==========================================================

Political risk analysis is an essential component of trading and investment strategies, particularly in markets as volatile and sensitive to geopolitical shifts as perpetual futures. In this article, we will explore the framework for assessing political risk in the context of perpetual futures trading, including key factors to consider, methodologies for analysis, and strategies to mitigate the associated risks.

Understanding Political Risk in Perpetual Futures

What are Perpetual Futures?

Perpetual futures are a type of financial contract that allows traders to speculate on the future price of an asset, such as commodities, currencies, or cryptocurrencies, without a fixed expiration date. These contracts are particularly attractive for traders looking to hedge against price movements in the underlying asset over an extended period.

Political risk in the context of perpetual futures refers to the uncertainty and potential for loss arising from political events, decisions, or changes that can impact the financial markets and the value of the underlying asset. These risks can originate from shifts in government policy, regulatory changes, geopolitical tensions, or even natural disasters influenced by political decisions.

Why Political Risk Matters in Perpetual Futures

Political risk is crucial to consider in perpetual futures due to the leverage inherent in these contracts. Traders may experience amplified gains or losses when significant political events cause sharp movements in asset prices. As perpetual futures have no expiration date, the long-term exposure to political risk can be even more pronounced than in traditional futures contracts.

For example, a change in a country’s trade policy or a military conflict can dramatically affect the price of commodities or currencies. This can lead to unforeseen market volatility and substantial losses for traders who have not properly analyzed or mitigated political risk.

Political Risk Factors in Perpetual Futures Markets

1. Government Policy and Regulation

Governments around the world implement policies that can significantly influence financial markets. In the context of perpetual futures, changes in regulations regarding trading practices, taxation, and financial reporting can affect market liquidity and investor sentiment.

Example:

A government’s decision to impose stricter regulations on cryptocurrency trading, as seen in countries like China, can drastically affect the market for Bitcoin perpetual futures. A sudden regulatory crackdown can cause a sharp drop in asset prices and, consequently, trigger liquidation events in leveraged positions.

2. Geopolitical Events and Conflicts

Geopolitical tensions or conflicts can introduce high levels of uncertainty and risk into the markets. These events may directly impact the pricing of commodities or currencies and create volatility that affects traders’ positions in perpetual futures.

Example:

The Russia-Ukraine conflict had a profound impact on energy prices, which traders in oil and gas perpetual futures closely monitored. Political tensions can lead to sudden price swings, catching traders unprepared if political risks are not assessed in advance.

3. Elections and Political Instability

The outcome of elections, shifts in political leadership, or periods of political instability can create uncertainty in the financial markets. Traders need to assess the potential impact of these events, particularly in countries where elections can lead to drastic policy changes that directly affect key markets.

Example:

In the lead-up to the 2020 U.S. presidential elections, traders monitored the potential impact of policies proposed by the candidates. A change in government could have resulted in regulatory shifts that influenced the price of U.S. equity perpetual futures.

4. Legal Risks and Enforcement

Changes in the legal framework surrounding financial markets and trading contracts can alter the landscape of perpetual futures. Legal uncertainties, such as disputes over the enforcement of contracts or legal action against a trading platform, can lead to significant risks for traders.

