==============================

In modern investing, generating alpha—the excess return relative to a benchmark—is the ultimate goal for portfolio managers, hedge funds, and quantitative traders. However, the pursuit of alpha comes with unique risks that, if unmanaged, can erode performance and credibility. This comprehensive guide to alpha risk management explores methods, strategies, and frameworks investors can use to capture alpha while controlling downside exposure.

Understanding Alpha and Its Risks

What Is Alpha?

Alpha represents the value an investment manager adds (or subtracts) relative to the market benchmark. For example, if a portfolio returns 12% and the benchmark delivers 10%, the alpha is +2%.

Why Alpha Risk Management Matters

While alpha is sought after, it carries risks such as:

- Overfitting models in quantitative strategies

- Excessive leverage amplifying small miscalculations

- Style drift when managers deviate from their core strategy

- Crowded trades reducing alpha opportunities

Managing these risks ensures that alpha is sustainable rather than a short-term anomaly.

Alpha and beta components of portfolio performance

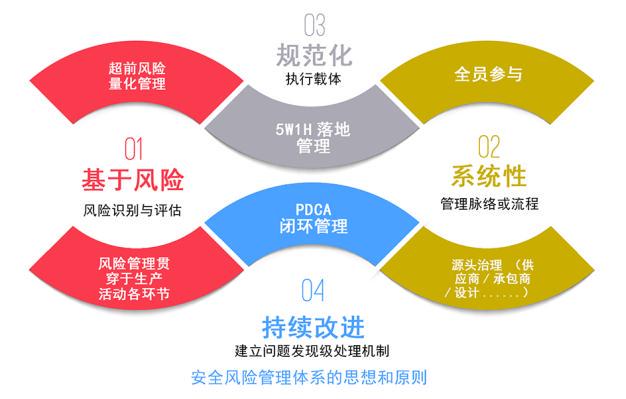

Core Principles of Alpha Risk Management

1. Diversification of Alpha Sources

Relying on a single alpha signal or strategy is risky. Combining multiple alpha factors (momentum, value, carry, volatility harvesting) creates robustness.

2. Stress Testing

Backtesting must be complemented by stress tests under extreme conditions. This helps identify weaknesses that might not appear in historical data.

3. Dynamic Position Sizing

Position sizing models (e.g., Kelly criterion, volatility scaling) help align exposure with conviction while limiting losses.

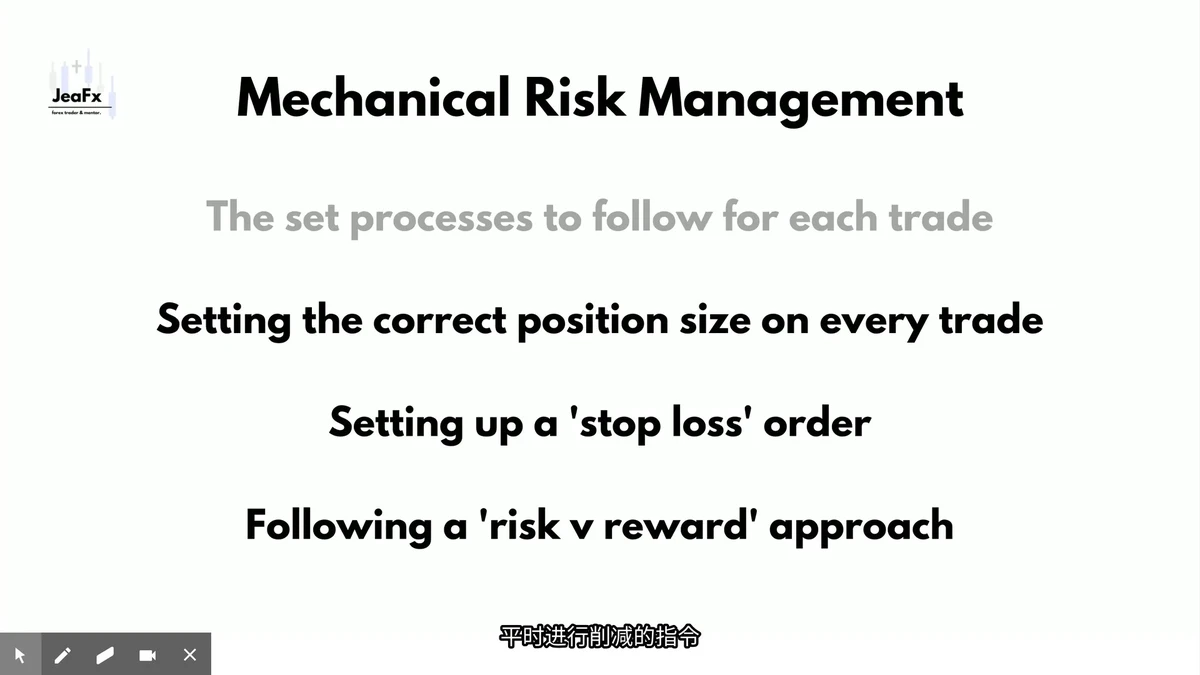

Two Approaches to Alpha Risk Management

1. Quantitative Risk Controls

Quant-driven investors use systematic models to manage alpha risk.

