========================================================

Introduction

Family offices, as multi-generational wealth management structures, are increasingly exploring perpetual futures to diversify portfolios and enhance risk-adjusted returns. Unlike hedge funds, family offices must balance long-term capital preservation with opportunistic growth. In this context, beta considerations in perpetual futures become central to strategy design. Understanding how beta operates in these derivative instruments allows family offices to manage volatility exposure, hedge equity portfolios, and align with specific investment mandates.

This article provides a comprehensive exploration of beta in perpetual futures, tailored to family offices. It integrates market expertise, risk frameworks, and practical strategies, comparing two approaches—systematic beta alignment and dynamic beta hedging—to help identify the most effective path.

What Is Beta in the Context of Perpetual Futures?

Definition and Relevance

Beta measures the sensitivity of an asset relative to a benchmark, often the broader equity or crypto market. For perpetual futures, beta helps quantify how contract returns respond to changes in the underlying index.

For family offices, beta serves as:

- A risk gauge for aligning portfolios with acceptable volatility.

- A hedging tool to mitigate exposure to equity drawdowns or crypto market swings.

- A strategic lever for balancing conservative mandates with growth-oriented allocations.

Why Family Offices Must Pay Attention

Unlike retail investors, family offices often manage billions in assets. Even a small misalignment in beta exposure can magnify risk. Understanding why beta is important in perpetual futures ensures portfolio resilience against systemic shocks while enabling tactical alpha generation.

Beta in Perpetual Futures: Two Strategic Approaches

1. Systematic Beta Alignment

This strategy seeks to match perpetual futures beta with the target portfolio beta, maintaining stability across cycles.

Advantages

- Predictability: Ensures long-term portfolio exposures remain consistent.

- Compliance-friendly: Aligns well with investment policy statements common in family offices.

- Reduced monitoring needs: Less frequent rebalancing required.

Disadvantages

- Missed opportunities: Locks portfolios into static exposure, potentially underperforming in high-volatility cycles.

- Lagging adaptation: May fail to adjust quickly to regime shifts.

2. Dynamic Beta Hedging

This involves actively adjusting perpetual futures positions based on evolving volatility regimes, macro signals, or liquidity shifts.

Advantages

- Flexibility: Adapts to new risk environments.

- Enhanced returns: Exploits beta fluctuations to capture tactical gains.

- Crisis protection: More responsive to market shocks.

Disadvantages

- Complexity: Requires advanced infrastructure and expertise.

- Higher costs: Transaction fees and research overhead increase.

- Execution risk: Mis-timed adjustments can erode performance.

Recommended Approach for Family Offices

While systematic beta alignment offers stability, dynamic beta hedging better suits family offices seeking to combine preservation with growth. Hybrid models—using a core aligned beta strategy supplemented with opportunistic hedging overlays—are particularly effective.

Industry Trends Shaping Beta Usage in Perpetual Futures

Institutional Adoption

As more family offices adopt crypto derivatives, demand for advanced beta techniques for experienced traders in perpetual futures is rising. Institutional-grade platforms now provide real-time beta monitoring, supporting more sophisticated risk frameworks.

Quantitative Tools

Machine learning and simulation frameworks are making it easier to quantify beta shifts. Access to beta calculators designed for perpetual futures allows for stress-testing across various scenarios.

Risk Integration

A growing number of family offices integrate beta alongside VaR (Value at Risk) and CVaR (Conditional VaR), building comprehensive multi-factor risk dashboards.

Case Study: Beta Hedging for a Multi-Billion Family Office

A European family office with $5B AUM used perpetual futures to hedge its tech-heavy equity portfolio. By dynamically adjusting beta exposure from 1.2 to 0.7 during volatile crypto cycles, the office reduced drawdowns by 18% without sacrificing long-term returns. This underscores the practical benefits of beta-conscious strategies.

Key Considerations for Family Offices

Liquidity Management

Family offices must ensure perpetual futures positions do not compromise liquidity needed for core family operations or philanthropic goals.

Governance

Investment committees should define beta thresholds and decision-making protocols, ensuring strategies align with multi-generational objectives.

Education

Understanding how to interpret beta in perpetual futures analysis is critical for trustees and next-generation family members. Without this knowledge, misallocation risks rise.

