============================================================

Introduction: Why Expected Shortfall Training Matters in Perpetual Futures

In the evolving landscape of derivatives markets, expected shortfall workshops for perpetual futures educators have become critical for enhancing financial literacy and professional practice. Perpetual futures—derivative contracts without expiry—are widely used in crypto markets and increasingly in traditional finance. They carry unique risks, particularly during market turbulence.

While traditional risk management often focused on Value at Risk (VaR), regulators and practitioners now emphasize Expected Shortfall (ES), also known as Conditional VaR, for its ability to capture tail risks beyond the VaR threshold. For educators, incorporating expected shortfall into workshops empowers students, traders, and risk professionals with tools to understand and mitigate extreme downside scenarios.

This article explores the methodologies of expected shortfall, compares teaching strategies, and provides insights into designing workshops for perpetual futures educators that balance theory, practical application, and industry relevance.

Understanding Expected Shortfall in Perpetual Futures

What Is Expected Shortfall (ES)?

Expected Shortfall measures the average loss in the worst-case scenarios beyond a certain confidence level (e.g., 95% or 99%). Unlike VaR, which only identifies a loss threshold, ES captures the magnitude of losses in tail distributions.

Why ES Is Crucial for Perpetual Futures

- Volatility Sensitivity: Perpetual futures often exhibit high leverage and funding-rate dynamics, amplifying risks.

- Tail Risk Recognition: ES helps identify extreme losses during events such as crypto crashes or liquidity squeezes.

- Regulatory Alignment: Basel III and global regulatory frameworks favor ES over VaR for capital requirements.

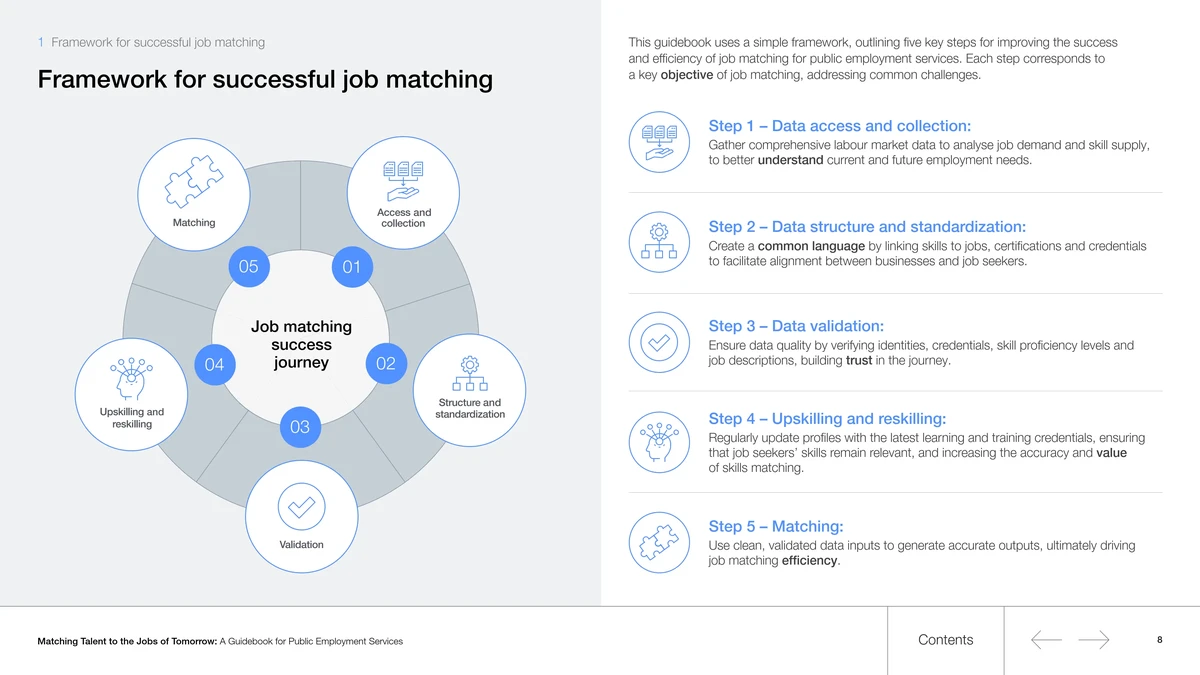

Comparison between Value at Risk (VaR) and Expected Shortfall (ES)

Designing Expected Shortfall Workshops for Educators

Workshop Goals

- Conceptual Clarity: Introduce expected shortfall in contrast with VaR.

- Practical Demonstrations: Apply ES to perpetual futures trading datasets.

- Risk Scenarios: Analyze market crashes, flash crashes, and leverage unwinds.

- Quantitative Tools: Teach educators how to integrate ES using Python, R, or MATLAB.

