================================================

Idiosyncratic risk—also known as unsystematic or company-specific risk—remains one of the most misunderstood yet crucial aspects of modern portfolio and trading strategies. While market risk is often highlighted in financial theory, idiosyncratic risk strategies can determine whether traders, portfolio managers, and institutional investors outperform or underperform. This comprehensive guide provides expert insights on identifying, analyzing, and mitigating idiosyncratic risks across assets and derivative instruments such as perpetual futures, options, and equities.

Understanding Idiosyncratic Risk

What Is Idiosyncratic Risk?

Idiosyncratic risk refers to risks unique to a specific company, asset, or security. Unlike market-wide risks such as inflation, interest rate shifts, or geopolitical events, idiosyncratic risks stem from internal factors like management changes, earnings announcements, or product recalls.

Why Idiosyncratic Risk Matters

For active traders and portfolio managers, ignoring idiosyncratic risk is costly. A single unexpected event in one asset can drastically affect leveraged positions, even when the broader market remains stable. That’s why why idiosyncratic risk matters in perpetual futures is central to risk management education and trading practice.

Core Principles of Idiosyncratic Risk Management

- Diversification – Spreading investments across multiple assets reduces exposure to one company’s failure.

- Hedging – Using derivatives like options or futures contracts to offset risks from concentrated positions.

- Active Monitoring – Constantly tracking financial statements, corporate news, and earnings cycles.

- Scenario Planning – Stress-testing portfolios for unexpected corporate events.

Expert Strategies to Manage Idiosyncratic Risk

1. Diversification-Based Approach

How It Works

By investing across industries, geographies, and asset classes, portfolio managers reduce exposure to risks tied to any single entity. For example, pairing U.S. tech equities with Asian industrials ensures that company-specific shocks don’t wipe out performance.

Advantages

- Simple and widely accessible.

- Proven historically to reduce volatility.

Disadvantages

- Does not eliminate systemic risks.

- Over-diversification may dilute potential returns.

2. Derivatives and Hedging Strategies

How It Works

Traders use options, swaps, and perpetual futures to hedge against idiosyncratic risk. For instance, a trader holding a long position in Tesla stock may short Tesla perpetual futures to balance unexpected earnings volatility.

Advantages

- Provides precision in managing targeted risks.

- Flexible for both retail and institutional investors.

Disadvantages

- Requires advanced knowledge of derivatives.

- Improper use can magnify losses instead of reducing them.

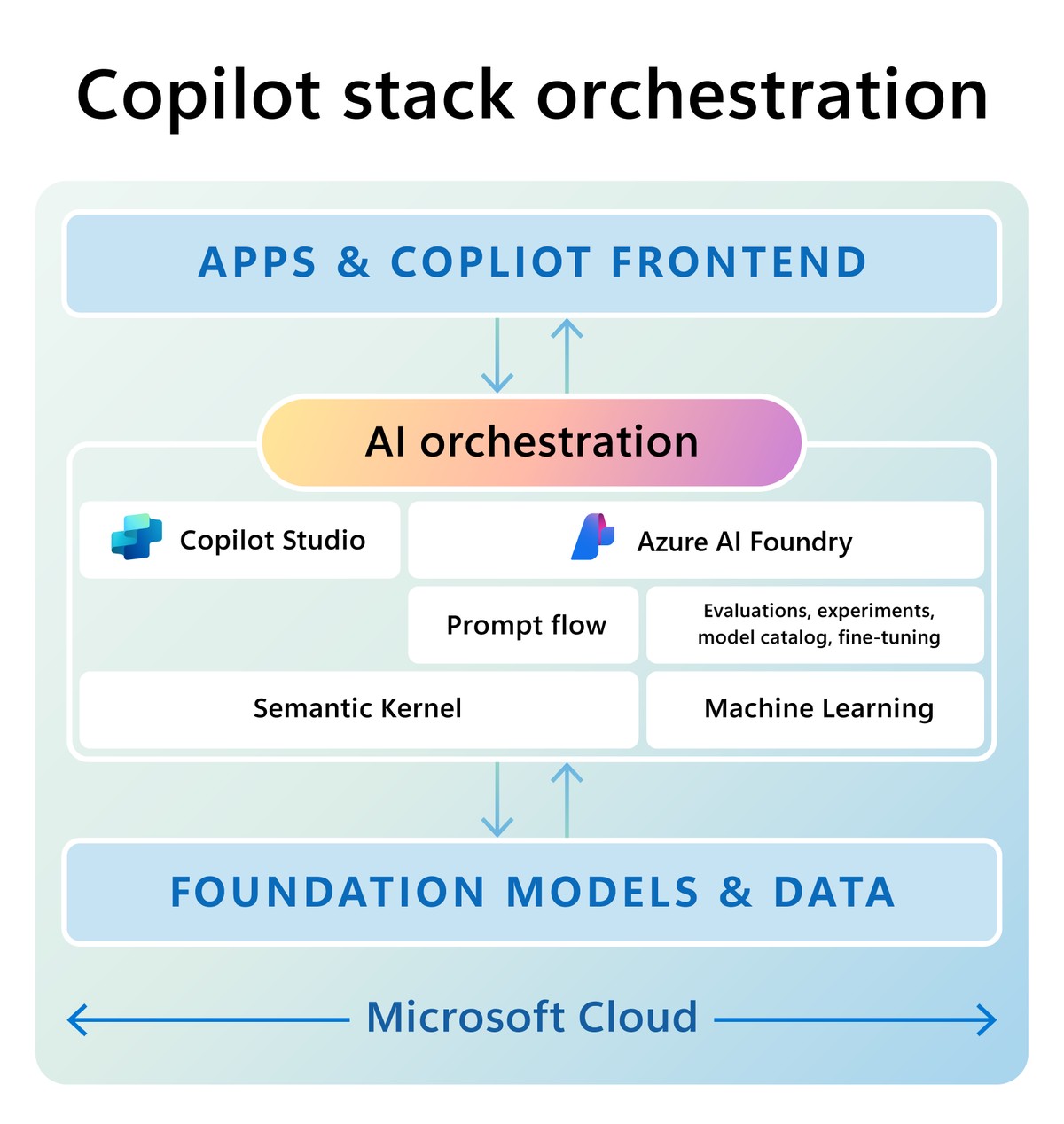

3. Technology-Driven Risk Analysis

How It Works

Machine learning and AI-driven platforms can detect hidden correlations, unusual order flows, or sentiment shifts that reveal potential idiosyncratic risks.