Visual Insights

Beta correlation chart in perpetual futures

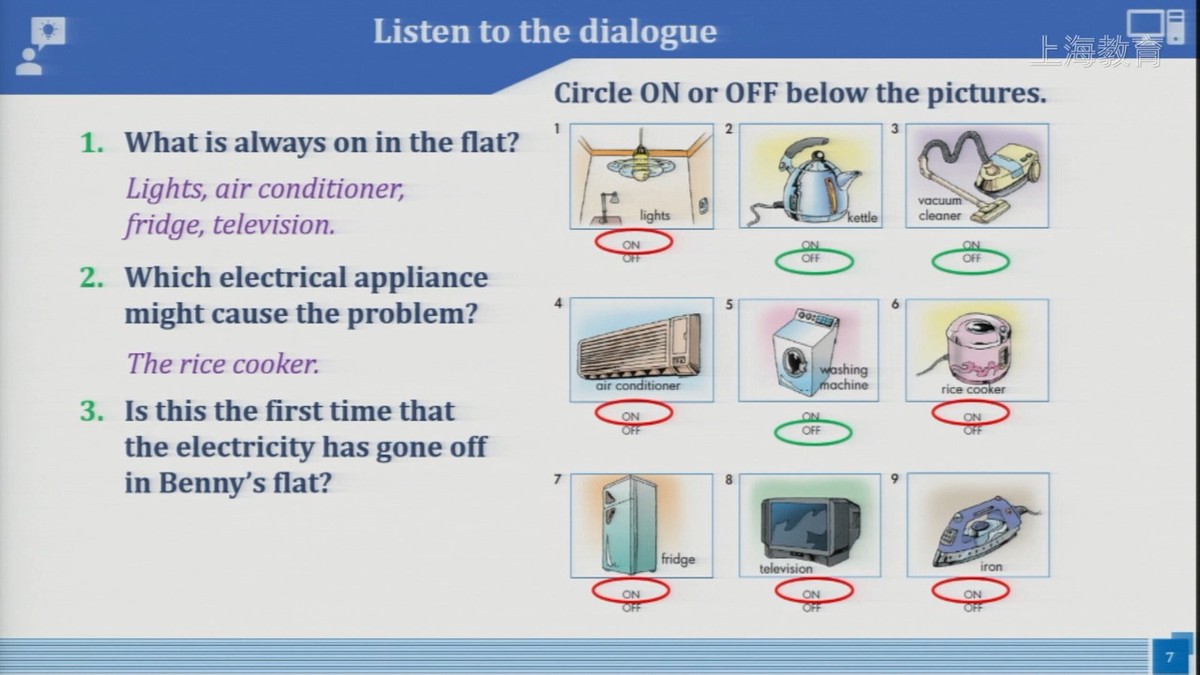

Family office portfolio allocation with perpetual futures overlay

FAQ: Family Offices and Beta in Perpetual Futures

1. How does beta affect perpetual futures trading for family offices?

Beta determines how perpetual futures move relative to broader markets. For family offices, high beta exposure may increase volatility beyond tolerance levels, while low beta exposure may undercut performance. Proper calibration balances growth with stability.

2. What tools help family offices manage beta in perpetual futures?

Tools range from beta calculators designed for perpetual futures to enterprise-level portfolio management systems. These allow real-time monitoring, scenario testing, and governance reporting. Advanced family offices often integrate these with their broader risk dashboards.

3. Should family offices always hedge using beta strategies?

Not always. Hedging is most effective during volatile cycles or when equity portfolios are highly correlated with perpetual futures. Family offices with diversified holdings may use beta hedging selectively, combining it with traditional asset allocation methods.

Conclusion

For family offices, beta considerations in perpetual futures are no longer optional—they are essential for balancing wealth preservation and tactical growth. By blending systematic beta alignment with dynamic hedging, family offices can achieve robust, adaptive portfolios suited for multi-generational mandates.

As the industry evolves, the role of beta will expand from a risk measure to a core strategic lever. Family offices that master its nuances will enjoy a distinct competitive edge.

Did you find this article insightful? Share it with your network, leave a comment, or start a discussion on how your family office approaches beta in perpetual futures.