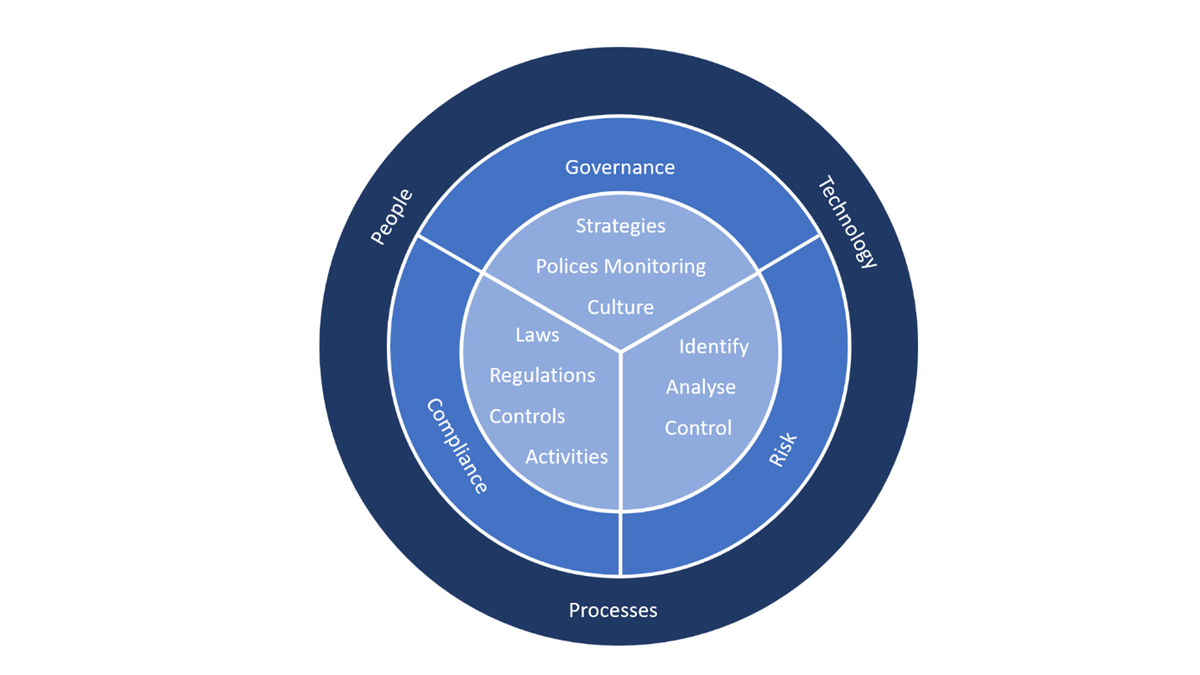

Framework for Political Risk Analysis in Perpetual Futures

1. Identifying Political Risk Sources

The first step in assessing political risk is to identify potential sources of political uncertainty that may impact the perpetual futures market. This can be done by:

- Monitoring government policies: Keep track of changes in government policy, fiscal regulations, and monetary policy that could affect asset prices.

- Tracking geopolitical events: Stay updated on global conflicts, trade agreements, and diplomatic relations that may cause market disruptions.

- Observing political events: Watch elections, changes in political leadership, and any form of political unrest that could lead to market instability.

