management frameworks. The goal is to give traders practical knowledge backed by both quantitative finance theory and real-world experience.

What Is Expected Shortfall?

Expected shortfall is a tail risk metric that measures the average loss in the worst-case scenarios beyond a specified confidence level (e.g., the worst 5% or 1% of outcomes).

For perpetual futures, ES is crucial because:

- Leverage amplifies downside risk – A small market move can wipe out leveraged positions.

- 24⁄7 trading – Unlike traditional futures markets, crypto perpetuals trade non-stop, making extreme moves more common.

- Tail events – Flash crashes or liquidation cascades are frequent in digital asset markets.

While VaR might tell you that your maximum daily loss with 99% confidence is 5%, ES goes further by estimating the average loss if that threshold is breached—say, 8% instead of just 5%.

Why Use Expected Shortfall Tools for Perpetual Futures?

Risk Transparency

- Traders gain a deeper view into downside risks compared to VaR.

- Traders gain a deeper view into downside risks compared to VaR.

Regulatory Alignment

- Basel III and other financial standards recommend ES over VaR for capital adequacy.

- Basel III and other financial standards recommend ES over VaR for capital adequacy.

Practical Strategy Evaluation

- ES helps compare trading strategies by focusing on risk-adjusted performance, not just returns.

- ES helps compare trading strategies by focusing on risk-adjusted performance, not just returns.

Market Volatility Adaptation

- Particularly important in crypto, where high volatility and fat tails make ES more reliable.

- Particularly important in crypto, where high volatility and fat tails make ES more reliable.

This connects with why calculate expected shortfall for perpetual futures, since accurate tail risk measurement ensures sustainable portfolio resilience.

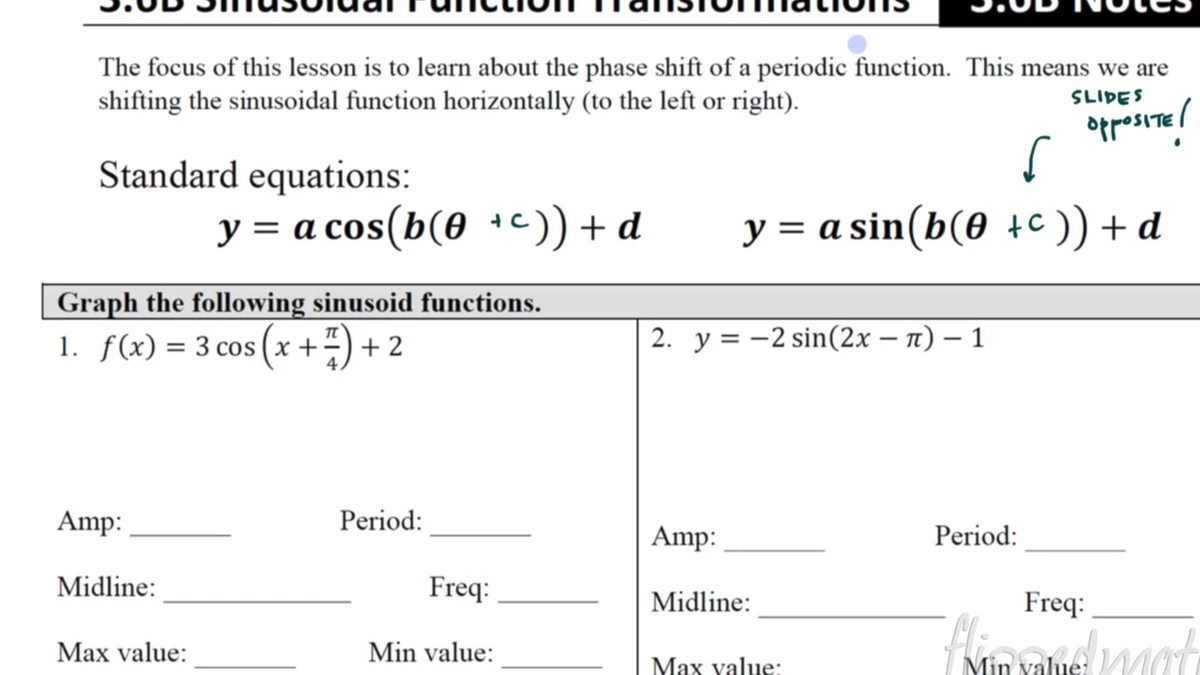

Expected shortfall captures the average loss in extreme downside scenarios beyond Value-at-Risk thresholds

Key Expected Shortfall Calculation Tools

1. Python-Based Libraries

a. Riskfolio-Lib

- Designed for portfolio optimization and risk metrics.

- Can compute ES alongside VaR and Sharpe ratios.

- Works well for perpetual futures portfolios, especially with multi-asset crypto allocations.

b. PyPortfolioOpt

- Primarily a portfolio optimization tool but includes downside risk metrics.