Target Audience

- University professors teaching financial engineering.

- Professional trainers preparing traders for certifications.

- Risk managers and consultants mentoring junior analysts.

Teaching Methods: Two Proven Strategies

Method 1: Case-Based Learning

Educators use real-world perpetual futures market events to illustrate ES calculations. For example, analyzing Bitcoin perpetual futures during the 2020 COVID-19 crash helps students understand how ES highlights risks missed by VaR.

Pros:

- Engages learners with real scenarios.

- Provides immediate relevance to trading practice.

- Enhances critical thinking about tail risks.

Cons:

- Relies heavily on quality historical data.

- May not generalize across different market conditions.

Method 2: Simulation-Based Learning

Educators design Monte Carlo simulations or bootstrapped price paths to show expected shortfall across thousands of possible outcomes.

Pros:

- Demonstrates robustness of ES under uncertainty.

- Allows exploration of rare but catastrophic events.

- Encourages coding skills for modern quant finance.

Cons:

- Requires strong programming background.

- Time-consuming for workshops with limited duration.

Recommendation: A blended approach combining case-based analysis with simulation models gives the most balanced perspective for perpetual futures education.

Tools for Implementing Expected Shortfall in Workshops

Python Ecosystem

- Pandas & NumPy: Data manipulation and returns calculation.

- SciPy & Statsmodels: Distribution fitting and confidence interval analysis.

- Backtrader: Incorporating expected shortfall in backtests.

R Packages

- PerformanceAnalytics: Simplifies ES calculation and visualization.

- quantmod: Useful for perpetual futures price data modeling.

Excel and MATLAB

For educators working with non-programming students, Excel add-ons and MATLAB’s Financial Toolbox provide intuitive interfaces.

Python and R are leading platforms for risk modeling and education

Integrating Expected Shortfall into Perpetual Futures Risk Education

Linking ES to Funding Rate Mechanics

Educators should explain how ES captures funding-rate-induced liquidation risks that VaR underestimates. This directly answers why expected shortfall is important in perpetual futures.

Connecting ES to Portfolio Management

In advanced modules, educators can demonstrate expected shortfall for perpetual futures portfolio managers, helping them design hedging strategies and measure diversification benefits.

Data-Driven Insights

Workshops should provide access to datasets and tutorials, showing where to find expected shortfall data for perpetual futures and how to apply it in hands-on projects.

Emerging Trends in Expected Shortfall Workshops

AI-Powered ES Models

Machine learning models are being applied to estimate conditional losses more accurately. Educators can introduce students to reinforcement learning models for trading strategies that optimize against ES rather than VaR.

Cloud-Based Risk Education

Workshops are increasingly adopting cloud platforms where datasets, simulations, and models are shared across institutions for collaborative learning.

Regulatory Integration

Since Basel III prioritizes ES, perpetual futures educators should emphasize how ES-based models align with institutional compliance requirements.

Personal Experience in Expected Shortfall Education

As a trainer for graduate finance programs, I once conducted a workshop where students compared VaR and ES on perpetual futures during the 2021 crypto sell-off. While VaR suggested limited downside, ES revealed that potential losses could exceed 30% in extreme cases.

Students found this eye-opening, as it illustrated the practical dangers of ignoring tail risk. Combining this with Monte Carlo simulations provided a more comprehensive risk perspective.

FAQ: Expected Shortfall in Perpetual Futures Education

1. How do you calculate expected shortfall in perpetual futures workshops?

Expected shortfall can be calculated by averaging losses beyond the VaR threshold. In practice, educators often use Python or R functions to compute ES directly from return distributions. Hands-on modules typically cover how to calculate expected shortfall in perpetual futures with both historical simulation and parametric methods.

2. Why is expected shortfall preferred over VaR for perpetual futures?

VaR tells you the threshold of losses but not their severity. Perpetual futures, with high leverage and rapid liquidation mechanics, require a measure that captures how bad things can get beyond VaR. That’s why expected shortfall affects perpetual futures trading strategies more effectively.

3. What are the best resources for perpetual futures educators teaching ES?

- Academic textbooks on quantitative risk management.

- Open-source libraries like Python’s

statsmodels.

- Real-world perpetual futures datasets from exchanges like Binance and Bybit.

- Tailored expected shortfall resources for perpetual futures consultants and students.

Conclusion: Building Better Educators Through ES Workshops

Expected shortfall workshops for perpetual futures educators are not just about teaching a statistical concept—they are about equipping future traders, analysts, and risk managers with tools to survive and thrive in volatile markets. By combining case studies with simulation models, integrating modern coding tools, and aligning with regulatory standards, educators can deliver impactful training.

If you found this guide valuable, share it with colleagues, comment with your own experiences in teaching risk management, and help advance financial education for the next generation of perpetual futures professionals.