Advantages

- High adaptability to fast-changing markets.

- Automates monitoring of vast data sets.

Disadvantages

- Requires investment in infrastructure and data.

- Algorithms can fail in black-swan scenarios.

Comparing Strategies

| Strategy | Best For | Pros | Cons |

|---|---|---|---|

| Diversification | Beginners & portfolio managers | Simple, low cost | May dilute returns |

| Hedging via Derivatives | Professional traders | Precision, flexibility | Complex, costly if misused |

| Technology-Based Monitoring | Institutional & quant funds | Scalable, adaptive | Requires resources, technical expertise |

Recommendation:

For most traders, combining diversification with hedging strategies provides the most balanced approach. Professionals and institutional investors should integrate technology-driven monitoring for competitive advantage.

Real-World Examples of Idiosyncratic Risk

Case Study: Enron Collapse

The Enron scandal in 2001 highlighted how company-specific risks—fraud, governance issues, and hidden liabilities—can destroy investor portfolios, even in strong markets.

Case Study: Meta (Facebook) Earnings Drop

In February 2022, Meta’s quarterly earnings miss led to a $230 billion loss in market capitalization. Traders without hedges faced devastating losses.

Case Study: Airline Industry COVID-19 Shock

Individual airlines reacted differently to the pandemic. Those with better liquidity and diversified routes weathered the storm, while others faced near-bankruptcy.

Advanced Insights on Idiosyncratic Risk in Derivatives

Idiosyncratic risk takes unique forms in perpetual futures compared to equities. Understanding how idiosyncratic risk differs in perpetual futures vs options is crucial:

- Perpetual Futures: Idiosyncratic risks often arise from funding rate imbalances and asset-specific liquidity shocks.

- Options: Risks emerge from implied volatility spikes tied to company-specific news events.

Institutional players often create complex hedging overlays to handle these nuanced risks.

Practical Tools for Traders and Investors

- Risk Dashboards – Platforms that consolidate real-time exposure analysis.

- Automated Alerts – AI-driven tools for monitoring earnings reports or regulatory changes.

- Scenario Testing Software – Helps model unexpected shocks and potential loss impact.

Exploring where to find strategies for idiosyncratic risk management often begins with accessing these professional-grade tools or taking structured risk courses.

Common Mistakes in Idiosyncratic Risk Management

- Overconfidence in Single Stocks – Assuming one company’s performance guarantees consistent returns.

- Ignoring Correlations – Assets that seem unrelated can still move together due to shared suppliers or customer bases.

- Improper Hedging – Using mismatched derivatives contracts increases exposure instead of mitigating it.

- Neglecting Technology – Failing to use modern tools limits risk visibility in fast-moving markets.

Best Practices for Managing Idiosyncratic Risk

- Always combine qualitative research (management analysis, governance review) with quantitative analysis (beta adjustments, volatility modeling).

- Update diversification strategies regularly—what worked in one market regime may fail in another.

- Adopt layered hedging approaches—using both options and futures for different time horizons.

- Integrate real-time technology solutions to catch early signs of risk events.

FAQ: Expert Insights on Idiosyncratic Risk Strategies

1. How is idiosyncratic risk calculated in practice?

Idiosyncratic risk is often measured using regression models where total stock volatility is decomposed into systematic (market-wide) and unsystematic (company-specific) components. Advanced approaches use factor models to isolate risks tied specifically to one security.

2. Can diversification fully eliminate idiosyncratic risk?

Diversification significantly reduces idiosyncratic risk but does not eliminate it entirely. Unique shocks—such as fraud or regulatory crackdowns—can still affect diversified portfolios. That’s why combining diversification with hedging strategies is essential.

3. How can technology influence idiosyncratic risk management?

Technology enables real-time monitoring of news, earnings, sentiment, and liquidity data. AI algorithms detect anomalies early, allowing traders to act before risks fully materialize. While not foolproof, this dramatically improves reaction times and accuracy.

Conclusion

Managing idiosyncratic risk is more than a technical exercise—it is a blend of strategy, psychology, and foresight. Traders and investors must integrate diversification, derivatives hedging, and technology-driven monitoring into their toolkits. With perpetual futures and modern instruments gaining popularity, mastering these insights has never been more important.

By understanding expert insights on idiosyncratic risk strategies, market participants can protect portfolios, optimize leverage, and create sustainable long-term growth.

Final Thoughts

Idiosyncratic risks will always exist, but their impact can be managed with careful planning, innovative strategies, and modern technology. Whether you are a retail trader or an institutional manager, the key lies in balancing risk exposure with informed decision-making.

If you found this article helpful, share it with your network, leave a comment with your strategies, and join the discussion—because collaboration is the ultimate tool for reducing idiosyncratic uncertainty.

Would you like me to also generate visual infographics (e.g., “diversification vs hedging chart” or “idiosyncratic risk flow diagram”) to include in this article for SEO and engagement enhancement?