- Useful for algorithmic traders who want to optimize futures strategies based on ES.

c. SciPy + NumPy + Pandas (Custom Calculations)

- Flexible approach to implement ES via historical or parametric methods.

- Allows full customization for perpetual futures contracts.

Pros: Open-source, flexible, transparent.

Cons: Requires programming skills and computational resources.

2. Trading Platform Risk Engines

Some exchanges and brokers have built-in expected shortfall calculators:

- Institutional Platforms: Often integrate ES into portfolio margining systems.

- Retail Exchanges: Rare, but a few advanced platforms (like Deribit and FTX, pre-2022) experimented with ES-based liquidation risk models.

Pros: Convenient, real-time.

Cons: Limited transparency, platform-dependent.

3. Commercial Risk Management Software

Examples:

- MATLAB Financial Toolbox – Offers ES computation with advanced statistical options.

- R packages (PerformanceAnalytics, rugarch) – Popular among academics and quants.

- RiskMetrics by MSCI – Institutional-grade, trusted by banks and hedge funds.

Pros: Professional-grade, well-documented.

Cons: Expensive licenses, steep learning curve.

4. Cloud-Based Tools & APIs

New solutions are emerging with real-time ES calculations via APIs:

- QuantConnect – Algorithmic backtesting platform with ES integration.

- Numerix Cloud – Risk analytics API for perpetual futures and derivatives.

- Custom AWS/GCP pipelines – Scalable, ideal for high-frequency trading desks.

Pros: Scalable, automation-ready.

Cons: Setup complexity, cloud costs.

Methods of Expected Shortfall Calculation

Historical Simulation

- Uses past returns of perpetual futures to estimate ES.

- Pros: Easy, data-driven.

- Cons: Doesn’t capture future structural changes.

Parametric Approach

- Assumes returns follow a distribution (e.g., t-distribution for fat tails).

- Pros: Efficient, computationally light.

- Cons: Biased if wrong distribution is assumed.

Monte Carlo Simulation

- Simulates thousands of scenarios using stochastic processes.

- Pros: Very flexible, accounts for nonlinear risk.

- Cons: Computationally heavy, requires expertise.

This approach is often preferred for institutional portfolios where how expected shortfall improves perpetual futures models is a competitive advantage.

Comparison of historical, parametric, and simulation-based approaches for ES calculations

Practical Example: Calculating ES for BTC Perpetual Futures

Suppose you hold a $10,000 BTC perpetual futures position. Using 1,000 daily returns from the past 3 years:

At 99% confidence:

- VaR = $900 (9%)

- Expected Shortfall = $1,400 (14%)

- VaR = $900 (9%)

This means that in the worst 1% of days, your average loss is $1,400—far worse than the $900 cutoff suggested by VaR alone.

Comparing Tools: Which Is Best?

| Tool Type | Best For | Pros | Cons |

|---|---|---|---|

| Python Libraries | Quant traders, analysts | Flexible, open-source | Requires coding |

| Platform Engines | Retail traders | Convenient, integrated | Limited transparency |

| Commercial Software | Institutions, funds | Reliable, professional support | Expensive |

| Cloud APIs | Algo desks, startups | Scalable, real-time | Setup complexity |

Recommendation:

- Retail traders: Use Python libraries or lightweight exchange tools.

- Institutional desks: Leverage Monte Carlo + cloud APIs for accuracy and speed.

Industry Trends

- Regulation: ES adoption is rising under Basel III frameworks.

- AI Models: Machine learning ES predictors are being tested in perpetual futures.

- Exchange Adoption: More exchanges are exploring ES-based liquidation risk management to reduce systemic crashes.

FAQ: Expected Shortfall Tools for Perpetual Futures

1. What’s the easiest tool to start with for ES in perpetual futures?

For beginners, Python libraries like Riskfolio-Lib are ideal. They are free, documented, and customizable for crypto trading.

2. Can ES be used in real-time trading systems?

Yes. Cloud APIs and optimized parametric methods can compute ES intraday. However, real-time ES requires careful calibration to avoid false signals.

3. How is ES different from stop-loss levels?

Stop-loss is a trading execution tool, while ES is a risk measurement metric. ES tells you how much to expect during extreme events; stop-loss defines how much you’re willing to lose on a trade.

Conclusion

Expected shortfall calculation tools for perpetual futures are no longer optional—they are essential for robust risk management.

- Retail traders should start with Python libraries and historical simulations.

- Institutional investors should implement Monte Carlo methods and cloud-based ES APIs.

- Exchanges are gradually integrating ES benchmarks into margining and liquidation models.

As perpetual futures continue to dominate crypto derivatives, expected shortfall will remain the gold standard for tail risk measurement.

If you found this article useful, share it with your trading community, leave a comment with your experiences using ES tools, and help others improve their perpetual futures risk management.

Would you like me to also prepare a step-by-step Python code snippet (with Riskfolio-Lib or NumPy) to calculate expected shortfall for perpetual futures so readers can directly apply it?