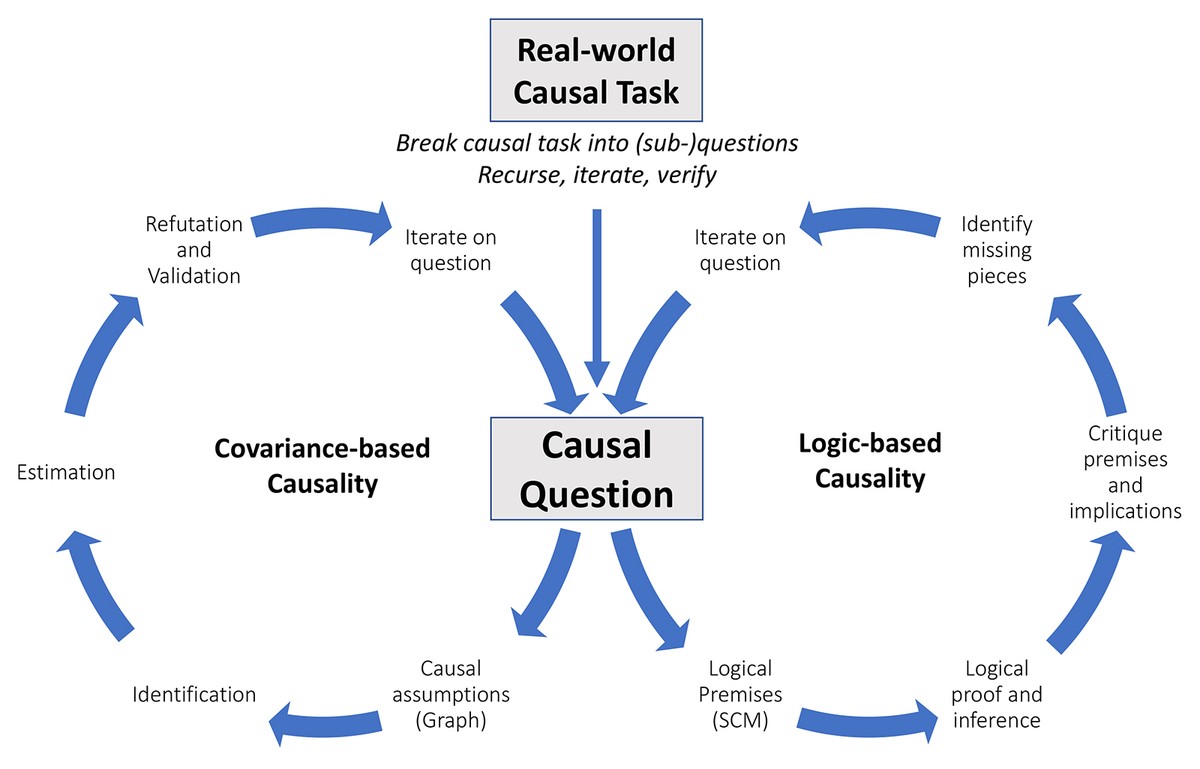

2. Quantifying Political Risk

Once political risk sources are identified, traders need to quantify the potential impact on their perpetual futures positions. This can be achieved through:

- Scenario analysis: Model potential political events (e.g., regulatory changes, conflicts) and simulate their impact on market prices and volatility.

- Stress testing: Use historical data to simulate how past political events have affected similar markets and apply these insights to forecast potential outcomes.

- Risk models: Implement risk management tools that allow for the incorporation of political risk factors into overall portfolio strategies.

3. Political Risk Mitigation Strategies

Traders can employ several strategies to mitigate the impact of political risk on their perpetual futures positions:

A. Hedging with Options and Futures

One of the most effective ways to hedge political risk is by using options and futures contracts to offset potential losses. For example, if a trader expects political uncertainty to affect an asset’s price, they may buy options to limit potential losses in case of adverse price movements.

B. Diversification

Diversification is a key risk management strategy that can help mitigate the effects of political risk. By spreading investments across different asset classes, regions, and markets, traders can reduce the exposure to any single political event.

C. Position Sizing and Stop-Loss Orders

By adjusting position sizes and utilizing stop-loss orders, traders can manage their risk exposure. Smaller positions can help limit the potential loss from adverse political events, and stop-loss orders ensure that positions are automatically liquidated if the market moves against the trader.

D. Monitoring Political Developments

Regularly monitoring political developments and news sources is critical in staying ahead of potential political risks. This allows traders to react quickly to new information and adjust their positions accordingly.

Case Studies: Political Risk in Perpetual Futures

1. The Brexit Impact on Currency Futures

The Brexit referendum in 2016 caused significant political uncertainty, especially in the British pound futures market. Traders in currency perpetual futures had to navigate the market volatility following the vote, as the outcome of the referendum had a direct impact on the value of the GBP.

2. U.S. Trade War with China and Commodity Futures

The trade war between the U.S. and China led to massive fluctuations in commodity futures, particularly in metals and agricultural products. Traders in perpetual futures had to account for the political risk posed by tariffs, trade agreements, and government intervention, all of which had the potential to alter the supply and demand for these assets.

FAQ: Common Questions on Political Risk in Perpetual Futures

1. How can I assess political risk in perpetual futures?

You can assess political risk by monitoring political developments such as elections, changes in government policies, and international relations. Additionally, scenario analysis and risk models can help quantify the impact of these risks on the markets.

2. Why does political risk affect perpetual futures markets?

Political risk can cause sudden shifts in asset prices due to changes in government policies, geopolitical conflicts, or economic sanctions. As perpetual futures are leveraged products, political risk can amplify both potential gains and losses.

3. What strategies can help reduce political risk in perpetual futures?

Some strategies to reduce political risk include hedging with options or futures, diversifying your portfolio, using position sizing and stop-loss orders, and actively monitoring political events that could impact the market.

Conclusion

Political risk is an unavoidable factor in perpetual futures trading, but it can be managed with the right framework and strategies. By identifying potential political risk sources, quantifying their impact, and implementing effective risk mitigation techniques, traders can better navigate the complexities of trading in markets influenced by political events.

Traders must remain vigilant and adaptable, utilizing tools such as diversification, hedging, and scenario analysis to protect their positions. With careful analysis and proper risk management, traders can minimize the adverse effects of political risk and capitalize on market opportunities in perpetual futures trading.