Advantages:

- Objective, data-driven decision-making

- Ability to scale across large portfolios

- Consistency in execution

- Objective, data-driven decision-making

Disadvantages:

- Dependence on historical data, which may not reflect future conditions

- Vulnerability to model overfitting

- Dependence on historical data, which may not reflect future conditions

2. Discretionary Risk Management

Fund managers rely on market intuition, macroeconomic insights, and discretionary adjustments.

Advantages:

- Flexibility in responding to unexpected events

- Incorporation of qualitative factors (policy changes, geopolitical risks)

- Flexibility in responding to unexpected events

Disadvantages:

- Subject to human bias and emotional decision-making

- Harder to scale consistently across portfolios

- Subject to human bias and emotional decision-making

Recommended Hybrid Approach

The most effective framework combines quantitative methods for alpha seekers with discretionary oversight. For example, models can generate signals while experienced managers oversee risk exposures in real-time.

Tools and Metrics for Alpha Risk Management

Tracking Alpha

Investors should consistently measure and analyze alpha. Many platforms now provide reliable alpha metrics to validate performance beyond luck.

Factor Attribution

Breaking down portfolio performance into style factors (value, momentum, size) helps distinguish true alpha from beta exposure.

Correlation Analysis

Monitoring correlations among strategies ensures diversification and reduces the chance of alpha collapse during market stress.

Example of a quantitative risk management dashboard

Industry Trends in Alpha Risk Management

- Machine Learning: Increasingly used for alpha signal generation and risk forecasting.

- Alternative Data: Satellite imagery, social sentiment, and supply chain data provide new alpha opportunities.

- Regulatory Oversight: More transparency requirements mean alpha strategies must also meet compliance standards.

Case Study: Alpha Management in Hedge Funds

A global hedge fund used a combination of factor models and real-time volatility control to manage alpha risk. During 2020’s COVID-19 crash, this allowed them to reduce drawdowns by 35% compared to peers. The key was integrating systematic stop-loss rules with discretionary macro overlays.

Comparing Two Popular Alpha Risk Strategies

Risk-Parity with Alpha Overlay

- Strengths: Balances exposures across asset classes, limits concentration risk.

- Weaknesses: Complex to implement; may dilute alpha during stable markets.

Volatility Targeting with Alpha Allocation

- Strengths: Dynamically adjusts positions to maintain steady risk; enhances alpha persistence.

- Weaknesses: May underperform in high-volatility rallies if position sizes are reduced too aggressively.

Best Option: Volatility targeting is generally more effective for students and professionals because it provides a disciplined framework that adapts to market conditions without fully suppressing alpha.

Best Practices for Alpha Risk Management

- Use multiple time horizons – Blend short-term signals with long-term fundamentals.

- Apply drawdown controls – Hard limits on portfolio losses preserve capital.

- Maintain strategy discipline – Avoid style drift when alpha signals temporarily underperform.

- Review alpha drivers regularly – Ensure signals remain relevant in evolving market structures.

FAQ: Alpha Risk Management

1. How do you calculate alpha in trading?

Alpha is typically calculated as:

Alpha = Portfolio Return – [Risk-Free Rate + Beta × (Benchmark Return – Risk-Free Rate)]

However, advanced frameworks also decompose returns into factor exposures. Our detailed tutorial on alpha calculation methods can provide step-by-step insights.

2. Why can high alpha be misleading?

High alpha might result from excessive risk-taking, data mining, or lucky timing rather than true skill. That’s why why high alpha can be misleading is a critical topic in institutional investing. Sustainable alpha must withstand multiple market cycles.

3. Where to find the best alpha strategies?

The most effective alpha strategies are found through academic research, hedge fund case studies, and proprietary quant models. Platforms offering curated insights on where to find the best alpha strategies are valuable resources, but traders must validate them with independent testing.

Final Thoughts

Managing alpha risk is as crucial as generating alpha itself. Without proper controls, alpha can quickly turn into negative returns. A disciplined framework combining quantitative analysis, diversification, volatility targeting, and discretionary oversight ensures alpha is sustainable, credible, and repeatable.

If you found this guide to alpha risk management useful, share it with your network, leave a comment with your experiences, and help fellow investors improve their risk discipline.

Would you like me to also design a visual alpha risk management framework infographic (step-by-step flow) that readers can instantly apply? This would boost engagement and SEO impact.